Leaderboard

Popular Content

Showing content with the highest reputation on 04/06/2025 in all areas

-

For future use for everyone using ATX, I'm going to copy Abby Normal's instructions to a new post of how to backup ATX data outside of the program and pin it at the top of general chat.5 points

-

Use the IP PIN received in January 2025 for all e-filing during calendar year 2025, no matter the tax year. The IP PIN belongs to the current calendar year.4 points

-

taxnotes© has posted a couple of articles on a recently released IRS memo (ILM 202511015). From the NAEA bulletin "The January 17 memo...determined that taxpayers who were cheated in their attempts to invest could take advantage of the theft loss provision for 'transactions entered into for profit'; and wouldn't be limited by the TCJA's restriction on personal casualty losses."3 points

-

Well, I think I have a similar situation. Of course they couldn't tell me in Jan or Feb, it has to be in April. Thanks so much for posting this info. May save my client some serious tax $. Tom Longview, TX3 points

-

That is a lucid, important and good post to have at our fingertips. Backups are SO important and too few preparers realize this or understand how to do it properly. Thanks Judy.2 points

-

Thanks Abby. I thought that's what you meant. The Task Manager. I have had occasions when the ATX would not start and had to end task. I'm not sure if I ended the server part though. Good to know when I do my backups.2 points

-

If your computer is turned off, you can't be backing up. I think what he is saying is that ATX backup files will not backup properly onto another file location (like a flash drive or second hard drive) unless you go into the background tasks and "end service" on each "ATX Server" running in the background. He can answer for himself, but that is how a non-techy accountant reads it. Tom Longview, TX2 points

-

If I understand it correctly, the new Cir 230 guidance will require you to advise the client to file amended returns or you must decline the engagement. The new rules are going to be tricky in circumstances like this. I can't believe I am going to say this, but I am really going to need to look at a good Ethics course this summer if the new regs are finalized. Tom Longview, TX2 points

-

ATX has carryovers for Sch D in the worksheets. Same for 8582 losses, foreign tax credit, contributions, PTP losses, etc. There's no one central place to see them all.2 points

-

Oh, I use Verifyle and love it as do many of my clients. But a surprising number of them still want a printed client copy of their returns. When I began my own practice I used and still do use twin pocket folders with the year label on the outside, my card inside and copies on the right with acknowledgements and my invoice on the left. So many long time folks still want those folders because that's how they keep their records. Of course, most of my clients are 'of a certain age' and the younger ones (most, but not all) just retain digital copies. One year I tried gray folders. Didn't go over well. My business cards and stationary are light gray and wine. My office is about 99% digital. I never keep paper copies of client data either downloading the pdf copies from Verifyle and/or scanning provided records with my trusty ScanSnap 1500!2 points

-

Here a link to the actual article BrewOne refers to: https://www.taxnotes.com/featured-news/tax-pros-welcome-clarity-scam-theft-loss/2025/03/14/7rnbr2 points

-

Might want to stock up on some printers now before the tariffs increase prices by 25-50%.1 point

-

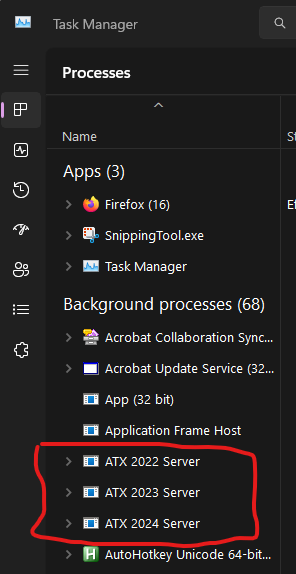

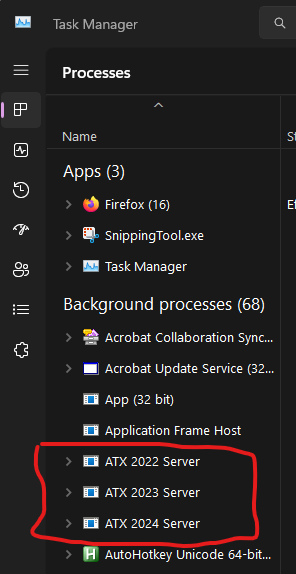

These are posts from Abby Normal as posted in another topic. First post: "Not having a full and complete backup of all of your files is foolish. In addition to backing up the entire Wolters Kluwer folder, you should at least backup your documents and many other things in your Users folder, plus anywhere else you keep important files. It's important that you end the ATX servers, all of them that are running, before backup up the Wolters Kluwer folder. Occasionally, I turn off all the ATX servers and copy the entire Wolters Kluwer folder to My Documents and then it gets backed up with all my other documents. I name the folder Wolters Kluwer yy-mm-dd and keep the latest 3." Second post - to turn off ATX Servers: Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.1 point

-

Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.1 point

-

1 point

-

Thanks for sharing, I have the same issue for 2022 & 2023, I will use their 2024 PIN.1 point

-

On the top of the report there is a dropdown box. Click the arrow and pick Passive. Everything will be there. Tom Longview, TX1 point

-

My inkjet all-in-one (that's old and not printing right now) was for anything that wasn't a tax return: copies, quick scan to paper or .pdf to give to client, color printing, faxing a piece of paper when I didn't have it as .pdf, etc., and it talked back and forth with my computer. At the time I bought it (2nd printer I owned), I had a color laser printer (1st printer I bought decades ago). The color laser didn't die; a non-HP cyan toner exploded inside it. At that time, it was so old that I wasn't going to spend time trying to clean it or pay money to clean it, if it was even possible (it was a LOT of toner). By that time I also had a fast black-only printer for tax returns. Margaret makes me think that my next all-in-one should be a laser, so it truly will do everything but tax returns, but could be a backup for tax returns. Two printers are enough, if both of them are laser. Thank you, Margaret, for telling me about your backup laser printer!1 point

-

Not having a full and complete backup of all of your files is foolish. In addition to backing up the entire Wolters Kluwer folder, you should at least backup your documents and many other things in your Users folder, plus anywhere else you keep important files. It's important that you end the ATX servers, all of them that are running, before backup up the Wolters Kluwer folder. Occasionally, I turn off all the ATX servers and copy the entire Wolters Kluwer folder to My Documents and then it gets backed up with all my other documents. I name the folder Wolters Kluwer yy-mm-dd and keep the latest 3.1 point

-

Marilyn, my all in one is my backup laser printer. When my old fax went out (I just received a 30 page fax this morning from a less techy client), I decided to have the all in one with laser to use as my back up printer. I've had to use it just once but belt and suspenders....1 point

-

Personally, I will never consider an all in one; though my son has good luck with and likes his. I prefer to use what I understand. Old dog, you know!1 point

-

1 point

-

Christian, I feel your pain. Mine died last fall and that was the impetus to get a new one (my tech guy builds mine) with Win 11 Pro. It was such a pain restoring, moving data, reinstalling programs, fortunately he did 90+% of the work. I'm glad it wasn't now. Hopefully you are back in business now!1 point

-

I've always used HP. Will continue. Not too many years to go. I have the low end ones. Not any problems. I assume the other big names are good too.1 point

-

I have used HP for years, but if and when I have to replace my printer it won't be with HP for the reasons given above. In fact, the last HP fax machine that we had in the office was the reason I switched to an electronic fax service.1 point

-

I have four HPs in my main office and have had no issues to speak of. Of course, they are all older models and some are refurbished. I also have a HP Color printer for special things. Couldn't ask for anything better. I always use off brand toners from Amazon and V4ink. If I get a bad one, they replace immediately.1 point

-

I miss my Brother printer. When it died I replaced it with an HP, which works well enough but can be very annoying as well. Checking in with the mothership to make sure I'm using "real" HP cartridges, deciding to stop and recalibrate halfway through a print job, waiting up to a minute before printing in case I decide to override which paper feed to use (when only one has any paper in it). They are "improving the user experience" to the point of wanting to take a sledgehammer to the thing on occasion. But the print quality - once it deigns to start - is terrific, as is the speed, and the ease of duplex printing.1 point

-

The flip side of this is I have one client whose DL expired in 2009-ish. She has not updated it as she has been working all over the world as well as in the US, flitting around like a butterfly. She has an international DL but that is not accepted for tax ID. We keep using the over-ten-years-gone ID and it still works for claiming refunds. She will be settling down (thank goodness; ugh) and will get a new, local, DL this year, she promises.1 point

-

0 points

-

My main computer crashed 3/6. I usually have two computers. I've never had my main computer die, it's always been the older one. It took the repair shop a week to figure it out and get it running. Then it took me 4 days to load programs and data. I've had worse weeks in my life, but that one is near the top. Lost about 30 returns I was in the midst of and about a dozen completed returns from the previous two years that I hadn't backed up properly. I have PDFs and paper copies of the past years' returns, so I might rebuild those later in the year. Since I had the older computer, I still had internet access, but couldn't do any real work. Clients seem to be understanding. I can tell some were a bit anxious, while some who dropped their info off right before the crash aren't fazed at all that it took me five weeks to complete their returns after I told them 1 to 2 weeks. Because I was totally unaware of the shit storm I was in the midst of, one client emailed me last Saturday, "Hope you are having a super Saturday. Gentle check in on completion of my tax return. A kind reminder that tax returns are coming due. Please provide status. Much appreciated."0 points