Leaderboard

Popular Content

Showing content with the highest reputation on 04/14/2024 in all areas

-

I will be working all day today and tomorrow. Then on to the extensions. This has been a whirlwind year. A client is bringing homemade soup for tomorrow. Then I can say that we have been given everything from soup to nuts. Friday it was two quarts of homemade maple syrup. You just have to love these clients who appreciate what you do for them and we really try to do the best job possible. Off to work I go.9 points

-

Yes! I definitely agree. Especially for those of us who work solo. Thank you!!9 points

-

I don't know what I would do without all of you and a couple of groups that I belong to on FB. I am hesitant to ask questions of some groups, but this bunch of awesome people are willing to help and be kind. All of my cronies here are dead, retired or just said that they had had enough. I hope that it's OK if I hang around here for awhile after I retire. I am just letting my permit go inactive, in case I get desperate and have to work for somebody else in Colorado.9 points

-

8 points

-

I'm in for a short time today but probably won't get much done. Got an email from a lost client. He's four years behind. Ha. Says he wants to catch up. Ok but he'll have to get his info to me. His son has been coming in regularly. We'll see. I jogged this morning. Feels good to get back to it after a few months off.7 points

-

5 points

-

I have had clients to whom I've just sent the extension forms and told them to file it themselves, with warnings about underpayment, etc.5 points

-

Yes, it's a godsend for all of us who are solo! And I too have had all but one other accountant I know retire.5 points

-

@Catherine @Abby Normal @G2R The three of you should get together and put on a seminar. "What the hell happened, how the law tax law applies, and how to enter the damn thing in ATX". I would attend if it qualified for CPE. If you held it in my hometown I would put on a BBQ dinner for you at no charge. Tom Longview, TX5 points

-

I had a (former) client who I hadn't heard from in 4 years text me at 6:00 pm Friday asking me to do a trust and individual return. This was the normal pattern when they were my clients. I told them I was "pretty much" retired and to call Block Advisors. Just remembered--one summer I sent them a warning they were about to hit the 60 day mark (minimum penalties kick in). They contacted me on day 61.5 points

-

Yes, a very heartfelt thank you to Eric, the moderators, and every colleague who reads and posts here. Without you, I would be bereft of what small dregs of sanity remain to me.5 points

-

4 points

-

I have the utmost respect for everyone here and I thank you for sharing your day to day and making me feel less alone. Sincerely. My plan was for this to be my last year but I looked at the numbers and I think I have to do at least one more. Here's hoping I'm just exhausted and maybe I can call it a day? Congratulations to those who are done. My best to those who will continue.4 points

-

Thanks to Eric and to all of you. I am starting to double guess myself and waking up in panic mode. Not Good! Without you, I would be lost, even with all the research material that I have. Please donate to keep this board alive and always appreciate all of the knowledge and comradery found here. Happy Summer to everyone.4 points

-

I had a pretty good start to the season, but then lost a week to tech crap in March, and this past week to a bad back. So I'm trying to remind myself why I thought it was a good idea to keep doing taxes a few more years. But I just prepared a partial list of folks I'm going to fire, I'll go through and finish the list this week. Then I just have to write the letter to them. Then only 2 clients I still have payroll returns for, that's a relief to have that so low! Next year, none!!4 points

-

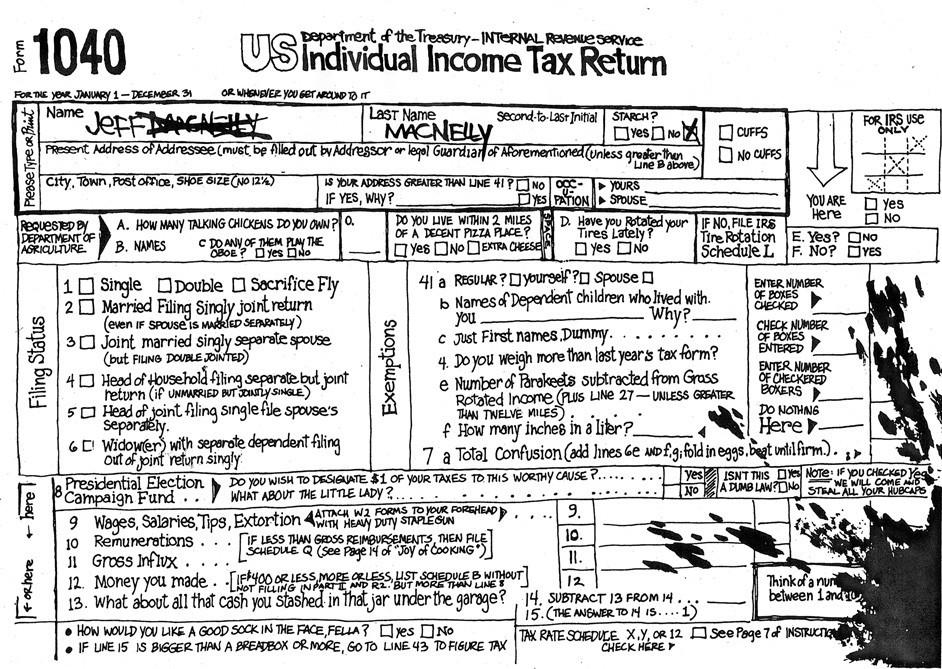

obviously the income ratio should not be .94--if $5,648 was in Box A, Lines 1 and 16, you'd get the correct result. ah, kathy beat me to it3 points

-

3 points

-

I definitely have a few in mind to fire. However, I'll wait until I've recovered a bit before making final determinations. Drake tracks time on a return (so I leave the client's return open when I'm doing anything with their documents) and one of the things I'll do is go back through 'em all and compare what I charged with what my time-billing fee would have been. Anyone whose time-bill is substantially more than the per-form charge is high on the list of candidate for firing.2 points

-

I don't, because then you just use the adjustment column with the appropriate codes, usually BO and combine the two adjustments, basis and ordinary income, and enter the net amount in the adjustment column. Easy peasy. I don't even break out the K1 sale to a separate line. I just leave it in the totals for that category (A, D, E, etc.). If that line already has an M for a code or an MW, the the code you end up with is BMOW, because they must be enter alphabetically for some reason. THEN, go to 4797 and enter the ordinary income in section II, using the Input tab. There a drop down box to select the K1 the income relates to. The ones that are easy to miss are when there is only a partial distribution of a K1 investment, because the K1 is not marked final. You're also supposed to attach a 751 election to the return, but I sometimes skip that part, even though I have an election boilerplate in my Blank Elections tab.2 points

-

Page 8 is where you enter MT source income. You entered 130K as MT income. Column B is for spouse MT income, not the total of MT income. Put the 5648 in Column A.2 points

-

Have you included the nonresident/part-year ratio schedule in the return? That ratio from the schedule would be applied to the overall MT tax on all income so that the tax is reduced to the same ratio that the MT income represents of the total income.2 points

-

I'm fortunate enough to be at a point in my life where I don't need to be bringing in money from preparing returns. For the most part, I still enjoy it and the vast majority of my clients I look forward to seeing each year. Email sent and now I'm going to go dig in some dirt and plant some veggie seeds!2 points

-

1 point

-

On occasion I'll send an extension form with recommendations, or (for those internet-savvy) a link to Direct Pay. Up to them, though. I'm not their mommy and they're supposed to be grownups!1 point

-

This one is online and 2 CPEs. No plans at the moment to go somewhere live. Got a group that wants to invite me?1 point

-

I'm done and done in. Last night I dug a hole on the edge of my foot to remove an already inflamed deepish splinter and went off this morning to the 5K charity event with a bunion pad and bandage. I completed only half of that, and then the sporting clays went about the same, like I was a raw beginner again. I had an awful season this year. My Mom passed at the end of Feb, and the I got the flu-a in early to mid March and missed many days. I actually sent 3 returns and a trust away because of it. There were a few days that I don't even remember in March when I started back working and was still very sick. Glad this season is over. If you made it this far, thanks for listening to me whining.1 point

-

1 point

-

Did you fill out tax schedule page 8 of form 2 to indicate MT source income?1 point

-

These guys have 90-100k invested in each PTP. And these things are frikkin complicated!! So I'm making sure I'm doing it all right.1 point

-

Certain people do come to mind and then they turn to dust. Breaking things after an aggravating day can be very satisfying.1 point

-

You are so right! I had about a dozen that I out right fired, about 10 more that I doubled the price and they went elsewhere and a couple more that paid the PIA fee. The stress these clients caused was not worth the money.1 point

-

Holding your ground is a good thing. Erosion (I am a left coaster so it is physical as well as mental) hurts.1 point

-

Amazingly 20 minutes after e-mail she shows up all apologetic. Didn't give her the return, only the original documents.1 point

-

It is very peaceful to let go of those whose revenue does not cover their expense and headache. Although long ago someone here said there is a price which makes any client worth having, and our job is to get that full price.1 point

-

I'm essentially done other than one that is a total PITA. They dropped off info late March. I sent email of a couple basic items missing. Various emails over the last 2 weeks to get the info. Sent email that they were done Tues, and she replied she will pick up today. Did not answer my return email as to what time today. I sent another this morning saying they need to be picked up by 1 pm. At 1:05 I'll be sending another email with password protected file of their original documents telling them they need to go somewhere else. They have 1 dependent that graduated HS in 2023 and another in college. Guessing at least one of them filed their own returns without indicating they were being claimed by someone else. Same crap happened last year and needed to prepare a revised return for them on 4/18 because kid claimed herself. I can be very nice until I feel taken advantage of. When I reach that point, look out!1 point

-

Waiting on a single marketplace form. Seems he doesn't read email or text messages. About 15 people need to pay me and pickup. On Tuesday, golf season begins.1 point

-

Next lesson: we cannot allow ourselves to care more than the client does. Care about the quality of our work, yes! Care more than they about penalties for being late? Nope. And I at least have to re-learn this every couple of years.1 point

-

1 point

-

Anyone else get the promotional email this morning from Kiplinger and Tax Tips, offering an "investment opportunity" in bourbon with something called Cask X? It was cleverly done - but in the thick of the season, I'm more interested in drinking it than investing in it. I did get a kick out of it, and would post the entire "opportunity" here if anyone else wants a chuckle from it but did not get it.1 point