Leaderboard

Popular Content

Showing content with the highest reputation on 04/13/2019 in all areas

-

5 points

-

5 points

-

My clients are all calling to see if I forgot to let them know their taxes are ready, After all, they brought their stuff in a week ago.4 points

-

Client calls Sunday and asks when I'll be in the office. M-F from 7-4pm each day at minimum. Sometimes later but I routinely have appointments outside the office in the evening. He'll be in between 12-1 on Monday. Easy stuff because he's almost completely retired now. He calls on Tuesday - just couldn't make it but he'll be in tomorrow and I repeat my hours. Calls Thursday at 4:45pm and wants to know why I'm not in my office. Calls today - he can't make it today because he works from noon-6pm. I mention I was in the office at 7am but he forgot about that. What hours do I have on Sunday? It's an ultra simple return, he's going to owe about $1k because he doesn't withhold taxes on his pension, he'll be completely shocked (again) that he owes and he'll have no clue how he's going to come up with the money on such short notice. Can he make payments?3 points

-

Remember that conversation we had about extensions? No? Well, I'll upload copies of your extensions next week to jog your memory.3 points

-

Now there are a number of reports coming from users of Avira security software that their Windows systems are running very slowly after updating.3 points

-

Lady just called - said "We can't get this TurboTax thing to work right or something. Are you busy this weekend?"3 points

-

I wondered where he went when I told him not to come here unless he's willing to pay me to prepare an extension. Apparently he moved to MO.3 points

-

2 points

-

Sounds like the story of the day trader who won the lottery. His friend asked him what he was going to do with his newfound wealth. He replied, "I'll probably just keep day trading until I lose it all."2 points

-

Go through the iteration; at some point the credit allows/disallows the credit. If it's still a close call, see if he has extra $$ to put into an IRA.2 points

-

If the B trust only holds non-income producing assets, such as a home, it has nothing to distribute until A dies and then the home is sold. If it has income producing assets, they can be distributed to the survivor , or children, or whoever the trust designates. Then it would be a by-pass trust. It is all determined by the terms of the trust. The main purpose of a B trust is to protect the assets of the decedent, so they can be passed on to his/her heirs. A common situation is where a divorced, or widowed person with heirs remarries.. It also protects the deceased assets in the event the surviving spouse remarries. Another aspect of the A-B trust is that could reduce the estate tax.1 point

-

I had one also just like that. My client put money into an IRA and everything worked out. I worked on those worksheets for hours and couldn't get it to work. Maybe I was tired also but lucky they could do IRA and solve the problem.1 point

-

The recapture of the credit produced a tax deduction. The deduction eliminates the recapture. What am I missing?1 point

-

I once had a client who was a broker with over 4400 trades, most of them wash sales. I charged him a bundle to create a spreadsheet to "move" each unallowed loss to the adjusted basis of the next purchase. After a couple years, his wife quit funding his trading. His only income was his own commissions, because he spent all his time on his own account.1 point

-

1 point

-

OIC. So if he sells the security at a later loss it will increase his loss or if a profit decrease his gain. Of course, as he had to cough up over $11,000 on those sale gains he lacked appreciation of this fact. Good grief the next question is does his broker recalculate the basis on those shares?1 point

-

You add the unallowed loss on the sale of the stock to the basis of the stock purchased. You're kicking the can down the road.1 point

-

1 point

-

I get the "I thought obtaining payroll software would do my payroll for me" from time to time.1 point

-

Not exactly. When a client has a loss on the schedule C, and part of that loss is derived from mileage expense, I include the home office worksheet in the return and check on the simplified method. Obviously, the simplified method will not increase the loss on the return as it is not allowed by the code to do so. My reasoning is that if the return is audited, I can show that there was a home office on the return, it just did not produce a deduction for the business. The workpapers to the return shows the square footage of the home and the square footage of the office, hence, there must be a home office. Sorry if that did not make sense. Maybe it still doesn't. Tom Modesto, CA1 point

-

Around here, where housing costs are relatively low, and climate is moderate (plus people heat with wood, at least partially) the simplified method can actually be better in terms of just OIH deduction. But only sometimes.1 point

-

about 1600 out of 2000 are on extension - we do too much real estate to deal with the aggregation rules and interest limitations that the software isn't handling correctly1 point

-

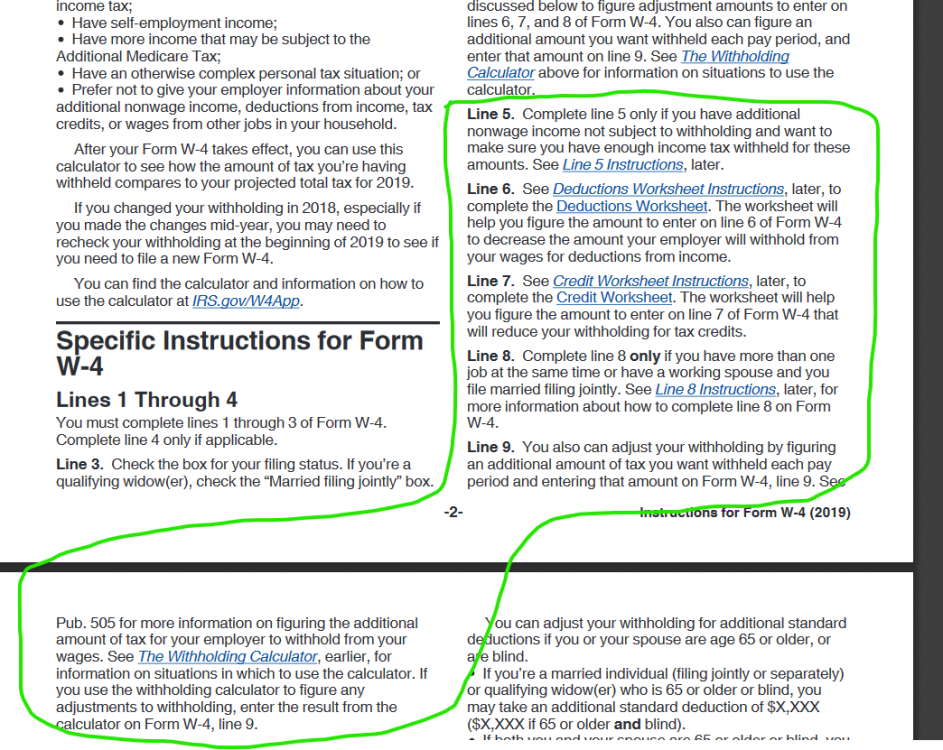

I can only guess at present, since there is no draft form (supposed to be released in May). What I base my guess on is the one floated for 2019, then delayed, primarily because of payroll industry lobbyists (I think, but I could be wrong). I had (and kept) programming code to calculate using the new W4. I needed four new data points (actually 8, as there is a chance at least one state will copy). Since those data points directly affect the calculation, my preference is to include those data points on the stubs, so the employee can self calculate / self check their paycheck. NonWage Income, Additional Deductions, Tax Credits, and Other Taxed Wages (that is what I called them anyway). The following link appears to be the instructions for the former draft version. https://www.irs.gov/pub/irs-dft/iw4--dft.pdf --- And: Filing status: Line 3 is used to indicate the employee’s tax filing status. The draft 2019 Form W-4 has checkboxes to indicate that the filer is single or married filing separately, married filing jointly, or head of household. Instead of claiming allowances based on filing status using a separate worksheet, the number of allowances will be calculated automatically based on the filing status that is checked – 2 if single or married filing separately, and 3 if married filing jointly or head of household.1 point

-

Tax Map Search: Search Help Navigation Help Tax Map Index A B C D E F G H I J K L M N O P Q R S T U V W X Y Z # Tax Reform Tax Topic Index International Tax Topic Index Affordable Care Act Tax Topic Index Exempt Organization Tax Topic Index FAQs Forms Publications Tax Topics Worksheets Comments About Tax Map IRS.gov Website Publication 974 Previous Page | Table of Contents | Index | Next Page Self-Employed Health Insurance Deduction and PTC(p56) Self-employed Health Insurance Deduction This part provides special instructions for figuring the self-employed health insurance deduction and PTC if you or your spouse was self-employed, you or a member of your tax family was enrolled in a qualified health plan in 2018, and you may be eligible for the PTC. Because the amount of the self-employed health insurance deduction may affect the amount of the PTC, and the amount of the PTC may affect the amount of the deduction, a taxpayer who may be eligible for both may have difficulty determining the amounts of those items. A taxpayer who may be eligible for both may follow the instructions in this part to determine amounts of the self-employed health insurance deduction and PTC that are allowable under the law. Using the special instructions in this part is optional. If you are eligible for both a self-employed health insurance deduction and the PTC for the same premiums, you may use any computation method that results in reporting amounts that satisfy the rules for both the deduction and PTC, as long as the sum of the deduction claimed for the premiums and the PTC computed, taking the deduction into account, is less than or equal to the enrollment premiums. Before you complete any of the worksheets in this part, you should first do the following. Read the instructions for line 29 of Schedule 1 (Form 1040) or Form 1040NR to find out if you meet the requirements for claiming the self-employed health insurance deduction. Read the Instructions for Form 8962 to find out if you meet the requirements for claiming the PTC except for the requirement that your household income be at least 100% but not more than 400% of the federal poverty line for your family size for 2018. You will determine whether you meet the 100% but no more than 400% requirement in the process of completing these instructions. If you meet the requirements described above, do the following. If you are filing Schedule 1 (Form 1040), complete lines 30 (Penalty on early withdrawal of savings) and 31a (Alimony paid). Also, figure any write-in adjustments you will enter on the dotted line next to line 36, other than any amounts identified as "DPAD." If you are filing Form 1040NR, complete lines 30 (Penalty on early withdrawal of savings) and 31 (Scholarship and fellowship grants excluded). Also, figure any write-in adjustments you will enter on the dotted line next to line 34, other than any amounts identified as "DPAD." Complete line 32 of Schedule 1 (Form 1040), or Form 1040NR if you made contributions to a traditional IRA and you (and your spouse if filing a joint return) were notcovered by a retirement plan at work or through self-employment. If you elect to report your child’s interest and dividends on your tax return, complete Form 8814. If, during 2018, you were an eligible trade adjustment assistance (TAA) recipient, alternative TAA recipient, reemployment TAA recipient, or Pension Benefit Guaranty Corporation payee, read the Instructions for Form 8885 to find out if you meet the requirements for electing the health coverage tax credit (HCTC). If you elect the HCTC, complete Form 8885. Using this information, do the following. If you have health insurance premiums for which you cannot claim the PTC (see Nonspecified premiums, later), first complete Worksheet P, or if required, Worksheet 6-A in chapter 6 of Pub. 535 but only with respect to those premiums. Skip Worksheets W and X if either of the following applies. You completed Worksheet P and line 2 is less than or equal to line 1. You completed Worksheet 6-A in chapter 6 of Pub. 535 and line 13 is equal to or less than line 3. Then complete Worksheet W and Worksheet X. You have to complete Worksheet X only if APTC was paid to your insurer on your behalf for the months you were self-employed. If APTC was not paid to your insurer on your behalf for the months you were self-employed, skip Worksheet X. After completing Worksheets W and X, you may choose to use either the Simplified Calculation Method or theIterative Calculation Method to compute your self-employed health insurance deduction and PTC. The Simplified Calculation Method is shorter, but in some cases will not produce a result as favorable as the Iterative Calculation Method. Worksheet P. Self-Employed Health Insurance Deduction for Nonspecified Premiums Before you begin: ✓ If you file Form 8885, read the definition of nonspecified premiums to find out which amounts you cannotinclude on line 1 of this worksheet. ✓ Read Exceptions, later, to see if you can use this worksheet instead of Pub.535 to figure your deduction for nonspecified premiums. Also read the definitions of specified premiums andnonspecified premiums. 1. Enter the total amount of nonspecified premiums paid in 2018 for health insurance coverage established under your business (or the S corporation in which you were a more-than-2% shareholder) for 2018 for you, your spouse, and your dependents. Your insurance also can cover your child who was under age 27 at the end of 2018, even if the child was not your dependent. But do not include amounts for any month you were eligible to participate in an employer-sponsored health plan or amounts paid from retirement plan distributions that were nontaxable because you are a retired public safety officer 1. 2. Enter your net profit* and any other earned income** from the business under which the insurance plan is established, minus any deductions on lines 27 and 28 of Schedule 1 (Form 1040), or Form 1040NR. Do not include Conservation Reserve Program payments exempt from self-employment tax 2. 3. Self-employed health insurance deduction for nonspecified premiums.Enter the smaller of line 1 or line 2. Do notinclude this amount in figuring any medical expense deduction on Schedule A (Form 1040) 3. If line 2 is equal to or less than line 1, stop here. Do not read the rest of these special instructions. Enter this amount on line 29 of Schedule 1 (Form 1040) or Form 1040NR. Use Form 8962 to figure the premium tax credit for specified premiums. If line 2 is more than line 1, complete Worksheet W. Also complete Worksheet X if APTC was paid to your insurer on your behalf for the months you were self-employed. If APTC was not paid to your insurer on your behalf for the months you were self-employed, skip Worksheet X. *If you used either optional method to figure your net earnings from self-employment, do not enter your net profit. Instead, enter the amount from Schedule SE, Section B, line 4b. **Earned income includes net earnings and gains from the sale, transfer, or licensing of property you created. However, it does not include capital gain income. If you were a more-than-2% shareholder in the S corporation under which the insurance plan is established, earned income is your Medicare wages (box 5 of Form W-2) from that corporation. Instructions for Worksheet P(p57) Instructions for Worksheet P Use Worksheet P to figure the amount you can deduct for nonspecified premiums. Exceptions.(p57) Use Worksheet 6-A in chapter 6 of Pub. 535 instead of Worksheet P to figure your deduction for nonspecified premiums if any of the following applies. (Only include nonspecified premiums on line 1 or 2 of Worksheet 6-A.) You had more than one source of income subject to self-employment tax. You file Form 2555 or 2555-EZ. You are using amounts paid for qualified long-term care insurance to figure the deduction. After you complete Worksheet 6-A, follow the instructions below. If line 13 is equal to or less than line 3, stop here. Do not read the rest of these special instructions. Enter the amount from line 14 of Worksheet 6-A on line 29 of Schedule 1 (Form 1040) or Form 1040NR. Use Form 8962 to figure the premium tax credit for specified premiums. If line 13 is more than line 3, complete Worksheet W. Also complete Worksheet X if APTC was paid to your insurer on your behalf for the months you were self-employed. If APTC was not paid to your insurer on your behalf for the months you were self-employed, skipWorksheet X. Nonspecified Premiums(p57) Nonspecified Premiums A nonspecified premium is either of the following. A premium for health insurance coverage established under your business (or the S corporation in which you were a more-than-2% shareholder) but paid for coverage in a plan that is not a qualified health plan. The portion of the premium for coverage in a plan that is a qualified health plan established under your business (or the S corporation in which you were a more-than-2% shareholder) but that is attributable to individuals not in your coverage family. Calculate how much of these nonspecified premiums are fully deductible by entering this amount on line 1 of Worksheet P, or if required, on line 1 or 2 of Worksheet 6-A in chapter 6 of Pub. 535. Complete the remainder of the appropriate worksheet. The following are examples of nonspecified premiums. Premiums paid for a qualified health plan other than during a coverage month. Premiums paid to cover an individual other than you, your spouse, or your dependents. Premiums for qualified long-term care insurance. Dental insurance premiums. Medicare premiums you voluntarily paid to obtain insurance in your name that is similar to qualifying health insurance. Example.(p58) In 2018, you were self-employed and were enrolled in a qualified health plan through the Marketplace. You enrolled your dependent, 22-year-old daughter in individual market coverage not offered through the Marketplace. This coverage has an annual premium of $3,000. This $3,000 premium is a nonspecified premium because it is for coverage under a plan that is not a qualified health plan. Include this $3,000 premium on Worksheet P, line 1, or if required, on line 1 of Worksheet 6-A in chapter 6 of Pub. 535. Filers of Form 8885.(p58) If you are filing Form 8885, nonspecified premiums do notinclude any of the following amounts. Any amounts you included on Form 8885, line 4, or on Form 14095 (the Health Coverage Tax Credit Reimbursement Request form). Any qualified health insurance coverage premiums you paid for HCTC eligible coverage months for which you received the benefit of the HCTC advance monthly payment program. Any advance monthly payments of the HCTC your health plan administrator received from the IRS, as shown on Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments. Specified Premiums(p58) Specified Premiums Specified premiums are the premiums for a specified qualified health plan or plans for which you may otherwise claim as a self-employed health insurance deduction on line 29 of Schedule 1 (Form 1040) or Form 1040NR. Generally, these are the premiums paid for the months you were self-employed. If you were self-employed for part of a month, the entire premium for that month is a specified premium. A specified qualified health plan is a qualified health plan that covers one or more members of your coverage family for a month for which your enrollment premium(s) has been paid by the due date prescribed under Enrollment premiums, discussed earlier. Qualified health plan, coverage family, and enrollment premiums are defined earlier under Terms You May Need To Know. Example.(p58) You were enrolled in a qualified health plan through the Marketplace for all of 2018 and you were self-employed from September 15 through December 31. Only the premiums for the last 4 months are specified premiums and only those premiums are entered on Worksheet W, line 1, and Worksheet X, line 27, if you are required to complete those worksheets. You are not allowed a self-employed health insurance deduction for the January through August premiums because you were not self-employed during those months. Those premiums are neither specified premiums nor nonspecified premiums. However, you may be allowed a PTC for your coverage for January through August.1 point

-

Also the tax savings today will most likely out weigh the future gain considering SE and ordinary tax vs capital gain subject to 1250.1 point

-

I also attach the car... ok not the car the receipt for the car I attach everything...never mail 8453 I recall a few years back, I had to send the 1099B details with a trust return. Not sure why it was a paper return, probably the state. That was back before most things were A or D or there were wash sales... needed to send the 1099B. IT was a zillion pages, so I copied it 4 on a page double sided. I didn't want to waste all that paper and postage to print single sided... you know NO ONE was ever going to actually read it!1 point

-

Yes to both. Not much help out there (except from folks like us) and then when we DO beat ourselves senseless to get them the right information, they "never get around" to telling HR.1 point

-

My idea for a W4: Enter the % you want withheld (min 8%). You can still claim exempt if you expect your EIC or other credits to zero out your tax. This will help part-timers, especially if their hours vary and sometimes have no tax withheld due to low hours in a pay period. Then everyone will be having a discussion about what % they're having withheld and people will start to understand what their effective tax rate is. And if they're under/over withheld, they can easily increase/decrease the %.1 point

-

David: The secret is to take control of your business (and your valuable time & health) out of the hands of your clients and put it back into your hands, where it has always belonged. Some of them won't understand - that is not your problem and they're not worth the aggravation. Maybe they need to be ruining someone else's peace rather than yours.1 point

-

I am going to need hair exentsions after this tax season I while back I was speaking to another accountant and he said he no longer sends extension if he hasn’t been given the okay by the client, out maybe 20 I haven’t heard from, only about 4 have called me to send an extension.1 point