Leaderboard

Popular Content

Showing content with the highest reputation on 02/10/2021 in all areas

-

This happens to me at least once a year, and it takes me forever to figure it out. Per 8962 Instructions: Household income above 400% of the federal poverty line. If the amount on line 5 is 401%, you cannot take the PTC. You must generally repay all APTC paid for individuals in your tax family (but see below for two exceptions). Skip lines 7 and 8, and complete lines 9 and 10 (and Part IV and/or Part V, if applicable). Complete only column (f) of line 11 or lines 12 through 23. Enter -0- on line 24, and enter the amount from line 11, column (f), or the total of lines 12 through 23, column (f), on lines 25, 27, and 29. Enter the amount from line 29 on your Schedule 2 (Form 1040), line 2.If your household income is above 400% of the federal poverty line but you qualify for the alternative calculation for the year of marriage (see the instructions for Line 9, later), you may be able to reduce the amount of APTC you have to repay.If you enrolled an individual who is in another tax family for the year of coverage, the other tax family may be responsible to repay all or part of the APTC (see the instructions for Line 9, later). This has worked for me in the past. I haven't had one like this yet in 2020.4 points

-

Well, that seems to be the heart of the matter, but the only way to give the irs new bank info would be to make an estimated payment for 2020 (using direct pay) and then file for a refund. And this is just for future stimulus payments, so it should be worthwhile.2 points

-

I am wondering if you actually saw the letter, or he just told you what it said over the phone. My GUESS is that he did not get one or both of the stimulus payments from the IRS for last year because his account numbers was incorrect. If that is the case, the 2020 tax return is the place that is reconciled and he would file to get the recovery rebate credit now, which would result in a refund and the bank information being transmitted with the return when you electronically file. I would put in the correct amount of his social security, and any interest income he has because I don't think you can transmit a return that has NO income whatsoever. You may need to put a $1 entry in somewhere, I am not sure. I have not actually had to file one for the recovery rebate credit yet.2 points

-

I think it would all flow from what is input on the stimulus worksheet on line 30. If you indicate stimulus 1 or 2 has been received the program factors that into the calculation. If you indicate only one or none of the payments was received, the program factors that as well. I'm not aware of anything besides completing that worksheet.2 points

-

We are holding off on the 1065s and 1120s, possibly for a couple of weeks. These forms seem to get updated all season long, but the big issues usually get corrected earlier than the later updates (where some insignificant entry doesn't carry to where it's supposed to and only affects one in a million entities). With all the changes to the changes that occurred this year, I doubt the IRS caught everything so we'll give them time. We probably won't efile individuals and 1041s until Monday or Tuesday, just so the ACKs will come back quickly, which probably won't happen with the onslaught on opening day.2 points

-

"When in danger, or in doubt, run in circles, scream, and shout!" Is that what you mean? At least it makes the others in your office leave you alone for a while.2 points

-

Brightening up our day is good use of your retirement time. Thanks for thinking of us. That was turtley funny!2 points

-

Ok, I figure it out, you need to input zero on line 16 and 19 on the recovery rebate worksheet if in 2019 they were a dependent, and not in 2020.1 point

-

Has your family that is attending/hosting quarantined? Have you? Are any or all of you vaccinated? Is your family the kind that WILL wear masks, stay six feet apart, wash hands, not shout or sing, etc.? Are you close enough to Pittsburgh that you won't have to use a public restroom on your way? Close enough that you don't have to stay overnight? Do you know and trust whoever is handling the food? Is the venue large enough that you can move every 15 minutes to mix and mingle and not hang around one person too long? Will the event/some of the event take place outdoors? If you're asking, you probably shouldn't go!! (I haven't visited my granddaughters in PA since last Christmas.) Stay safe.1 point

-

Augh, yet one more misuse of "comprise" which is synonymous with "include", not "compose"! From Words on Writing (by Erin Hart): "When using the word comprise, follow these five guidelines. Comprise is a stand-alone verb—it does not need a helping verb like “is” or “was” or a modal verb like “will” or “might” to create future tense. Prepositions like “of” do not grammatically follow comprise. Comprise is a transitive verb and must be followed by a noun or series of nouns. Going from large to small is essential when using comprise—the whole comprises the parts. Comprise can be interchanged grammatically with “contain” but not with “compose.”1 point

-

I they can NOT be claimed by someone else as a dependent in 2020, then they claim their own RRC. If they CAN be claimed as a dependent in 2020, then they do NOT qualify for the RRC.1 point

-

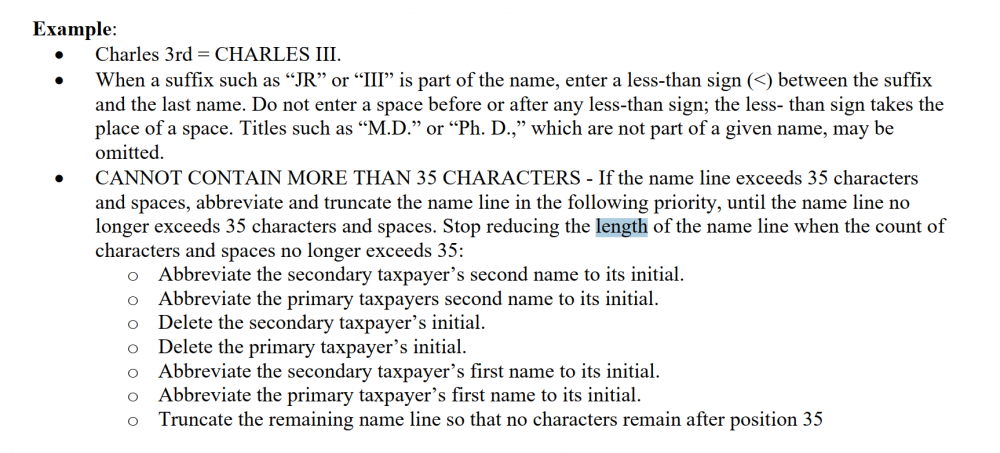

Look at the Social Security card and just use the first part of the last name or a shortened first name, since the IRS does not care about first names.1 point

-

If you've got any information returns among the client's documents, do any of those show truncated or abbreviated names or portions of the names? Take your lead from those and ask the client whether they agree with the treatment shown. I've got several clients from cultures that appoint multiple names and so far have found that they're accustomed to using fewer names to fit in -- literally -- with various bureaucracies.1 point

-

She only has a choice if she filed the election to be treated as an s-corporation. If she hasn't made the election then she would file on schedule C. Not sure about IL but KY does require an additional form (and fee - LLET Tax) to filed for the LLC.1 point

-

I've already transmitted a couple less complicated 1040's. Fingers crossed.1 point

-

No, the contribution deduction on the original return is unchanged by the NOL carryback because that deduction on line 10 is specifically calculated without regard to any NOL carryback to that year. In other words, do not recalculate that deduction. This is covered in the instructions to form 1120, but that is more difficult to find at the moment because that document is currently under revision. An older version of the instructions states this as it pertains to calculating the deduction on line 10 of the 1120:1 point

-

I don't like to override anything on any return because if items change, that override will give me different results. I remember about 8 years ago I posted an issue with a simple override, ever since, I have not use it.1 point

-

1 point

-

If she is a single member LLC it is considered a disregarded entity and she will continue to report income and expense on Schedule C.1 point

-

I only have one client who received an EIDL Grant, which is not taxable. I am showing it in Other Income on their financial statement. Then I am showing as an M -1 item, Line 7. It should balance.1 point

-

1 point

-

I restarted the computer and now all is well. It may have been my security software causing the problem.1 point

-

Business returns have been open for a while, so the pent-up onslaught issue doesn't apply. As I state before, I'll hold off. Just a day. It's not worth my worrying about problems at/with the IRS e-file system; I have easier ways to hurt myself.1 point

-

I would be very skeptical and keep that chat transcript in my files for penalty abatement (reliance on an expert from the software company). Tom Modesto, CA1 point

-

1 point