Leaderboard

Popular Content

Showing content with the highest reputation on 12/19/2022 in all areas

-

5 points

-

I got my new glasses and they are wonderful. The blue light protection is wonderful. Also, I can spin around in my chair to client across the desk and see the client perfectly. I can see the bird sanctuary outside my window as well. Very happy.5 points

-

If you receive a commercial email with the following message at the beginning of your email: "Images are not displayed - Display images below - Always Display images from [email protected]" If you click on this link then you are authorizing the sender to embed Meta Pixels in the current and future emails from the sender. At that point you have no way of knowing what or how much information is being sent back to the sender and to Meta! At my age I am not capable of going "off the grid"3 points

-

Many email apps have a setting to display or not display images. If you have your account set to not display images, most email apps will put a message like this at the top of the page. Not all emails with images have tracking pixels. There are browser add ons that will detect and block tracking pixels.3 points

-

If there's an EIN, I file and mark it final. Last thing I want is a letter, two years from now, and having to dredge up the old information.3 points

-

13 composers fighting over the last slice of cake. Very well done. Seven minutes.2 points

-

Windows 11 is mostly minor refinements, minor new features, and a fresh coat of paint compared to Windows 10, not a huge overhaul like the new version number would suggest. I would say that if your software vendor says it's compatible, and manufacturer of your peripherals (printers, scanners, etc) are supporting Windows 11, then you're safe to use it. Do whatever you're comfortable with. https://support.atxinc.com/includes/atx system requirements.pdf I think doom and gloom rants about either choice (sticking with Windows 10 or choosing to buy a Windows 11 computer) are probably a bit of an over-reaction. I don't think there's much risk either way... but if you're the type to get flustered by technology changes, then right before tax season might not be the ideal time to start getting acquainted with a new version of Windows.2 points

-

If he has a W-2 job and devotes 2 to 4 hours a day I would be skeptical that he meets the requirements to be a professional gambler. Determining whether an individual is engaged in the trade or business of gambling is based on the facts and circumstances. In Comm’r v. Groetzinger, 480 U.S. 23 (1987), the Supreme Court concluded that “if one’s gambling activity is pursued full time, in good faith, and with regularity, to the production of income for a livelihood, and is not a mere hobby, it is a trade or business.” Courts have considered the following factors in assessing whether a taxpayer has the necessary profit motive (no single factor of which is controlling): Manner in which the taxpayer carries on the activity Expertise of the taxpayer or his advisors Time and effort expended by the taxpayer in carrying on the activity Expectation that assets used in the activity may appreciate in value Taxpayer’s success in carrying on similar activities Taxpayer’s history of income or losses with respect to the activity Amount of occasional profits, if any, that are earned Taxpayer’s financial status Elements of personal pleasure or recreation.2 points

-

Fortunately, I have one gal who loves digging through the papers and sorting out the expenses. She comes in when I need her and does an awesome job. Believe me, she looks at everything and questions that lunch at McDonalds or that bottle of Bourbon and isn't afraid to call the client on it. When she is ready, she calls them in and puts them on the "hot seat" and ties up all the loose ends. When she is finished, all I have is totals. At the same time; she is doing a great job of whipping them into shape. She isn't interested in tax prep, but loves the numbers and loves coming here just to be a part of the "fun"! One client has 9 rentals and tries to bring in reports that are a mish mash of a mix up. He knows that when Gen wants to talk to him, he had better have his answers ready.2 points

-

If you don't fund it, you just spent a heck of a lot of money for raw materials for a fleet of paper airplanes.2 points

-

I'm shameless about this eyesight business. I alternate between taking my glasses off to look at someone sitting across the desk, putting them on to look at the computer screen or read a document, and grabbing one of several magnifying glasses lying around when the text on a document is too small. I'm thinking about mounting a magnifier on a swing arm on my desk so I can keep both hands free.2 points

-

After a recent eye exam, my Doctor gave me two prescriptions; one for everyday wear and one prescription for Computer and Document Reading only. Am I correct in assuming that I can deduct the cost of the computer glasses as a business expense?1 point

-

From my perspective, my daily checking and savings do not need to be in the trust, since it is a relatively small amount (not even a month's expenses). The accounts will automatically transfer to the person who will be managing our estate, enough to keep things going for a couple of weeks in case other access gets held up. Same for a life policy, it is a small one, and will go directly to two desired people, outside of anything else. Our main cash holding accounts are in the trust, as is our home. We monitor to make sure anything not in the trust will be probate proof (small estate exception). A trust is not an end all/catch all, it is part of an overall plan (to me).1 point

-

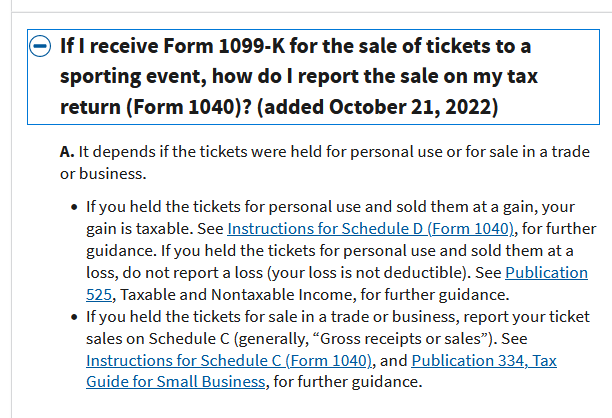

Watch/ask for any additional costs, such as bank or charge card fees between time of purchase and time of payment. Make sure the 1099 is accurate, and shows the amount actually paid out. IOW, watch for the broker fees. Candidly I bought as many tix as I could for a certain performer's LV shows. Sold all but 2 right away, at a multiple profit (which more than paid for our personal tix, flights, and hotel), but lower than what most were asking. Those we held for personal use, we let go right after the "cancellation/postponement". The entire process turned us off so much, I did not try the same for another recent performer whose online sales process failed, even though it absolutely would have been profitable, and we have a few family members who would have wanted to go... Team tix may be slightly different as many/most will have a controlled resale portal which may have been used.1 point

-

It's definitely interesting given that he devotes 2-4 hours a day in research for his sports bets. He is trying to make the argument it is no different than a part time job. He keeps records detailing his bets, has a separate bank account for this activity and has a profit motive.1 point

-

https://www.journalofaccountancy.com/issues/2016/oct/taxes-for-gamblers.html https://www.cpapracticeadvisor.com/2015/07/16/taxpayer-fails-to-hit-jackpot-as-professional-gambler/19245/ https://www.cpajournal.com/2019/12/24/taxation-of-gambling-income/ Also, look up this Advice Memorandum because it has links to several court cases: IRS Advice Memorandum, Professional Gambler's Wagering Losses and Business Expenses AM 2008-013 December 10, 2008 Code Sec. 165 Code Sec. 162 Internal Revenue Service: Chief Counsel: Advice Memoranda: Professional gambler: Wagering losses: Business expenses.– Office of Chief Counsel Internal Revenue Service Memorandum Number: AM2008-013 Release Date: 12/19/2008 CC:ITA:B01 - JGMEEKS POSTN-139898-08 UILC: 165.08-00, 162.00-00 date: December 10, 2008 to: Sara M. Coe Deputy Division Counsel (Small Business/Self-Employed) from: George J. Blaine Associate Chief Counsel (Income Tax & Accounting) subject: Professional Gambler's Wagering Losses and Business Expenses This Generic Legal Advice responds to your request for assistance about a recurring issue in litigation. This advice may not be used or cited as precedent.1 point

-

I'd like to be judgemental on people not doing things correctly with funding their trusts but our checking account and savings account are still in our joint names. When Covid hit, it was a pain to get into the bank so we've never made the switch. My wife is off next week, that might be our goal!1 point

-

I'd rather blow $3.49 each and get EFileMyForms to take care of it all. I know for certain-sure that their system works.1 point

-

Like every time they stop at a fast food joint for lunch or a package store classified as "meals and entertainment"? I prefer the clients who classify half their entries as "ask accountant." My least favorite are those who don't have separate business debit/credit cards and just give you their bank statements. Everything is in there--groceries, gas, shoes, dating services, and of course cell phone payments for the entire family. Bookkeeping can take a LOT of time, but if you can charge enough for it, go for it. The answers are more black and white than positions on a tax return--if you can get the details from the client.1 point

-

About 90 % of my annual income comes from 7 monthly Write up/Payroll/Business Entity Tax Return/Business Owner Tax Return clients. Five of these clients I have had for over 25 years. Including these clients I did less than 40 total tax returns last year. It's a very viable practice niche with less hours and a lot less stress.1 point

-

The credit may potentially only be claimed in a year when the taxpayer does not pay AMT itself. The credit is available as carryforward if the taxpayer paid AMT in prior years, but not all of the AMT will factor into the credit. Only the portion of AMT that relates to depreciation and ISOs will ultimately be used as part of the credit calculation. Deductions that may have triggered AMT in the first place, such as state income and property taxes, home equity mtg interest, and miscellaneous deductions, are excluded. I can't answer specifically where this is in ATX other than to say that it should be with the input for form 8801, and it may be that many of the figures may be prefilled from prior years' forms 6251 and 8801 if the prior return was prepared in ATX.1 point

-

Yep. I've had many cases over the years where someone applied for the EIN and the IRS mailed them a letter 2 years later wondering why nothing was received. I spend more time on the letter than I do a 1041 showing $1 of income.1 point

-

If they applied for and received a tax ID number, I would. IRS might want to know why you got a number and never filed a return, and if they ask, you are going to have to spend time on the account anyway. Tom Longview, TX1 point

-

Now that you mentioned it Lion, Amazon has several sellers of progressive computer glasses. The trick is getting the right prescription. I am glad that I took the plunge and ordered them custom made. Just sorry that I didn't have the top left clear, but it might turn out to be all right. They will never leave my desk, but I still have my old glasses for distance, although I seldom need that. I can drive without glasses. See better without them. I am definitely going to deduct them as I have separate invoices and, believe me, nothing is inexpensive these days. Had blue light put on my regular glasses as well. One thing I do believe in is taking care of my eyes. They are my greatest treasure and I am so thankful that they are basically healthy, just old.1 point

-

I installed it about a week ago. The interface looks the same except that the icons at the top seem a bit more cartoonish to me. It's a current trend, but not what I expect or want in a professional program.1 point

-

I got blue light blocking computer glasses a few years ago and they really help. But I never thought of deducting them as a biz expense! D’oh!1 point

-

These glasses will live on my desk. He also prescribed progressive lenses in another pair for all around use. We shall see how it goes. Most of the time, I don't wear any or pick up a pair of cheaters. However, lately I have had issues with reading the documents to enter into the tax returns. I really have no qualms about deducting the expense. I am certainly not going to track time. It isn't that critical of a deal. Thanks for your comments. I already know that I will be sorry that I didn't have him put distance at the top because the bird feeders are right outside my office window. Also have wild turkeys and deer walking around the yard quite often.1 point

-

1 point

-

1 point