Leaderboard

Popular Content

Showing content with the highest reputation on 01/17/2023 in all areas

-

Around last week of December 2022 I had to talk to CA FTB agent, one of my client received notice requesting to file 100S for few past missing years for IL based software consulting business. Normally I file tax returns only when consulting business hires employee in CA or have an end client who is being serviced in CA for that respective year. Earlier CA use to collect minimum $800.00 franchise fee regardless of whether you did business in CA or not. As long as your business is registered you are on the hook to pay this fee unless you forfeit your right to do business in CA Since client did not file tax returns as there was no CA source income in fact agent waived off franchise fee whichever years business had zero source CA income. This was something new to me because in the past for other clients they had to pay $ 800.00 fee regardless of whether you did CA business or not. In fact client requested me to close CA business account but FTB agent suggested me to keep it open & continue doing what I am doing & just file tax returns when business has CA source income.3 points

-

[Note: I luckily had no client do this.] I would amend the years for which they received ERC now, so they know how much they owe. If they received the ERC monies, I'd e-file immediately, with direct debit or other payment arrangement. Otherwise, I'd hold the returns until the client receives the ERC monies and have them sign then, and I'd e-file. If they have both 2020 and 2021 ERC, those monies probably will arrive at two different times, so I'd e-file each amended return on its own schedule.2 points

-

It is malpractice on the part of the ERC company to tell a client not to file a return that will show a balance due. The ERC company does not want the client to see the "true" cost of the ERC because they will know that the fee they paid as a percentage of the net they got is not what was advertised. Your client should report this to the IRS. They won't, but they should. Tom Longview, TX2 points

-

Ain't that the truth! Not so much here, but on other boards I've seen people hold themselves out to be "tax professionals" when they are nothing more than a glorified keypunch operator. Software is a great tool and there are times when it catches my mistakes, but then again, there are other times when it gives an answer that I know if not right. Generally it's because I didn't click on a box or other. If someone doesn't have a good idea of what the result should be, they don't know to look at what has to be checked. I think those of us who "could" do a return with calculator and pencil are going the way of dinasours!2 points

-

This is a reminder that we do NOT host political discussions on this forum, and with new leadership in the U.S. House, I expect that some members will be tempted to post about proposed new legislation on here. Already this morning, I've deleted two posts and modified a third to eliminate a political reference in a very minor way that does not affect its content. I'm asking that each of you to please be cognizant of content before posting to keep this a politics-free site. This would be especially true of any legislation floated out that we all know has no chance of becoming law short of h*ll freezing over. Thank you.1 point

-

I am going to call in mom and have an extended chat. The daughter prepared her own return last year but did not claim the dependent exemption. Now she and mom are not getting along very well so it clearly is time to get a firm reading on this one. Thanks.1 point

-

Which one is your client? As you can see, you might have a conflict form the get go.1 point

-

So, you have to have the appraiser with you each time you want to donate crypto? He is the one that will give faith to the price. How about the passage that reads that you can deduct the amount that the "church" received when property was sold?1 point

-

"If an apportioning trade or business is (1) operating as a sole proprietorship owned by a nonresident individual or (2) operating as a single-member disregarded LLC owned by a nonresident individual and therefore treated as a sole proprietorship, for income arising from activities that occur both within and outside California, the single-sales factor formula must be used to determine the California source income of the individual on Schedule R-1. For more information, see Cal. Code Regs., tit. 18 section 17951-4(c)(2). Nonresident individuals with service or intangible income from a trade or business or profession may have California source income if they have income from California as result of market assignment. See market assignment information in the General Information section, Specific Line Instructions, R&TC Section 25136, and Cal. Code Regs., tit. 18 section 25136-2, for more information." This relates to a Corporation, which is a horse of a different color.1 point

-

If you look at CA Sch R apportionment & allocation It has 2 subsets first is CA sales to total sales & 2nd subset has 3 factor formula CA property, payroll & sales to total sales.1 point

-

@mircpa CA has moved to a new scheme of revenue sourcing regardless of the old nexus rules. Nexus rules still apply in some circumstances, but in the case of service based business, the location of the benefit of the service takes precedence now. Tom Longview, TX1 point

-

I am surprised I was the first person to talk about nexus unfortunately my post was voted down.1 point

-

I think you need the exact time. As volatile as crypto is, it could have traded between $70 and $150 that day. Bitcoin, for example, sometimes seems to be going up at 9AM but by 5PM is down over $400 (and there is no trading day so who knows where it was before 9 or where it will be by midnight).1 point

-

Here is a lengthy analysis of the state income tax nexus situation in The Tax Advisor, dated December 1, 2022: https://www.thetaxadviser.com/issues/2022/dec/states-reactions-to-mtc-application-pl-86-272-to-internet-sales.html1 point

-

They did, Wayfair (which was a change to, IIRC, "Quill"). This "new item is states adding the interpretation of Wayfair to PL 86-272. The PL was before email, so there is wide room for interpretation. It is a federal law, with a non government entity (MTC) giving boilerplate suggestion. Sound familiar? It is what we have with Wayfair and sales tax, some states are common, the suggested formula and triggers, and others elected something else. It is an interesting thing our Union allows. Even within Wayfair and sales tax, states have different/sovereign rules on what is taxable such as in my case, how is canned software treated as a whole, and does delivery (hard media or electronic) alter the status. Same with employment law, states can nexus on first second worked in state (and what defines in state), some give 30 days, and so on. So, to me, it seems like the only "case" would be some update to PL 86-272, which has not happened in nearing 40 years. For me, the avoidance of unwanted nexus has a clear/easy/viable path. For most others here, it likely means no outside of domicile returns, unless you can get a higher return than in state returns. Tom might be one to opine, assuming he kept more than a few CA clients, and wants to keep them. Again, for me, I do have to watch what I do when we travel, as I do not want to trigger nexus just by checking an email (hello again NY as the worst case example).1 point

-

LLC is a state-by-state entity and not a federal entity. I'm a CT SMLLC. Will I fall under the rules for a CA LLC with the minimum tax of $800 and whatever the CA state LLC filing form is? Not only might I revert to a sole proprietor, I might send my CA clients elsewhere. I'll still get those CT residents who work for a large bank or Fortune 500 firm in NY and spend a couple weeks at their CA headquarters so have Form W-2 with CA, NY and CT, unexpectedly. NY and CA seems to be a common duo for nonresident returns due to work locations or part-year returns due to a move. I don't think I can get rid of all CA-sourced income under current CA law; too many surprises at tax time about training in CA, for example.1 point

-

The Supreme Court will need to rule on this. Imagine if 50 states had this type of ruling. Locally we have a city earnings tax. If you live outside the city but work in the city, you owe the tax. Prior to covid if you worked remotely or at an off-site (outside the city) you were exempt for those hours. During Covid the city ruled you were subject to the tax whether you stepped into the city limits ever during the year. The Supreme Court will be ruling on that also but it's going to take years.1 point

-

Emailing directly, user opens their email software or clicks a link which opens their email software, does not trigger nexus (IMO). Nor does sending a fax, or phoning. The triggers are VERY specific, both in the MTC suggested text, and in CA, and in NY's proposal. MTC suggested is "interacting with a web site or app to communicate". CA and NY (proposed) mention only via website. Even without income caused nexus, accepting communication via a non exempted method can trigger nexus, as it can be argued you were trying to have income. No income does not always mean no reporting, min tax, registration, etc. For me, no more online instant chat unless a chat service comes up with valid means to exclude based on location (which they back up with $), and no more website fill in and send messages (since it is easy to click and use their own email, although I lose the ability to require certain details). At least (for me) once NY or any state other than CA goes live with the new policy.1 point

-

I would also be concerned about whether your client obtained a PPP Loan during the same time frame or any of the other pandemic payroll related credits, because you can't use the same payroll dollars twice and double dip.1 point

-

As I have gone through my updates and CPE this year, I think the consensus of the "experts" is to just include the K2/K3 and reduce your liability. There is too much outside of your control to use the exceptions. That is what I am going to do. Paper is cheaper than the hassle. Tom Longview, TX1 point

-

For me only, YMMV. Since I am in CA, I don't have to do anything yet, but with NY already having something similar in the works, I have to plan. My "problem" is a customer contacting me via a clickable email link, web email form, or web chat, triggers nexus under these new Wayfair caused rulings. I asked my web hosting service about using IP to geolocate by state. There are ways to do so, so I could serve a state specific site, or not have clickable contact info. (As an aside, if my web host service is not paying CA taxes already, answering my message, which was sent via web based email form, triggered CA nexus!) Given IP info is not 100% accurate as to geolocation, I am going to make best effort as follows. Remove clickable email links, the type which ask the user's system to open their email program with my address prefilled. This includes in documentation, which resides on the users computer. For web based email forms and web based chat, require the person select their state, and offer a check box to verify they are not in the states I elect to avoid nexus. I can already get their IP address as a backup to the zip code. Definitely not offer any sort of remote access help to anyone in the special states. (Rare that I offer anyway.) --- I think what I am pondering is a reasonable and defensible effort to stop nexus claims, at least until there is some test cases to see what "flies". I suspect states which go after nexus will operate complaint based, or via some sort of testing that someone in the state can use the site in a way to cause nexus. By asking for zip code, and an affirmative selection, I shift the onus back on the viewer to be honest. I suspect once someone gets dinged by CA, the web chat providers and web hosts will come up with something, as those that do not will lose business. I equate this "issue", in my circumstances, to the EU rules about cookie and privacy pop up we all see, except on sites, like mine, which block access from EU. --- For others here, if you have a web site, or in any other way get messages other than via someone manually typing in your email address, watch for nexus in CA, and be ready for other states to follow.1 point

-

Let the mother claim her children for any available credits. If mother gets a refund, she can repay grandmother.1 point

-

I have now learned that I will never prepare a CA tax return for anybody, unless they are willing to pay me an extra $1,000 or more just to cover the extra taxes and fees I may have to pay. Wow.1 point

-

California is pushing the nexus boundaries to the breaking point. It's way beyond whether you have a resident employee. Just read FTB Pub 1050, it's a real eyeopener!1 point

-

CA is starting to look at challenging PL 86-272. But that was not the point of the original post. This was services provided to an end customer in CA. There is a whole discussion of "doing business in CA" on the FTB website that gets into your situation @cbslee www.ftb.ca.gov Search "doing business in CA". Tom Longview, TX1 point

-

That should have been being done on an ongoing basis. It's crazy, in my opinion, not to do so.1 point

-

while you have the old server running, print to PDF every client for every year that you are not going to install on the new server. I would install only two or three years on the new server. Since you give copies to your clients, you should be OK.1 point

-

I had to call BSO technical support. I got through right away. The support person was helpful, then I was able to log in and start uploading my clients W 2s.1 point

-

I remember when I was taking Accounting Classes in college waiting and waiting until the cost of a Texas Instrument handheld calculator finally dropped to to $125 so that I could finally afford to buy one:)1 point

-

Had a new guy last year who I really thought was going to be a problem. 3 calls before we ever met (all implied problems were possible) and when we met he gruffed and complained. Turned out to be a terrific guy and he's referred several others to me in 11 months. Over the summer he dropped by my office just to thank me and see how my vacation went.1 point

-

1 point

-

Yes - and as a result, I have rarely had to fire on the spot. As time goes on I am refusing potential problem clients upon their first inquiry. With existing clients, if I start to see signs of trouble creeping in, I recommend that they seek other help because it seems they need more assistance than I have time properly to provide. The last client I fired I finished his return (and got paid, not nearly what it was worth) and then sent a letter stating I would not be able to help him going forward. Thought for sure with him I was going to have to tell him to leave, but knowing I was ready to say it came through enough in our interactions that we were able to finish that one last year. He got a lot more slack than others, since doing his return was a favor to his late mother. Thanks for the reminder, as well as for confirming the impression that people are not telling the truth as much any more. On the tax end, I don't know if they're just incompetent financially, confused by confusing rules, overwhelmed with general busy-ness, or just lying. But I definitely see it more and more.1 point

-

1 point

-

I too use the Fujitsu for scanning. I choose to use File Center for my storage capabilities. It has some great integrations with my portal that make it even more efficient. I could use Windows to save, but found File Center worth the money for the time saving features.1 point

-

Pacun, I looked on the IRS website, clicked on the news tab and yes, the IRS has set the date to begin filing on 1/23/2023. Here is a link IRS sets January 23 as official start to 2023 tax filing season; more help available for taxpayers this year | Internal Revenue Service1 point

-

All I had mailed out were the employee copies. The online service deals with e-filing with the SSA and IRS. My particular problem with login solved for $4 - far less than the cost of the time I'd already wasted.1 point

-

In 30 years I only have personal knowledge of the IRS visiting a client unannounced once, about ten years ago. My client kept making their federal payroll tax deposits very late. It was kind of surprising since they only had 3 or 4 part time employees. According to my client, the IRS Agent didn't actually do much except to ask some payroll related questions which as I remember they didn't answer truthfully. This was a client who I fired.1 point

-

It is supposed to, however for years I just printed and mailed black & white laser printed copies with no problems. Now I efile thru a third party.1 point

-

I tried to sign in the middle of January which I consider to be timely. Even the IRS uses text to send Pin numbers to you.1 point

-

I had no trouble just before EOY. I have not heard any complaints from my customers, other than those who wonder why they have to sign up with SSA (such as ask me what an SSA ID is). If you do mail, I always suggest using something which offers proof of delivery. Personally, I would mail, first class, but I need to do what my customers might do, so I efile. Mailing is less time consuming (I know many will argue, but print, stuff, and mail takes what, a few minutes, versus sign up, login, password reset, etc.), so less costly, assuming you keep copies, have proof of delivery, and monitor for receipt (as mentioned in a different thread).1 point

-

Let the online services have the headaches! My W2s are mailed and filed. Done. Next year I won't even bother trying SSA Business Services Online.1 point

-

We have our clients bring the instruction letter to the fiduciary and/or the check stub and/or the letter from the fiduciary. One of them, somewhere, says something pertinent. When I was a church Treasurer, I always made sure donors got those fiduciary letters for their records. They say something on the order of "here's $2,000 from the IRA of John Smith made out to First Parish Church Temple of the Blessed Heart."1 point

-

1 point

-

1 point

-

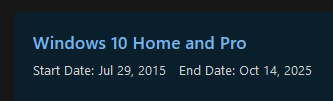

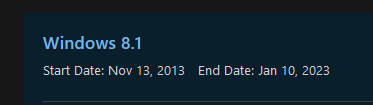

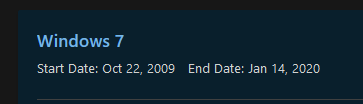

For the hold outs, the last time I checked, Microsoft will support Windows 10 until (at least) October of 2025. If getting a new box, there is zero reason to get anything other than a current OS. I find this totally encouraging. I know time flies, but this allows me to stop worrying for a while. I just saw this morning that it is ten years since I took a 200 mile trip to take and pass a test that turned out to be redundant. The good side of the story is that I don't have to be tested every year to maintain AFSP status. This is a quirky and difficult business in so many ways. I wonder if we have to be a different breed in order to stick with it. Good luck to all this year!1 point

-

The service provider could report the income in 2022 or 2023 depending of the accounting method, but your client can only issue the 1099 for the year in which the money was paid, as Bulldog Tom said.1 point

-

1 point

-

I Agree the 30% Backup withholding applies if recipient refuses to submit a W-9. However, hard to collect the Backup Withholding from a recipient when it was a one-off service and payment was already issued prior to having the mess of providing the 1099NEC etc that is dumped in your lap on January 28th... Just Sayin..1 point

-

1 point

-

Imagine if employers pushed to be allowed to give negative references to equal the playing field.1 point