Leaderboard

Popular Content

Showing content with the highest reputation on 04/13/2024 in all areas

-

Thanks to Eric and to all of you. I am starting to double guess myself and waking up in panic mode. Not Good! Without you, I would be lost, even with all the research material that I have. Please donate to keep this board alive and always appreciate all of the knowledge and comradery found here. Happy Summer to everyone.7 points

-

I'm done. This morning I filed the extension for my ultimate procratinator, and other than the extended returns, I am waiting on one to pickup (SO unexpectedly hospitalized day she was scheduled to see me) and one couple that have had the returns for almost a week and must return the 8879 to me. Tomorow I am participating in a charity event in the early morning and then will be shooting at the clay pigeons. That's been ongoing as weather permitted and really helped keep my sanity this year. Plus, it's fun.7 points

-

Certain people do come to mind and then they turn to dust. Breaking things after an aggravating day can be very satisfying.6 points

-

You are so right! I had about a dozen that I out right fired, about 10 more that I doubled the price and they went elsewhere and a couple more that paid the PIA fee. The stress these clients caused was not worth the money.6 points

-

Yes, a very heartfelt thank you to Eric, the moderators, and every colleague who reads and posts here. Without you, I would be bereft of what small dregs of sanity remain to me.5 points

-

So, there's nothing wrong with the 1099-R--the custodian has no idea if the taxpayer rolled it over or not. 1099-R Worksheet--enter the data (and code) that is present. In ATX: Box 2a, below "Taxable Amount" there is another line "Rollover amount included in 2a"--that's where you handle it.5 points

-

DANRVAN, Than you so much for your advice. This mess is being fixed. The attorney is rewriting everything and keeping it so that the remaining partners did the buyout of the old partners shares. The partnership will be terminated and the bank has no problem renaming the loan to them personally, since they already had used their property as collateral. My clients are happy and I have a little less stress.5 points

-

4 points

-

3 points

-

I'm fortunate enough to be at a point in my life where I don't need to be bringing in money from preparing returns. For the most part, I still enjoy it and the vast majority of my clients I look forward to seeing each year. Email sent and now I'm going to go dig in some dirt and plant some veggie seeds!3 points

-

Almost over people !!! Take a couple weeks off then finish the stragglers we filed extensions for. Its been a trying year that has dragged on forever !!! Been saying for years we need to cut back, but this year solidifies we need to. Tired and wore out as I imagine we all are. Hope everyone has a fantastic summer !!2 points

-

I don't know what I would do without all of you and a couple of groups that I belong to on FB. I am hesitant to ask questions of some groups, but this bunch of awesome people are willing to help and be kind. All of my cronies here are dead, retired or just said that they had had enough. I hope that it's OK if I hang around here for awhile after I retire. I am just letting my permit go inactive, in case I get desperate and have to work for somebody else in Colorado.2 points

-

These guys have 90-100k invested in each PTP. And these things are frikkin complicated!! So I'm making sure I'm doing it all right.2 points

-

There is a fillable version available from irs.gov here: https://www.irs.gov/pub/irs-pdf/f8978.pdf and the instructions: https://www.irs.gov/instructions/i8978 Good luck!2 points

-

When there is NO information on which to base anything - no papers at all, a client who varies year to year from owing v getting refunds - the worst that happens, that I see, is that the IRS invalidates the extension later. But they may not. If there ends up being a refund, you have extended the statute for collecting that refund an additional 6 months. I have a couple of clients who show up every 3 years, with 3 years' worth of documents in hand. I put in extensions, every year, just in case. They know the risks (as they get told, by yours truly) and if they don't pay anything it's all on them. I figure it's worth a try, for minimal effort on my part.2 points

-

2 points

-

If I have nothing, I just use last year's tax as a guesstimate for this year. I automate that in ATX by linking the prior year tax from the comparison form to the 4868. It's better than zero.2 points

-

I hate it when the K1 sale is on the 1099-B. The basis is NEVER correct.1 point

-

Some people call support for some of the dumbest reasons, and both tie up the lines and increase costs for the software company. I hope the software companies can flag those users and make them a lower priority. I wish the software would only allow you to call 5 or so times, and then you have to pay per call for additional support. That would make these inconsiderate people think twice about calling for dumb .1 point

-

I also note is is very limited in time, and only for the day before the due date. They are also asking people only to call in with time-sensitive issues rather than general questions.1 point

-

I have no experience with this and don't use ATX but googled and found that ATX does not list this form as part of the ATX packages. https://support.atxinc.com/taxna/software-system-requirements/atx-forms1 point

-

1 point

-

1 point

-

We treat the payments as a separate from the extension, and the client handles that, most of the time. so we efile extensions without payments and let those who normally know they should make a payment.1 point

-

Holding your ground is a good thing. Erosion (I am a left coaster so it is physical as well as mental) hurts.1 point

-

Amazingly 20 minutes after e-mail she shows up all apologetic. Didn't give her the return, only the original documents.1 point

-

I have always agreed with your statement. My threshold gets lower and lower every day. For instance, I have a hard line of end of relationship when a customer sends me something my granddaughter should not see. It is a matter of being professional/business-like, as well as liking to have her in play in the room when I am working.1 point

-

It is very peaceful to let go of those whose revenue does not cover their expense and headache. Although long ago someone here said there is a price which makes any client worth having, and our job is to get that full price.1 point

-

But then we're waiting on signatures to direct debit payment to the IRS, and especially to the states where so many require payment to accept the extension. I've been sending these late ones to DirectPay and their state equivalents. Then they call/email me with questions, but I can go only so far in the states to tell them each step. I'm tired. And, cranky!1 point

-

I'm essentially done other than one that is a total PITA. They dropped off info late March. I sent email of a couple basic items missing. Various emails over the last 2 weeks to get the info. Sent email that they were done Tues, and she replied she will pick up today. Did not answer my return email as to what time today. I sent another this morning saying they need to be picked up by 1 pm. At 1:05 I'll be sending another email with password protected file of their original documents telling them they need to go somewhere else. They have 1 dependent that graduated HS in 2023 and another in college. Guessing at least one of them filed their own returns without indicating they were being claimed by someone else. Same crap happened last year and needed to prepare a revised return for them on 4/18 because kid claimed herself. I can be very nice until I feel taken advantage of. When I reach that point, look out!1 point

-

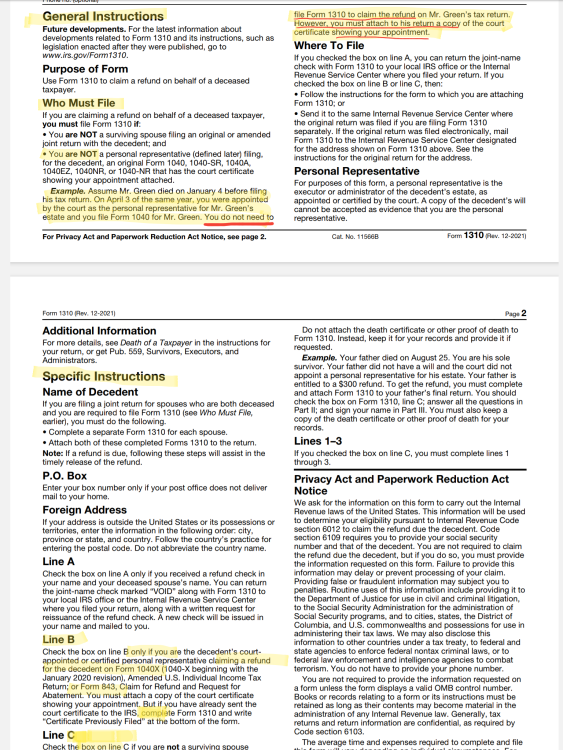

From the instructions, Form 1310 with Box B checked is only required for an amended return, not the original return:1 point

-

Waiting on a single marketplace form. Seems he doesn't read email or text messages. About 15 people need to pay me and pickup. On Tuesday, golf season begins.1 point

-

That's what I do too, but it is so frustrating. This is a large return in terms of the number of bank, brokerage, and retirement accounts and pensions this couple has.1 point

-

just enter the amount that was rolled over at the bottom of the 1099-R worksheet, will show zero taxable on the 1040. Didn't need to be issued if it was institution to institution--but it could be correct if taxpayer moved the money themselves.1 point

-

The person who set it up made a lot of money. Apparently enough to "incentivize" brokers.1 point

-

Without knowing all the facs, It might have been less complicated if they had assumed his share of liabilities instead of borrowing money to pay him cash; which he then used to pay off his share.1 point

-

That is against the unwritten rules. No one may ask for tax advice before doing something. The more idiotic the step, the more strictly this is enforced.1 point

-

You shouldn't need to paper file either if you get on it. I just efiled one where the taxpayer died in December.1 point

-

I think they need an online account, because Direct Pay (which doesn't require an account) will ask for a confirmation number if you want to look up a payment1 point

-

Like Catherine, I switched to Drake back in 2012. My love for Drake cooled last year to 'like' and this year had cooled even more (NOT a fan of the new owners). Fortunately, I have not experienced the crashes/freezes others have. Nonetheless, I've had tons of issues that didn't exist a couple years ago. Three weeks ago I was ready to look at alternatives after several disastrous calls to support. Don't know what happened, but the software has been working a lot better for the past couple weeks and the last two support calls were handled by someone who knew their stuff. I'm relieved! I'm too old to switch to something else. Now, fingers crossed the improvements last.1 point

-

PLEASE IGNORE ME. I'm an idiot, and I fixed it. Software user error. Sorry.1 point

-

1 point

-

Scholarships and grants are only excluded from income if used for qualified expenses (e.g., tuition, fees, books, etc.). If used for living expenses, they are taxable. Many scholarships are restricted and can only be used for qualified expenses - there is no option to shift them to living expenses (which would allow some of the qualified expenses to be used for AOC or LLC). Pell grants are unrestricted. You can treat them as being used for living expenses (even if they were actually sent directly to the school and used for qualified expenses - money is fungible). That part then becomes taxable to the student, but any qualified expenses that are now treated as being paid by other funds can be used for AOC or LLC, which often more than offsets the tax. For other scholarships and grants, there should be documentation saying they are unrestricted or can be used for living expenses. A good hint is seeing box 5 greater than box 1.1 point

-

oh my goodness! This always comes up on the warnings - "check into making the scholarship taxable" and I have always wondered about it - but never took the time. Thank you for the info!! D/WI1 point

-

roof - gone but many of the 30% are still limited to $600 - better but not great! IMHO D/WI1 point

-

1 point