Leaderboard

Popular Content

Showing content with the highest reputation on 03/19/2016 in Posts

-

5 points

-

Well, new client left a nice new package of hipsters underwear in her bag of old tax returns for me to review. I'm happy with a jar of homemade apple butter, but this is special. Proud day for me.4 points

-

Ah yes, "the hipster underwear taxpayer strategy". Happens to me at least once a year. Taxpayer slips in a flattering (size), popular, functional and colorful 3 pak, trying to gain your generosity in calculating their tax liability. IRS knows all about it and they have sent out briefs on the subject to warn us to not get boxed in by this ploy.4 points

-

No luck here. I have had an in-house audit going on for three scattered full days. Total disruption of ordinary business. This past Tues, she was here again. Literally takes over audit; moves chairs around; puts her papers and stuff wherever she wants. She is polite, but intimidating and we don't have time or room for this. Next meeting will be at Federal building. However, she assigns "look fors" to me and my assistant. She is doing the audit, can't she look for things herself. This has put a terrible crimp in my ongoing flow and has left me in the weeds as far as production goes. Besides that, we both have terrible upper respitory something going on and are coughing our heads off. If it weren't for several really sweet clients, I would be ready to throw in the towel.4 points

-

Client read your earlier post....they are stalking you on this board. Man, you people in TN are weird...and that is saying something coming from the land of fruits and nuts. Tom Newark, CA3 points

-

My husband's parents are visiting with their aggressive 90 lb dog who will eat my dog on sight, so they must be kept separate at all times and I've been a nervous wreck because that dog doesn't seem to be very fond of me either, so I've been trapped in my office with my dog and a .22 pistol just in case and neither one of us have been very happy. They are leaving today. YAHOO!!!!3 points

-

I would say it's property settlement and not deductible. The QDRO could have been amended or redone.3 points

-

I like www.taxadmin.org/state-tax-agencies And BTW, I love all of you, don't know what I'd do without you. Like a former life of mine, sitting around the kitchen table in a ghetto firehouse....there's no problem we can't solve. Now here, still putting out fires and finding our way through the smoke, and depending on each other. You don't find that kind of comraderie everywhere. You're the best. Bill3 points

-

so the auditor sets the date March 4th as late as he would extend as client lost first letter on dash of truck - and THEN son'e wife - new owner of business goes into labor and thank goodness has the baby that day. - As due date is Mar 18th - the new date of Audit.. - when I asked why being audited - said they had a loss - -1,800 and they needed 1065's. I said they filed a Final amended , IRS did not have for 2013... great. First thing I said to auditor was never again - audits during tax season! Great way to start but this was impossible taking 4 hours out with taxes from Feb first weeks! Good to be busy And he did say he would see 30 days came in May. Anyone have luck putting an audit off during tax season? WI sales tax did the same thing in January - that was not so much the problem but now he wants to finalize it and his numbers are all wrong!!! They do not match anything - I sure wonder what they look at when they cannot even match what is filed!! I said we cannot possibly respond until May 5th - I do not want to see this report until April 5th. He goes - let the client handle - I said if it was $600 - let them pay but you have over $2,000 and will not let them correct the QB error for 9 months they did of putting the bids in and paying sales tax on and then the next month putting the invoice in when paid and paying again - only $100,000 difference. she had been doing her sales correctly for 3 years since she was last audited and then changed it to above - go figure!!! Gotta love 'em - they keep us in business or busy....2 points

-

Your son knows your size from doing your laundry and was concerned that you might not own enough to be properly covered until laundry day or end of tax season, whichever comes first.2 points

-

Either that or my mom snuck them in there. Moms do stuff like that in TN. Not sure about you heathens. Tom.2 points

-

Maybe next time won't be during tax season and you can take your dog and go to a spa somewhere while they visit with hubby.2 points

-

But this dog has already attacked her dog. That justifies the muzzle. Besides putting on a muzzle is NOT punishing the dog. it does not hurt the dog, merely prevents him from biting. And just removing her dog does not deal with the fact that their dog has already been aggressive to HER, not just to her dog. Relationships are all about compromising, but she should not have to live in fear in her own home, just because her husband does not want to confront his parents. The muzzle is 'the compromise' in this case. I'm a total dog lover, but no one should have to tolerate any dog being allowed to behave aggressively without correction in their home.2 points

-

A technical termination is deemed to have occurred if there is a sale of exchange of 50% or more of the total interests in the partnership within a 12 month period. But I believe the regs at Section 1.708-1(b)(2) specify three transactions that are NOT deemed to be sales or exchanges triggering a technical termination, and the first one is disposition of an LLC interest by gift, bequest or inheritance. I am not positive, but I think that if he had sold his interest to his daughter in law, it would have triggered a termination but giving it to her did not. You might want to read this article http://www.thetaxadviser.com/issues/2014/jun/case-study-june2014.html2 points

-

2 points

-

Well, now you are getting into legal issues. IF the father transferred the property in 2013, BUT retained use of the property for his life, i.e. life estate, then it depends on state law, but it may well be that the basis is FMV at father's DOD, not the date of the transfer. Or could, depending on how done, have been a 'gift'. So here's hoping that dad did it with an attorney, as seems to be the case, since you mentioned a lawyer. Ask your client to get a letter from the attorney and you are good to go, relying on that letter. Just don't rely on only verbal, you want it in writing.2 points

-

No way to avoid them, there is no rule against it, and they do audits year-round. BUT, you do not have to let the auditor take over YOUR office, Marilyn . You tell him/her where to set up, they have to respect your rights, so if the only space you can offer is cramped, the 'desk' is a wobbly table in a corner with a folding chair, etc, that's what they have to use.2 points

-

Why not insist that the visiting dog be required to wear a muzzle at all times he's not being fed [outside] on a leash? It seems like a reasonable compromise. If hubby does not back you on that, he deserves to be kicked out of your bedroom, IMHO.2 points

-

I don't have any cites off the top of my head. But I would agree. Besides, amending might cost him more in legal fees then the tax savings on $5000. And he has the $5000 in his retirement account to continue at tax deferred earnings.2 points

-

You still have a partnership. It had more a 50% ownership change so you have a technical termination, but the partnership continues. It uses the same EIN. See the following links: See the last question and answer (Q16) at the bottom of this IRS page for how to handle the filing: https://www.irs.gov/Tax-Professionals/e-File-Providers-%26-Partners/Partnership-FAQs And see the last bullet point in the "Partnership" section on this page about the EIN: https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Do-You-Need-a-New-EIN2 points

-

If your client is the one that sold, you report the sale for whatever the brother paid him and use your client's share (1/3 ?) of the DOD value. It sounds as if the brother that purchased may have used the DOD value as the amount to purchase out the other two. If that is the case and if your client didn't incur any other fix up expenses or expenses of sale, then the sales price and basis would be the same figures and there would be zero gain or loss.2 points

-

OJ For those of you who need a good laugh, watch this short video.2 points

-

usually land transfers do not differentiate timber from land purchased (transferred). sometimes you will see someone purchase land for the specific purpose of timbering, and then they have a price allocated. Most of the time, timber is not considered and just part of what you got. And most of the time it doesn't make that big of a difference to the tax return because it is capital gain. I really get annoyed when someone takes the gravy, still owns the land that will produce trees again - and still tries to avoid paying a little tax on it.2 points

-

If it showed up in his W-2, he already paid ordinary income tax rates on it, and you add it to any out-of-pocket cost to get his basis. Are you saying he paid $20,000 cash plus $30,000 was on his W-2? Then, his basis is $50,000.2 points

-

1 point

-

1 point

-

1 point

-

CT has only one real across-the-board-applies-to-anyone-who-owns-a-car-or-house deduction, and they were trying to penalize everyone by reducing it yet again. But, they goofed on their tables and now want it back!1 point

-

The Form 1099-R must be from the CT Teachers' Retirement Board to qualify for the subtraction of 10% on the Form CT-1040. And, the pension must have been included in gross income for federal income tax purposes, as well as be received from the state teachers' retirement system. The percentage is due to increase each year: 10% for 2015, 25% for 2016, and 50% for 2017 and each year thereafter. http://www.ct.gov/trb Trying to compete with NY and MA retirement benefits, not to mention FL.1 point

-

CT goofed on the property tax and now admits it: http://www.ct.gov/drs/cwp/view.asp?Q=578316&A=1436 ERROR AFFECTING SOME RESIDENT STATE INCOME TAXPAYERS BEING CORRECTED For Immediate Release: Friday, March 18, 2016 Hartford – Connecticut Department of Revenue Services (DRS) Commissioner Kevin Sullivan issued the following statement. “Late Thursday, DRS discovered that certain information provided to some resident income taxpayers claiming property tax credits was in error. The error does not affect single filers claiming a property tax credit but does affect some other filers claiming the credit. As a result, about 7% or approximately 120,000 of all resident income tax returns processed to date may have resulted in a higher credit to their tax liability. When we make a mistake, we own it and fix it immediately. In this case, we did not correctly inform taxpayers of the additional phase down of the property tax credit enacted by the General Assembly in the 2015 legislative session. This year the DRS will process 1.6 million resident state income returns and while this affects a relatively small number of income taxpayers, I apologize for our error and the inconvenience to those taxpayers. Affected taxpayers who have already received refunds or whose tax payments were completed before the error was discovered will be notified in writing by DRS. Those with a resulting underpayment will be billed without penalty or interest for the balance. Those who already received a refund will be given the option of making repayment now or as an offset when filing for the next tax year, also without penalties. Those whose returns were not processed prior to March 17th will either receive a reduced refund or notice of additional tax to be paid.” Additional Background and Information: The Department of Revenue Services has discovered a miscalculation in the Property Tax Credit applied to the resident Personal Income Tax. For certain filing statuses in the 2015 income tax year, it is anticipated this miscalculation has resulted in about $11 to $12 million in underpayments of personal income taxes across fewer than 7% of income taxpayers. As part of the biennial budget, there was a change to the Property Tax Credit as it applies to the Personal Income Tax, which reduced the income thresholds at which the credit would begin to phase-out for all filing statuses. That was due to take effect on July 1, 2015 and apply to the 2015 income tax year. However, DRS’ system was only applying the change to the resident Property Tax Credit to individuals filing as Single. As a result of this miscalculation, individual taxpayers who file with the statuses of Married Filing Joint, Married Filing Separate, Qualifying Widower and Head of Household, who fall within the affected income thresholds, would either be underpaying or filing for refunds in amounts higher than they should have received. The Department of Revenue Services has stopped processing income tax returns that fit this criteria until the error is fixed.1 point

-

Randall has it right, and has also provided you good reasons to give the client to ease his pain. Just don't let the client make you feel any of this is your fault! If he wants to be mad at someone, his lawyer is the one to be mad at.1 point

-

Can't help with One Note. I had the same situation this year and ATX made it pretty easy. Sorry, not ignoring you, just don't have an answer. Tom Newark, CA1 point

-

The trick is getting someone to put a value on the timber. Almost always, client comes in after the fact with a 1099T which usually equals no basis.1 point

-

I have started signing my e-mail: Jack Raby E.A. I.T. Technician/Tax Return Preparation Specialist Phone e-mail Seems to impress those who are not my peers....1 point

-

It's not that partners are not considered self-employed under the ACA, it's that the plan is not considered 'established by the business' if the partnership does not pay/reimburse the premiums. For partners, a policy can be either in the name of the partnership or in the name of the partner. You can either pay the premiums yourself or the partnership can pay them and report the premium amounts on Schedule K-1 (Form 1065) as guaranteed payments to be included in your gross income. However, if the policy is in your name and you pay the premiums yourself, the partnership must reimburse you and report the premium amounts on Schedule K-1 (Form 1065) as guaranteed payments to be included in your gross income. Otherwise, the insurance plan will not be considered to be established under your business. https://www.irs.gov/publications/p535/ch06.html#en_US_2015_publink10002088431 point

-

1 point

-

Had a "timber" client (normal person, not in business, etc.) who in 2012 purchased land (second home/vacation) for 95K and in 2015 had a "timber" person purchase timber for $5,500. The purchaser supplied the basis of the timber in 2012 as $4,000. Did the "sale" with cap gain of $1,500. Am planning on reducing basis in property by $4,000 (timber value at purchase) to 91K. Does this sound correct? OR should property remain at 95K and the timber basis (4K) is already accounted for in the sale? Again, Thanks in advance.1 point

-

Yes. And we appreciate that I think things are so complicated that none of us can know everything and so these forums are great!1 point

-

BEGIN RANT....and then the stupid IRS will issue a late notice to fix the problem since the geniuses running our tiny little lives just...duh....forgot about partners while they were so busy with the SCorp shareholders. I'm surprised there isn't more online squawking about this, and I bet most preparers are merrily using the SEHI deduction for their partners like always....END RANT.1 point

-

I know! All of the research materials and references I checked, including the instructions and pubs, all say SE partners can take the deduction, but it appears that this is not the case.1 point

-

I think Jack is right. I'm really cheesed off about the Publications. 2015 Pub. 535 clearly states that partners who receive SE income can use the SEHI deduction. But, we can't use the Publications as having any kind of authority. IRS and DOJ addressed SCorp shareholders in Notice 2015-17, but remain officially silent on partners. Grrr...1 point

-

He made enough to have additional medicare tax withheld. The additional gets added to withholding. Is that the difference?1 point

-

This calls for a free tax return preparation, I always do free returns when they say I look like Brad Pitt and charge double when they say I look more like Richard Kiel.1 point

-

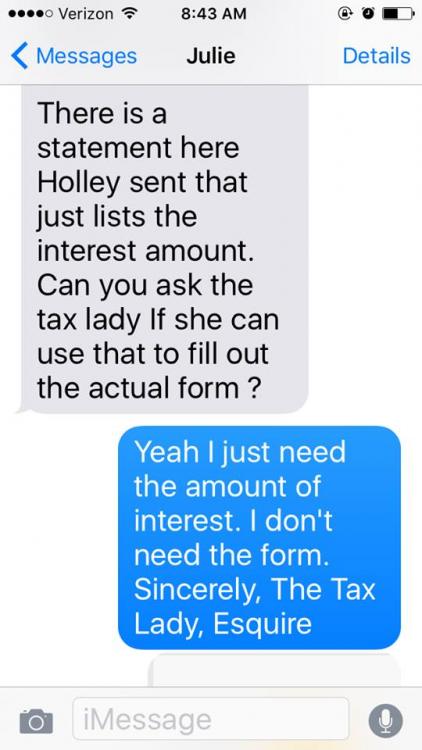

Esquire wow!!! What else can we add to the end of our name? I had an administrator in a school that I taught at send memos with every designation possible at the end of her name and almost to the point of "Really" So, in my infinite wisdom I replied to a memo that I received from her that was somewhat derogatory and signed my name at the bottom with the designation of KMA after my name. Nope, she didn't get it.1 point

-

Here is a free source........... https://ct.wolterskluwer.com/resource-center/guides/corporation-handbook Table of Contents Forms of Business Organizations Nature and Characteristics of a Corporation Formation of Corporations Corporate Finance Shareholders Directors and Officers Changes in Corporate Structure Tax and Reporting Requirements Foreign Corporations Going Public; Federal Securities Laws1 point

-

I think it should be felony to send our clients letters February - May. DIYers should get them, but not our clients.1 point

.jpg.ea5ea735cf67d18e3f2738d5f548bc63.jpg)

.jpg.b758330b77b3cb29729e563112229471.jpg)