Leaderboard

Popular Content

Showing content with the highest reputation on 03/02/2018 in all areas

-

Could it be that it's just the point of Antarctica furthest from the pole? "Northern tip of Antarctica" is such a weird thing to say. That's the kind of phrase that will give you an aneurysm if you think too hard about it.7 points

-

I had a colleague who said the big firms, brokerages, etc., lock a bunch of lawyers in a room until they come up with a usable loophole. Then, the IRS locks a bunch of lawyers in a room until they can close that loophole. Rinse and repeat...7 points

-

7 points

-

I was reading an article about a heretofore unknown huge colony of penguins off the "Northern tip of Antarctica". The focus of the article itself was the possible implications regarding the global warming narrative. But that isn't what caught my attention. I'd like to ask, isn't EVERY tip on the perimeter of Antarctica actually a "northern tip"?6 points

-

6 points

-

Corporations The name control for a corporation is the first four significant characters of the corporate name. Omit the word "The" when followed by more than one word. Name: The Meadowlark Company Name Control: Meadowlark Company Include the word "The" in the name control when followed by only one word. Name: The Flamingo Name Control: TheFlamingo Wouldn't just love to be in a room alone with the people who dream this crap up? With, perhaps, a baseball bat in your hands.5 points

-

I just got off the phone with a client that is dumb as a rock. Seriously. Two years in a row I discovered that she wrote down her phone number wrong. I tried to call several days in a row for answers to my questions to no avail. "That number is not in service." With that, I sent her my printout of notes with 2 simple questions 10 days ago. Days go by with nothing but crickets, and then she called from the (correct) number that she should have given me, and it is apparently in her boyfriend's name, so I assumed it was a spoofed fake name from a robocall and didn't answer the call. After listening to her message and calling her back using redial, she wonders how I had the correct phone # to call after I told her that she wrote it down wrong. When I asked if she got my notes in the mail, she said 'no' and then said, "well, I didn't open anything from you anyway" Arrrrggggghhhhh! I suffered on with the conversation and mentioned that tax law changes should benefit her but that it might be a good idea to check her 2018 withholding (because she's one that likes a big refund) because the IRS revised the withholding tables, and if she would like to discuss that to please bring a recent pay stub, and ... wait for it... she said "oh, one more way they are screwing us." Did I say Arrrrggggghhhhh! already? She's one that won't be invited back next year.5 points

-

After preparing the 2553 and emailing it to them, I got back from them an IRS acceptance letter for the S-corp, dated Feb 26. I guess the question to them should have been - "Do you remember signing form 2553"? I am willing to bet, however, the answer would have been - "What's a form 2553."?5 points

-

Idiot clients? Client makes a solid salary and is a single earner in the household - last few years he'd made about $150k. They always received a $7k refund which they used on vacation. Nothing changed from what I can tell in their lives except he took a new position in the company and this year earned $345k. Nice. Except now they owe about $4k with the return. The wife informed me she didn't have a clue how they were ever going to be able to afford to pay that and is wondering about a monthly payment plan. How is that possible?5 points

-

5 points

-

If the payment is really alimony then client needs to report it as such. Also report and back out of C to prevent the IRS letter. You can spend a lot of time and money trying to get ex to correct it.5 points

-

JKL, You took the words right out of my mouth..."She's one that won't be invited back next year." Life is too short for such nonsense, and you can count on the fact that she's a tad bit smarter than she lets on. Not too big of a tad, but a tad anyway! With all of the changes that have come and gone and will come again next year, if you don't give it your all, you don't come back! You may even be told to go somewhere else before next year! Take care, Cathy4 points

-

4 points

-

The employer needs a better payroll person!! There is a specific place to send the garnishment, and a specific way to treat it in the company books. Both sets of knowledge seem to be lacking.4 points

-

It's either take an occasional break for a little nonsense or else throw something (or maybe give out a few Rita hugs). Right now I'm opting for taking a break, but it's still early in the season.4 points

-

Twilight Zone reruns are fun to watch. You constantly see many actors in their younger years as they were starting out before they went on to become famous.4 points

-

4 points

-

I just said this the other day to a client when explaining the nonrefundable portion of the AOC where one of the rules says "at least one of your parents is still alive." I also like asking the question about if they've ever been convicted of a felony.4 points

-

The internal workings are amazing to watch! https://i.imgur.com/mfIT62X.mp4 My uncle had a hand crank one. It was like playing a slot machine!4 points

-

Technically it's a calculator. I'm old enough to have used an adding machine. Damn thing nearly threw my back out carrying it to clients. I think it was the CPA firm's version of hazing.4 points

-

It's just a prop these days. I occasionally use it when facing a client and I'm afraid I'll screw up the math in my head.4 points

-

Yep, Jack got it right. The episode is called "It's a Good Life" where the little boy wishes people off to the cornfield.4 points

-

Yes. Yes, they do. My daughters term it "little old Italian lady" smell because ALL of the elderly aunts drench themselves in gag-me perfume. You should hear my girls' tales of getting buried in perfume when my grandmother died and they got tightly hugged by all the little old ladies there, nearly to the point of Rita-hugged! "Near-death by perfumed bosom" is one of their nicer terms for that ordeal.4 points

-

Probably not according to the rules of this thread, but I'm nominating Southwest Airlines as Tax Star of the Week. This company has a top-notch reputation and I see one reason for that in their attitude toward their customers. A client included their Southwest check stub in their tax info, and I see that every time a Southwest employee cashes their paycheck, it states in bold letters across the top, "DEPOSITS MADE POSSIBLE BY YOUR SOUTHWEST CUSTOMERS". Nice perspective - more companies should adopt it.3 points

-

I've been to their house - I don't see the wife as a big spender. It's a nice house and they drive nice cars but they've had them all a few years. It's certainly not clothing or jewelry from what I've seen. I have another couple about 30 years of age and no kids. She makes $100k and he makes $130k. They live in a $150k home (with a full mortgage) and have no assets outside of their retirement plan (they do contribute about $30k there). WTF is the money? I have friends who make exceptionally similar money at 50 years of age - NO dividends or interest and a full mortgage (they just built a new / slightly larger house but nothing massive).3 points

-

Robert, Robert, I think your answer to "How is that possible?" is in the prior sentence (same paragraph). It's the wife...the husband is a single wage earner for the family and the wife is a stay at home shopaholic and may have found a nice little place to gamble too. I have seen couples like this and God forbid, something tragic happens with the wife. After, the widower trucks on and always has plenty enough to pay me without asking me to hold his check. I can say this outloud because I'm a female too! Not one who would live way beyond my means....but nevertheless I have seen it happen too many times over the years.3 points

-

I would think the only way that the employer would report it is as part of their employee's w-2 wages.3 points

-

A quick update, the ex spouse nor their business was the issuer, the employer was garnishing the ex spouse wages and they didn't how to report it3 points

-

I have one clear winner who wears the sickliest sweet perfume like some really awful cheap bubble gum. I try to avoid the hug at all costs. We can still smell her perfume 4 hours after she's left. You wouldn't need a hound dog to track her down!3 points

-

But I used to love multiplying on an adding machine by holding the plus bar down long enough to "add" for each place, putting an extra zero on the end as needed. Miss that sound. Calculators aren't nearly as much fun.3 points

-

But it would not hurt for her to just politely tell him that he should not report alimony on a 1099, and that if he is concerned that former spouse will have records showing a different amount, he is welcome to send her a letter stating what his records show. Then he will still do whatever he wants, and so will she. That is, if they are being polite to one another and can speak without an arbitrator.3 points

-

Well, he may just not know. I mean, we do have the question here from a tax pro. He may have been given bad advice from his attorney or barber. For all we know, he paid an accountant to prepare the form. Of course, you are most likely correct, but this can be handled with a Sch C or a letter in response to a CP2000. Either would be more efficient and cost effective than going back to court. And she can smile sweetly and wave at him knowing he looks like a fool and she doesn't.3 points

-

Still simply WRONG! Business money should be moved to the ex spouse's personal account, then paid to the proper agency. NOT from company funds. My statement still stands.3 points

-

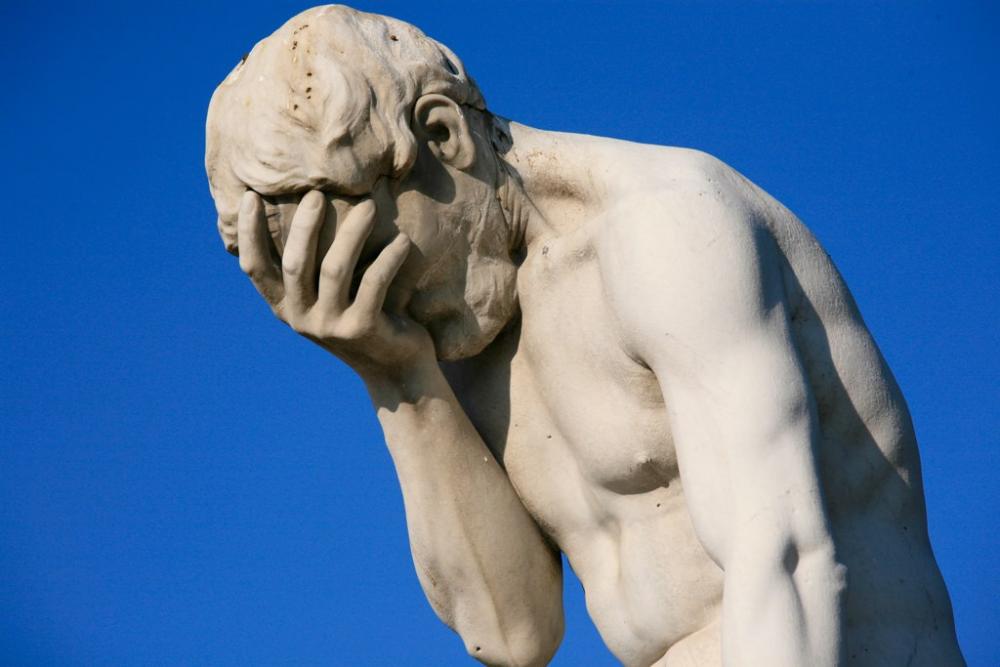

That picture is form an episode of "The Twilight Zone" in which the little boy controls the whole town because of he evil powers.3 points

-

3 points

-

3 points

-

3 points

-

3 points

-

Mine's not tax related. When I work, I have my back to the client. My computer table is behind my desk. I have a beautiful ivy plant on the corner of my desk and when it got too long, I just took the end and looped it back up to make it look fuller. When I was finished her return, I turned around and she tells me she's 'untangled' my ivy plant, removed the dead leaves and now it's draped down onto the floor. (Oh. Gee. Thanks?) The icing on the cake was she wore one of those sickeningly sweet perfumes that older ladies like, and it irritated my throat and made me cough. I asked to please not wear perfume in my office because I have asthma. She sniffed herself and said she only put on a few drops. I think they become immune to the smell and just put more and more on every time. She perfumed our restroom so much that it still smelled several hours later. But I really wanted to tell her to LEAVE MY FRICKIN' PLANT ALONE!3 points

-

My guess is high-end phone plans, top-of-the-line cable TV service. Dinners at nice restaurants, buying lunch every day at work. Vacations that involve hotels and airfare. Eats up the money fast.2 points

-

Shareholder insurance is taxable wages but you subtract it right back out as SEHI, so it doesn't make sense to withhold taxes on it and give the government an interest free loan. We add to last paycheck in December and don't increase fed or state withholding. My withholdings are my business and I have enough withheld to avoid underpayment penalties.2 points

-

But I bet there double spender! I see these kinds too often and I always ask, 'no interest or dividends', with my most incredulous look.2 points

-

2 points

-

2 points

-

2 points

-

Exactly. And if it happens again next year, and the issuer is a business, I might hand her a 3949-A. Just kidding. Maybe.2 points

-

The $6k he receives in 2017 is capital gain. Yeah. The $9k loss in 2016 is ordinary income reduction.2 points

-

Pic of ivy after I 're-tangled' it. https://photos.app.goo.gl/9I7Mlr1dXgSVfeCE32 points

-

Taxes and "makes sense". Funny You must separate the shareholder/employee from the S Corp/employer. It is not the obligation of the employer to know or handle any part of the emplyoee's tax return. The employee controls their withholding via the W4. The employer honors that (or faces penalties). No verbal adjustments, or other adjustments because enough is already withheld is allowed. This is the "rub". All the current advice I can find is from the tax return perspective. There is little or maybe even no "hard" advice from the employer/payroll perspective. The Indiana case makes the tax return perspective untenable for the employer to rely on. Plus, there may be other taxes/deductions which do not offer a credit.deduction later, such as a local tax, garnishment (the insurance is part of disposable wages), alimony/CS calculations, etc. I 100% get most here are not on the payroll processing/employer perspective, but you could end up with a return from an S Corp client, and who could be subject to penalties from not withholding properly (even if for themselves, again, have to separate the two "entities" the one person may have). I can see this as another add on to the "reasonable wage", "meeting pay frequency no matter the income flow", and other similar issues those who are the owner and employee have to deal with. It is tough to always treat the employee self as if that part of the person was a stranger to the owner self.1 point

-

1 point