Leaderboard

Popular Content

Showing content with the highest reputation on 03/14/2019 in all areas

-

This is already my favorite new TV show! Can't wait for the next episode.5 points

-

Have you been doing th e8606 every year to show the basis and the total balance in the IRA's? Part of this is going to be taxable because you have to withdraw taxable (earnings, deductible contributions) pro rata with the non-deductible amounts withdrawn. In other words, you can't withdraw only the non-deductible contributions from a traditional IRA and then withdraw the earnings later. But the 8606 is the form that should calculate the amount that is a return of basis and therefore non-taxable. Did you complete Part I before you completed Part II?3 points

-

FYI for all, when posting please remember the forum policy of limiting the discussion to only the tax law and its provisions, and that all commentary related to politics, politicians, or their motivations will be hidden or deleted. Thanks.2 points

-

That is the case. I actually have two of these situations were the kids do very well in school and have a great amount in scholarships. Both come from low income families, so even in the past the Kiddie Tax wouldn't be much different between either child or parent, but with the new way it is being taxed it is hitting these kids hard.2 points

-

If your question is about 199A QBI, it doesn't matter as Cap Gains are not included in 199A. My concern would be the valuation. How does farmland increase in value nearly 4.5 times in 2 years? Was it rezoned for housing, commercial, industrial use? Did soething else happen that would affect the valuation?2 points

-

1 point

-

1 point

-

Tax Extenders still in limbo: "The House Ways and Means Committee in Congress held a hearing on Tuesday to discuss temporary tax provisions and the urgency of both currently expired provisions and those set to expire. According to the Joint Committee, there are 80 provisions set to expire between now and 2027, and around 29 provisions which have expired in 2017 or 2018. Many of these provisions have been routinely extended and are often expected to be extended, including clean energy and energy efficiency incentives that have left taxpayers in limbo. Although the hearing was set to discuss these temporary policies in the Internal Revenue Code, the discussion quickly turned political, with arguments from both sides about the value and impact of the Tax Cuts and Jobs Act and how it was enacted. The limited discussion about actual tax extenders led to a suggested outside third-party review to determine which provisions should be extended and which should end. However, it is unclear where this will go."1 point

-

1 point

-

1 point

-

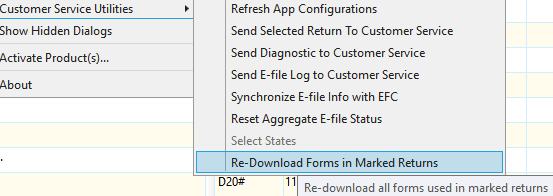

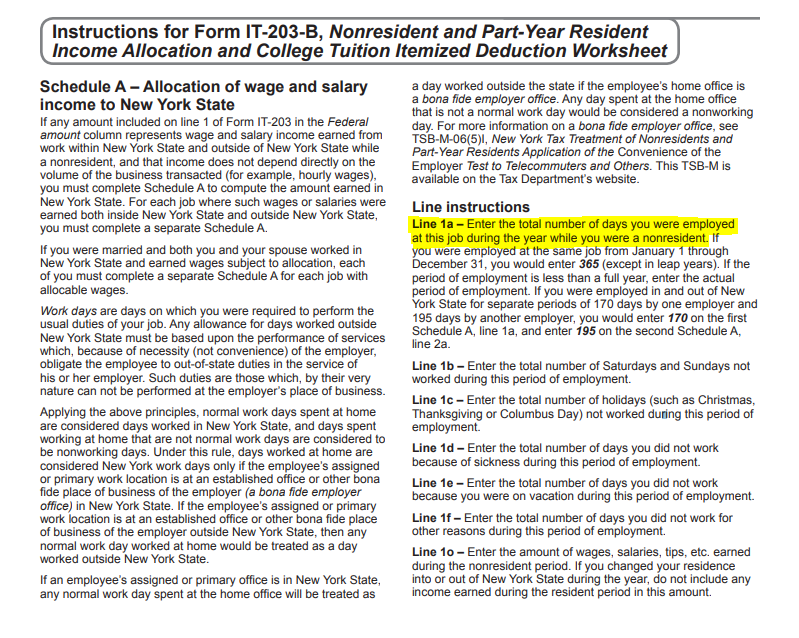

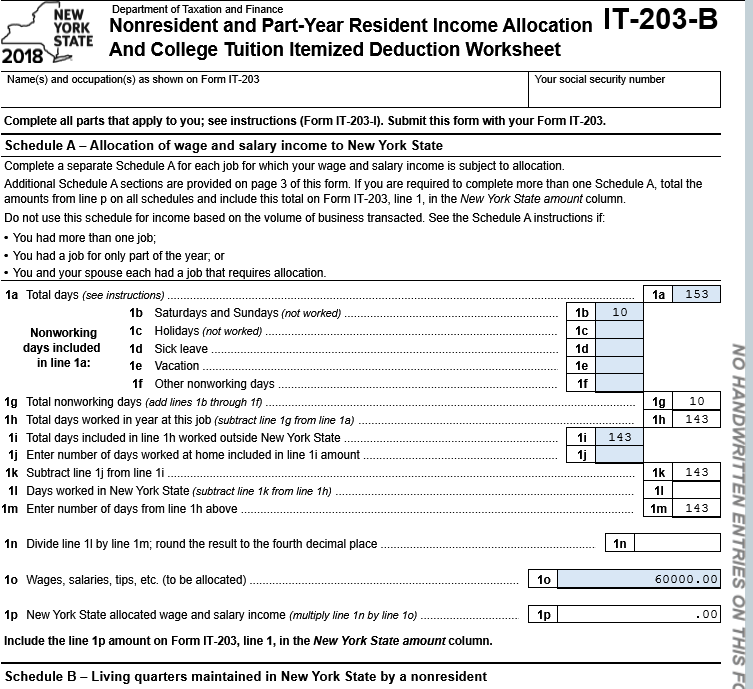

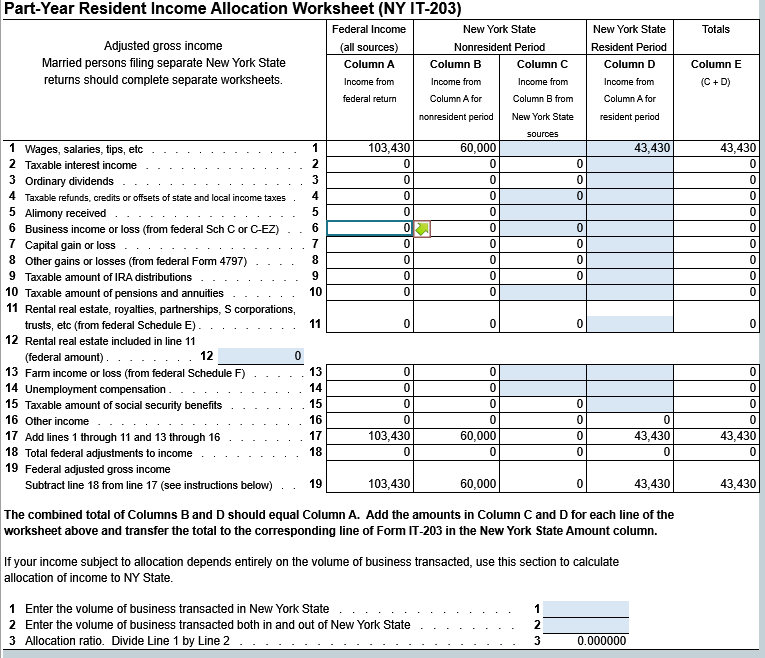

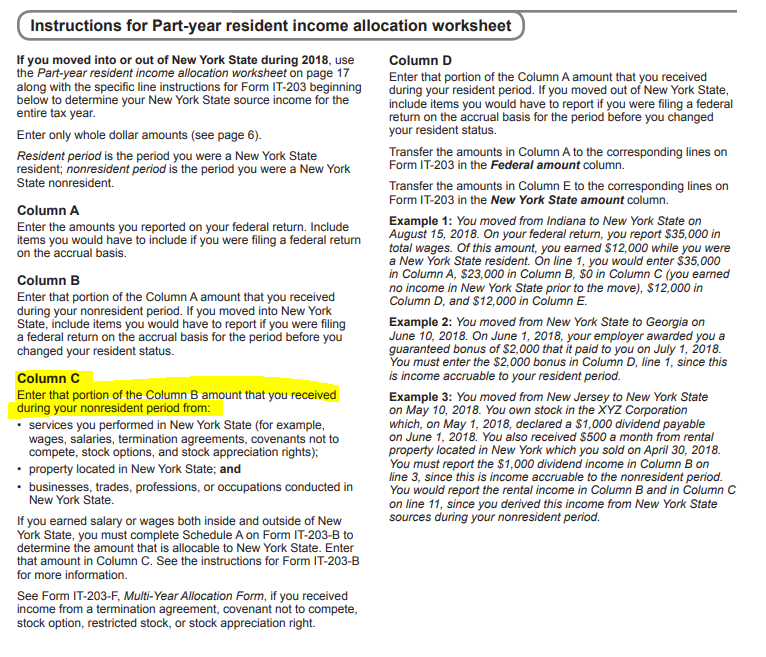

I think I see where you went astray. The instructions say for the IT-203B to enter NYS income info for when you were a nonresident of NY. You've entered the entire year and backed out the IL time. I think it should be entered like this (I'm just assuming $60k earned while in IL). You manually enter the IL wages on line 1o of the IT-203-B worksheet, then manually DELETE the Column C wages ATX flows to the Part-year Resident Income Worksheet for the NY IT-2031 point

-

FYI: NY W-2s (and CT and other states) are required to have the federal wages listed for NY. That's the starting point for the NY return. Then you complete the worksheet to allocate for part-year situations.1 point

-

And don't forget the Section (whatever; I forget - it's late) election to treat distributions in the first 65 days of the year as having been made in the prior year.1 point

-

Only backup withholding can be passed through, so no break there. If the trust did not distribute the income from the annuity in 2018, it is responsible for the taxes anyway. Corpus is not relevant here, since the trust had $55k in income that it apparently did not distribute. In the future, it should distribute the income before Dec 31 so the beneficiaries are taxed on it, presumably at a lower rate. It should also specify no withholding. If this is an irrevocable trust, I don't see how an annuity can be pulled out and given back to the grantor. Best to read the trust document.1 point

-

I need a second set of eyes on this one. I have a client who is a student at UCLA. He is very smart and as a result has scholarships that way exceed his tuition. His scholarships and grant is $36,107 his tuition is $11,754. So he has taxable scholarships of $24,353. In addition he has a W2 for 3,219. Because the taxable scholarship isn't counted as support for himself, his parents are still able to claim him, thus causing a form 8615 situation by which they want over 4,000 in taxes. Am I understanding this correctly? Did I mess up last year and not figure Kiddy Tax for him based on the scholarship be non earned income? He was in the same situation last year, however I didn't do the Kiddie Tax Return thinking that non earned income was basically interest dividends, investments ect… I never would have though of scholarships in that classification (he worked hard, in my mind earned it). What say you? Am I missing something?1 point

-

Drake's paper returns are on a single page. Seems like a no-brainer to me. I don't now why all software vendors don't do this.1 point

-

1 point

-

1 point

-

Just curious here - does the student receive all the money from the scholarships that are in excess of the tuition, etc. for which they are meant to cover? I thought many/most scholarships were paid directly to the school, not to the student, so am wondering about the excess. I haven't had any of these, just average smart students, I suppose1 point

-

Yes I have the actual account transactions and they are matching to the 1098-T. Even with the 12000 standard deduction the taxes are over 4,000. I guess it is what it is, but honestly the only way I would have ever caught this was Drake flagged it. I used ATX last year and nothing, but looking over the instructions for the kiddie tax form it has been this way for quite some time. I will have to look at last years and see if it would make a difference. I really don't believe so because to be honest with you the kid makes more in scholarships than his parents do working.1 point

-

Are you working off the bursar's statement that has dates for the amounts? Forms 1098-T are frequently wrong.1 point

-

Let me throw my 2 cents worth in. While SaraEA very well maybe correct, I think it is always best to obtain the trust document (instrument) prior to filing any type of trust. The trust document will tell you the details you need to properly file the trust return as well as the taxation of the earnings and to whom it applies.1 point

-

Below is a different twist in this situation. I would check further into the changes for 2018 to be sure this is filed correctly. Yes, unearned income (including scholarships) is subject to the Kiddie Tax. For 2018, Kiddie Tax rules change and will be taxed at Trust rates. However, for some mysterious reason the Standard Deduction treats scholarships as 'earned' income. In other words, the student will get the $12,000 Standard Deduction, and only the income above that would be subject to Kiddie Tax.1 point

-

Scholarship income is unearned income for Kiddie Tax purposes. Yes. Now, you taught me something: I didn't realize the taxable scholarships are NOT counted as support provided by the student. Also. I wonder how many education credits are reported incorrectly. I hate it when I see a 1098-T.1 point

-

In the middle of the bill is what I believe to be new tax extender : Sec. 122. Exclusion from gross income of discharge of qualified principal residence indebtedness (sec. 108(a)(1)(E)). The provision provides through 2019 a maximum exclusion from gross income of $2,000,000 for a discharge of qualified principal residence indebtedness. Generally, indebtedness must be the result of acquisition, construction, or substantial improvement of primary residence. The provision also modifies the exclusion to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into before January 1, 2020. Very interesting, how many taxpayers really need a $2,000,000 exclusion ? I'll bet there is a special favor behind the inclusion of this item!!!!1 point

-

1 point

-

I doubt they are concerned about the extra work they cause. I am certain they are far more concerned about the pressure they are receiving from the lobbyists of the 50 Industry groups that are pushing hard for this bill to be passed!1 point

-

Do any policymakers of either party have a clue about how much work they cause everyone by spending their time playing politics instead of doing actual work? They love to change the tax code on the last days of December so IRS employees have to scramble to update software, forms, pubs, etc. Last year they passed the extender bill in mid-February, when lots of returns had already been filed. This caused many banks that left PMI off their 1098s to pay for printing and mailing new forms, many tax pros to sift through completed returns that needed amending and then amending them, the IRS to have people hand process all those amendments. I've noticed this year that the banks are including PMI on the 1098s even though it doesn't count (yet). I have been keeping a list of clients who have PMI, might benefit from the tuition and fees deduction, etc. so I don't have to comb through my list of completed returns to try to remember who might benefit. The policymakers make it sound like (and may believe) they are helping people by doing things like the extenders, but they are actually creating havoc everywhere.1 point

-

This commentary from Politico spells out the murky future of this bill: EXTENDERS PROCESS GETS EXTENDED: Remember when tax writers believed they had to restore those dozens of temporary tax breaks within a year of their expiration? No more: The last extenders package passed in February 2018, more than a year after the incentives expired. And this year? There’s no telling when any of the tax breaks might get revived. The Senate Finance Committee — led by Chairman Chuck Grassley (R-Iowa), a reliable supporter of preferences for biodiesel — has been pushing to wrap up extenders more quickly. But people watching the issue say they detect no real sense of urgency out of the House, and that the extenders are likely to slip past April 15 unless something changes — meaning that the current filing season would end, and taxpayers and businesses would, presumably, be filing without a clear understanding of whether those tax breaks would once more get new life. Of course, the tax-writing committees know that a lot of businesses at least file extensions until Oct. 15, which could ease the pressure for the House and the Senate to make a deal. It’s also far from the first issue where House Ways and Means Chairman Richard Neal (D-Mass.) has been proceeding methodically (think the president's tax returns), as he tries to integrate 10 new Democrats into the panel. Still, Sen. Ron Wyden of Oregon, the top Democrat at the Finance Committee, told Pro Tax’s Aaron Lorenzo on Tuesday that he believes a bit of support is beginning to take hold in the House, where new Ways and Means lawmakers have been learning about extenders. “I’ve seen it building because everybody’s getting the same kind of concerns from home on uncertainty and what’s the timetable,” Wyden said. And stay tuned: Grassley and Wyden will soon lay another marker on tax extenders, likely on Thursday, according to a Finance source. The observation that the passage of this bill may not happen until after April 15th is an on point example of the times that we live in.1 point