Leaderboard

Popular Content

Showing content with the highest reputation on 01/22/2019 in all areas

-

Bart: As you well know, a sense of humor and not taking ourselves too seriously can get us through a lot of tough situations. Although I have to say a client took it real personal one time when I told him I'm not a caring person, but I am feeling person. (We were talking about a tax problem he had which was of his own making.) After staring in awkward silence, he replied he didn't understand. So I explained, "I really don't care, but sometimes I feel bad about not caring." You know, that guy left and never did come back.6 points

-

Check your Windows update. 2018 requires netframework 7.4.2. It would have been included in a Windows update. Without the updates, you would have 7.4.1. I had exactly your problem. Updated the netframework, and BINGO! works just fine. Trust me on this one.5 points

-

I use the engagement letter because it keeps the IRS out of my hair. The IRS dislikes Engagement letters more than any one else. The Engagement letter clearly puts it on the taxpayer, and not on ME for their fraud. Or for their inability to give me info in a timely manner, or why I did year X, but no year Y and Z (when they didn't send me anything) or why state W was not filed for them. I use the engagement letter EVERY Year so that you can say that you didn't read it one year, but EVERY year for 10 years? I use the Engagement letter to satisfy a "block" that gets checked somewhere. Even if I never get sued. But if I do, it get checked. It DOES limit my legal liability. I may pay, but it might help save as well. I use the Engagement Letter to establish the parameters of MY STAFF and MY behavior going forward. Not the clients. If I do not like what the client is doing, I fire them. And then I do not have a problem anymore. Rich4 points

-

Anyone else think ATX should hire Jack as a customer service rep? He is much more timely with his responses and much more helpful.4 points

-

It seems not to be fully functional yet, but things are set up to flow. You cannot override Line 9 on the Form 1040 where the QBI deduction is taken. If you jump to the source for that number, it takes you to the Sec 199A Worksheet, so the number is supposed to come from there. In my test return, I added an 1120S K-1 worksheet and a Schedule C. Back to the Sec 199A Worksheet, on the Activities tab, both activities are listed. For the S Corporation K-1, the amounts of QBI, wages, and qualified property from the K-1 come over to the Activities tab. There you can designate each activity as a qualified business or a service business. It does not supply a number for the Schedule C business, so at this point, you have to supply it yourself. The net income from Schedule C should be reduced by the SE tax deduction, the SE health insurance deduction, and deductions for retirement contributions to the extent attributable to that activity per Regs. Sec. 1.199A-3(b)(6). Query: if the SE health insurance deduction is allowed from the S corporation, where would that reduction to QBI be entered on the worksheet? At this point, if the activity is classified as a service business, you cannot select it from the dropdown on the activity line of the QBI Deduction - Service tab. However, any activities classified as a qualified business flow the amounts from the Activities tab to the QBI Deduction tab. The QBI for each activity is calculated there. From the QBI Deduction tab, it brings the QBI deduction to the QBI Deduction Summary. The QBI amounts from the activities are compared to 20% of taxable income, and the lower number carries from that Summary to Line 9 of Form 1040. If all else fails, you can override the cumulative QBI deduction from activities on Line 2 on the QBI Deduction Summary in the Sec 199A Worksheet. So it seems ATX still needs to allow activities to flow to or be selected on the QBI Deduction - Service tab. Also on the wish list is a worksheet to subtract required amounts from Schedule C and Schedule K-1 to adjust QBI for an activity. There also seems to be no way to aggregate activities under the election made available by Reg. Sec. 1.199A-4.3 points

-

This part of the issue is "on you", for the reasons I already mentioned. Before you expend energy and money on switching, consider the reasons you are using the software you are, and how you must adjust your methods of keeping safe and current, which would have prevented this particular issue. No software will have 100% flawless CS results, be bug free, etc. Humans are imperfect, and humans make and use software. If you like the software you are using, send an email with your experience, and suggest they update their installer settings to check for required items so no one else has the same issue. I have no idea if they charge for support, but having two hours of support time is... wasting your time in most cases. If something cannot be fixed in five or ten minutes, ask to escalate, or for someone else to try. A CS person is not likely to stumble on a fix after a few minutes, and candidly, is wasting your time and theirs if they keep stumbling around. If they will not escalate, then ask for a written response within a certain reasonable amount of time, so you have documentation of the issue. Note. I have no skin in this one, since I am not the software developer, nor do I use any of their products. I am merely sharing my experience from the other side. For this particular issue, you failed in your responsibility to your clients, to keep your computer up to date and as safe as possible. To me, this mistake is the glaring issue, whether or not the software was working. Thankfully, you have realized the issue, and hopefully not repeat it, and that your customer data was not compromised by your mistake.2 points

-

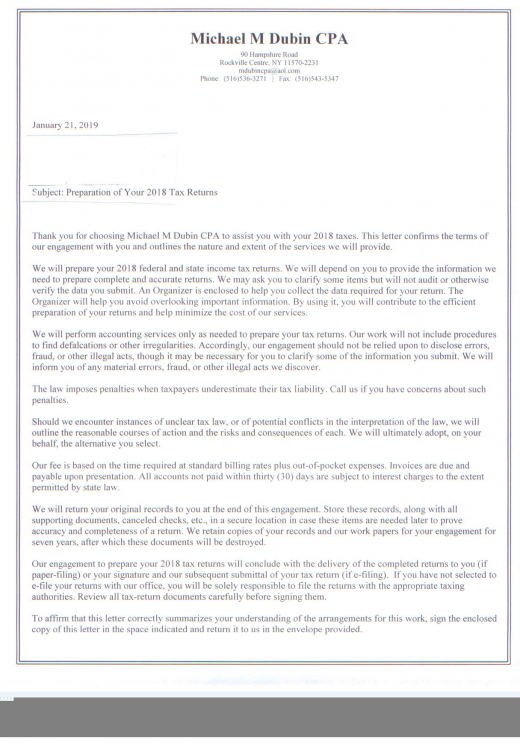

individual eng letter.pdf This is my 2017 letter - i added a paragraph re sec 199A, QBI, etc.2 points

-

2 points

-

Upper level employees should have reserves, but low level employees don’t make a ton of money, and if in DC, it’s an expensive place to live. It also depends on the length of time on the job, size of family, etc. if you think the people keying paper returns make enough to save 6 months living expenses, you aren’t thinking correctly. I had the same kind of experience after college as Katherine did, although she didn’t mention any stints of homelessness as I had. And looking for the free food the Hare Krishnas served in the park. While I was working, too. But I have a bit more compassion for others in hard circumstances.2 points

-

I agree with you 100% I want my voucher to get free meals and food, as well as a promise of backpay, if I should get furloughed. My question: What did they do with all the extra money they have earned for all the years they have been government employees. Smart people have 6 months living expenses in a rainy day fund. If they don't, too bad, so sad.2 points

-

No problem. We all need help with this new software. I spent 30 minutes screwing around with the form trying to figure out how to make it work. There are no silly questions related to QBI. Tom Modesto, CA2 points

-

The proposed regs have knocked out all of my rental clients except one whose qualification is questionable since he is always juggling multiple business issues and the probability of him maintaining a contemporaneous activity log is pretty low. For those of you with clients who might qualify, here is a step by step in depth analysis : https://www.forbes.com/sites/anthonynitti/2019/01/19/irs-publishes-final-guidance-on-the-20-pass-through-deduction-putting-it-all-together/?ss=taxes#55344e92d9f01 point

-

@Mitzi rogers please see the notation in red that is part of this forum's registration rules that you agreed too:1 point

-

I agree flipping is usually ordinary income subject to SE tax, but I think you could make the case that if a taxpayer only flips one house, they are not carrying on a business and the income classified as capital gain not subject to SE tax.1 point

-

I use the engagement letter every year for every engagement for a couple of reasons. All those mentioned by Rich. I am a member of the AICPA and insured by their affiliate. There is a significant premium discount for using them. Several years ago I called for advice about a potential claim (didn't happen, though). When I forwarded the signed engagement letter, I was assured then that all was covered. It was a great relief. If any potential client looks askance at the requirement to sign said letter, we part ways. We need to know the expectations of each other and who, exactly, is responsible for what. I am still amazed at the number of folks who seem to have lost or misplaced prior year tax returns. I actually wonder if they have a clue as to the location of the supporting documents. More than once I have been asked about a W-2 or other document for a prior year. Yes, I do, in fact, have a copy. Where is theirs (she asked rhetorically)?1 point

-

Given that there may be more non-clients than usual calling with questions this year, what's your plan? Here's a possible script: Caller: "I just need a little bit of info about the new tax law so I can finish my return. Do you answer questions?" Preparer: "Yes, I answer one question for free and then there's a charge for each additional question." Caller: "How much do you charge for each question?" Preparer: "My fee is $200 per question. What's your next question?"1 point

-

Plus you will all be very amused at the background graphics. They are really well done. As for the presentation itself, it is certainly worth thinking about, ladies! Hengist Mountebank Presents1 point

-

Tax News and Tips (in Pennsylvania) has an excellent newsletter. They have color, black-and-white, and e-versions. They will personalize to your masthead and mail for you. We have used them for years. Nice folks to work with, as well.1 point

-

Aw, shucks; if you're gonna be nice about it (as well as being a gentleman and a scholar), then I guess I'll just have to say that's true and you might be right.1 point

-

I'm in Va Beach, and do a lot of VA/NC returns. Last week, VA was still in Gen Assembly deciding whether or not to allow a stand-alone Sch A for the state. Haven't checked to see if NC has allowed itemizing when the standard is taken on the federal. Maybe we should start a leg with state updates. I sure hope they decide soon.1 point

-

1 point

-

BullDog Tom, thanks for clarifying! I felt silly asking, but I do appreciate you taking time to answer.1 point

-

1 point

-

I was setting up my seasonal office last weekend. No client appointments, just making sure the new computer connected to the old printer, setting up the internet, that kind of stuff. One of the other tenants in the building stopped in for a quick question. Was sure that his CPA was working for the IRS and not for him. 20 minutes later, he was convinced we all work for the IRS, but he got his answer confirmed. The next tenant who dropped in to say hi was a general contractor. 20 minutes later I had the answer I was looking for from him about some work I want done on my home. What goes around comes around. I try to be generous with my free time. I know that if that first tenant ever decides to move his tax work, I will be on the short list. He may never do so, but I have planted the seeds of my knowledge and experience. Who knows if it will ever blossom into an invoice. And the guy I took 20 minutes from may be able to invoice me for some work I want done on my home. No guarantees, but he gave me some good information and for that I will give him a shot at the work I want done. Tom Modesto, CA1 point

-

In simple terms a Qualified Business is a pass through entity that qualifies for the deduction. A service business is a Specified Service Trade or Business as defined in the TJCA. The first box means you can take the deduction, the second means that if you exceed the income limits, the deduction may be phased out or eliminated. Hope this helps. Tom Modesto, CA1 point

-

Hours of work is a bizarre method. As an example my sister in law didn't show up to a family event a few years ago and I asked my brother why. He commented that she was doing her father's tax return and I said that couldn't take very long. His response was that it was a 3-4 hour job that was now in week 3. My Bro and SIL were at one time CPAs.1 point

-

Caller: I have a question.... Me: Let’s setup an appointment and I charge $XX, and if you become a client I will credit the payment towards your next invoice. Caller: Let me check my schedule and I will call you back. You know the rest.1 point

-

So Bart, did you have multiple letters for him so he could choose which one to sign?1 point

-

I don't think "interesting" is the word you're looking for. Yeah, they're people too, but their circumstances are quite different from you and me. People here would kill for a government job, but you can't get one unless you "know" somebody or are related to them (it's pretty much closed to applicants without a connection). They have pay, benefits, insurance, and retirement that private sector people can only dream about. One low-level government worker's wages would hire three clerks in private business. Plus, as Catherine notes, about the only way to get fired is to pull a gun on somebody. I also have been laid off a few times and there was no pot of gold waiting at the end of my unemployment rainbow. As for the tear-jerking paycheck to paycheck angle; give me a break - many responsible private sector people (with notable exceptions) making much less than the fed group can weather the storm; why can't they?1 point

-

That is EXACTLY my point. They have jobs that pay better than what most of us make. Those jobs come with benefits most of us can only dream of from afar. They can NOT be fired, under usual circumstances, even if they goof off all day surfing kiddie porn, very much UNlike you and me. But people are bemoaning their fate as if they are being made to walk the plank into shark-infested waters - when what they are facing is far LESS than a regular garden-variety lay-off. With NO guarantee of call-back, NO guarantee of back pay eventually, and no one publicly mourning their dire fate. Sorry; they got nothing from me. NOTHING. I've faced nasty lay-offs too many times, where I quite literally had NO idea where my next job was going to come from, or how I was going to survive until then, with no savings (used up in the last lay-off and just barely caught up to zero with no reserves yet) to help at all. In desperation taking crap jobs doing what I did to put myself through school, running a cash register at nights at a gas station ALONE (young and female), substitute teaching knowing I was working that day because of a phone call at 4AM, day-work bookkeeping via an agency running a paper-tape calculator. Quite a come-down from the supposedly well-paid engineering jobs I had spent years qualifying for. Work a high-school dropout could do. All for minimum wage but nowhere near 40 hrs/week - not just for lack of work, but also because I had to keep up the job search. Yeah, it sucks being out of work. It sucks worse when you don't have a call-back with pay waiting for you in a month or two. I got NOTHING.1 point

.thumb.png.67a89a3330b2e011dd02dd85ff529ba6.png)