Leaderboard

Popular Content

Showing content with the highest reputation since 04/25/2024 in all areas

-

yesterday Catherine White EA was the presenter for Tax Practice Pro, a c.e. provider. Her presentation was a case study of what happens when a client changes tax professional, and issues with prior years are discovered by the new tax pro. Kudos to Catherine on a well developed and perfectly presented class.12 points

-

7 points

-

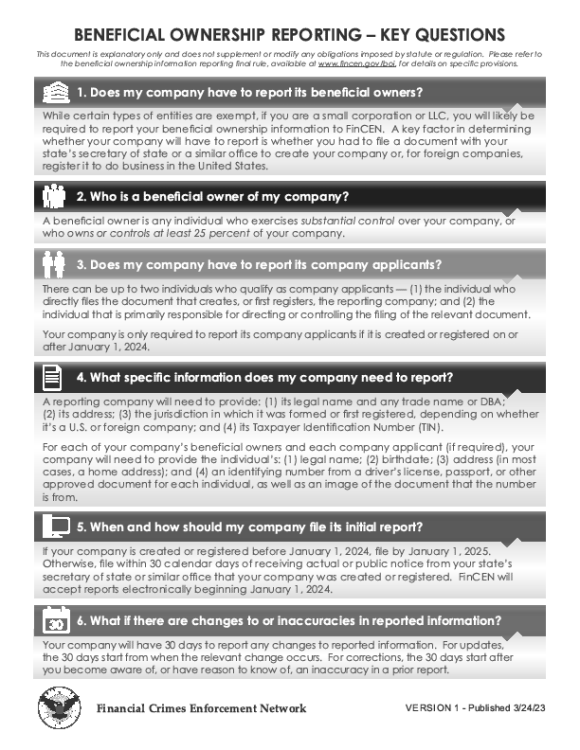

I have to decided to limit my involvement to informing my clients of their obligation to report I am not giving any advice or answering any questions. BOI has nothing to do with providing accounting. payroll or tax services.7 points

-

After reading all that, for one of my biz clients similar to my example, from what I've seen of them in action, I'd say the H&W are but the kids are not. In another one of my biz clients, I'd say all four are. In both cases, I think the one with the ownership interest would disagree with me (for different reasons in each case). So, I really don't want to be involved in these filings. Less and less the more I read. I'm sticking to tax!6 points

-

I'm currently on the phone with PPL for a reduction in a 2023 refund for a 2019 additional assessment. My client never got the CP letter since his wife is in the army and they move quite frequently. His address on record was/is his dads and apparently his dad didn't take notice of any IRS letters. I'm not sure if I will be able to do anything for him. Learned a lesson though - I'm getting 2848 for all my clients in the military so I can get the correspondence.5 points

-

It's my understanding that basis gets full step up in value as if the life estate never existed.5 points

-

Because I have a vendetta against Intuit, I will never willingly purchase one of their products. I have never forgiven them for what they did to Parsons Tech; the program that I started with in 1992. Also, I see some of my clients struggling with and being limited to use of Quickbooks; which, IMO, is overkill and over priced. So says the person who knows that she should never hold a grudge. I have committed to Max for one more year and am moving on. And, yes, it does do the calculations for the WI OS form.5 points

-

I like to say, "I have easier ways to hurt myself!" and Eric has (or had?) a GIF for us on that exact topic.5 points

-

My E&O (NAEA group policy via Calsurance) said they are NOT covering preparers for this -- at this time. They did say that IF reporting BOI becomes a core service for tax preparers in the course of their biz, that they would consider covering in the future. From Megan Killian/NAEA: "As of right now, Calsurance will not cover this under their E&O policy, and the consensus has been that most other providers will not be either. However, I suspect that this will change over time once it is more established and it is also demonstrated that this will be a core service offered by many tax and accounting professionals." I do NOT want to report BOI for my clients. My biggest worry is that clients will forget to notify me of changes in ownership until next tax season, missing the short deadline for reporting changes. And, create new businesses without telling me until next tax season. I don't think I could charge enough for this. Wresting true ownership info from clients will take time. Penalties are high. I can make money by preparing taxes all year long. Why break my stride to jump out of my tax software over to FinCEN and also spend the year making sure no client has made any ownership changes?! I will make sure all my biz clients know about it this summer. I hope to steal a 1-pager from someone who creates a thorough how-to flyer.5 points

-

I just did this for MD. Check the box on the state EF info form to unlink from MeF. Then just create the state efile. Easy peasy.5 points

-

In the case of a Life Estate, the basis is stepped up to the value on date of death. Besides which, being an inheritance as well as a (gift), there are no tax repercussions unless there was a profit on value on date of death. The gift tax return was unnecessary at the time that the Life Estate was drawn up. In the case of a Life Estate, the property is not (gifted) until the date of death.4 points

-

Because a life estate changes the gift into an incomplete gift. https://www.stoufferlegal.com/blog/navigating-life-estate-remainderman-tax But the death of the "previous owner" essentially wipes out the life estate and the beneficiaries get a full step up in basis. Basis is more complicated if the house is sold before the life estate owner dies.4 points

-

4 points

-

4 points

-

The site does have the option to stay logged in, and stays that way until the user clears browsing history unless leaving cookies intact. I'm logged in almost all the time. The site also has the ability for a user to log in anonymously too and stay that way.4 points

-

I'm not Lynn EA but can answer. I upload the client copy of the returns, pdf. I then upload what I call the signature pages, beginning with 8879. The signer(s) are part of the portal with their email address originally entered as a client. The software prompts me to determine if I want to add signatures. For the client copies, no, but I click Yes for the signature pages. All is then uploaded for client access and I am prompted to indicate which signer is to sign first, i.e., taxpayer. I scroll to the signature line and highlight it. Then highlight the date line. I also highlight for initials the bank information and selection for payment or refund. At the end, I am prompted for the next signer, if there is another. Repeat the process, review if desired, send. The clients receive an email (each one) and are directed to the highlighted spaces to accept/enter. When the first signer is finished, an email is sent to the next one. I am notified at every step. A few of the folks were reluctant until I or someone explained it's similar to the now ubiquitous signing pads everywhere. I think you can try it out.4 points

-

First it's too complicated to cover in 1 page, given all of the exceptions and etc. IMHO, creating a "How To Flyer" is offering advice.4 points

-

I am not touching it. The potential for the client to not give updated information to report in the required timeframe scares me. The penalties are just too high to justify the potential revenue from the client. Plus, if I understand the rules correctly, you have to report yourself as the preparer of the document. Some will do this, I will not. Tom Longview, TX4 points

-

https://www.law.cornell.edu/uscode/text/26/2036 The value of the gross estate shall include the value of all property to the extent of any interest therein of which the decedent has at any time made a transfer (except in case of a bona fide sale for an adequate and full consideration in money or money’s worth), by trust or otherwise, under which he has retained for his life or for any period not ascertainable without reference to his death or for any period which does not in fact end before his death. Sounds to me like as long as they had the right to possess the house until they died, it is included in their estate and the kids get a step up in value. In other words, a de facto life estate should work. In instances where the owner of the property has deeded the property to others but did not retain a life estate in the deed, but nevertheless continued to live in the property as a life tenant, see IRC § 2036 which uses the word “retained” not “reserved”. It has been successfully argued in the past that a right can be retained without being reserved, and that the continued occupancy of the home after the transfer of title, without paying fair market rent, is evidence of an implicit agreement, understanding or assumption of the parties of the transaction. Estate of Linderme v. Commissioner, 52 T.C. 305 (1969)3 points

-

After a bit more research, I found this on Cornell Law website: life estate A life estate is an interest in property that lasts only for the life of a specific person, usually the possessor of the estate. The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime. If the measuring life for the life estate is someone other than the possessor, the estate is considered a life estate pur autre vie. A life estate is created by a deed that gives the property to the person "for life" and identifies what should happen to it after that person dies. For example, a deed stating that land would go "to John Doe for life, then to Jane Doe" gives John a valid life estate, and Jane a remainder. John could use the land during his lifetime, and even sell his interest to a third party, but that third party would have to surrender the property to Jane upon John's death. So I'm wondering now and again about the deed. I'm reading this as though the mother (the possessor orignally) transferred the interest during her lifetime (gifted to daughter). But then it seems that the deed must state that the property is given to the person (mother) "for life." The client has not yet responded. I hope they used an estate or real estate attorney.3 points

-

maybe file 8821's for all those clients and wait until they need representation (and that you want to represent them) for the 2848's? just a suggestion3 points

-

Thank you, ladies. And, duh, when all else fails, read the instructions! I did tell mom and daughter that I want to see her LTC contract to know what's covered (she talked as if it's NOT the per diem coverage, but need to read her contract).3 points

-

Thanks again. I'm now wondering if this was something thought to be a solution outside of actual legal guidance. It seems to me that the gift tax returning, gifting the condo to the daughter, was a way to 'transfer' ownership without specifying a life estate, that it was de facto. I've asked the questions. The closing document shows daughter's name only as seller. I wonder what the deed shows.3 points

-

Thank you, Marilyn! As I wrote, this is my first, so unsure of how to handle. Client will be so happy! I have no idea why there was a gift tax return, not my client at the time or maybe I would have known all this already. I will double check on documentation showing life estate rather than just letting mother live there. Client told me 'life estate,' but I want to see it. I will still do research but have great guidance now.3 points

-

https://verifyle.com/Verifyle_8878-8879_compliance.pdf3 points

-

As I said, any activity that took place in Kentucky, is taxable to Kentucky, no matter where the taxpayer lived.3 points

-

I have one couple who share an email, and I send to them twice - once for him, and once for her. I suppose in theory one could sign in both spots, but for that you'd have to know the clients, I guess. I had emails in the workspace sent by each of them (signed by name; different 'voices'), and so knew both were on board and spoke with each other about the returns regularly. If it was a couple where I had contact, mostly, with only one of them, I might be chary of using a single email address.3 points

-

Both good points. Even in a situation where the site is cached for logged out users, the TTL would be set to a low value, likely to an hour or less, so they would still see almost all of the most recent content. Then, after that period of time, the cache expires and the next hit generates a fresh copy. It would go a long way to dealing with all of the bot activity that the site sees. Every hit from one of those bots is processed like any other, which generates multiple database queries. Serving them a static file would be tremendously more efficient. In any case, I'll know more once the move is complete, and I've had time to work on the server/software configuration for a little while. There's a reasonable chance we'll be able to get away without the caching layer at all.3 points

-

As long as they are in a Workspace thread with both people, you set up the two signers. It goes to #1, automatically to #2, then back to you once signed.3 points

-

What is substantial control? For example, husband owns 80%, wife 20%, adult son 0% but VP of marketing, and high school daughter 0% but VP of finance. Both H & W are the producers of the local TV shows as well as being the on-air talent. Does only husband report? Or, some combination of 2, 3, or all 4? Would it matter if the responsibilities stayed the same, but the "kids" didn't have VP titles? Is there a difference between the kid that's over 18 and the kid that under 18? I guess I have to go read the details at the website! Thanx, Lynn, for your post. That's what I'll send my clients, with the website in large font, bolded, and highlighted.3 points

-

3 points

-

If you are a member of NATP, NAEA, Tax Pro Fellowship, these organizations offer free subscription to Verifyle, a secure document sharing platform. Also included, and free, is electronic document signature.3 points

-

Fortunately for me, the Oregon Secretary of State has published a two page guideline with live links that I am going use. I am also going provide a live link to FINCEN'S guidelines which is 51 pages long3 points

-

Thank you Abby. That worked perfectly. I had never seen that option before. Greatly appreciate all the help you provide to this board.3 points

-

Thank you, @Eric, for everything you do for us. Do you need any donations at this time to fund the new server? If so, please let us know!3 points

-

Like others in our community I have received my annual renewal notice and I too have wondered what is the rush? In looking around I find that some other providers are coming out with product that is cost competitive with ATX and has features from the perspective of a small time tax guy like me that bear close scrutiny such as unlimited efiles as opposed to ATX's upper limit of 75 and then they tack on an additional fee which becomes not insubstantial to your total cost. Now that the pressure is subsiding I am going to take a close look before pulling the renewal switch this year.2 points

-

The notice tells you who issued the 1099R. Have the client call them.2 points

-

This is a legal argument, not the bailiwick of the tax professional. Don't go there. While we aim to please and serve our clients, sometimes they ask too much of us.2 points

-

And I learned something new today. Thanks for the education. Tom Longview, TX2 points

-

If it truly became a Life Estate, it should be so noted and recorded on the deed. In a Life Estate, the mother would retain a remainder ownership until she passed. She would also be responsible for all expenses and taxes until she died. The gift tax return woud have been moot. I just had my first gift tax return this year. Seems we are never too old to learn something. I don't believe that Life Estates are any longer a legal option unless drafted before 2017. Then, it would be Grandfathered in. (This may only be true in WI. I have no further knowledge pertaining to other states.)2 points

-

I believe the IRS does require ID verification (see below from IRS Website). Does Verifyle include identity verification and do they charge extra for it? I know Drake uses a soft credit inquiry to generate questions used to verify identity. What are the ERO’s responsibilities with regard to e-signature? If the taxpayer uses the e-signature option, the ERO must use software that includes identity verification. The software must record the following data: Digital image of the signed form; Date and time of the signature; Taxpayer’s computer IP address (remote transaction only); Taxpayer’s login identification — user name (remote transaction only); Results of the identity verification check validating that the taxpayer’s ID verification was successful; and The e-signature method used to sign the record. The ERO is also responsible for maintaining a tamper-proof record in a secure, access-controlled storage system for 3 years from the due date of the return or 3 years from the IRS return receipt date, whichever is later. ERO's must be able to retrieve and reproduce legible hard-copies of the signed form.2 points

-

I was a long-time user of ATX, back to the days of Saber. It was a product that I depended upon and served me well during the time I subscribed. One of the drawbacks for me was I have a moderate number of clients who work in different states, necessitating the credits for taxes paid to other jurisdictions. ATX used to charge a premium to have that calculation done automatically...I'm not sure if that is still the case or not? I also had to pay an additional fee to use the ATX portal for my clients. I transitioned to ProSeries Professional during the 2021 tax year. The learning curve was minimal as both programs are form based. I've been pleased with the performance of the program, which includes all necessary calculations for the taxes paid to other jurisdictions, populating the appropriate state returns as required. The program also provides "free" use of their client portal and my clients seem to find it easy to navigate. By no way is this post intended as a knock toward ATX, it served me well during my time using it. I just wanted to provide an alternative in the event you are considering a change.2 points

-

A spreadsheet can be created at any point and during an audit, it might leave an aroma. Paper records, along with a couple of pictures sent to your email every 6 months will not be challenged. Thank you for your suggestions and going to my local store sounds excellent.2 points

-

You're very welcome. I feel like people should be donating to Judy instead, as she's got more to do with keeping this place running smoothly than I do. I doubt there will be any significant change in cost--instead of one powerful/expensive server, I'll have all my sites broken up into multiple smaller, less expensive virtual machines. We'll see how the first few days go. Because the whole site is dynamic, I can't get away with leaning on caching as much as I do with your average static website. E-Commerce sites are similar in that way. It'll be interesting to see the CPU/RAM required to run the site when it has its own dedicated resources to work with. If resource use seems excessive even after tuning, I may entertain caching the site for guests (those who aren't logged in) so that content might be outdated by an hour or two unless you log in.2 points

-

Verifyle is only $9 per month if you are not with one of those organizations. I have been using it for 3 or 4 years and am very pleased with the service and responsiveness to my questions at the outset. I use workspaces, one for each year, and request that all client communication be managed there. That way I can keep messages for each client in one place. At the end of the season, I copy the message string to my client file for each one for each year, just in case.2 points

-

I agree with mcb39. If a resident of WI at the end of the year, he'll file KY 740-NP. Ky source income (the sale) will have to be reported to KY. Yes, check to see how much can be excluded as residence but the business is business.2 points

-

The first question that comes to my mind was how long did he live on the farm and does it qualify for the main residence exemption. Of course, the business part will have to be separated, which further complicates things. WI will tax him as a part year resident and tax him on the income made in WI. A part year KY resident is taxed on all income from all sources while a Kentucky resident and on Kentucky-source income. Therefore, the entire sale gets taxed to KY. KY does have partial reciprocity with WI, but only for salaries and wages earned in WI. I think that I could prepare this return, but am glad that it is you rather than me. BTW, you have to be domiciled for more that 183 days in KY in order to be considered a Resident.2 points

-

I ran into something similar with an amended OH return. I decided it was easier to include a 1040X with no change and the explanation that it was being filed solely to amend the state return. Apparently OH requires a federal return to accompany an efiled return. Client received a letter last week from IRS acknowledging no change. Client is still waiting for the refund from the amended OH return.2 points

-

The smell and sounds of a printer is one of those favorite things for me. We had a printer really close to our office back in the 90's and I was the lackey who would get sent over to have something printed and loved that smell. Only thing better is a barn.2 points

-

Might not matter where they still had their residence at the time. States vary, but over time more are taxing full-year income regardless of where earned. Then they adjust based on % earned in what state, or $ earned in each state, or they apportion by date. Home state will give credit for tax paid to another jurisdiction, usually up to the amount they tax on that same income. You'll need to research what KY and WI want for part-year resident reporting.2 points