Leaderboard

Popular Content

Showing content with the highest reputation on 04/15/2016 in all areas

-

The coffee machine makes me recall something that happened many years ago when I was the young controller for a small ink manufacturing company. True story here: This was long before the days of cell phones - we had nothing but land lines. I lived about 20 minutes from the plant and the owner (Jack) live about 30 minutes away. We had a bookkeeper (Ginger) who was always the first person to work. Ginger was very talkative and always in a high state of excitement even on normal days. One morning as I arrived, Ginger met me at the door, very agitated because we'd had a break-in the night before. They took calculators, typewriters, petty cash from the vending area, etc. (didn't have computers at that time). She told me she had already called Jack at home, and she was especially upset because the only thing he seemed concerned about was the coffee pot. Jack arrived soon afterward, and we spent most of the day filing police reports, buying new office equipment, notifying our insurance company, and arranging for some security enhancements. When things settled down and Jack & I were sitting in his office reviewing the day's events, I told him I was puzzled over Ginger's comment about his concern over the coffee pot. He said -> "I knew you were probably on the way in and you'd take care of things. But I couldn't get Ginger off the phone so I could shower, get dressed, and come on in as well. She just kept telling me over & over again what all had been taken and yelling 'They took everything! Everything!'. So I finally asked her if they took the COFFEE POT. She said 'No, why?' I said 'Well make some #$%^% coffee and I'll be there in a half hour!' She needed something to do and I figured that would keep her occupied until you got in."8 points

-

7 points

-

7 points

-

7 points

-

The last 7 returns I reviewed from my staff all got rejected by me. Careless errors and of course these are our most complicated returns with up to 50 k1's and multiple brokerage accounts. I just told everyone to just do extensions at this point, the returns can go out next week. Of course my partner who doesn't get involved in tax prep just wants to keep producing so he can keep billing.6 points

-

Yes; knowing when to stop, whether for the day or the season, is very important. With our computer issues this year, I decided to put in all extensions the first week of April. I'm still working, still finishing returns -- but knowing that all those clients are already on extension. So I am taking my time and working carefully. ALL my stress this year was March 22 - 30 with the computer problems.6 points

-

5 points

-

Nothing wrong with a wee bit of Macallan 15 during the say to lubricate the brain cells. Its only a problem when the wee bit becomes a 16oz cup. Catherine you are a baby still complaining about your computer issues, our Coffee Machine stopped working this morning, now that's an issue worth crying about. So far our intern has made 3 coffee runs for us then we got smart and bought a Kurig. Too small for our office normally but should get us through the weekend.4 points

-

Thanks, Judy. Issue for me was the wording in the IRS pubs that talked about an AGI-based "taxable compensation" limitation that said nothing about earned income/wages in their definition of compensation. I finally found code section 219(f) and sure enough you have it spot-on. And I was not crazy. At least, not because of this.4 points

-

I'm not sure what other comments you are looking for. You are correct that in this case the limit is the husband's comp IF he didn't contribute to an IRA of his own. Compensation is wages, salaries, commissions, SE income (but not a loss), alimony, and nontaxable combat pay. The SE income is after the reduction for 1/2 of the SE tax that represents the equivalent of the employer's share of the FICA and Medicare taxes. Technically, the withdrawal of the excess isn't required. The wife could leave it in and designate the excess as a contribution for 2016 and pay the 6% on the excess for the 2015 tax year, that is assuming that one of them will have at least enough taxable compensation in 2016 to allow for that excess to be a contribution. If they want to take the excess out and not pay the ~ $150 on the excess left in, get them an extension so that they have the additional time through the extended due date to withdraw the funds.4 points

-

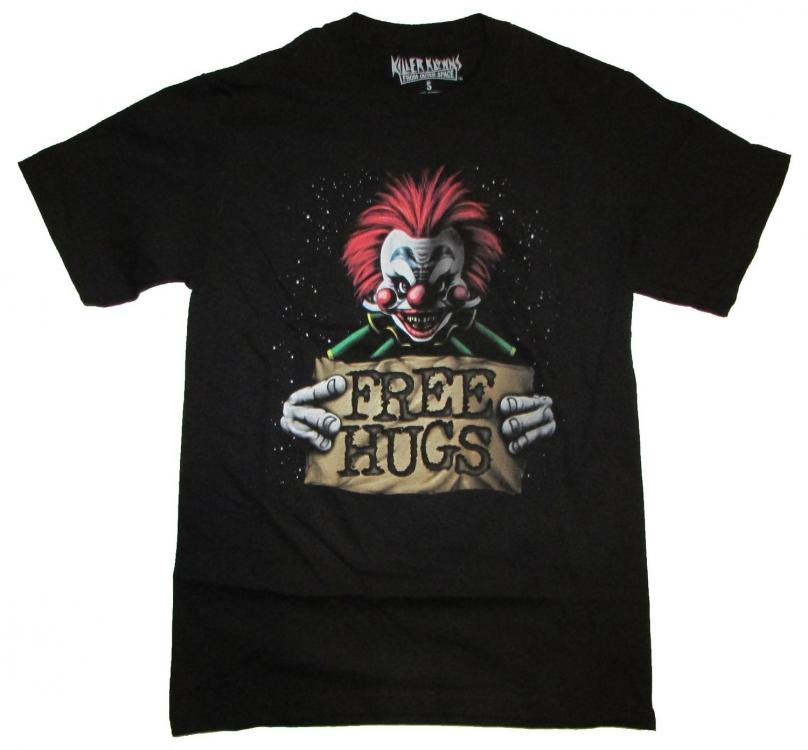

Laundry to fully cleanse his shirts. Sunscreen since he's standing outside. Hand sanitizer between clients.4 points

-

I hope he's reporting that $2 income and paying tax on it. Not too many deductions on that one.4 points

-

Just switched gears earlier today. Back to monthly writeup, financial statements, payroll processing and quarterly reports. It's a wonderful life !4 points

-

I can understand the pressure when getting towards the end. With a small practice like mine just under 250 returns (just me and an admin assistant) I have the luxury of being done before the deadline, with only about 15 extensions. But when computer problems hit and giant returns trying to get completed and the clock ticking, it's just not worth the expense of things going wrong. I admire both of your decisions and glad I'm not in your shoes, because I would have probably shot myself by now, or start drinking....more that is.3 points

-

No returns are expected to come into the office for 2+ weeks. two pickups remaining three I'm waiting for a small amount of data each but we've been given a 1-month extension. Waiting on e-file authorization from about 25 returns but I know on Monday I'll get 1 call for all of them that says - GO! I might have a beer or four tonight.2 points

-

2 points

-

That's good advice. I see all manner of weird entries in Box 14. It gets used for state-specific items, for employer-paid items, informational tidbits, and more.2 points

-

2 points

-

One or two more returns to file (just waiting for 8879's to come in). Double-checked all extensions yesterday and had them all but one or two which are now filed. A couple of emails to return, then I turn my attention to quarterly payroll issues. Oh, and getting my own QB re-installed on this machine. Possibly seeing if the boat anchor machine can be revived. Sigh.2 points

-

I have a similar case; clients had coverage, state dropped the ball. Kept asking for proof of income and proof of residence which were supplied multiple times. They are getting a penalty that they should NOT have to pay as they had been working to resolve the issue for months before coverage was dropped. State paperwork even states THEY were at fault, not clients! So what *is* the solution here: mark them as having coverage, and use the state letter as proof it was NOT their fault?2 points

-

What happened to your client is so common, I had another client apply, they sent him his insurance card, received a letter stating they hadn't received his payment, sent another payment, a couple of months later same letter, ACA peeps told him they would resolve it, weeks later they drop him Who's fault was it?2 points

-

2 points

-

I have a LOT of extensions to file. Saturday. And a couple siblings with kiddie tax to proofread Friday, one sign/pick-up Friday (which means I have to shower and dress!), and maybe the family in Singapore to dig into Friday and try to complete by Monday. If I can squeeze in any little ones (I don't have little ones, especially in April) Sunday and Monday, it would stop some of the phone calls. I gave amounts to mail in to the clients who will mail in extension payments. Going to e-file extensions for all extensions, whether they tell me they're mailing or not. (Thank you, Jack, that's a good idea.) And, have a bunch that called and said please file extensions, so I have no info, so zeroes. I've had only one extension denied, and it was by CT a few years ago for a single mom who teaches violin and doesn't make much money. So, I hope this is not the year any government cracks down on "zero" extensions, because I think I may be e-filing more than my usual number of zeroes. Going to get some sleep before I have to shower and dress!2 points

-

I have two more left to file that are done and 32 more extensions to file. Usually that's all I have, but this year I've already filed almost 50 extensions. I left for my client conference today and will be filing from my hotel room. The two hour drive to San Jose actually did me a LOT of good. That and the nap before I left that my roommate insisted I take before driving.2 points

-

Finished with my last evening appointment for the season, and there's no other work to do afterwards. I'll get to the extensions after a nice break.2 points

-

I have only a handful of federal extensions including for my own return. My state's due date is 5/2 so I'll finish most of the returns within a few days after a much needed break. Everything I have in is mostly complete at this point anyway. Like Lee, after that I'll get to the quarterlies and the accounting work2 points

-

Every time I tell my wife I have nothing to do the phone rings, the fax starts up, I get an email and then tomorrow morning I go to the post office so who knows. But I'm on track to be done tomorrow. Just missing the usual late ones, and I'm not calling them this year.2 points

-

Last one picked up a few minutes ago. All done except my own which is a project for tomorrow.2 points

-

Sure there are. That is a specific uniform (to give him that "perfect" look), he had to travel to and from there so the entire cost of his vehicle and all the expenses of the vehicle are deductible because he only uses it for his hugs business, his gym membership to keep him looking like that, his haircuts and all the food he eats that is good for his body and looks. And don't forget the medicinal use of cannabis for stress relief after a long day of work. //s Tom Newark, CA1 point

-

Absolutely they should be responsible for any interest and FTP penalties. Don't accept any responsibility for their procrastination. Personally, I'd give them an option. I'd estimate the tax liability based on a worst-case scenario (the entire amount taxed at ordinary income rates). Then explain to them that this is a high-side estimate - it may be lower or it may not, and they brought it in so late that there isn't sufficient time to research it. With the understanding that they will get a refund of any overpayment, and that they will owe a combined interest and FTP penalty of roughly 1% per month (plus estimated tax penalty if any), let them decide whether to send a payment with the extension. Also, keep in mind that the NC FTP penalty is a flat 10% of the tax due, plus 1/2 of 1% per month. I'd make it clear that if they choose to pay less than the high-side estimate, ALL penalties & interest are their responsibility. Make it harsh and crystal clear - this is no time to soft-pedal the potential end result. This should probably be in writing. If they don't agree, hand their stuff back and wish them good luck. They still have the weekend to sit in an HRB office somewhere for a few hours and likely end up with the same result.1 point

-

I keep the task manager open and check the memory and CPU usage when it starts running slow. Have to reboot periodically and if I need a big memory clean out, reboot the computer. I had my first crash today, of course when I'm barely able to type my password.1 point

-

I thought that was what was happening. At least he gets a big credit towards his NY tax.1 point

-

I ended up paper filing my Nonresident NY return. Thanks for all the help but never did get it figured out. It is just for a $5 refund anyway.1 point

-

Welcome to my world, only with over 800 cities with income taxes and 600 different sets of rules.1 point

-

Correct, and we are supposed to report the income where it would ordinarily be reported according to the type of income it is. The problem is that these mutual funds can't/won't be able to tell the taxpayer whether it is dividends, cap gains, or whatever it is. The OP needs to go back to the client for more information on this.1 point

-

Congrats! I'm definitely doing something wrong. So many of my clients have a cow if they go on extension. I will be busting my rear until Monday. The good side is I won't have as many people on extension bugging me to get them done in April while I'm trying to do payroll and property taxes. I have had so many complicated returns this year that it has really put me behind on smaller ones. Way too many new businesses started and too many late K-1s and 1099's.1 point

-

One pick up left and all the 8879 forms are accounted for I have more extensions than ever before. Going to see how that works out. Have a 12 year old bottle of Glenlivet gifted by a nice client to celebrate our twelfth year of doing business.1 point

-

I have a couple of these, too. have been training but one is super-stubborn. So this year I asked him about something unrelated and when he turned to look for whatever it was I asked about, I grabbed the whole stack away from him. It felt like victory. Went through one-by-one in record time; "Your w-2, the retirement statement, interest, dividends, your usual charities, re tax, excise -- yup; got it all. Great." He didn't know what to do. Hoorah!1 point

-

...hear Spock's voice in their head when they click 'Remember' in the print dialog box? No? Just me? I do tend to get punchy this time of year.1 point

-

1 point

-

How about the envelopes that have instructions on them as to how to open them. "Tear off the right and left side tabs, slide your finger under the...." Oh for god sakes, it shouldn't be that complicated to open an envelope! Of course if the client gets one of these, they don't follow the directions and the tax document comes in in all sorts of pieces.1 point

-

Reprint fee. $30 or more, depending on how much of a PITA they are. At least, that's what I do.1 point

-

Add on to the aggravation of having to open the darn envelopes are those clients that give us additional information written as notes on the outside of them! I throw the envelopes away whenever possible. I have one woman with many 1099s from bank int, divs and iras, and she reconciles each one back to her other records with notations on each envelope. I can't throw any of them away, and worse yet is that I have to stuff the docs back into their envelopes after scanning them in. It is such a waste of time!1 point

-

Oh, and my gal who told me her boss provided health insurance, but she really got the PTC thru the "Marketplace" (I hate calling it that), just texted me, "Will that form change the amount I owe?" Again: Uh...Yes, when IRS sends a letter telling you to file a form, there is generally a change of some kind.1 point

-

My very anxious man for whom I faxed proof of withholdings on SS to IRS said, "Please let me know the minute they respond." Uh... Ok, I'll do that. I honestly think he thought IRS was gonna dial me right up and say, "Hey, Rita, we got your fax, all is well, how's it going?" Hello? If they couldn't dial up SSA, they're not calling ME back. I was reminded of the Esurance commercial where Beatrice has pictures on her wall and friend says, "That's not how it works. That's not how any of this works."1 point

-

1 point

-

When I was in the marines, the warrant officer I worked for would write a letter and ask me to read it. He would then ask if I understood it, and if I said yes, he would say "good, then anyone will be able to understand it."1 point

-

1 point

-

I took a CE course last year where these tips really stuck with me: 1) Never underestimate your client's intelligence. 2) Always underestimate your client's knowledge. And that has very little to do with this topic, but you know I gotta talk, so... You know what's aggravating the crap outta me today is those who dropped off, were missing stuff, still haven't brought missing stuff, I told them they'd be getting extensions, and they are now reminding me to get them extensions. I guess they are not being condescending, just being careful. You know, since they had three months to get it together and didn't. They are all over it now. Got it covered. Told her to get an extension. Yessssss.1 point

-

Another one I love -- from clients who have sent absolutely NO documentation so far -- "Am I going to owe this year?" Magic 8-Ball says "answer hazy; ask again later." Like, maybe after you send me some information on which to base a guess.1 point