Leaderboard

Popular Content

Showing content with the highest reputation on 02/20/2018 in all areas

-

A few don't want the taxpayers providing insurance for them. I think very few. Many have been under a rock since 2010 and don't know how to apply or that they should. I think in general, people are pretty helpless about being their own advocate. And I don't have time or the desire to sign them up for insurance. Paid or otherwise. Plus we all have that free counselor side gig. Some of them have tax preparers who are entering the unaffordable exemption on 8965 and getting away with it. Or using DIY software and entering unaffordable and getting away with it. It seems very logical. Health insurance IS unaffordable now. Not for SRP purposes, though. The SRP cannot go away fast enough for me. I am losing business because I am preparing returns correctly.6 points

-

I haven't attached these in several years. I try to get the client to have broker send me a cvs file and import it to ATX. And it's been several years now since the brokers have been required to track and report basis to IRS. So you can just put in the totals on Sch D a lot of times.5 points

-

So true!! I've lost two already this week because I would not use the Affordability exemption (since SRP did not support it). I also kinda understand their point....these particular clients were not actually offered a plan through the marketplace that was anywhere near what SRP uses in calculating affordability.4 points

-

4 points

-

3 points

-

Explain the options to your client and let her decide. Make sure she understands that if she goes the 8919/SS8 route that the IRS may contact her employer and she may lose her job. She might not want to rock the boat. Installment agreement. ES payments going forward. MIght be an opportunity for you to educate wealthy family and their bookkeeper on how your state labor dept. as well as federal might view their disbursements -- for a consulting fee. Maybe pick up a new corporate cliet.3 points

-

I have a client who is over 80 and has 100% private health insurance - refuses to sign up for Medicare. His son in law is a surgeon who told him at one point that he refuses to accept Medicare or Medicaid patients so he thinks all doctors do that. He had a knee replaced and the insurance company is who covered it all.3 points

-

If the client wants to keep things as is with their "employer", maybe the client should get a business license, since they can no longer claim ignorance of the current relationship actually being employee/employer. They could then get listed as an approved "provider" with their local service agencies, and maybe hire employees themselves... or find a better/more profitable customer. (Typed as my spouse is going through our annual IHHS interview for our daughter, they are always seeking more providers, either for the IHHS type care - and there is also plenty of need for job coaches.) The cash gig jobs tend to not last, and this could be a great opportunity to turn a bad situation into a profitable business.2 points

-

The first thing that struck me was that this looks more like baby sitting. or senior sitting, than health care. It doesn't look as if there is any health care, or health assistance involved and the people are not health professionals. I do have a client that pays for a person to provide for health care and other non-health tasks. He only deducts 50% of what is paid as medical. So, this could be insurance fraud unless the insurance provides for providing company and performing odd jobs. I don't know what would happen in NY, but in California you can claim that you should be treated as an employee and if the EDD decides in your favor, they will come down like a ton of bricks on the employer, with a lot of penalties. If the IRS gets involved, and they too determine that these people are employees, they can go back to each quarter and assess late payment penalties.2 points

-

If your client does not want to rock the boat, maybe suggest self purchased disability insurance, as it is easy to get hurt on that type of job.2 points

-

I agree with Rita L. Let her decide. Be sure and explain that the extra cost to her is 7.65% [of the net income, subtract expenses, if any], not the entire kit and kaboodle. On $49,000 the cost of being self-employed is about $3,750. It might be unwise to give up the job over that amount. Just being real.2 points

-

We don't import. Just enter totals. Never attach anything. Not a peep from the IRS. Rarely enter directly on Sch D unless clients only have codes A & D with no wash sales. Prefer to have it all on 8949 Detail where I can see totals and tie to 1099B.2 points

-

Client's income was such that her required contribution was zero....Marketplace subsidy would have completely paid for her bronze plan. She chose not to get the insurance. Now paying $695 penalty. What the hell is wrong with people?2 points

-

Those dividends won't create a taxable event until the policy's cash value exceeds the total of premiums paid over the life of the policy.2 points

-

I think they stand on the corner too long, outside Eddy's doughnut shop, guzzling too many Coronas.2 points

-

2 points

-

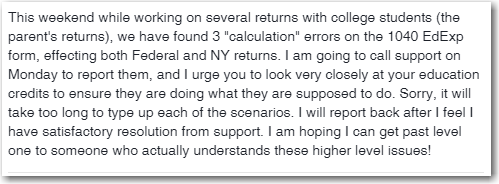

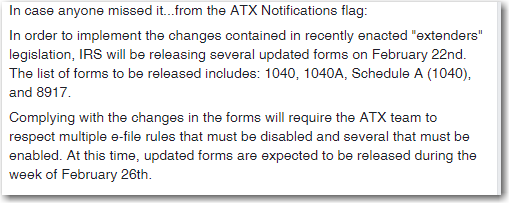

Huge thank you for posting this! I have only one affected so far and client is scheduled to pickup at 1pm tomorrow, to be amended later on. It's an easy fix that I'll take care of in the morning.2 points

-

1 point

-

1 point

-

She is an household employee even if no medical care. Wonder who is doing the corp. tax return. They should advise them it is not 1099 expense.1 point

-

Well, it is only about $2800 when you take the Adjustment. That's a little over $230/m, so a lot of people might not want to risk losing the job for that.1 point

-

This is what I do. I don't want any part of it otherwise. It's up to them to mail in their estimated payments. I give them a memo of the amounts but they determine how much they can actually pay at the time.1 point

-

1 point

-

Kook of the week nominee..... Get a call from a Texas number. Guy leaves a message. Referral from another client. I call him back and he starts telling me how he has this little problem with the IRS. Apparently, he has not paid his taxes from 2013 and 2014. Says he has been disabled and he can't seem to get through to anyone at the IRS because they keep getting disconnected while he is on the line. The penalties and interest are really piling up. But the last person at IRS he talked to said if he would fill out a "Form 22 something" he could get all the penalties and interest wiped out. So I start asking questions. Do you have your tax returns from 2013 forward? "Well, I moved and I don't know where they are". Did you prepare your returns or did you have someone do them? "Well, my daughter did the returns". Can you get the returns from her? "Well, we aren't speaking right now". His next statement "I only have disability this year, but I need my taxes filed and that 22 something form filled out. Can you do that?" My response..."Yes, I can do your tax return. The representation is at $XXX per hour, and will include taking a power of attorney, getting copies of your transcripts for the years in question, communicating with the IRS and you, and then coming to some resolution that allows you to pay back what you owe, or put you in the Currently Not Collectible status until such time as you can start making payments. I estimate a minimum of 10 hours, and I require a 50% retainer before I start working on your case." His response..."Well, let me look for my returns and I will get back to you." Tom Modesto, CA1 point

-

I would just put it on the return in his name (since he received the money and all that) and tell him he needs to submit a new W-9 to the royalty company so the problem does not resurface next year. If the property was truly in her name alone, he may have to send the royalty company some kind of evidence that the property ownership passed to him. But for the current year, I would do as I suggested in the first sentence and move on.1 point

-

Any word on when the IRS will update form 5695 and allow for e-filing of returns that contain this schedule?1 point