Leaderboard

Popular Content

Showing content with the highest reputation on 04/30/2020 in all areas

-

My son, still in college has a NY residence, is a teachers assistant in Indiana, worked summer of 2019 in Massachusetts, and in January 2019 he got paid for his unused PTO from summer of 2018 job in Arizona. A college kid had to file in 4 states. I enclosed a discounted invoice of $675. A few days later I got a text, "are you out of your friggen mind?". I responded with , oh good you got it, sending An invoice was a sure way to know he received it and cheaper than sending certified or UPS.5 points

-

Sometimes I fail to listen to those thought bubbles and these stupid calls take up way more of my day than they should.5 points

-

Phone rings yesterday. I pick up. I know, don't ask me why, but I did. What can I say? I don't have caller ID, and sometimes it's google, and I can just slam it back down. Retiree Caller: You know that stimulus payment? Me: (Thought Bubble: Just yes or no, Rita, yes or no.) Yes. RC: Is it taxable? Me: (TB: Don't adlib, Rita, yes or no.) No. RC: Is the interest [income it will earn in the bank CD I'm putting it in] taxable? Me: (TB: WTH do you think?? Are you kidding me right now?? Yes or no, yes or no, yes or no...focus...) Yes. God is working in my life, y'all.5 points

-

Or, like the sign my younger daughter got me for my desk: "I can explain it to you, but I can't understand it for you."4 points

-

I had to hop on a different computer, so I had to create a different ID last night... But I'm still me. I gotta be me.4 points

-

My first summer job was working as in "intern" at a summer enrichment program run by the United Methodist church locally. I got to do a lot of different things, and saw a whole different side of life than I had seen before. I even got to help dig an outhouse! My mother arranged this job for me but I can no longer ask if she did it because she thought it would be a good attitude adjuster for me. I know it was a good experience, and not because I learned to use a shovel.3 points

-

Sometimes it's hard for a person to understand something when they think their best interests may be served by not understanding it.3 points

-

Yes! The first one that called me after consulting the They Said I Heard Tax Club with the question about whether their return (refund) would be affected 2020 - Oh, my soul. I don't even remember how he asked the question now, but wow, I tried way too hard to answer it. He finally said, "I don't understand," to which I replied, "I know you don't."3 points

-

I predict there will be a lot more people choosing direct deposit from now on. I've been encouraging it for a long time, and the majority of my clients have opted for the smarter choice of direct deposit. There's no good reason not to.3 points

-

Your client can mail Form 8822 to change his address, but it will sit in a trailer of mail.3 points

-

While that would certainly be fastest and easiest, the response that would do the kid more good in her life would be a good spanking, along with some mission work in a seriously poor area, to learn how good she really has it.2 points

-

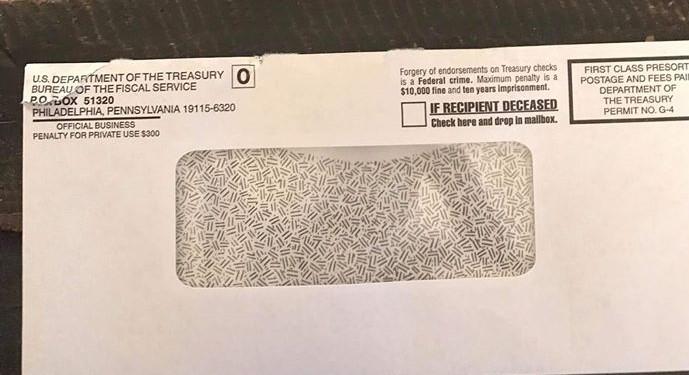

I just love that your example envelope has been opened and the check removed!2 points

-

Lion, I don't have an answer for that, but did not want you to think I ignored your post. The Client calling the FTB is going to be the best way to find out how to get a replacement check. But it is going to take a big boatful of patience to get through to someone there. A lot of the employees are homeschooling their kids and FTB is backed up just like every other CA government agency. If the check is complete, just ripped, they could try going to a check cashing establishment and see if they will cash the check. And if the check is complete, and she has mobile banking, she can take a picture of it and deposit that way. Or make the deposit in an ATM? Tom Modesto, CA2 points

-

2 points

-

The link below is just hot off the press from the IRS. A lot of important information for answers regarding the employee retention credit and the PPP loan. https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act2 points

-

The 990 was extended. There's a notice for that and I don't remember the notice number. First notice mentioned only 990-T and a subsequent one specifically included the 9902 points

-

Yes, but it sounds like the devil is whispering in your ear!2 points

-

In an interview recently with the WSJ, Mnuchin said that those checks to deceased persons should be returned and said that Treasury is working on a method to retrieve the funds by matching up databases. That should have been done before the checks were issued because they won't get money back from a lot of these cases. I received a call from the son of a married couple client. The mom died 3 days ago and the father is in hospice and is expected to pass in a few days. I haven't done the 2019 return yet because I hadn't received any datta, and that was the reason for the son's call, to find out what documents he should look for. Dad is still alive at this point, and I think these people would be a case where they were both alive when the law was passed, and those funds would go toward their final medical and care expenses. I think the funds shouldn't be returned in their case but I'm not sure now.2 points

-

2 points

-

Pacun, she's not my client nor can she afford to pay me! You are right that the parents would lose more than the child gains. Catherine, I love taking teens to serve on Appalachia Service Project. It's an eye-opener for teens who've never been out of Fairfield County, CT.1 point

-

They are still eligible for the stimulus payment, if they meet the other AGI based criteria. Their payment will either come as a paper/mailed check. Or if they go to the get my payment section of the IRS website they could input banking details for direct deposit.1 point

-

Another possible option is to open a new account in another bank with the check and additional deposit covering it stipulating that all funds would remain in the account at least until the torn check cleared. It seems unkind at the least to not allow it to be deposited when it is clear that it was torn but made out to the payee and has all the parts together. I mean, things happen in the mail. I do like Tom's suggestion of taping very carefully the parts together and making a mobile deposit. If done well, it might work. If not, try something else.1 point

-

If the bottom line on both returns is the same. the IRS will treat it as a duplicate return. If the numbers are different, because something was changed to allow efiling, it would most likely be treated as an amended return. Although, the IRS says "don't do it", I know of no penalty, or consequences resulting from doing so.1 point

-

Yes, and is an instructor at HRB for maybe 20 years or so. Retired U.S. Foreign Service Office.1 point

-

I saw that notice 2020-23 extended the 990-T, but I must have missed the one that specifically mentioned the 990. And being paranoid, I would file the extension just in case. So thanks for the info Lynn!1 point

-

1 point

-

He might want to go to the IRS site for the stimulus payment and change the infomration there so that the stimulus check doesn't also get returned to the IRS. If he is expecting a check.1 point

-

The Where's My Refund Site has instructions as to what to do. Too bad for him they too are down for now. He will just have to be patient as this is the quickest option and but for the shutdown would have provided a timely solution.1 point

-

Yes, the checks go to the bank; the papers go into tractor trailers to wait.1 point

-

I'll give you odds that the check I am sure will be sent with my return will be processed before a year has passed.1 point

-

Cash the check and when it clears, pull out your checkbook and make a check payable to the sister and put it in her tomb.1 point

-

I have a client whose returns for the last 3 years have been rejected and had to be paper filed because someone had used his SSN and name on a tax return. It turns out, his father was claiming him as a dependent even though son is in his forties. I prepped his returns for a while, so it happened after that. The father is a little strange, completely paranoid. He used to carry his tax papers and computer around with him on a suitcase cart, because he told me that people go into his apartment and move things around so he couldn't find them. It was all part of a scheme by the landlord who wanted to get him to move out so the rent could be raised in rent controlled SF. This included playing loud sounds and flashing lights at night to keep him up. The next time I saw me he told me his computer had been stolen right off the cart in a supermarket.1 point

-

Sounds like she gave info to the scammers! File on paper with the covering rejection notice and Form 14039 and requested attachments. Police report. Consumer Protection in her state. FTC.gov/IDtheft has some good information on all the things to do. Apply for an IP PIN. Place fraud alerts with all credit agencies. Order credit reports to report errors. Freeze all credit. SSA. www.irs.gov/identitytheft.1 point

-

Used to be a shipping fee then changed to processing fee when they didn't ship out anything.1 point

-

Ex-client called all in a tizzy because her daughter was yelling at her because daughter won't get $1,200 because parents claimed her. Daughter is 15 or so, earned a few bucks in the summer, and is definitely a dependent of her parents. But, all her girlfriends got $1,200 and are planning how to spend it. Daughter doesn't have $1,200 to join her girlfriends and is mad at mom. And, can I fix it? At least can I tell her how to fix it -- without charging parents, of course. Seems like the entire student body of that high school got $1,200 !!0 points

-

The answer is no! In order to get your refund, it must be filed by tomorrow. I called Richmond.0 points

-

If you don’t have an answer by morning, I’ll call the VA PPL and find out for you. Donna aka Possi0 points