Leaderboard

Popular Content

Showing content with the highest reputation on 02/23/2022 in Posts

-

This morning I had contact with two prior clients. They were both PITA so I didn't care when they left. One was absolutely indignant when I passed on taking her back as a client. LOL!6 points

-

Your state law will determine if it is stepped up 100% or some other portion. If she did not own any part of it (based on state law) before his death, she should get 100% stepped up basis like any other person who inherits. If she was a partial owner (based on state law) then only his portion gets stepped up. Tom Longview, TX6 points

-

No, never. Around 2003 I stopped attaching brokerage statements. Prior to that I typed "see attached" w/ "various" for dates and totals in the proceeds and basis. After 2003 I put broker's name for the security instead of "see attached" and stopped attaching statements. When the 8949 came out around 2010, I started using code "M" and never attached a statement. Thousands of tax preparers around the country never attach a statement.3 points

-

I don't know why I bother to call support. They never have a person there that can even look at the issue. Then they ask for the same info over and over again, then they say a technical support tech will have to look at it, at which point they ask again for your Cust ID and name and number. I miss the days of Maine customer support...... Tom Longview, TX3 points

-

3 points

-

3 points

-

2 points

-

This applies to clients as well. I had one client who wore too much of sickeningly sweet smelling perfume, and sometimes she's hug me and I'd smell her perfume until I went home and took my clothes off. Thank goodness for the pandemic and working from home!2 points

-

Mine filled in automatically once the form was uploaded, which was automatic too when I opened the return.2 points

-

We spend more time trying to decide if some of these credits are actually legit. Every day is a new learning session. I don't know what to do about charging. If you raise them too much, they just don't "get" it, even though we spent half the day researching and deciding between us what box to check for who. And who gets to claim the child and every other year parents are both getting the CTC. Ugh!!!! Later Marilyn2 points

-

2 points

-

Usually there is no need to attach 1099Bs because everything is listed on the 8949s or directly on the D. The only time I ever attach the 1099s is when there are loads of pages of noncovered transactions, wash sales, etc., that would take forever to type in individually. Actually, lately I've just entered the totals for each type on the 8949s if there are pages and pages of transactions. Bottom line is the same.2 points

-

Years ago the firm I worked for had a retailer of fresh fish and seafood. OMG, that smell permeated the papers and the clothes of the poor staff person that worked at their site. I was very thankful that it was not assigned to me! I worked on it in later years back in the office, and the smell would be on my hands from working with their journals. It was just gag-me awful.2 points

-

Yes, the perfumes and the smokers are horrible! And they can stink up your whole file drawer. I have asthma and both of those can set me off, so those ones get copied asap and then sealed in an envelope.2 points

-

To jasdim better squash than poop. To Abby. A competitor used to smoke something awful. Folks would go in and have him chain smoke. Before he finished one cigarette he would light the next one and duck the partial butt in his ash tray which was overflowing. Clients reportedly left his office smelling as if they had been in a tobacco smoke house.2 points

-

The mistakes always happen on the persnickety ones - I agree - bad karma. I just did a PA return for someone and forgot that federal wages and PA wages are not the same when there is retirement deduction on the federal. They marched in this afternoon all up in arms. Ugh. I don't know why the program can't catch that one. I feel like it used to. PA returns became more complicated in ATX over the last couple years, and PA is not complicated.2 points

-

I tell clients to drop off their info or mail it to me and I'll get back to them if I need anything else. But years ago when I would have a sit-down with them to go over everything in my office, I always enjoyed stuffing the boilerplate and the mailing envelopes into the shredder as we were talking. Sometimes, while that thing was grinding away, the expression on their faces would be priceless.2 points

-

The worst is records from a smokers house. Smells awful and it makes me sneeze. Fortunately, there aren't many of those anymore. Also, I never see the hard copies of the records, just a PDF, so someone else has to deal with smelly records.2 points

-

The best thing I've ever gotten in a client's bits was a $50 off coupon for H&R Block. I thought about dropping their return off. The second best thing I've ever gotten was a 1099-SSA with a huge red stain on it and an arrow to a note from my client saying 'this is squash'.2 points

-

1 point

-

Don't think it's required in your case. Sorry for all the posts and fixes. Having a very bad day here. Ugh!1 point

-

It may be a glitch if there was a credit shown on line 12 of the 8812, but if line 12 is -0- then 8867 isn't required. That appears to be a factor in determining the need to include the 8867, so the diagnostics may or may not be correct. In general, reading code that deals with the due diligence of "determining eligibility" of these credits I'd agree with you, however looking at the instructions for 8867 that I've quoted below, it may not be a required form for inclusion with the return you are trying to file. After reading the quote immediately below, if you do remove the 8867, I think you should still keep notes and due diligence Q&A to document your work and determinations anyway to be safe. If you need the actual reference and language in the code, it says this (bold is mine):1 point

-

1 point

-

The only entry I had to make was zero on line 23. I also did not delete the “Obsolete 8915E” just in case it didn’t work for me.1 point

-

It worked for me. Did you use the line 23-26 worksheets? Flowchart says to fill in lines 23-26 as applicable.1 point

-

If you received $3,300 that's the amount you should receive on 1040 on top of withholding and EIC. That's true when the client didn't refused any advanced payments and when the number of children are the same. Knowing that will help you know if the program is calculating correctly. This is what I would do in this return if I have doubts. I would save the return, delete the K1 with the loss, and then check if $3,300 shows as child tax credit on line 28 1040. If it looks correct, I would close the return without saving, reopen it and see where the issue is.1 point

-

actually - using basis to allow the -6,000 - regardless if it was 1120S or 1065 - I show they have a tax of $3,300 I am not saying the software did it correctly - but I checked box 13a on the 8812 and the tax is then calculated over on pg 3 of the 8812 Sure does not seem correct - did have income! when I took the basis down to $100 - I got the same answer - $3,300 tax - so now I wonder what I am missing!! MISSING the H/H Birthdate!!! Gets the $3,300 additional credit!!1 point

-

Client is a high income couple, he is self-employed. Has been able to max out his SEP contribution every year. Asked me what the limit was earlier in the year. I gave him the amounts right off the IRS website which say: 25% of your net self-employment income or $58K, whichever is less. I forgot to add the part about the special rule for self-employed. He did not earn enough this year to max out under the special rule at 20%, but did if you take the general rule of 25%. When I was preparing the return, I let him know he had to withdraw the excess contribution and now he is pissed at me. It is my fault, I should have been more specific about the rate. Sometimes it sucks to do this job. Thanks for letting me whine about my mistake. Tom Longview, TX1 point

-

I did the same thing with a PA return and still feel guilty. If ATX has a two-year comparison, that might help you notice the discrepancy before it's too late. I view the two-year in UT for every return I do. NJ, MA, and others also tax some items federal does not. I guess all of us should learn to look at all the state entries when we enter the W2, especially when working with a "foreign" state, because the auto-populated ones can be wrong. And I disagree that PA is not complicated! With the local tax and school tax and all those reciprocal agreements, PA is hardly straight forward.1 point

-

Like Abby, I use the 8949 and group them by transaction type.1 point

-

The most persnickety of clients have karma attached to them, attracting mistakes on our part. Seen it time and time again over the years!1 point

-

Money is fungible. It doesn't matter what she actually used the distribution for. If she had qualified higher education expenses in the same year as the distribution, the penalty is waived for the amount of the distribution up to the amount of the expenses.1 point

-

I almost never use those lines because I like to see the totals on the 8949 Details tab. In the case of multiple brokerages, I would enter totals by brokerage by code. I would not add them together because it's easier to look at later and double check, if they're entered separately. But from a tax standpoint, you could add them up or do an Itemized List on Sch D, but at that point, you might as well enter them on 8949.1 point

-

Same, but I like to input on the Details tab because it's like a spreadsheet and it has totals. You'll want to set the Preference to not calculate when working in Detail tabs because, for some unknown reason, it calculates really slowing in Detail tabs. But saving recalculates so enter a line and save, then check that the gain is correct. If there are wash sales, the code is MW, and multiple codes have to be alphabetical (BMOW). And, yes, I have used the BMOW code when a K1 sale is included on the 1099B.1 point

-

1 point

-

Her note should have said, "don't call the cops". Then when the cops' chemical analysis came back that it was squash, she could have said, "I told you not to call the cops".1 point

-

I have many clients with multiple brokerage accounts and frequently report the aggregate totals of covered transactions on Sch D as long as there are no adjustments.1 point

-

ditto to Catherine - 2 of mine had success calling.. I have them waiting from Feb, March - the one from 2017 - just got hers!! amended in 2018!!1 point

-

Thanks so much Catherine! I will ask my client to call.1 point

-

That is aggressive. Wish they had a code section or regulation to back that up. Unless the rules changed, going from your home to your work has always been commuting miles. Tom Longview, TX1 point

-

From the general chat section, there is a pinned topic where users have collected TIN's for various states. I found this: Vermont (as provided by a Guest): EIN 03-0350860 , 133 State Street, Montpelier, VT 056331 point

-

If the contribution was made in 2022, then he can just apply the rest to the 2022 contribution.1 point

-

I just go with what the report says. I don't add miles to it. It is my understanding that Uber now count the miles when you first connect to their application. So technically, you could drive a lot of miles before you pick up anyone and those miles will be reported. Remember that it is a business need for the uber driver to move to busy areas after each food or passenger is dropped otherwise they could stay parked all night. I personally hate home office because they are painted gray. I have done only a few in my life time and for sure NOT for uber drivers. Most of the records they present are pulled in two minutes from uber's website and they consist of their 1099 forms and report at tax time.1 point

-

I like getting the 1099DIVs that still have the last quarter of the year's check attached. Is this my tip?1 point

-

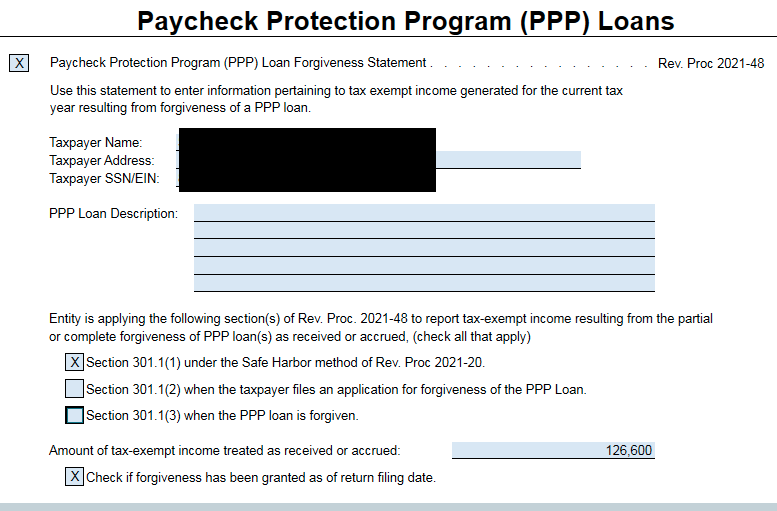

There is a form that must be filed with the return giving the amount and amount forgiven. Nothing to do with being taxed.1 point

-

I seem to have gotten a lot of the plastic binder/envelope things. Not sure what they're called, but they're just a little too wide to fit in my file drawer, plus I'm not paying to mail back crap like that with their tax return. And yeah, the ones who don't open their mail and give me all the envelopes. Or include tons of stuff I don't need, often things they don't even need. But better too much than too little, sort of.1 point

-

You might recommend to your client that they (not you!) call. I've had two clients who called; one had their refund approved but not released and it took the phone call to release the hold so the IRS would actually send the check. The other never got (or so they said) the "we need you to prove who you are" letter. In both cases, the processing would never have proceeded without the calls. But yeah, most of them are just cases of take the deli ticket and wait in line to order your half pound of roast beef.1 point

-

1 point