Leaderboard

Popular Content

Showing content with the highest reputation on 04/30/2015 in all areas

-

Remember the boot incident I had about three weeks ago? That action would be appropriate for this. Pretty sure.6 points

-

Hey, the brokerage firms do corrected corrected 1099s all the time. might want to put a date on it somewhere.5 points

-

Because the person preparing the form has no real idea what is or is not taxable, so they check that box to cover their a__?5 points

-

Don't agree! See below from Pub 554 Disability benefits. If you retired on disability, taxable benefits you receive under your employer's disability retirement plan are considered earned income until you reach minimum retirement age. Minimum retirement age generally is the earliest age at which you could have received a pension or annuity if you were not disabled. Beginning on the day after you reach minimum retirement age, payments you receive are taxable as a pension and are not considered earned income. Taxpayer must still meet all of the other requirements for EIC Joel5 points

-

I was a little worried about how the new software would run, and things just don't feel as snappy as they used to. I imagine it'd get even worse around tax season when the site is under heavy load. I have a new server being built this very moment with much beefier hardware including a RAID 10 array of SSD drives. I'll most likely do the migration this week, but the downtime should only last a few hours. I'm going to try to get it done in the evening.4 points

-

But I think that if you paid the premiums for a disability policy it would not be reported on a 1099R because it would not be considered taxable income. And of course, large companies never make mistakes on the tax reporting of insurance proceeds. /s4 points

-

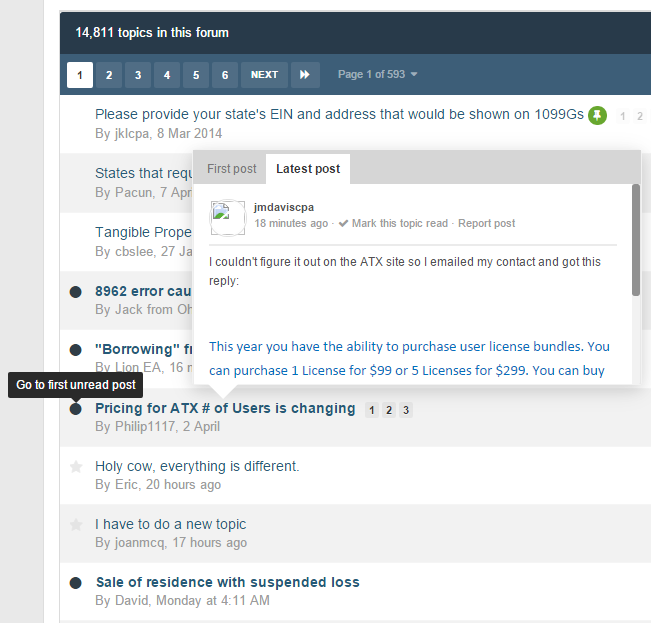

I'm saving $400 this year on ATX due to changes in licensing: This year you have the ability to purchase user license bundles. You can purchase 1 License for $99 or 5 Licenses for $299. You can buy the 2 additional Licenses for $198 but you get a better deal by adding 5 Licenses for $2993 points

-

Yes. Just prepare another corrected one. The IRS will be totally confused, but at least it will be correct.3 points

-

Fujitsu, definitely. They're the workhorses of the scanner world. Then the model that fits your needs and budget. FI-5160Z is great, small footprint.3 points

-

I've gotten CP2000 notices for SE tax even when the amount WAS listed in Box 3, so don't feel bad. Stupid tax is right.2 points

-

All I got is the boot recommendation. Sorry, my friend, I am still in the stone age filing paper 1099s. I just don't want to let it go.2 points

-

Ah, if only my foot could reach that far! So to correct an efiled 1099, one must, as I did, open the original 1099 and check the corrected box. I don't see a corrected corrected box. Should I just resend the original one with the old numbers in it? No, can't do that as it has already been accepted. Maybe try to create a new one altogether? I did try that before but because all the information (EIN, SSN, etc.) was the same as one already efiled, I was scolded by the system to correct it on the originally efiled return. Any ideas on how to create another corrected box on top! Sigh... time to pack it in, I swear! And I just got off the phone with my rep and am really annoyed to have to spend money for MAX because I have 6 trusts and 2 pships which would be extra and then there is the payroll package and 'small' efile fee now plus Ohio cities package. At least I had a nice week in the mountains last week. Should have stayed!2 points

-

2 points

-

Another consideration - if taxpayer paid the premiums for the disability policy, it is not earned income. http://www.irs.gov/Credits-&-Deductions/Individuals/Earned-Income-Tax-Credit/Disability-and-Earned-Income-Tax-Credit2 points

-

2 points

-

Catherine, I have a pretty good supply of red 1099 misc forms left over. I'm out of the office until Monday but will be glad to mail you some if you wish.2 points

-

2 points

-

I agree, but now I'm tempted to re-crop the image to center the spiral I couldn't believe the hate the circles were getting on the software vendor's forum. Anyone who feels that strongly about circles has deeper issues than we can help with, so I think the circles are here to stay. Glad the small style changes helped... it's amazing the difference a few very subtle changes can make. I agree that everything kind of blended together before.2 points

-

She did not pay it, did she? The rules are very clear on that. Executor or administrator. If you administer a deceased person's estate, your fees are reported on Schedule C or C-EZ if you are one of the following: A professional fiduciary. A nonprofessional fiduciary (personal representative) and both of the following apply. The estate includes an active trade or business in which you actively participate. Your fees are related to the operation of that trade or business. A nonprofessional fiduciary of a single estate that requires extensive managerial activities on your part for a long period of time, provided these activities are enough to be considered a trade or business. If the fees do not meet the above requirements, report them on line 21 of Form 1040.2 points

-

Yeah, and I bet there are people who didn't even know about the button at all. Like me. Hey, I love this hovering over a topic and getting the opening post. Two thumbs up.2 points

-

2 points

-

I love the TWAIN-compatible Kodak ScanMate i1120 but the drivers were never updated to work with Windows 7. HOWEVER -- it runs just fine from Adobe, and probably from other software. All you lose is the quick-start buttons and those are not that useful if all your scans are going to different places. The Fuji ScanSnap S1500 is also good but I think the more-vertical paper path of the Kodak is less susceptible to jams.1 point

-

1 point

-

Third - I have the S1500 and love it! I only wish I had gotten it 2 years earlier. It's so fast and double sided and very small footprint.1 point

-

IRAs always have the taxable amount not determined box checked, because the custodian has no idea of the taxable amount. The only true pensions I've seen with the box checked are old ones from OPM, where you have to use the simplified method to determine the taxable portion.1 point

-

I guess I fixed it myself. I had atxcommunity in my browser compatibility folder, I deleted it and everything came back the way you all were seeing it. For a while I felt soooooooo left out. I couldn't post or anything, and boy did everything look weird. I think when I get use to the change I'm going to love it! Thanks Eric and All!1 point

-

Well, then, she deserved to pay a stupid tax, so it all worked out. Seriously, though, I always enter 1099-Misc income on the line where IRS is going to look for it, and if the form is wrong, subtract it off with an explanation. Typically back of Sch C, page 2.1 point

-

Yes, it probably would not be on a 1099-R if paid thru employer. I have never seen an incorrect 1099-R. /s1 point

-

One document that you could have used would be the Certificate of Occupancy. Shame about the client missing the credit for so few days, but that happens sometimes.1 point

-

1 point

-

It seems there is no "managing" them because there's no delete function that allows that. I tested deleting an attachment in a post where I'd used a pdf, and I converted it to quoting from the source or linking to another site, so that appears to work. I did that with some old posts by getting rid of the pdfs. No content changed and it saved space. I'll remember to do it that in future or use some other method of sharing, so there's no need to increase the size, especially if that is costing you more money. I was not aware that would cost you more. Thank you for making that clear.1 point

-

Members list has been removed, and functionality moved to the search. If you miss the tab at the top, I can create one that brings you right to a members search. You can manage your attachments by clicking your name at the top-right, and choosing My Attachments from the list... I'll also increase the limit to 20mb. I worry about increasing it too much because we have a lot of members and SSD drive space isn't cheap I might also suggest dropbox for sharing docs publicly?1 point

-

Feel free to bring up any features/items that you miss from the old forum and I'll look to see if they have been removed or simply disabled by default in the new software. I'll check out the Members list soon. I have a feeling that the member you're talking about registered, but hasn't yet validated their account by clicking the link in their email. There may be issues with email deliverability, but I'm not going to troubleshoot them on the existing server with a move happening very soon.1 point

-

I typed that from my phone. That was exhausting. So, I know nobody is looking forward to another period of downtime, but I think the wait will be worth it. All of your donations around the end of tax season made the upgrade possible, so I'd like to take advantage of it right away. You might not notice a huge difference, but I measure website performance in milliseconds, and the new software is measurably slower on the existing hardware.1 point

-

Good grief Rita. And I thought I had clueless clients. Good grief ! I see I am listed as an advanced member. I am sure it must be my age.1 point

-

Eric, thanks for adjusting the contrast. That's helped these tired eyes too. Two other things I noticed since the change are that there's no ability to delete items from the notifications list., and second, the names of people that "like" a post is no longer displayed, only the # of people liking it. It seemed that many here used that to indicate they'd read the response to their question without having to say thanks. For those asking about the refresh, another way for those using IE is to right click the mouse and choose refresh from the drop down in IE11, or in Firefox right click the mouse and click the circle with arrow at the top of the box that pops up, or use F5 like Eric suggested. I don't have Google, but it probably has something similar.1 point

-

http://www.irs.gov/uac/First-Time-Homebuyer-Credit-Questions-and-Answers:-Basic-Information JB, this is from the page linked above: Q. When do I have to buy a new home to get the credit? A. The credit is available for eligible home purchases after April 8, 2008. You must enter into a binding contract to buy the home before May 1, 2010, and close before July 1, 2010, in order to obtain the credit. For a home you construct, the purchase date is considered to be the date you first occupy the home. (11/19/09) Reference is IRC sec 36(c)(3)(B) that says "A residence which is constructed by the taxpayer shall be treated as purchased by the taxpayer on the date the taxpayer first occupies such residence."1 point

-

Thanks, Eric, for once again doing so much for this community. As Yardley mentioned the first glance doesn't seem too drastic. Two things I did notice: there is a lot of extra space at the top with the placement and size of titles. I would personally prefer to see a longer list of the topics below and less blank space at the top. Then I noticed the absence of the MyAtx link. I would occasionally use that convenience. Is it gone for good? It was a amazing how much I missed seeing this site most of today. Guess it is very integrated into my daily life. Thanks again, Eric, for making it all possible!1 point

-

Definitely different but not drastically. At least, not after a quick look over. Great job, Eric!1 point

-

1 point

-

Not just the price. ATX has always had more forms than any other single tax software package. For one price you got not only tax but also payroll, OIC, sales tax forms, Franchise tax forms, LLC, etc. A fantastic option for not only tax offices but law firms, etc.1 point

-

Renewal already? I didn't get mine yet. Where is this pricing detail, anyway? Why am I so out of the loop (sniff, sniff)?1 point