Leaderboard

Popular Content

Showing content with the highest reputation on 02/27/2020 in all areas

-

This goes back to we don't charge enough, we are at the same level or above as these payroll companies if they can charge that, so can we.4 points

-

Well, well, well. Guess who has a healthy 1099B? Yup. Cost basis is reported on $60k of short term gain but not on $23k of short term gain. The non-covered stock sales show the same date for acquired, 03-01-19; dates sold are 05-23-19 and 06-18-19. These are the same sale dates as the long term sales. Box 12 code V is about $19k. I believe I can safely enter the $19k as basis since it has been taxed on the W2. I could probably add fees, but they are not on the statement and honestly, I'm kind of ticked this 1099 wasn't in the original papers. She knew it was out there. I'm heading to bed now, but I'll be back first thing to see if anyone responds. Gee, it's nice to have an open office with people I actually like.4 points

-

And, 4Q PLUS annual reports in January, even for seasonal landscapers. In my state, you owe reports every quarter, even if zeros. Not to mention the deadlines and the huge penalties for missing a deadline.3 points

-

Like tax prep, payroll providers are often asked (appropriately or not) for advice and to share expertise, not just bang on a keyboard and produce paper. If I were still processing for others for pay, I would have some sort of flat rate per month, rather than a fee per sheet of paper/check. Helps cover those 8pm calls about firing someone (which in our state, requires instant payment), or their power's out, how can I get people paid, etc. I would charge monthly, even if seasonal, as reports, inquiries, worker's comp audits, etc., do not take the winter off.3 points

-

Actually, one employee, or two or three. there isn't much difference in how much trouble the payroll is. If $1300 is their per pay period cost that is outrageous. On the other hand, if it is a weekly payroll 52 weeks per year, that is about what I would charge just to do the payrolls - $25 each, plus an additional charge at the end of the quarter for the VEC and 941 reports. And I don't think that my charges are high.3 points

-

I keep reminding myself that I don't charge enough. Ask me how many times I stick to my $500 minimum. I haul that out for price shoppers. I seldom get the chance to use it on actual referred clients.3 points

-

That does make sense, and it seems that little by little you are getting all the pieces to the puzzle...finally.3 points

-

Yes, and in the morning I will go back and check that W2. Box 12 code V is about $19k. Also, something I've never seen is Box 14 "RstkTxble" which I see is restricted stock that becomes taxable when fully vested. Since she left her job, it became taxable. I believe I can add this to the basis as well as the Box 12 code V. They are 2 separate events that culminated in the same moment, it seems. Here's what I found:3 points

-

I have a minimum of 165 that is state and federal. for very basic return. When there are kids involved and that damned 8867 comes into play I took the advise of another professional and added an hour's billing of $135 for IRS due diligence reporting. (the form states an hour to 90 minutes to prepare this form) So this return would be a $350 bill for me.3 points

-

I use Fax.plus for 100 pages per month billed at $60 per year plus tax. They say they will port in your phone number for free. Since I do maybe 2 faxes per month - 100 pages is far more than enough for us. We used to have everything physically wired and went to VOIP this year (Ring Central) for phones and this service for faxes. It can take several minutes for a fax to go through if that's an issue. My guess would be it is pretty similar process to what Ring Central was at. Our old phone system (with fax line) was $600 per month, we now pay $1,300 per year!2 points

-

Abby, I'm with you. It's mind boggling to me. I requested a copy of the S-Corp Return and might be forced to terminate the engagement if I do not receive it.2 points

-

2 points

-

Thanks all! Sounds like it is going to be close for this particular taxpayer, but no way to tell for sure.2 points

-

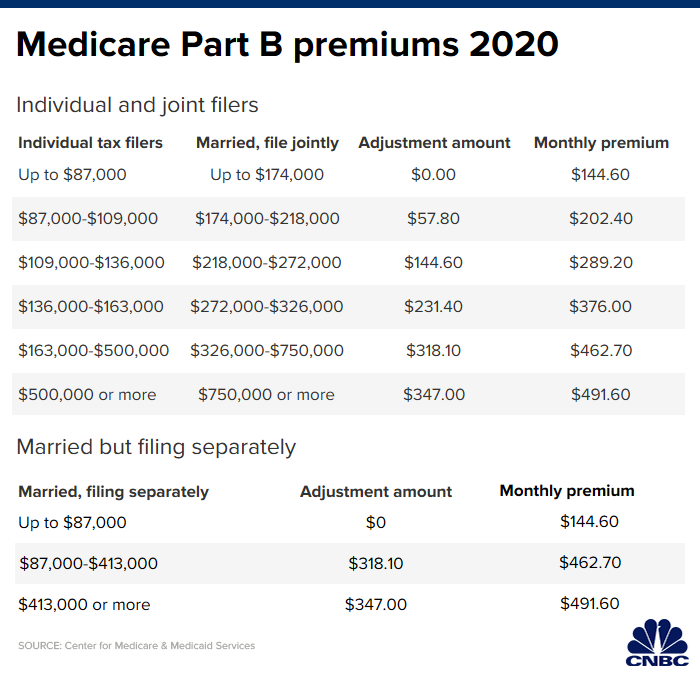

^ that's correct and Gail already has that info in her post for 2020. With the premiums based on a 2-year lookback and her asking about her client's 2019 income level being slightly over the threshold in that chart, I think she is asking what the premiums might be for 2021.2 points

-

I don't charge enough Let's talk about payroll processing companies, 1 employee (and being a seasonal worker) = $1,3002 points

-

Copied from Investment News: "For the first time in a decade, the income brackets used to determine Medicare premium surcharges for high-income retirees will be indexed to inflation starting Jan. 1. As a result, some retirees may experience a reduction in their Medicare surcharge costs next year. Beginning Jan. 1, the income related monthly adjustment amount brackets used to determine high-income surcharges for individuals and married couples will be indexed to the consumer price index based on the 12-month CPI change from September 2018 through August 2019. In August, inflation increased 1.7% over the previous 12 months, according to the CPI data released last Thursday. As a result, the income brackets used to determine Medicare surcharges in 2020 will increase by 1.7%, rounded to the nearest $1,000. In general, that means income tiers will increase by $1,000 to $3,000 for individuals and by $2,000 to $6,000 for married couples filing jointly, according to a new analysis by HealthView Services, a leading provider of retirement health care cost data for the financial services industry. Medicare premium surcharges for 2020 will be based on income reported on 2018 federal tax return." Therefore next year the IRMMA brackets will be indexed to the nearest $1,000 based on the change in CPI form September 2019 thru August 2020.2 points

-

My minimum is $150, and that sounds like what I would charged your client. I had a new client yesterday, after I finished going through the mountain of pages from last year's HRB return, I found their bill for $529. Well no wonder they give the client so many useless worksheets and statements, they have to justify that ridiculous price! I'm thinking mine will be around $300.2 points

-

Not to beat a dead horse if you think you got this...but.... I have a client who works for Tesla. They get quarterly awards of stock options. Tesla is very good about giving the worker all the details of the awards, so it is just a matter of hunting for the award date and the amount of income that was included for that lot when it was awarded. Just finished that return last week. From your original post above, it is not clear that the client has "sold" the stocks, just exercised the right to purchase the stocks. If that is the case, then there will not be a 1099B. At the point of grant (not exercise of grant, but the grant of the options), there is generally no reporting, because there is nothing of value that has changed hands. The employee has the option, but not the requirement, to purchase the shares at a given price (the option price). If they don't actually choose to purchase, they have received nothing from their employer. This is what it sounds like happened to your client. Then, when she was leaving the company, she exercised the options, purchasing shares at a discount to the FMV on that date. The amount she gave the company (the option price) is basis, as well as the spread between the option price and the FMV on the date of exercise of the option. The spread is the portion that should be included in the W2 at ordinary rates. This is also the amount you need to hold on to for the actual sale of the stocks when it happens, because the broker may or may not have the correct basis reported on the 1099B. If there is no 1099B, then there is no sale. Double check with your client that they did not receive a check. If she got a check, she should also get the corresponding 1099B. In a lot of cases, the grant, the exercise and the sale all happen on the same day. Even in this case, there should be a 1099B. It generally results in a small CG loss due to the broker commission (as Judy said above). Back to your original problem. The real question is: Did she sell? If so, make her get the brokerage statement. If not, then ask her where the stocks are held right now, because she owns them and some broker is holding them in an account with her name on it. Hope this is clear as mud for you? Tom Modesto, CA2 points

-

I think it only takes 12 credits per term to be considered full time student. So yes you can also have a full time job.1 point

-

Unless she's a full-time student, she would not be a dependent. If the 529 Plan distributions cover her tuition and expenses, then she has nothing left to use for the Lifetime Learning Credit. If she wants to make her 529 distributions taxable and pay her tuition with her own funds, then she can take the LLC. Off the top of my head, I don't know which would be most beneficial to her, but your could run the numbers both ways to find out. Research "coordination of education benefits."1 point

-

Fax.plus sounds good! The reason I have wired lines is that a few years ago I went wireless in early February (it was a deal) for my main line and internet but kept the fax, wired line for some weird reason. Within 2 weeks the power went out for a couple of days and the only access I or clients had was my fax line. I still don't give out my cell number to clients or I would be called too often. When I retire, then and only then will I give up the wires. Burned one, twice shy.1 point

-

Mystery solved. They were paying for a previous year on installments and the IRS applied one of the payments to 2016 instead of 2015. The bill has been paid off so IRS is applying to 2019. Thanks for the responses.1 point

-

The year is adopted with the filing of the FIRST tax return. If this is the first year in existence they may have a short year, xx/xx/19 - 12/31/19. Form 1128 is not required in the first year. Your reading is correct.1 point

-

This particular TP gets paid monthly and operates the same season as a landscaper except they don't so snow removal. The payroll processing still charges a monthly fee, Yikes1 point

-

AMERICAN AIRLINES INC. v. U.S.looked at lack of restrictions on transfer and use of cards in determining that they were cash equivalents.1 point

-

We never gave out our actual efax number, we just had our fax line forward to the efax number, if we didn't answer.1 point

-

I have and have always had a separate fax line connected to a retired computer with a fax modem and program in it. All faxes are "printed' and saved to the appropriate client file through the connection (it looks like another drive) with my main computer. Junk faxes are deleted. Before cell phones it was nice to have an extra phone in my home office to call out when needed. Costs about $12 monthly . I also use the number for 'required' phone numbers when I don't want calls.1 point

-

Right After I posted that I went down to cook dinner and I realized. "She already knows that- that is what she posted" I apologize.1 point

-

1 point

-

Found this article published in Nov 2019: https://www.investmentnews.com/medicare-premium-increase-and-irmaa-surcharges-announced-for-2020-170646 Some excerpts include these quotes: "High-income surcharges will be adjusted for inflation for the first time in a decade." "For the first time in a decade, the income brackets used to determine those surcharges will be indexed to inflation starting Jan. 1. As a result, some high-income retirees may experience a reduction in their Medicare costs in 2020 compared to this year. Medicare premium surcharges for 2020 will be based on income reported on 2018 federal tax returns." "Currently, there are six income tiers that determine high-income surcharges for both Part B and Medicare D prescription drugs plans. The income thresholds that determine who pays the Medicare surcharges have been fixed at their current levels since 2011." "Income thresholds will be indexed to inflation in future years starting in 2021, except for the top-level income thresholds of $500,000 for individuals and $750,000 for married couples filing jointly, which were added in 2019. Those top tiers will be indexed to inflation starting in 2028." ETA - Was posting at same time. It seems I found a similar article from that same publication as cbslee with some information less specific, some more specific as to when indexing will occur but with no figures as to the actual effect on 2021 except to know that it will be indexed for all but those in the highest tier.1 point

-

Wow, that really clears this up for me. I'll save this one, as I do most of my resolutions here! I just emailed her to see if she sold them. She moved from a big position at Anthem and it is a substantial figure.... to me, that is.1 point