Leaderboard

Popular Content

Showing content with the highest reputation on 04/28/2025 in all areas

-

I'm with you two. I just copied a doc I had showing the points needed. I made a few notes, wrote my name on top and put NA in a few places. That was my WISP. Like mcb39 said, if it's not good enough for them, so be it. Hey, it's a WISP.7 points

-

I made my own as well. Took it from the IRS prototype, changed it to meet my needs, and then made my employee/spouse read and sign it. Scanned copy in the folder somewhere - Where did I put that? Oh well, like all the 8879s that I sign that the IRS has never asked to see, I am sure I could do a search of my documents and find it if I need to. Tom Longview, TX5 points

-

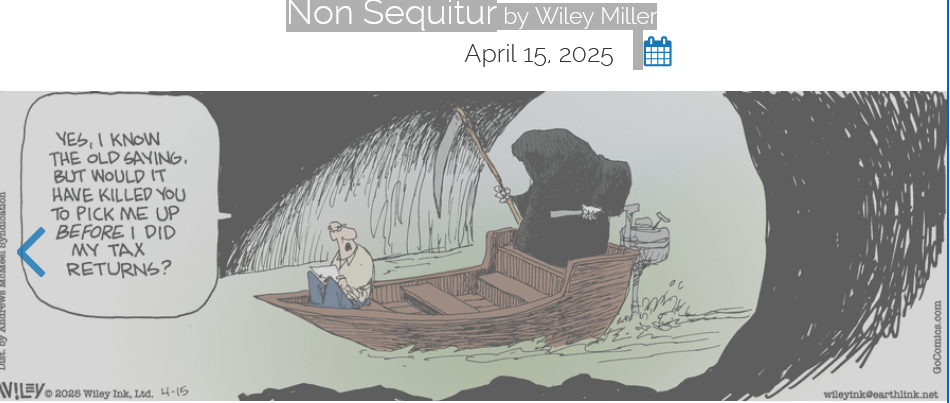

Another moral: always owe a little bit, so you don't have to wait for your refund...3 points

-

I developed my WISP by asking GROK to produce one. It was excellent. I did the same as others have - edited in my specific info, tweaked a couple of items, printed it out, and filed it away.3 points

-

I wrote my own WISP; printed it and sealed it in plastic. If it's not good enough for them, so be it. I can step aside any time they want me to. And, of course, there is that unforgiving increase in the price of the program. ATX, as well and an email every other day reminding me that I should renew before the end of May. I have not even decided yet what I am going to do about next year. Pretty soon the phone calls will start.3 points

-

you put your right foot in, you take your right foot out, you put your right foot in, and you shake it all about! good grief.3 points

-

First and foremost, she needs adequate errors and omissions insurance as well as regular business insurance, and a personal umbrella policy for however many millions makes sense. But in the past 30 years I've only done LLCs, which she could do and remain a sole proprietor. Whether it's worth electing to be an S corp is hard to say, but factors to consider are losing the home office deduction, paying for payroll processing and payroll tax returns, and paying for an S corp income tax return. With a service business, the IRS is going to want to see almost 100% of profit being taken as salary and not distributions.2 points

-

I think we have reached the BOI status of confusion.2 points

-

Had a farmer go through this two years ago and its still not finalized. Hence my post above about 2 years later. They asked for "Income Verification" only in first letter related to Schedule F. Client sent that in. Then 6 months later they wanted Schedule F "Expense Verification". Sent that in. 6 months later, they wanted copies of their Schedule C and Income/expense report related to that. Wife had small schedule C with around $1200 in income and no deductions other than some material. Well, we sent that in along with copies of all 1099's, W2's, 1098's, etc.. We mailed in everything, including hard copies of the tax return. That way they couldn't ask for anything more !!! 6 months later... they get a letter stating all is in order and a refund will be issued. 6 months later, still no refund. And it isn't much of a refund !! A few hundred !! Moral of the story.... Send them everything, including the kitchen sink !! If you give them only what they ask for, it will drag out.2 points

-

Yes, I do too. They have the 1099NEC. What else do they need. I can understand expense verification and net profit. But whatever. Just answer and wait for them to followup.2 points

-

While I use Drake (and have a WISP), I don't have anything set up that requires a QR code. I don't even recall seeing or hearing anything about such a thing on Drake. Maybe I've just had my head in the sand...2 points

-

And no, I didn't mean to say "WASP"... But all of you know what I'm talking about anyway. The increasing talents of the identity theft pirates mean that we must jump through more hoops every year to protect ourselves (and clients) from identity theft. This year we were supposed to have a "WiSP" Written Information Security Plan. I drafted a WISP from my seminar materials. I counted on Drake to provide the machinery necessary to bring about my WISP. When I contacted them, they showed me one of those weird rectangles with all those tiny dots. My daughter calls it a "QR" or something like that. I objected to Drake, as I don't want to deal with something that I don't what is doing, and apparently this thing is supposed to suck personal data from my cell phone, which has absolutely no tax information stored in it anywhere. I asked Drake for an alternate method and they said absolutely not. And of course, they are billing for renewal with an 8% increase. And no effective response for my WISP. I feel out of touch with this whole scenario, and I'm sure there are those among you who will chime in and agree. Why can't we concentrate on becoming better tax preparers and not have to become I.T. people? For what it's worth, I also subscribe to the Elon Musk belief that we are in danger of A.I. running our entire economy and taking personal decisions from us. This post may invoke all manner of comments. I didn't engineer it that way, at least not on purpose.1 point

-

I usually don't like to set this up too close to the filing deadline. If eary on, I do it for a few client who request it. Most of my clients are ok with refunds being directly deposited but if they owe, they choose to send a check. We'll see how it goes for next year when they put through the new requirements (or change their minds).1 point

-

My credit union will cover from savings, but they won't transfer online from savings more than 3 times in 30 days. So if I have made transfers online, or they have had to cover another payment, the third time that month that this happens, they will refuse the transaction. They told me it was federal law - at least the last time I tried to make too many online transfers in one month which has admittedly been several years ago.1 point

-

Drake does display a QR code as a part of the proceess to set up MFA. At first I resisted it, but eventually decided to set up MFA after reading about it on this forum. Now it’s a really seamless process that I’ve become comfortable with and I feel as though I’m protecting my client data with another level of security.1 point

-

1 point

-

No reciprocal agreement for nonresidents selling WV property. Taxpayer will need to file a WV nonresident return that will include the cap gain on the sale of the property and will calculate the total WV tax. Then the tax withheld on the sale will be applied against that. Here is the WV code sec: https://code.wvlegislature.gov/11-11-5/ Seller or settlement agent should have filled out WV form NRSR at the time of sale which calculates the tax to be withheld from sale proceeds. This form must be attached to the WV nonres income tax form. You should check the WV IT-140 instructions as to whether paper filing is necessary, but it may be possible to attach the form as a pdf attachment. https://tax.wv.gov/Documents/Withholding/nrsr.pdf The withholding at sale is claimed on the WV nonresident income tax form. It should be entered on WV IT-140, line 15. Your client will receive credit for that withholding against their total tax, and they may owe some if the withholding wasn't enough to cover what they owe, or they will get a refund if the withholding exceeds their WV total tax before payments and credits. You should read the instructions to line 15 to make sure the appropriate federal forms go with the WV filing. This link contains the IT-140 and its instructions. https://tax.wv.gov/Documents/PIT/2024/it140.2024.pdf1 point

-

You'll want to wait for someone who works with MD/WV, but I do know that most reciprocity agreements are for wages only. So, do some research on the WV website while you wait. Good luck.1 point

-

My bank has that option for certain accounts, but the account holder must set up that feature, kind of like setting up the online bill pay or online banking for statements. The account I have doesn't have that feature available, and I don't have a savings account there anyway because their products aren't worth investing in.1 point

-

After income verification, they will want expense verification. Better have your client get everything ready. 4 or 5 letters and two years later it will be resolved.1 point

-

You already received the best answer is to have client use IRS' Direct Pay. About the above statement, don't ever assume that a bank or credit union offers overdraft protection or that the account is of the type that even has that set up.1 point

-

1 point

-

Attorney should get 1099. IN GENERAL, the part for services provided to your client should be on NEC box 1. The settlement portion should be on the MISC, box 10. The amount to include will depend on how the check was made out. My basic understanding is that if the check was paid to only one attorney, then obviously that attorney gets the 1099 for full amount. If one check is paid to co-payees, I think they each get a 1099 for the full amount. If attorney gets money and part is for co-counsel, then attorney gets 1099 with full amount, and they issue a 1099 for amount they paid co-counsel, but again, that depends on who check is made payable to. There is also the issue on what type of settlement the payment is for. Example, as the article below explains, payments for personal injuries don't require 1099s to the injured party but will be issued to the attorney, depending on how the check is made out. I'd suggest start your reading with the article below from the ABA that is written in more layman's language and is informative before going to the 1099 instructions for preparation, and then the code . The 1099 instructions do reference the applicable code sections. Also, perhaps a separate post would be better for what portions of these payments are deductible by your client. Slippery Pencil is correct that attorneys are an exception to the corporate rule. They get 1099s regardless. Anyway, here is the ABA article to start with: https://www.americanbar.org/groups/business_law/resources/business-law-today/2020-february/irs-form-1099-rules-for-settlements-and-legal-fees/1 point

-

1 point

-

We had that selfsame vehicle as a loaner summer before last when we had car trouble on vacation! Smelled like the chickens it had been recently used to transport, and we called it the Chicken Mobile. Every time you turned it on, a different set of warnings would come up.1 point

-

Now that the convo seems to have exhausted and concluded, I found this funny clip about those farm trucks. It is a Facebook clip, so I'm sorry that those of you not on that platform won't be able to see it. https://www.facebook.com/share/r/16AqLmzUXp/?mibextid=D5vuiz1 point

-

With second homes stuff happens and plans often change so just because you can doesn't always mean you should1 point

-

Send him to IRS's Direct Pay immediately. He gets an instant confirmation of payment. You can calculate his P&I to pay, or he can wait for the IRS letter with P&I.1 point

-

Well in our area all farmers drive big fancy trucks and run them into the ground hauling animals, feed, etc.. And they have to drive on the interstate to get places. Not uncommon to spend over 1/2 million on a combine that comes stock with gps farming systems, ac and a descent sound systems. Is that extravagant and doesn't meet deductible standards ? Hell we have farmers with multiple thousands of acres. Sell millions in crops and animals each year. If I said you can not depreciate your 1/2 million combine with a stereo system or your Ford F450 extended cab with leather seats because they are too extravagant, I would get prodded with a pig sticker !!!! If its not 100% farm use, give them a percentage.1 point

-

If you think the client is lying, then by all means you should decline. That is your call not mine. I don't think a behemoth of a truck is preposterous for a ranch. 2 tons of feed in a trailer going up hill....on the freeway....at 70 mph. It takes a truck. A man sized, full power, get through the mud truck. I just wish we could plug in an app like the insurance companies do and at the end of they year it would spit out a mileage log so we don't have to guess where it was parked and driven. Maybe the next Acting Commissioner (fifth, sixth...I lost count) can make a rule that they have to have that device to get a mileage deduction... how cool would that be? Pipe dreaming Tom Longview, TX1 point

-

1 point

-

I am thinking about doing all my business in the "other office" down the hall, and use it exclusively, that will resolve the issue.1 point

-

Sounds good, but I would suggest this substitution: After reflecting, I realize that I need to reduce my workload to a more manageable level.1 point

-

I decided to keep it very simple. This is what I came up with: "This tax season was rather hectic for me, especially toward the end. After reflecting, I realize that I need to reduce some of the workload to maintain my sanity. While I have enjoyed helping with your tax prep needs over the years, I think it’s best that you make other arrangements for next year. I wanted to let you know now so you have ample time to find another preparer." Thoughts?1 point

-

to describe what yesterday was like. Today I want to hide under the desk. What is wrong with people?1 point

-

Absolutely agree too. No job is worth sacrificing your health. I’ve learned to pace myself, only because my time the last two years have been tied up with caregiving at home, having a 101 y/o mother 232 miles away that I need to relieve my brother every month, who is ready to shoot himself. So finding a balance to safeguard my health was imperative. I found that balance and never felt better. I hope everyone here can do the same. Congratulate yourselves, you made it!1 point

-

You are speaking directly to me. As a warning. And I thank you because I needed to be reminded. I've been doing taxes since 1986 or 1987. On my own since I think 1990? I have brain fog right now but it's close. Many, many of my clients are about to be "fired." It's best for all of us. After almost 40 years? Time to put myself first.1 point

-

When I read posts like some here in this topic and others, and I think back to the workload I endured in my earlier career, I worry about some of you and about us as a profession overall. I haven't made nearly the amount I could have for whatever talents I have, but I have made a concerted effort for a healthier work-life balance and am happier because of those choices. This work can be extremely rewarding, but I believe that it shouldn't be at the expense of our health and well-being. I wish you all well, hope that you recover quickly, and are able to enjoy some quality time away from the office. I also hope to see you here in the off-season as we continue to work at a less hectic pace.1 point

-

Yesterday was the worst day of my career. Patti said that nobody liked her; I don't even like myself. I finished last night at 10 PM with two pages of extensions filed; swollen feet, an aching back and exhaustion. I am trying to get things done this morning that have been neglected for months. Let's get some of these bills paid, etc. Turns out that most of them were already paid. Must have done it in my sleep. I prepared a deposit which will sit here until someone goes to the bank for me. My assistant showed up all grumpy after I almost had to shove her out the door last night. She will never know how close she came to being fired. You see why I don't like myself today.1 point

-

The rounding issue reminds me of the spreadsheet days of ATX. Most ALL calculations did NOT round, but "display" was globally set to zero decimal places. I had a client get a "nastygram"(TM Catherine, IIRC) over EIC when AGI was shown as yadda 50, but was actually yadda 49.70. Took forever to track down. I never entered cents after that, and any calculations that could produce decimals, were edited to include =round(x,n)!1 point

-

1 point

-

1 point

-

I usually only work a half day today. Take tomorrow off. Back on Thursday but I probably won't get much done. Fridays off the rest of the year. Semi-retired the rest of the year.1 point

-

1 point

-

I spent an hour of my life that I will never get back debating rounding with an engineer. He wanted to know why his calculation of interest income differed by $2 from what was on his return. After I told him it was due to rounding, he asked if I rounded first, then added, or added first and then rounded. He proceeded to lecture me on why I should add all the interest first and then round. I explained how the software required that each 1099 had to be entered separately and would not allow me to enter the cents, so I had to round first. And how $2 did not change the amount of tax owed. He insisted I add $2 to his interest amount. Luckily he did not come back the next year.1 point

-

1 point

-

Almost all of my (rare) posts start with "I don't often chime in, but I appreciate your knowledge." At least once a day during tax season, I tell myself that I have no business doing taxes because I'm no longer qualified. Times have changed. Laws have changed and I took the wrong classes to try to stay up to date. I've done this for 38 years and I'm good at it. Until the weird thing hits my desk and I wonder if I'm smart enough to figure it out. It's April 14 and I'm on the edge. But you're not alone and you're not stupid. If you are? Then so am I. I can't wait for this time tomorrow.....1 point

-

I agree, but should I have her pay in as if it is SE income (how can it not be?). Really ... am I missing something? I feel really stupid right now. About this time of year, I usually start thinking I'm not qualified to do this. Does anyone else have those types of thoughts when something like this floats across your desk? Maybe I'm not qualified to do this ...1 point

-

One way of getting rid of such clients is to significantly raise their fees so they leave on their own. Beware, though, they may just pay it, but at least you'll be compensated for the aggravation. I had one jerk whose fees I raised by $500 each year for a couple of years. He started out at $800 and went to $1,800. He was on schedule for $2,300 when another accountant in the office took him over.1 point