Leaderboard

Popular Content

Showing content with the highest reputation on 02/24/2018 in Posts

-

9 points

-

From that... to Tax Stud. What growth you have shown! LOL! Rich5 points

-

5 points

-

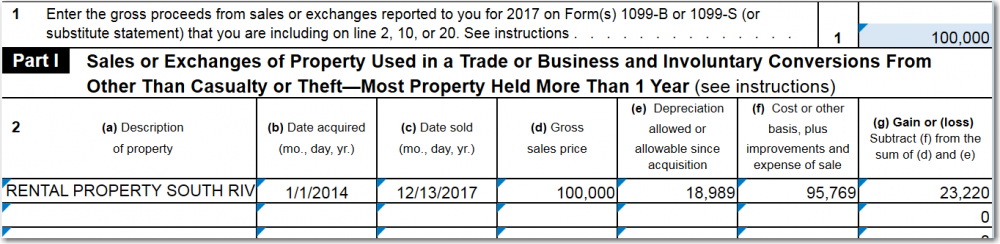

I prorate the sale proceeds between building and land based on the same percentages they bear to total cost basis. If any furniture, fixtures, appliances were on the depreciation schedule, you have to deal with those too.3 points

-

You should be proud of yourself for only one incident of excessive vulgarity/profanity. If it wasn't excessive it would just be routine and normal and not even get an honorable mention. Proud of you brother, keep up the good work!3 points

-

3 points

-

Without a doubt, that's why I keep Catherine on speed dial if I get stuck and frustrated.3 points

-

I would break out land for part 1 and put house on part 3.2 points

-

Hey, it was my first tax season with ATX. Swearing was the only way I could get through it. I had to enter all assets because none of them converted. And then the letters. Oh, the letters...2 points

-

2 points

-

2 points

-

Turned out that the problem was not with the EIC but the child tax credit. Any how I just moved everything to Schedule C-EZ and problem solved.2 points

-

2 points

-

when did the title change to the beneficiaries? They might have to amend their returns and claim the depreciation. If you don't then the basis still has to be lowered by the depreciation that should have been taken. Sounds like the estate accountant really messed up. Was the house left to the beneficiaries or to a Trust for the benefit of the beneficiaries? there are a lot of questions to be answered before you jump on this return.2 points

-

So do we post our tax kook of the week nomination here? I had a client this week that I still have a headache from! Think of everything he said as being in a Gomer Pyle voice, because that's what it was. Last year, he came to me for a second look at his return because "there is no way she prepared it right last year. She didn't know what she was doing. Look at that high amount on that form (his Social Security statement). That high amount should've gotten me thousands of dollars in refunds." I had to explain to him that receiving Social Security did not actually amount to a large refund. If no money was withheld, there would be no refund from that. I also had to explain that last year's preparer did, in fact, prepare his return correctly. He argued with me for quite awhile - I had to chat my husband to come in and rescue me. I dreaded my appointment with him this year from the moment I saw it appear on my calendar. This year was worse! He insisted on claiming his daughter because it was his right to claim her because she was his daughter. No SSN. No support paid to the mother, and she did not live with him. I told him that I would need a signed form from the mother allowing him to claim him or a court order that gave him permission to claim her. Aside from that, I could not put her on his return. He told me he didn't care what the IRS or the courts said, he should get to claim her because she's his daughter. (Remember Gomer Pyle voice) Then he freaked out because "every tax form is required to have a dollar amount on it (?) and that form there (insurance documentation) doesn't have a dollar amount on it. While I don't think the dollar amount on it should be as high as a thousand, it should have at least $500 on it." He had to get additional documentation to me to finish his return, and I finished it last night. I knew I should've just sent him on his way with his documentation on Sunday, but I thought maybe I could talk some sense into the guy. He came in to pick it up today and refused to pay the measly $60 I charged him "because you must've prepared it wrong. You don't know what you're doing. You're scamming me out of my money. You wouldn't let me claim my daughter. That paper I brought in from the mobile home park (lot rent) had a lot of money on it, and I should be getting at least $1000. And $60 is too high. A normal tax return is only $25." Guess my nine plus years of preparing returns does not qualify me to prepare a simple property tax credit in Michigan. I can't believe I could only get him around $300 when he got all that FREE Social Security money! I did invite him to pick up his documentation and take it to the place that would only charge him $25 and would know how to prepare his return. I just hope all the paper they give him has dollar amounts on it! Have a great night, everyone!2 points

-

Not unusual at all. Be sure to allocate a portion of the selling expenses to each component included in the sale.1 point

-

I am so flippin' excited to see you again, girlfriend! This will be so much fun! I'll bring the 'Ritas! And maybe a Cowboy!1 point

-

1 point

-

A discount to a good tenant who won't trash the place can be allowed. True below market rent to a related party is simple personal use. Line 21 income, no expenses.1 point

-

Then, personal use rental, below FMR to a relative. Haven't done one of those for a long time. I don't think you depreciate....1 point

-

1 point

-

Lynn, I'm looking at the form in ATX and most lines say reserved for future use. Any idea what line to add the costs for energy efficient windows? Thanks so much for the prompt response!1 point

-

I think you will to use Sch D but before that need to enter the basis of the property. Don't forget to include 1/3 of the land that was not depreciated.1 point

-

No I never went there. I just now put in the changes I think should be done and the refund dropped from 98 to 73. I can live with that! Serves MA right if they send the full 98, because their forms are way too complicated.1 point

-

1 point

-

1 point

-

It is a full year calculation. This is one of the pitfalls (critical oversights/flaws/stupid law crap) of the ACA. You have to estimate your future income, and the penalty for not knowing the future at the time you sign up can be financially devastating to the taxpayer. I am not being critical of the politics, just the actual law as it is written. It is unfair to the TP to make their estimate of income the determining factor in the amount of a tax credit that will need to be repaid if the estimate is incorrect. Getting off my soapbox now. Tom Modesto, CA1 point

-

I tend to think that the sooner you take the tests following April's deadline this year the better insofar as the questions should follow closer to what you have been accustomed to for all of these years. If you wait until late 2018 or 2019, you'll be dealing with the newer rules and regulations as a result of the new tax laws. I'd rather try to stick with what I know now than wait and take a chance on what I'll have to learn for the 2018 filing season especially since we are still waiting on confirmation of some Extender tax issues for our 2017 returns in progress. Food for thought: I've had clients in the past who have asked me if I was an EA. When I would tell them "no", the vast majority of them would say they were relieved because I wasn't an "IRS Agent". Just a free perk of living in the country! Take care, Cathy1 point

-

Mine is not wacky, just annoying to me. HOH with a full time job that pays around$ 88K and also earns $40K through direct sales. One of her friends sells the same stuff with probably $200K in sales and a couple of other self employed businesses. He says that he and his wife don't pay any taxes, because they write off everything. She wanted to know what I was missing. I explained that we are using every legit write-off possible and that I have been for years and that next year there will be a new business deduction that will help decrease income tax only. I told her that if were legal to write EVERYTHING off, that I'm pretty sure that no one would pay any taxes. I hope that he was just blowing smoke up her rear or that he gets caught some day. She is pretty sure that he prepares his own taxes. Go figure!1 point

-

Kook of the week nominee..... Get a call from a Texas number. Guy leaves a message. Referral from another client. I call him back and he starts telling me how he has this little problem with the IRS. Apparently, he has not paid his taxes from 2013 and 2014. Says he has been disabled and he can't seem to get through to anyone at the IRS because they keep getting disconnected while he is on the line. The penalties and interest are really piling up. But the last person at IRS he talked to said if he would fill out a "Form 22 something" he could get all the penalties and interest wiped out. So I start asking questions. Do you have your tax returns from 2013 forward? "Well, I moved and I don't know where they are". Did you prepare your returns or did you have someone do them? "Well, my daughter did the returns". Can you get the returns from her? "Well, we aren't speaking right now". His next statement "I only have disability this year, but I need my taxes filed and that 22 something form filled out. Can you do that?" My response..."Yes, I can do your tax return. The representation is at $XXX per hour, and will include taking a power of attorney, getting copies of your transcripts for the years in question, communicating with the IRS and you, and then coming to some resolution that allows you to pay back what you owe, or put you in the Currently Not Collectible status until such time as you can start making payments. I estimate a minimum of 10 hours, and I require a 50% retainer before I start working on your case." His response..."Well, let me look for my returns and I will get back to you." Tom Modesto, CA1 point

-

It's on my calendar, too, and my finacee is very excited about going to Tennessee. She loves Dollywood and Gatlinburg. And June is better anyway, should be warmer.1 point

-

1 point

-

Well, alrighty then. June 23rd. My house. Visiting hours (not like funeral home) begin at 2:00. Cookout for supper. Message me for directions, my email address, all that stuff. Absolutely no hurry on the RSVPing. I'm excited!1 point

-

What the what? I'm gone five minutes and y'all are doing menus. I was actually kidding in my first post, but I can see a cookout happening at my house after May. May is a graduation, a wedding, and a new grandbaby. We can "play the corn holes", as my very unique neighbor says. Bull riding. You know, the usual stuff that happens in the back 40. Let's get thru this little tax season and talk about it later.1 point