Leaderboard

Popular Content

Showing content with the highest reputation on 04/07/2018 in all areas

-

https://www.forbes.com/sites/anthonynitti/2015/04/05/ten-days-until-tax-day-how-to-tell-inconsiderate-clients-youll-be-extending-their-returns/#3e7153702aea Dear _________, I heard you stopped by the office today at noon. Sorry I didn’t get to see you; lately I’ve been spending my lunch hour in the parking lot, sitting in my car and quietly weeping. Judging by the disorganized pile of unopened envelopes and food-stained receipts on my desk that alerted me to your visit, it looks like you dropped off your tax information. How sweet of you! But here’s the thing. It’s April ____th APRIL _____th!! The tax deadline is in less than ten days. And you know this. You’ve always known this. Because unlike Thanksgiving, Easter, and Arbor Day, tax day is always on the same exact day of the year: April 15th. Well, except when it falls on a weekend, in which case it might be the 16th or 17th, but you get the idea. Yet, despite presumably possessing the ability to comprehend the standard Gregorian calendar, here you are, dropping off all of your information mere days before the deadline -- just as you did last year, and the year before that -- and leaving me a Post-It note thanking me for “squeezing you in.” Only I won’t be squeezing you in. It’s nothing personal, it’s ju….OK, maybe it is a little personal. I have to know -- why are you dropping your stuff off now? I could understand if you were waiting for a K-1 or some other information from a third party that just arrived in the mail, but that’s not the case. You’re a W-2-mortgage interest-charitable contribution kinda’ guy, and you’ve always been that way. Yet, simple as that sounds, you can never manage to get your information to me before the calendar turns to April. And that’s freakin’ rude. Squeeze you in? When, exactly, would you like me to squeeze you in? Last week I worked ___ hours, and I still have ______ returns to get out the door before April 15th. And every single one of those _____ returns is in the queue ahead of you, because those people had the good sense -- nay, the decency -- to bring me their information BEFORE THIS WEEK. So by asking me to squeeze you in, you’re basically saying, “Hey, I know the next ten days of your life are going to be pure hell, but do me a favor…when you mercifully reach the end of the months-long pile of returns you’ve had to complete, just knock mine out real quick.” It's as if I was asked to run a marathon, only to have you show up with 100 meters left and move the finish line back another mile. And for that, I hope you c0ntract a raging case of pinworms. Come to think of it, actually, it would be a refreshing change if you conceded that you were at the end of my list. Because if memory serves me, every year you drop off your information on the 5th or 6th, and then start calling on the 7th to find out “how things are coming.” Well, this year, let me tell you in advance “how things are coming.” Since tax season started, I’ve put on _______ pounds. I haven’t seen my kids during daylight hours since _______. My neighbor just told me that the Fed Ex guy's/Avon lady’s car is often parked outside my house for hours at a time, but whenever I get home, I’ve got no packages/cosmetics but one helluva happy wife/husband. THAT’S how things are coming. So no, I won’t be “squeezing you in” before April 15th, because that’s a physical impossibility. The only time during the day when I’m not sleeping or preparing a tax return is on my drive to and from work, and careening off the road while trying to prepare your return at 70 mph is not how I intend to die. Although to be honest, right about now the idea of eternal rest sounds pretty damn appetizing. In short, I’ll be filing an extension for your return. See you in May/hell. Sincerely,9 points

-

Finished a return for a client with Advance PTC this morning, Filled in all the boxes on the 8962 showing they had insurance every month. The return rejected because I did not check the box on page 2 for full year coverage. Couldn't ATX/IRS see that every month was filled out on the form? This is a minor annoyance, but just something I don't think we should have to deal with. Just like the box on the CA 540 that I have to check that asks if there are any schedules other than A or B attached to the federal return. Duh, the software should know what federal schedules are in the return and check the box one way or another for me..... I feel better now that I got that off my chest. Tom Modesto, CA6 points

-

Tell 'em how you feel Abby - don't hold back!6 points

-

Loved the letter. Most of my clients know post 3/15 = extension. Next year my letter may say ANYONE may go on extension at MY determination, at ANY time. For those who claim to be desperate, I offer them a $150 dollar rush fee... To cover me having to bump them up in the queue and then make apologies to those bumped *down* the queue. Funny how many who NNEEEEDD that return RIGHT away - don't, when it's going to cost them extra.4 points

-

You could shorten the letter somewhat: Dear client: Sorry to break it to you like this, but: 1) I'm not jeopardizing my health for your $400 refund or anyone else's. (Martyrdom is way overrated) 2) Here's your extension. Sincerely, ============================================= For the clients who call to ask about progress on their return, how about this? "Sorry things keep stretching out. You see, every time you cal to ask 'how's it coming?', I pull out your folder to check on its status, can't remember where it was, and so then I return it to the bottom of the stack."3 points

-

When I see those K1s I tell my clients that each K1 is $50 per year and $100 when any units are sold. Partial redemptions are the worst because they're easy to miss if you're in a hurry.3 points

-

The answer is yes , your client has a Texas payroll, workers comp and liability insurance responsibilities. Lion, this is a different issue.2 points

-

Once again, this thread saved my life. Love you guys. Kinda hate this client. He had zero business signing up for marketplace insurance.2 points

-

709 I meant! Thank you for the link Margaret. Just starting a return from an Ohio resident who has moved to NY. Perhaps I will be bugging you again soon!2 points

-

The PTPs with K-1s inside brokerage accounts are a real pain. I started stating an additional charge on my invoice for them. One client with 6. I charged an additional $100. And when they sell the units. Ugh!2 points

-

I use Drake and set up a macro to check all the boxes. Then I just adjust for the situations that are different. Whew!2 points

-

HA! I amazed myself with this desk, but I think the low volume background music form the 60s might have something to do with my energy level. I do know I like standing at a bar with music playing (or a ballgame) in background with good conversation on each side of me, I never get tired, so maybe it is the same principal. Your painter shouldn't worry, it's all in his head, he gets enough exercise and should have peace of mind knowing his work is top notch using a high quality Purdy brush. You're a nice guy too, like everyone else here, it's the nice guy and gal forum, maybe that's what keeps us up.2 points

-

1 point

-

Nah. I like the bad boy that Rita's mama warned her about.1 point

-

there is also a link on the form 8962 that takes you where you need to go. you just fill in county.1 point

-

I could eliminate those points and take away your bragging rights if you prefer.1 point

-

I have used this thread many times and am so grateful that you guys can understand the instructions. I just can't remember from year to year how to do this stuff. Why is it that so many of our self-employed clients are getting SS and making the calculations even more difficult. I really love when they come in and tell me that I have to make sure that the income is this amount. I tell them, no you had better have made sure that you reported your income to the marketplace. An IRA contribution saved my last one's rear. I just wish that it would all go away.1 point

-

I hope Tom and Rita got a point for vulgarity in this thread. I'd hate to think I'm the only one with marks on my permanent record.1 point

-

I would consider the option that this work from home person is an independent contractor.1 point

-

The taxation (who, if anyone, gets the state tax bite) is the EASY part... How it gets withheld/paid, some get it correct, some do not, but the states will eventually get theirs. The employer will absolutely initiate nexus in the employee's state, since the employee's home also becomes their place of business. This is the part many ignore or are unaware of. Must ensure things such as all required labor posters displayed, liability insurance naming the new location (all of the usual workplace liability issues), UI for the new state, WC covering the new location, etc. Employer may want to create a written handbook covering the workplace rules (awkward, but wise). If it were me, I would only consider it if there is a dedicated space, probably a room (not a desk in a shared room). If there is a product, or samples, and they are not appropriate for children to handle for safety reasons, a policy for the product or access should be considered... The employee also has to consider what they give up, such as privacy (employer can certainly visit the work space, maybe at any time), subject to things like payroll audits at their location, personal insurance for business use of home, and so on.1 point

-

You'll have to visit the web sites for both states to read up on their definition of state-sourced income. With Texas in the mix, I'm betting Alabama says the employee is under the control of an Alabama employer!1 point

-

No depreciation, however it did require major improvements which I am going to add to the cost basis. Thanks1 point

-

As long as he never depreciated the property, I think I would just go with Sch D1 point

-

Having several for the 8283 data is great. I start most returns using one to enter the usual answers for foreign accounts, another for "yes" to healthcare coverage, and then a couple of single-stroke macros for special situations. One that is useful right now will prefill Fed & State extensions, then pause and wait for me to input the amount the client is paying. After you write a few, it becomes almost second nature, doesn't it?1 point

-

If items, including real estate, are sold to pay the debts of the decedent, the sales expenses are considered administrative expenses. If they are just sold because the heirs don't want them and the estate is liquidating them to get cash to distribute, they are deductible subject to the 2% AGI rule. If there is only one beneficiary, the sale was to benefit that one person and the costs are not deductible at all. You can, however, add them to basis. Now that the 2% category is gone for individuals in 2018 and beyond, I wonder if it will be gone for estates too.1 point

-

If the mother had her own insurance, she should have her own 1095B, so her insurance payments/advances are not allocated. You can allocate the family's advances any way you want, including giving 100% to the parents. Since the daughter will not have any taxable income and is likely below the poverty level, I'd do just that.1 point

-

Unless your client is on track to gift and have enough left over at death to total $5.9m, you don't have to worry about the election. Do be sure to enter the gifts to the grandchildren on the GST section of the 709.1 point

-

Those macros in Drake are an incredible time saver, aren't they? Now that I'm hooked, don't know if I would ever be happy with any software that didn't offer them.1 point

-

Use Form 709, Gift Tax Return. The exclusion is $5mil, tax credit $2mil+ The potential tax is applied against the lifetime credit. Since this is a generation skip, look at the election https://www.law.cornell.edu/uscode/text/26/2632 I think with a little reading and the correct form, you will figure it out. With such generosity, take into account any earlier filed 709's.1 point

-

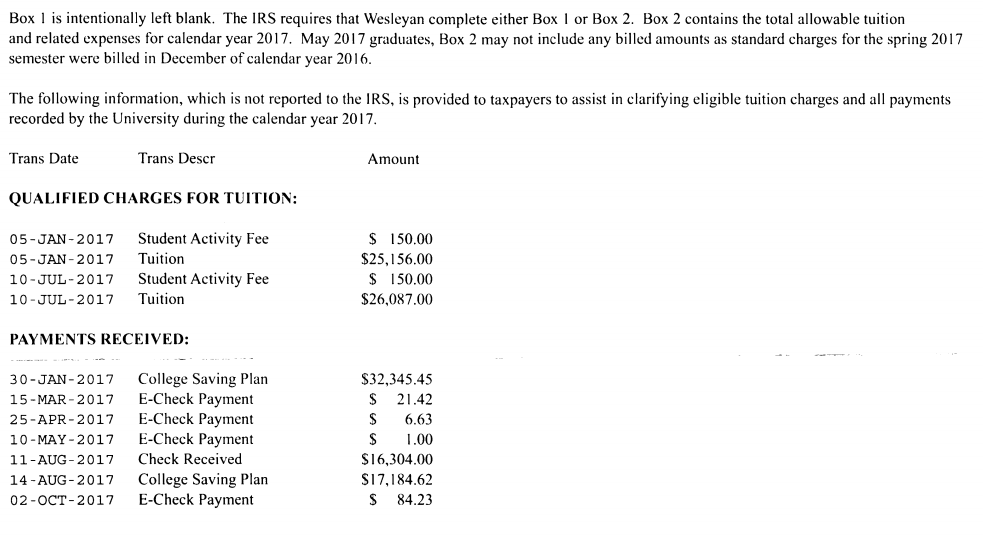

You know how you explain to clients the first year Junior went off to school that you need the Bursar's statement from college, and they remember to bring that every year forever and ever? Yeah, me neither.1 point

-

1 point

-

1 point

-

1 point

-

1 point

-

1 point

-

Ugh! Not sure how I would handle that. Then again, I actually know all of my clients and most of them from church. When they drink, I likely would be with them! But not in my home office - save the occasional red wine with my neighbor/former employee/friend/client.1 point

-

1 point

-

I like the meme except he has a paddle. Most of the time I don't feel like I do.1 point

-

Now I am pissed off, I let the TP use the bathroom and he pissed all over the toilet seat, I was just informed0 points