Leaderboard

Popular Content

Showing content with the highest reputation on 04/08/2018 in all areas

-

Since no one responded to the thread for the week of 3/24-3/30, I hope you all like my decision to make @Eric an Honorary Aficionado for putting up with us (probably mostly me bugging him at times), and I'm also awarding him a crown of golden laurels for keeping this forum up and running for the last 11 years. Thank you, Eric! If anyone that has benefitted from this forum has not yet donated to Eric, please consider doing that to help keep the site up and running. If you consider the time another member here may have saved you by providing answers not easily found in other reference materials or sites, or if this site has helped make your season a little easier or more profitable, I think you'll agree that a donation isn't too much to ask.7 points

-

Well, here ya go. ILLMAS took the initiative to start the post for this week after having to deal with a drunk client and the resulting bathroom disaster too. He gets the star award.7 points

-

I was going to change my voicemail message to say, "We are working as hard as we can to finish as many returns as we can by the deadline, and we will call you when your return is ready. If you leave a message asking how your return is coming, we will do your return last and you will definitely be on extension."6 points

-

I just realized that, if I recall the date correctly, it was 11 years ago yesterday the date that CCH shut the official forum down on us and led to the formation of this unofficial community. I don't know exactly when all of the details were ironed out for this site, but if we use Eric's join date of 4/9/07 as the anniversary date then the star award is all the more fitting. Thanks again, Eric!4 points

-

Just go with adding them together. Clients get two because something changed, mainly that they were filing against the spouse's account, and now they are filing on their own account, or vice versa. Check the lower right corner box #8, Claim Number. There might be different numbers there. Rich4 points

-

Whenever these things happen, the first questions I ask are: who got the checks? Where and when did they deposit them? And how in the world did they negotiate a check made out to a corporation? Did your shareholder client receive any cash from this late windfall? If not, she should be making inquiries or filing complaints.3 points

-

The error I had today? No VA withholding on the VA Part-Year return. 1. It was on the W-2. 2. It was posted to VA. 3. It did not get picked up on the VA return. 4. Why Not? We had not added the special VA form for WH. Why couldn't the system added that darn form... Rant Off Rich3 points

-

You could shorten the letter somewhat: Dear client: Sorry to break it to you like this, but: 1) I'm not jeopardizing my health for your $400 refund or anyone else's. (Martyrdom is way overrated) 2) Here's your extension. Sincerely, ============================================= For the clients who call to ask about progress on their return, how about this? "Sorry things keep stretching out. You see, every time you cal to ask 'how's it coming?', I pull out your folder to check on its status, can't remember where it was, and so then I return it to the bottom of the stack."3 points

-

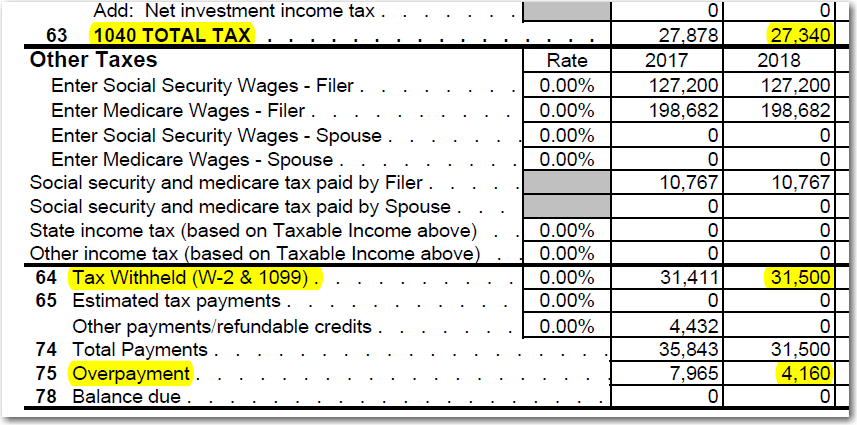

Another thing, for those where I'm not really doing full planning I've been eliminating the federal withholding entries altogether and taking the discussion only through the total tax line because I don't want to mislead anyone thinking that the bottom line bal due/refund is truly representative. I tell those clients that I'll be happy to help them project out or adjust the withholding starting next month.2 points

-

2 points

-

2 points

-

If I said what was on my mind about some of the returns and a couple of clients, I'd rack up so many bad points that I'd probably have to ban myself!2 points

-

Just completed returns for a young documentary filmmaker with two states, lots of SE income, a couple of W-2s, and lots of APTC. His income was thousands higher than the prior year, most of it NY SE. So, of course, he had to repay ALL his APTC. Luckily, ProSystem does the iterations with SE health insurance deduction and the repayment. But, proofing was a bear. I can't charge this kid enough. (He's already applying for a payment plan.) If I say any more, I'll get a mark, too!2 points

-

https://www.forbes.com/sites/anthonynitti/2015/04/05/ten-days-until-tax-day-how-to-tell-inconsiderate-clients-youll-be-extending-their-returns/#3e7153702aea Dear _________, I heard you stopped by the office today at noon. Sorry I didn’t get to see you; lately I’ve been spending my lunch hour in the parking lot, sitting in my car and quietly weeping. Judging by the disorganized pile of unopened envelopes and food-stained receipts on my desk that alerted me to your visit, it looks like you dropped off your tax information. How sweet of you! But here’s the thing. It’s April ____th APRIL _____th!! The tax deadline is in less than ten days. And you know this. You’ve always known this. Because unlike Thanksgiving, Easter, and Arbor Day, tax day is always on the same exact day of the year: April 15th. Well, except when it falls on a weekend, in which case it might be the 16th or 17th, but you get the idea. Yet, despite presumably possessing the ability to comprehend the standard Gregorian calendar, here you are, dropping off all of your information mere days before the deadline -- just as you did last year, and the year before that -- and leaving me a Post-It note thanking me for “squeezing you in.” Only I won’t be squeezing you in. It’s nothing personal, it’s ju….OK, maybe it is a little personal. I have to know -- why are you dropping your stuff off now? I could understand if you were waiting for a K-1 or some other information from a third party that just arrived in the mail, but that’s not the case. You’re a W-2-mortgage interest-charitable contribution kinda’ guy, and you’ve always been that way. Yet, simple as that sounds, you can never manage to get your information to me before the calendar turns to April. And that’s freakin’ rude. Squeeze you in? When, exactly, would you like me to squeeze you in? Last week I worked ___ hours, and I still have ______ returns to get out the door before April 15th. And every single one of those _____ returns is in the queue ahead of you, because those people had the good sense -- nay, the decency -- to bring me their information BEFORE THIS WEEK. So by asking me to squeeze you in, you’re basically saying, “Hey, I know the next ten days of your life are going to be pure hell, but do me a favor…when you mercifully reach the end of the months-long pile of returns you’ve had to complete, just knock mine out real quick.” It's as if I was asked to run a marathon, only to have you show up with 100 meters left and move the finish line back another mile. And for that, I hope you c0ntract a raging case of pinworms. Come to think of it, actually, it would be a refreshing change if you conceded that you were at the end of my list. Because if memory serves me, every year you drop off your information on the 5th or 6th, and then start calling on the 7th to find out “how things are coming.” Well, this year, let me tell you in advance “how things are coming.” Since tax season started, I’ve put on _______ pounds. I haven’t seen my kids during daylight hours since _______. My neighbor just told me that the Fed Ex guy's/Avon lady’s car is often parked outside my house for hours at a time, but whenever I get home, I’ve got no packages/cosmetics but one helluva happy wife/husband. THAT’S how things are coming. So no, I won’t be “squeezing you in” before April 15th, because that’s a physical impossibility. The only time during the day when I’m not sleeping or preparing a tax return is on my drive to and from work, and careening off the road while trying to prepare your return at 70 mph is not how I intend to die. Although to be honest, right about now the idea of eternal rest sounds pretty damn appetizing. In short, I’ll be filing an extension for your return. See you in May/hell. Sincerely,2 points

-

Was the S Corp prepared under the accrual method of accounting where it could possibly have been included in the final return?2 points

-

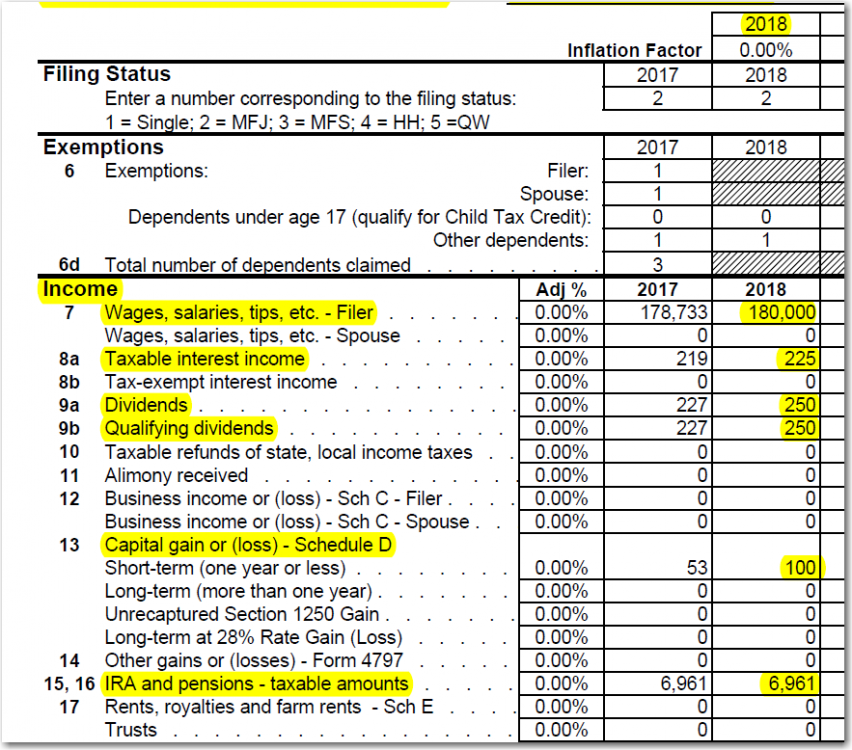

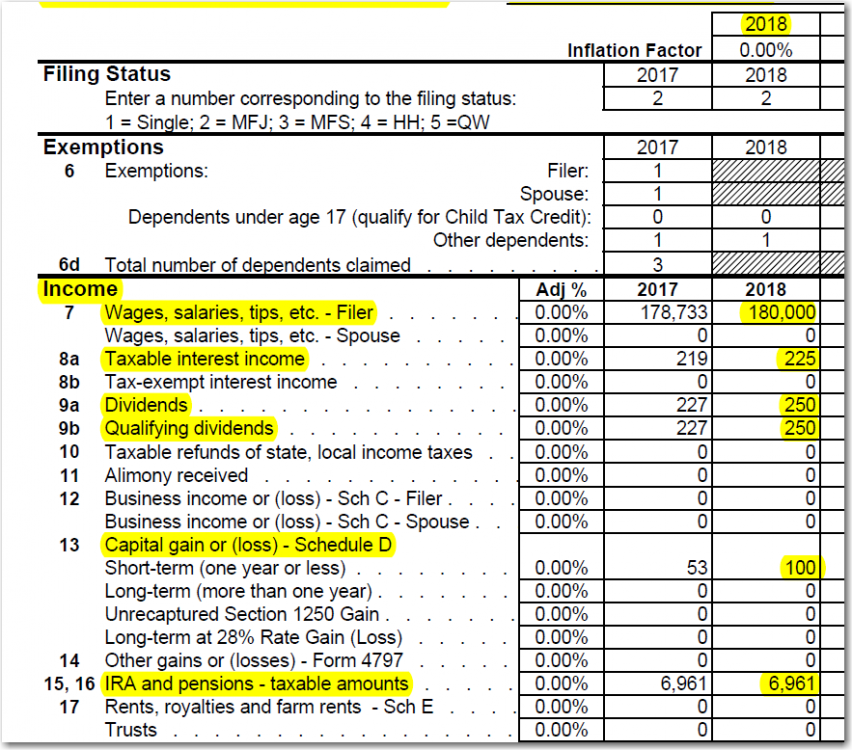

I use the ATX planner for virtually all of my clients. I think it's important to plan for the following year and try to avoid any surprises. The packet I prepare includes a copy of the planner and there is a sheet that provides an overview of how it compares to the current year. My clients know to contact me if there are any significant changes throughout the year. Whether they contact me is another story. As I use the planner, I've noted that the vast majority of clients are benefiting from the new tax plan. I would say at least 80% are being impacted favorably. That surprises me a little, I guess I shouldn't listen to all the doom and gloom media stories about how the plan will turn out to be more negative than positive. Obviously, time will tell how much of an impact it will have on the deficit, but for many of my clients, it seems to be working in their favor.1 point

-

My tax star would be my spouse.... While I am in the office on a Sunday until 11pm, she brought in dinner both nights for us. I carry the laundry downstairs, she get it thru the cycles and then I carry back up stairs. And she supports me in so many other ways as well. I am one lucky guy. Rich1 point

-

1 point

-

I'd say only half or so of my clients are doing significantly better with the new law. 25% are about the same and 25% are paying more. The ones with large 2% deductions and high SALT deductions with no kids are getting hurt the worst. I've also been adjusting the withholdings down substantially because we know that will happen with the new tables.1 point

-

Wow, I didn't know that. A good bit of CCH/ATX history to know. I'm a long time user (since Saber days) but never used or even knew about the official forum. Thanks Judy, and of course, Eric too!1 point

-

I need to check on TaxWise and see if there is a planner like that. We have state tax here, and I think the worst event will be that most will choose to take the standard deduction on the federal, forcing a standard on the state. That will stink.1 point

-

Ever if you were to choose to include in personal tax return you still need to file corp tax return & back it out (may be you can take this approach if client deposits check in their personal account)1 point

-

They need to find out If they followed accrual basis of accounting & if in fact this amount was included in 2016's tax return if not amend 2016's tax return & include this income OR if cash basis of accounting file 2017's tax return as final & include income.1 point

-

She did receive the 1120S... for 2016... and it was the final 1120S. The issue is that I now have 2 more 1099s issued to the (now) closed S Corp. She will contact the preparer to see if this might have been the accrual method and if it already reported that particular income.1 point

-

She will contact the firm that prepared the final 1120S and see if this was already included as income. If it was, I'm done. If it wasn't, I'll be back here asking how to negotiate this!1 point

-

Finished a return for a client with Advance PTC this morning, Filled in all the boxes on the 8962 showing they had insurance every month. The return rejected because I did not check the box on page 2 for full year coverage. Couldn't ATX/IRS see that every month was filled out on the form? This is a minor annoyance, but just something I don't think we should have to deal with. Just like the box on the CA 540 that I have to check that asks if there are any schedules other than A or B attached to the federal return. Duh, the software should know what federal schedules are in the return and check the box one way or another for me..... I feel better now that I got that off my chest. Tom Modesto, CA1 point

-

If I could, I would nominate my husband for a tax star. He knows nothing about doing taxes. If it doesn't come in an envelope labeled "Important Tax Information" he doesn't even know that it goes with the stuff for our taxes. BUT - he has dinner ready and serves it to me whatever time I come home. He has been trying to do my laundry for me for the last month and a half. He doesn't nag me to come home early, or expect me to have energy left over to do what he wants to do when I do get home. He cleans the house and mows the yard now that he is retired and I am not. If I decided tomorrow that I have had enough of this and wanted to retire, he would be all in favor of that. But if I decide to keep working, he is fine with that too. This has been the hardest tax season for me personally that I have ever had, and he has made it possible for me to get up and face it. I am so lucky!1 point

-

I only break a K1 into two or three when they have amounts in more than one of boxes 1, 2 and 3. And this is because ATX warns me those different types of income have to be calculated separately. The amounts on other lines are always too small to make a difference. As for box 20, the only ones that matter are A and B. Code V is only important when the K1 is owned in an IRA. If it's over a certain amount, it can cause tax or penalty or something.1 point

-

I haven't had my PTP clients arrive yet, but if I remember correctly (not better than a 50/50 chance this late in the season) I was able to log-in as me/my name/my email, probably to retrieve K-1s for clients using their names/EINs. I did receive emails that a couple of the K-1s are ready now. One new client last year invested in one or more PTPs with his broker's advice. He was smart enough to see that they do not fit his plans and sold them all. Dealt with that on his 2016 returns. 2017 had no new ones. I gave him a nice discount this year! Don't show your clients the TaxPackageSupport.com site, because it has had the ability to download into TurboTax.1 point

-

If you get a booklet of instructions or the large fold-out sheet/poster of instructions from one of your clients' PTP, keep it. They spell out all the details. You can go in your own software to a partnership or a sample partnership, and force it to print the complete directions. And, I'm sure you can get a complete set online someplace. I prefer the booklet plus "poster" as my reference guides, compact and not my printer/toner. You could try a site such as TaxPackageSupport.com1 point

-

I’ve always had better luck amending the prior return instead of using 1045.1 point

-

Maybe the client needs to take the 1099 forms to the accounting firm that prepared the 1120S?1 point

-

There is a check box at the top of page two of the 1120S that indicates the accounting method used.1 point

-

That's why it's continually referred to as "Tax Simplification"1 point

-

I ignore the entries that relate to the Domestic production. Yes, one K1 turns into 3. Sheesh.1 point

-

Yes, selling is a real pain. I was going to start thinking $25 per K1.1 point

-

Abnormal, this is the best of all ideas, except the company is a federal contractor and the Texas guy has to be an employee. Thanks. Don't expect any realistic solution from the State of Alabama or Texas. They both fashion arguments to have this guy.1 point

-

Loved the letter. Most of my clients know post 3/15 = extension. Next year my letter may say ANYONE may go on extension at MY determination, at ANY time. For those who claim to be desperate, I offer them a $150 dollar rush fee... To cover me having to bump them up in the queue and then make apologies to those bumped *down* the queue. Funny how many who NNEEEEDD that return RIGHT away - don't, when it's going to cost them extra.1 point

-

Nah. I like the bad boy that Rita's mama warned her about.1 point

-

Tell 'em how you feel Abby - don't hold back!1 point

-

No depreciation, however it did require major improvements which I am going to add to the cost basis. Thanks1 point

-

As long as he never depreciated the property, I think I would just go with Sch D1 point

-

1 point

-

1 point

-

1 point