Leaderboard

Popular Content

Showing content with the highest reputation on 11/07/2018 in all areas

-

Thank you every one for your help. I have so so many cobwebs from the financial class. I am terrible! And I know I know how to do this. I have been doing mundane tax entry for so long, I haven't had to look at any financial math in years. What discount rate to use keeps coming up.4 points

-

3 points

-

3 points

-

This is why we have computers and software. We couldn't really do tax returns without a computer anymore.3 points

-

3 points

-

WHEN WE GET TO THIS STAGE WE WILL KNOW IT IS TIME TO PACK IT IN. ABBY IS JUST AHEAD OF THE CURVE.3 points

-

Client has not been a good boy with the IRS or the state of CA. Worked out a payment plan with CA. Working on a payment plan with IRS. Told him to keep his PR Tax payments up. Told him multiple times. He did not listen. CA defaulted his agreement for untimely PR tax payments and swooped in and cleaned out all his bank accounts. No money to pay the mortgage. There is only so much we can do, but damn, this makes me feel bad. Tom Modesto, CA2 points

-

21 years now, and I have yet to have a single client make the life, financial, changes needed to solve their problems. Nor have I had even one, follow my suggestions in this area, or estimated payments. I stopped having compassion. File the returns, collect their payment for my services (which increases 10% each year). Nod and smile as they lament about their financial woes. File their information. Wait for the call that they are filing bankruptcy. Charge extremely well for my assistance with that. Sleep well at night. You can't fix stupid, or the unwilling.2 points

-

I thought we covered this. I am closer to retirement age than you are! I will not be working in 10 years. But for now, I'm still having too much fun to retire.2 points

-

When I identify clients with financial problems after seeing their documents and the interview, I will suggest a financial planning session after tax season, before they get into trouble. Some take me up on it and if they use the advice they can get their cash flow and budgeting (a new term to them) under control. Also they are happy when I find any deficiencies in their insurance policies, show them how to reconcile a checkbook, set up auto pays, and give them a primer on estate planning. I'll monitor them and find that they do well when they take this seriously.2 points

-

In my experience, very few taxpayers with similar problems have the fortitude to make the lifestyle spending changes necessary to pay off debts of this magnitude, which is the very reason they ended up in big trouble in the first place. I have reached the point in my life where I really have no interest in working with clients with these problems.2 points

-

2 points

-

If you have Excel, use F1 for help and search for "XNPV", then click on the link there for the instructions for that function. Scroll to the bottom of that article for an example of how to set this up. You'll need to enter the discount rate too.2 points

-

I would say that both documents should be reviewed for their wording and intent. First look at the separation agreement to determine if that alimony was open-ended or if it says that it will be redetermined when the final divorce decree is signed. Then also look at the final divorce decree to see if it references continuation of the earlier agreement without change, if indicates that that earlier agreement will remain in effect, or if there is some sort of modification that will use the new provisions of the TCJA. Quoting from a topic ~ 2 mos ago:2 points

-

Congrats on being able to sell your practice !!! May you have the retirement of your dreams!2 points

-

2 points

-

2 points

-

I've signed a sales agreement for my practice. I have high respect for the guy who's buying my business and I'm thrilled that what I started 27 years ago will continue to grow and prosper, and that my employees will have a great new boss and continued employment. (is everyone singing that Who song in their heads right now?) This coming tax season should be my last full-time one where I work 70 hours and 7 days a week. I still need/want to work part-time for several years to come, perhaps at the wine bar in the town where I live. They've been struggling to find reliable employees who won't steal from them or screw up their inventory. Excited for the next chapter of my life and for being less stressed. I can't believe it all worked out exactly as I always hoped. I'm not much of a planner but I've always been lucky as can be. Don't worry. I'm not leaving this forum. You all (y'all) are like family to me!1 point

-

@BulldogTom I do feel for you. One of the hardest things I had to learn - and I have to keep RE-learning it every couple of years, is that I can not allow myself to care more about my clients' finances and tax situations than they care themselves. We know how to fix it - if only they will listen! Their lives could be so much better! But many if not most if not all will not listen. So instead, concentrate on "Let not your hearts be troubled." Note that at some level we allow ourselves to get all worked up; stop it. (Lecturing myself at least as much, maybe more, than you.) You did your best; the client screwed up and it's not your fault. Do not let your heart be troubled. And charge him a big fat fee - up front - if you take on trying to get even some of the mess fixed. Plus hugs to you. Not Rita hugs! Sympathy hugs.1 point

-

1 point

-

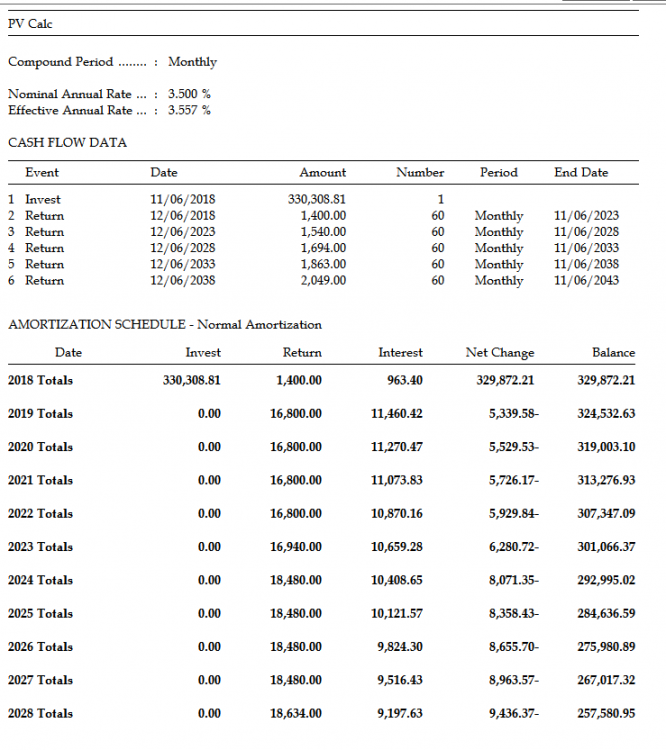

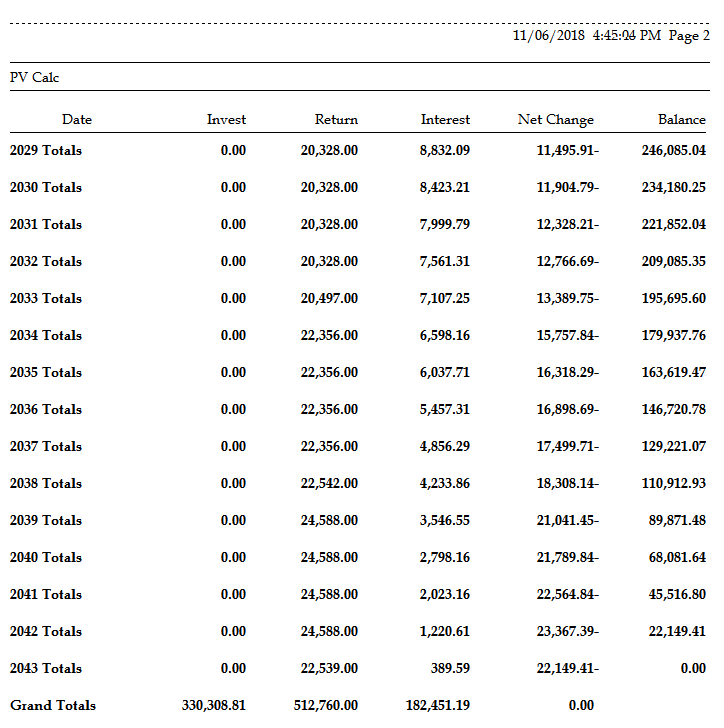

I was just an "expert witness" in a divorce case arguing what the discount rate should be on a long term portfolio. With Excel the math isn't overly difficult but it all comes down to what you want to use as the discount rate. The attorney asked me to do that and then both sides made the leap I was making a bunch of other financial projections off that figure. That was a completely different task that nobody asked me (or paid me) to do. I say the math isn't difficult - I barely passed Financial Planning in college which was basically just a set of these formulas to determine net present value, future value, discount rate and so forth. Excel makes everything easier. I'd enter all 300 payments and do a NPV for each of them and add them up.1 point

-

If it were my client, I would charge this person a nice fee to get the levy modified, if it is not too late. The bank has to hold the money for 10 days. (if it is the IRS, 21 days). He needs money for operating expenses and maybe money to pay rent/mortgage. Of course he would have to come with the money to pay my fee. Credit cards are fine. EDD and the FTB will usually modify the levy to take just the missing installment payments plus one more.1 point

-

I hate when this happens, I sometimes tell my clients, help me help you.1 point

-

1 point

-

In reviewing the replies and looking over the highlighted items as well I come away with the thought that IF the parties have drawn up the divorce settlement as the client tells me they have ("We have already agreed to everything.") and signed it he will likely be able to continue deducting the alimony EVEN THOUGH the decree itself falls on January 4th of 2019 as is noted above " Experts believe an instrument signed before December 31, 2018, will qualify for pre-TCJA tax treatment, even if the divorce is not yet final". In the end I suspect his attorney has been outfoxed by her attorney and that the final settlement document has not been signed nor will be until after January 4th.1 point

-

ugh - it's been way too many years since I have done real math!1 point

-

1 point

-

1 point

-

1 point

-

" NBA player who has to file returns in every state that he plays in. " And likely lives in, even if domicile is not a played in state. Add some city/local taxes, possibly requiring forms as well. (I actually gave some thought to applying for a team's payroll specialist many years ago, but as cool as it sounded, I did not need the headache, and that was limited to the payroll process only!)1 point

-

Thanks! This has made me think about who will be on this forum in 10 years. Young'uns like @RitaB and @Possi will be, but a lot of you are older than I am.1 point

-

I sat in the front row in colllege physics, professor similar attributes, and I regularly fell asleep.1 point

-

Ah, but NOW you can say, "I've made a fool of myself in a better place than this, and lived to tell the tale!" My mortification tale is from college. I had stayed up late working on a problem set. Had an 8AM, small, class - with a teacher whose voice was a good match for Charlton Heston; a deep monotone. Sat in the front row (the only one) figuring shame, if nothing else, would keep me awake. Fought and fought and fought to stay awake, and just as I went under, I heard the monotone state, "I see we've lost the front row..." and I had just enough time to think "oh, poopy!" (not that word) before I was out for good. Great story now; utter humiliation at the time.1 point

-

1 point