Leaderboard

Popular Content

Showing content with the highest reputation on 03/28/2019 in all areas

-

Donate button on the top right tab. I'm so guilty of not being consistent about this. I have no idea what made me think of it at noon on 27 March, but I'm so glad I did. Posting this in case this has fallen through the cracks in anyone else's 'taxed' brain like it had mine this year. Eric, thanks so much for providing this space for us. I truly can't imagine the season without this group of colleagues. Also, many thanks to Judy, moderator extraordinaire. If I missed any thank yous, I apologize.5 points

-

5 points

-

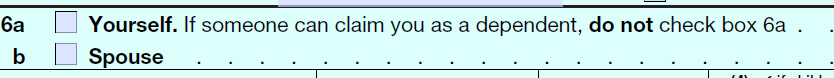

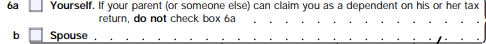

Just venting but who the heck thought up this question AND who approved it! "If someone can claim you as a dependent, do not check the box." Woulldnt it have been much clearer to just have a box to check if you CAN be claimed as a dependent on someone else's return?4 points

-

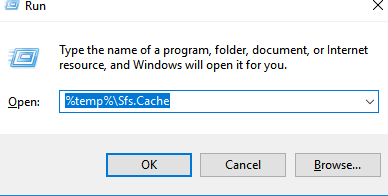

3. Use efficient, well-supported software that doesn't require enough memory to launch a space shuttle4 points

-

The handling of these 1098-T with colleges is getting quite frustrating and at this time of the year, I don't have time to dig into each and every scenario. New client's daughter is attending college and present me with a print out of the expenses from the college. Good so far. The statement wasn't totaled in either column (Charges & Credits) and for the life of me I don't understand why the college wouldn't do this. Now on to the rant. The 1098-T has an amount received that according to the client is only half of the year. ARRGH!! Apparently they are correct, the charges column adds up quite a bit more than the 1098-T. The charges column greatly exceeds the scholarship in box 5. But, on the 1098-T, the amounts received are less than the scholarship funds so it looks as though there is an excess when there is not. Yes, I did subtract the R & B charges and there is still more paid then box 1 of the 1098-T shows. To add another twist, the client's payments for the spring semester paid in 2018 don't show on the statement from the school. Thankfully the client has receipts. Here is the rant, why in the hell can't these universities that are teaching higher education get their billing right??? I know I am being a bit paranoid here. Within the last two years I have had three clients questioned by the IRS regarding the education credits, especially the AOC. How do you defend this crap when the time comes. Does anyone trust a 1098-T? Geez!3 points

-

3 points

-

Thank you BOTH - Eric for making this forum possible, and Judy for being such a terrific moderator!3 points

-

Yes, it is well worth the donation that I make every year in December ! Even when it's not a topic that I am currently dealing with, the questions and varied points of view wake me up and give me a kick in the pants !3 points

-

The extenders have been a thorn in our sides for too long. Let them die or make them a permanent part of the next tax legislation.2 points

-

Yes, that's funny, but he's right. I've been fairly fortunate this year, but every once in awhile I get that pain in the hip error message and I have thoughts of going somewhere else next year. But then it passes.2 points

-

I seriously had to look at one forever last night and convince myself I knew what I was doing. No, it's not the first time I've seen it this year. And, yes, I do a double-take every time. Every. Time.2 points

-

Entry in ATX W-2 allows for 4. If I put the fifth one on a second W-2, anyone know what will explode?2 points

-

Medlin, the problem is that many people don't read but just click and click. I once had a colleague who wiped out Office because he was in a place in the computer he shouldn't have been in and didn't read, just clicked.2 points

-

Use a 2nd W2 input sheet for the additional codes. Move $1 from box 1 wages on the 1st input sheet to box 1 on the 2nd w2 input sheet or ATX will not transmit it.2 points

-

The decision of how to word things (assuming a programmer's decision) is the stuff I face daily. If not something anyone can look at and state from only one (positive or negative) position, one cannot just use (what used to be) common sense. Programmers have to look at the number of times a particular item causes support questions, multiplied by some in house factor relating to the number of people who had the same issue but never reported it. For instance, despite having a watermark on our print preview images, we still get calls asking how to print the item without the watermark (select Print, not preview ). Before the preview is shown, we show a dialog box - which the user has to close (stating the same thing, to have the actual report printed, to select Print, not preview) which one would think would prevent the need to ask the question...2 points

-

2 points

-

Terry, I provide Jolly Ranchers in my office, because I don't like hard candy. I never provide dark chocolate, because I'd eat it all. But, I prefer clients NOT come to my office. I can work in my jammies and fuzzy slippers with no make-up. I can work late and maybe sleep late and not shower until I can take a break and comb my hair once in a while. I have FileShare on my website and eSign and a large mail slot in my front door.2 points

-

2 points

-

They'd rather we verify 1098Ts for accuracy, give our clients lie detector tests or whatever. Threaten to fine us with penalties if the documents we're given are incorrect.2 points

-

All it would take is for the IRS to audit one major university, and very publicly punish them for the rest of the universities to get their act together. But like EIC fraud, it will never happen. Universities and poor people are politically untouchable. Tom Modesto.2 points

-

Filing education credits and college statement analysis. As I said, these are people providing higher education but for some unknown reason can't see the importance of accuracy. Maybe the colleges should be fined by the IRS for whacky and no sense making reporting.2 points

-

Just one thing, I believe since the vehicle wasn't in service at the end of the year, there would not be a deduction for 2018 depreciation. Then you would probably have a loss in 2019 assuming the insurance check was less than the original purchase price.1 point

-

Box 14 is CAN be just information that's not needed this year. But, it's on your client to bring you documentation.1 point

-

A bipartisan group of House members has introduced a bill called "Restoring Investment in Improvements Act". They cherry picked one issue out of the various proposed TCJA Corrections problems. This bill is a one issue bill which would retroactively correct the "Qualified Improvement Property" glitch in the original TCJA bill from 39 years to 15 years qualifying the property for immediate expensing. There has been no apparent movement in the House on any of the Tax Extenders or other TCJA Correction issues1 point

-

I am not sure what you do if they haven't kept copies of this stuff. At this stage of my career, I would walk away even if they were willing to pay me an extra 1 K.1 point

-

I had the exact same situation a couple of years ago. The wife had used the pre-printed vouchers with the husband's social as primary but she had written the checks from her own account and listed her social security number on the checks. I wrote a letter explaining the situation and attached copies of the cancelled checks and payment records for the installments showing that they were paid from the wife's personal account. It took them a couple of months but she finally received a letter from the IRS saying they had applied the payments to her return and she received a refund.1 point

-

I'd give the client a list of returns and worksheets that I need from the prior preparer and that I can't proceed without these documents, unless they want to pay me an extra grand or so.1 point

-

all of you who have problems for more than 30 minutes or a few hours after rebooting, you need to do one or both: 1.- Use your machine as a working tool not something that you use for facebook or for watching cool and funny videos. 2.- Buy a new computer with a decent amount of memory.1 point

-

We keep a spreadsheet of Work In Progress (remnants of my days as an engineer). we have about a hundred with no papers (some we have heard from, some not). Next week we start on extensions. First for all clients underway of that we've heard from, then for the ones we haven't heard from. Those we'll wait to send in until we have word.1 point

-

All you needed was hyphens and you'd look like you had made a common-sense-making report. I know this stuff because I was an English major.1 point

-

<<<<<whacky and no sense making reporting.>>>>>>> Don't you just love that grammar??? Yes, I am college educated even though it doesn't show.1 point

-

Yes. You divvy up the dependents, deductions, etc., and the IRS calculates. Although, it's been a few years since I've prepared an 8379 myself.1 point

-

Sorry, ATXers. My software is the same as in previous years and is unambiguous with the checkbox labeled "dependent of another".1 point

-

What works with one financial institution may not work with another because they each have their own rules.1 point

-

Agreed. I wonder how other software companies are doing it. If it is a command from the IRS, I like it. I can see that most dependents will make a mistake when preparing their taxes even when careful.1 point

-

Seeing a significant amount of late filers this year. Oh well. I just charge a fee for filing extensions and then they get annoyed that their taxes are completed a few days after 4/15. Cant pile everyone in by 4/15 is what I tell them. Get here earlier next year. But they dont listen.1 point

-

Make sure the POA specifically give power over tax matters, signing returns when necessary, planning, anything tax related.1 point

-

Pffft. We don't call them until August or September. Ain't nobody got time for that!1 point

-

Smart move. Daughter may be in some sort of denial about mom's cognitive abilities. Facing reality now might just help her save mom from some catastrophic financial decision or third-party scam somewhere down the road. Some con artists have a unique ability to sniff out vulnerable people.1 point

-

I don't use ATX, I use my QB files. I created a report that shows me who has been billed and by date, compared to last year. If someone was billed last year by the date I run the report but not billed this year, I can spot it pretty quickly. I can also run a history report on a client to see every return we billed for an on which date. Gives me a pretty good idea if they are late. Tom Modesto, CA1 point

-

I usually have my staff start calling sometime this week with a message along the lines of 'we are assuming that you have gotten your taxes taken care of, but if you need us to file an extension, let us know'. Usually brings them running in. I have had 20 people drop off this week. I guess they are calendar challenged. I was going to have my assistant make calls on Monday, but the flow was so steady, I decided to hold off. Now she'll have far fewer calls to make. I'm down to 2 or 3 that i haven't heard from, but it was 25 or so at the beginning of the week, so I think it's pretty standard!1 point

-

Same as Tom. I think I'm ahead of last year. Either that or I'm not and just think I am.1 point

-

1 point

-

Update, spoke with the daughter, she does indeed have POA for both parents. I asked for a copy of it to maintain in my files. Also, required the daughter to be present when we review the return. Daughter really didn't think this was any big deal and I reinforced that with this was the only way I would prepare the return, no other exceptions.1 point

-

Their definition of scholarship is sometimes a little different than mine also. I would not consider amounts paid from a 529 plan as scholarships, but one Virginia university did in at least one case that I looked at. I would not consider a loan to be a scholarship, but at least one Virginia university did in a case that I looked at. I am not even sure they get the half time student box right because at this point I don't trust anything they put on those forms.1 point

-

If the daughter did NOT pay more than 50% of her own support and meets the other requirements to be a qualified dependent of her parents AND files MFS, then the parents can claim her. If the daughter files MFJ, then the parents can claim the daughter if the filing was ONLY to get back their withholding. But, that's not the case described in the OP. The parents would ALWAYS have to state to you (and show you, if you had reason to doubt them) that their child did NOT pay more than 50% of her own support, and that has nothing to do with being married. If a three-year-old child actress supports herself more than 50%, then the parents can NOT claim that little darling. Yes, you can file the daughter MFS. But, you say she wasn't your original client? Who IS your client? If the "kids" that got married are your clients, advise them what's in their best interest, which often is MFJ. If the boy's parents are your clients, it doesn't matter. If the girl's parents are your clients, then advise them what's in their best interest, which might be to claim their daughter. If more than one of the parties are your clients, then you have a conflict of interest. Disengage from one or all of them. It's a family matter. If the family works it out and you still want to keep one or more of them as your clients, then do what's in YOUR best interest. Until the next family feud. See Pub. 17 pages 28 and 30 for Joint Return Test and page 29 for Support Worksheet.1 point

-

The Forms 1098-T have seldom been accurate and probably will stay that way. When they reported Billed, we knew we had to have our clients get the bursar's statement. Now that they report Paid, you'd think they'd be better. But, apparently, colleges don't all use the same definition of Paid. Sometimes Paid is from all sources, sometimes after Scholarships &/or loans are applied. We still need the bursar's statement PLUS have the parents/students add up what they paid out of pocket. And, there's still separating what our clients paid for tuition from R&B and other expenses. And, yes, these are the folks teaching the next generation. Employers can't use a loose definition of what they Paid their employees. We can't be sloppy with how much we Paid for our business deductions. Rant over.1 point

-

I/we feel your/our pain. When this form was new, my husband worked at University of Cincinnati and they produced a sterling form including the breakdown of payments received, scholarships, loans, everything way before it was needed. I've never seen a better one since.1 point

-

AW hell!!!! 7.5% medical is already in the TCJA for 2018 but not for years beyond. The PMI is the big PITA here. AGAIN.1 point