Leaderboard

Popular Content

Showing content with the highest reputation on 03/25/2021 in all areas

-

My recollection is that you can request direct deposit to the estate account, but often the banks reject them because the names don't match exactly (name of estate vs irs deposit). I think the hold up on direct deposit would be a bank issue and not an IRS issue.6 points

-

I have never seen worse, in 25+ years. Y'know, we're going to start looking back on LAST year, with EIDL and PPP and stimulus-only returns, and think, "Good times, man, good times." (Whimper.)6 points

-

4 points

-

There is no reason to file 3115 in that situation. Just amend 2019 and go forward.4 points

-

Besides, every client always says “My situation really isn’t all that complicated.” We can believe them. And all you need to do is press a button to send it - right?4 points

-

And if it had been TEOTWAWKI, she would have forgotten all about the cash. Which would have been worthless anyhow; in that situation she'd have been better of with barter-ables like cigarettes and liquor. LOL.3 points

-

Great song by Zager and Evans. By 9595 we may have a problem if those lyrics come true.3 points

-

After I got short with her, she looked again and discovered that she did receive it! Arrggghh!3 points

-

There was a great cartoon I saw, some years ago (and of course can't find it now). The caption read, "How tax software is supposed to work." The drawing was a computer with a huge hopper above the monitor, and the person was dumping paper in the hopper. I swear that's what our clients think we have.3 points

-

I can't answer about what ATX is doing, but here is the section from the 8863 instructions. I don't see a contradiction. See bold that is mine where it says "you DO qualify."3 points

-

Since this happened in 2019, you would amend the 2019 tax return. This situation doesn't meet the requirements for a "Change in Accounting Method." Question - what kind of lease was this, operating lease or financing lease?3 points

-

3 points

-

3 points

-

2 points

-

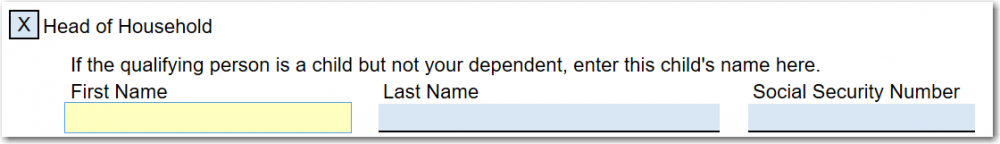

The custodial parent (IRS's definition, not the divorce court's) signs 8332 to give the dependency to the noncustodial parent, in your case every other year. The custodial parent is and remains HOH every year.2 points

-

2 points

-

2 points

-

I have 2 that owe a few bucks but the non-refundable child tax credit takes care of that. I am going to file as if nothing happened. I have been suggesting that the IRS only programs line 28 (I believe) to 0. So that line should read: Maximum repayment = 0 and be done with it.2 points

-

Yes, I have clients who were sure I didn't need to know about EIP2 because it arrived in 2021, and others who gave EIP3 amounts, and others who are sure they never got anything.2 points

-

It's not just the elderly. Many get confused with the more recent payment and forget the first. I usually tell them to track it down because it is very unlikely they would get one and not the other. One lady insisted she did not get one, looked at her bank accounts. Then remembered her nephew scared her with 'end of the world' stuff and remembered she cashed the check and put the cash in a safe. Ha.2 points

-

Gee, did the daughter get unemployment, too, and the boyfriend get APTC, and the parents had a Covid-related IRA distribution, and the baby has a bank account/kiddie tax, and dad worked in NY or another state that decoupled from The CARES Act, and...2 points

-

There is only ONE answer now:2 points

-

2 points

-

ATX support called and said state forms for unemployment changes should start coming 3/29.2 points

-

I feel like Andy is peddling as hard as he can to save his own butt. We are also legalizing pot.2 points

-

2 points

-

https://www.irs.gov/retirement-plans/ira-deduction-limits Check to make sure your client qualifies for a deductible Traditional IRA. Also, see if the Saver's Credit is available?2 points

-

I was only half joking when I said a few weeks ago that we should all close our offices for a month, to let this all get sorted.2 points

-

Catherine, MN needs to do that too! They haven't even worked out which of the gazillion federal changes from last year we'll conform to. And the legislature is in session until around May 17th, so that's when they'll probably do something. Absolutely the feds and states need to match the Estimated dates to the return dates!2 points

-

New York State did something sensible (I am shocked, but hey I guess these things can indeed happen). They changed ALL their due dates for every type of return and payment to July 15th. No exceptions. Of course, the feds' date is earlier, but still. Sensible! Pick a date far enough in the future to matter, and make it across the board. Good for NYS for this.2 points

-

I am going to say the same thing as Lion EA. My brother is the none custodial parent. He files single every single year and every other year he has a dependent. The mother, every year she is HOH and claims EIC credit every year. On her return, every other year she lists ONE dependent and gets EIC. Every other year she DOES NOT list any dependents and gets EIC because she has a salary of $25K. (I have to mention that $25K because someone might interpret that she gets EIC credit for her and not for the child).1 point

-

Yes, you are correct. There MUST be one of the taxpayers with social security number for the return to be unsealed and once unsealed, the dependents come to play.1 point

-

cbslee is right. I haven't had a Single or HOH ITIN holder (no spouse on return) with kids, so hadn't remembered that correctly. There has to be one spouse on the return with an SSN, but other spouse can have an ITIN; then SSN spouse and all kids with SSNs get EIP/RRC. If they'd been disqualified from EIP1, then they now can get RRC1. So, giogis' situation will get no EIP and no RRC.1 point

-

1 point

-

There has been some crazy stuff with this. Married couple also in their 80's on EIP2 he got it and she didn't. This was back when we could look it up or I wouldn't have believed them!1 point

-

1 point

-

I can't believe they took down the site to check and see if the payments were sent.1 point

-

Assuming she has smart phone in her own name, you could help her set up an email account in less than 1 minute.1 point

-

Thanks for that. I must be bug eyed. I read that several times and was thinking Do NOT. Sheesh. And ATX concurs.1 point

-

I was doing a Spidell webinar yesterday going over the changes from the ARP law. Under the topic of Premium Tax Credit, the materials says... "For 2021 and 2022, the Premium Tax Credit is significantly expanded by: Deeming taxpayers who received at least one week of UI benefits during 2021 as having received income of 133% of the poverty level for purposes of determining the amount of their Premium Tax Credit for 2021 (even if their income was actually higher) (ARPA §9663). The new law also changed the household income contribution percentage for 133% income range to 0%. The way I read this, if you get UI for even 1 week of 2021, you get health insurance from the exchange for free. Am I interpreting this change in the law correctly? Tom Modesto, CA1 point

-

I'm still mad about PPP funds being abused and then not even being taxed. And while I found a wonderful substitute for health insurance in 2015, this is all too stupid to be real.1 point

-

No requirement to fund the ira before filing. You can file in February, receive your refund in March, then use the refund to fund the ira.1 point

-

I just opened the NYS form and see it hasn't updated yet. Thank you though for the update. This tax season is just nuts!1 point

-

MA *might* vote on something - heaven only knows what - this week. So we're on wait.1 point

-

Yes, read about Cost, Adjusted Basis, how a disallowed Wash Sale loss adjusts basis, how to code adjustments to basis, etc. And, use your software's Help, Knowledgebase, Chat, Support, whatever features to learn how to do the data entry for the rows and columns on that 1099-B. I suggest taking a simple return with smaller numbers and preparing it by hand on paper forms to understand how the numbers flow from one form to another. When you know where all the numbers go, enter the same return in your software to make sure you understand the data entry needed to get the correct results. Then you'll feel more confident with larger numbers &/or more complicated returns.1 point

-

A Roth IRA contribution is not a tax deduction. Does he qualify to make a deductible Traditional IRA contribution?1 point

-

MD did July 15th before the feds due to MD law changes in February (that they still haven't fully implemented).1 point

-

Thanks, Judy. I read the information in pub 559 which indicates: Medical expenses not paid by estate. f you paid medical expenses for your deceased spouse or dependent, claim the expenses on your tax return for the year in which you paid them, whether they are paid before or after the decedent's death. If the decedent was a child of divorced or separated parents, the medical expenses can usually be claimed by both the custodial and noncustodial parent to the extent paid by that parent during the year. Based on this information, my client can take the expenses he paid in early 2020 on his 2020 return as an itemized deduction subject to the 7.5%. He does not need to make an election or amend the 2019 return. Is that correct?1 point

-

1 point

-

Doncha just love the ones that answer "we got a debit card, but thought it was a scam and shredded it - now what do we do?" Right along with "I got a check and it got put in the recycling pile by accident - now what do I do?" At least those are a bit more creative than "I dunno."1 point