Leaderboard

Popular Content

Showing content with the highest reputation on 01/27/2022 in all areas

-

Baby granddaughter at just over 8 months old, has her first little toofie. So exciting!10 points

-

7 points

-

I included the IRS definition of virtual currency straight from the 1040 instructions with my letter. That puts onus on client that they need to tell me to check box or not. https://www.irs.gov/instructions/i1040gi#en_US_2021_publink1000614424 points

-

I still remember a motivational speaker from about 40 years ago, "I give myself permission to make 10 mistakes everyday, after all, the only people who are mistake free are 6 feet under the ground."4 points

-

You need a Section 7216 Disclosure Authorization to talk to anyone else about their taxes. It's actually a pretty fine line to tread with our elderly clients. I try to have them come in (or meet me with) a family member - use an excuse, such as "making sure someone understands new technology" or something they'll accept. Once the client has freely spoken to you with that family member present, you can also ask about "should there be trouble in the future, may I speak to X?" to start the discussion.4 points

-

3 points

-

As long as the "fireproof" safe is not in the same potential harm area as your computer, this is not bad at all. I would personally add one or two more drives, and make them monthly swaps, with the offsite storage at a different (third) location. A bit more work than using online backups as your second and third location, but can be easier to manage. Once There is a good backup system in place, keep reviewing it. Testing to see if the backups contain what you actually need, considering the area of "harm", etc. Backup plans are not "set and forget" - without testing, there is no point even having a backup! (When you get a duplicate key made, the first thing to do is see if it works....)3 points

-

And more likely to happen, make sure you have a good full backup before letting any tech "expert" touch your "live" computer. Today's incident is a customer who thought they had some sort of nefarious software on their machine. A certain national company who comes to your site sent someone out, who "cleaned" things up by doing some sort of "tune up". (Likely an off the shelf software anyone can use, likely for free!) Unfortunately, whatever was done removed their PDF software, and the customer had no idea what PDF software is, or what it does, other than they could no longer view PDF files. This is not the first time I have had customers share their experiences in this vein. Usually it is a failed transfer of all data and programs to a new computer (which is way more complicated than some sort of $99 service can do), with the customer having no idea of the consequences, and having no backup. The next common is when a "backup" system is put in place, and when needed, it is found to only have the things in the pics, photos, and documents folders. Ironically, the same type of customer who relies on the call out services have never availed of our free - included - secure online backup storage, or even made a backup of any type at all. They usually assume we were somehow connecting to their computer to make backups for them. -- I assume I will (again) have to bug out with 15 or less minutes notice, so I have all things securely online in backup form, so I do not even need to grab my computer. The pro photos we do not have digital copies of, the photographer has them securely stored (we asked after our last bug out).3 points

-

Gulp! I replied to the totally wrong thread! This was supposed to go with the 2 family to single family issue. I just glanced at the reply without noticing the issue. I will now crawl back into my hole and bury my red face....3 points

-

I'm not convinced they ever do anything with 941X forms. Any 941X I've ever sent in for any client was ignored totally. I think when they see the X, they ceremonially burn them without reading further than the EIN, and then send tax due notices.2 points

-

I, too, use Backblaze recommended several years ago by my computer guy (he has personally built the last 6) and set up for me. I also have a second hard drive next to the main drive and I back up to an external drive (alternating between tow) which I keep in a fireproof safe. That's what I am willing and able to do. It may not be enough but it's what I do.2 points

-

Maybe "Do you have a fiduciary, family member, or other person you would like to get copies of any documents"? Some will already have their affairs in order and a plan in place, some may not and you might even trigger them to consider their final affairs.2 points

-

You will be able to apply the full repayment protection amount of $2,000 for each excess qualifying child if your modified adjusted gross income (AGI) is at or below the following amounts based on the filing status on your 2021 tax return: $60,000 if you are married and filing a joint return or if filing as a qualifying widow or widower; $50,000 if you are filing as head of household; and $40,000 if you are a single filer or you are married and filing a separate return.2 points

-

Before treating and backup source as functional, test a FULL restore. Some online sources take an inordinate amount of time for a full restore... Plus, you may not have realized the default settings will not likely backup everything you wished to be able to restore. I am willing to repeat one day's work. Thus, I backup once a day, at my off peak times (lunch, usually). I have an SD card, an external hard drive, a personal AWS location, and a separate secure online location. I use various free or low cost backup software, such as CloudBerry and Cobian.2 points

-

The upload process is done well, and "should" be an example for the other tax agencies. More so that they have baked in the accuwage (testing) process, instead of making folks download a new app (and possibly java) each year. The BSO and dealing with the likely case of forgetting the password you may not have used in a year, is another animal. Printing and mailing, especially if your software is approved for self printing on blank paper, is a snap., Especially since paper copies are needed for employees, and the employer. SSA will not be late in getting the forms scanned as they likely hold up personal returns processing waiting to try to match income.2 points

-

Letters may be wrong especially if taxpayer has moved or changed bank accounts. The suggestion is to check the amounts in the letters with amounts on the new IRS revamped site. https://www.accountingtoday.com/news/irs-child-tax-credit-letters-may-have-wrong-information?position=editorial_1&campaignname=V2_ACT_Daily_20210503-01262022&utm_source=newsletter&utm_medium=email&utm_campaign=V2_ACT_Daily_20210503%2B'-'%2B01262022&bt_ee=nOEDxhLpYf76%2BKr3%2B8RyP1pGdsv5fhS3Ipv9puUHWgt5zRDyEiZmOVMTXBQTTQhk&bt_ts=16431949640991 point

-

The software probably tried to update and failed due to security software. I had that problem with iDrive, which I never really cared for. It kept trying to update and failing, but it failed after it had uninstalled the old version. This is also why they weren't notified. I'm guessing the software does the notification, not the website. It would be better if the website notified you. I have Backblaze set (from the website) to email me backup results weekly. So if I don't get that email, I know something's wrong. But I open backblaze from the system tray several times a week to see how it's going. The lesson is, you can't ignore your computer and assume everything is working. Computers mess up, and you need to be sure what you think is running, actually is running. This is why I'm always looking at my system tray area to see what icons are there, including backblaze.1 point

-

Now, I am thinking, how about two online backup services instead of one. I have WD failed, so not trust external hard drive much anymore, because the machine may not expensive, but to recover the data is. How do you think?1 point

-

Even more wonderful, because yesterday I learned that a long time friend had passed on; his heart problems caught up with him. Yesterday was a bad day, and I wandered around in a fog all day doing things poorly and eventually gave up on trying to accomplish anything.1 point

-

Warning with BackBlaze: some colleagues near me use it, and it failed to make any backups for two weeks and never notified them of the failures. How'd they find out? Looking for a backup copy of something accidentally deleted, that was less than two weeks old. They were seriously not pleased.1 point

-

Always makes me chuckle that the SSA programmers cannot strip out the non numerical characters. It is a simple function in any programming language. I would do it for you, but some of the other agencies which use the same file structure might allow the non numerics, and some customers like the non numerics for other reports. Also makes me chuckle when other agencies claim to use the SSA format with no alterations, which is only true about 50% of the time. For next year, send images of the error messages. Likely not something you have to change more than once, such as some sort of invalid character in a field.1 point

-

In the few classes I've taken/articles I've read on cryptocurrency, NFTs usually come up. Apparently there's no official guidance but what I hear/read is that, for now, treating NFTs as you would crypto is probably the best you can do. Property. But do you treat NFT like inventory, then inventory. Did you create it; in biz. Did you receive it for something you did? Then could be compensation, earned income, or could be interest for tying up your NFT/crypto. Selling; you have your basis. No wash sales, though, at least until 2023. Buy something else with it/swap it; probably a sale. Lots and lots of unknowns.1 point

-

The Form 941 & 941X Backlog as been reduced from 2.3 Million to about 1.5 Million Returns1 point

-

1 point

-

1 point

-

JMO but the security of the cloud isn't my major concern, it's Drake going out of business (for the cloud issue). Even there I believe Drake would be sold - they've received a significant outside investment already so just going poof is very unlikely. My question really is if the product is fast / slow and if it's significantly different from the desktop version. I'll process their demo after the tax season. My major cloud issue previously was that occasionally I go work at client's homes / offices and I couldn't count on internet access but that's not so much an issue anymore. The web version of my current software (I don't use it) is horrifically slow. The ability to never have to worry about updates, my computer dying and ease of working from home without taking my laptop with me would be nice. My laptop dying is a major business risk. That's probably 2 days of work gone. Loading all the old software is a pain.1 point

-

LOL. They never call before hand and then it's your fault they have to write the check!1 point

-

I thought you were referring to "Numerous Family Townhouses" as NFTs So in your example, say t/p buys a duplex, lives in one and rents other, then converts personal to separate rental. Then a few years later converts both to a single family unit. In that situation, for depreciation purposes you would have three separate assets: the original 1/2 rental, the one half converted from personal, and the remodel/conversion to a single family unit. Each would have a separate depreciable life beginning on the date when placed in service. If the single unit dwelling is later sold, the basis would be the combination of the three less respective accumulated depreciation.1 point

-

The answer provided by cbslee seems to be correct if you bought it, but what about a nice hat and you make it NFT? What if you have an inventory of NFTs?1 point

-

No, don't check the box if all they did was buy. It's confusing because the wording is "did you receive...." Well, if you bought of course you received crypto. It really means is "receive for services or goods."1 point

-

The most common "error" is not an "error", it is a warning, that the submitter and the employer's EIN's are the same. This is a warning only, and does not prevent submission. The SSA defaults to the submitter not usually being the employer... Next often is an incorrectly formatted piece of data, such as a phone number having anything other than the 10 numbers. Other than those two items, anything else is usually a setup or data entry issue, and is usually only seen with first time efilers. Personally, this is the first year I efiled W2 data, and both the signup with BSO, and the submission (with the warning about the matching EIN's) went smoothly.1 point

-

1 point

-

1 point

-

Keep in mind, folks, that while local hard drive backup is good and cheap and reliable, you have to take the drives home with you every night - or one break-in, broken pipe, or fire could destroy all your records including all your backups!1 point

-

An amazingly wonderful peaty single malt Scotch whiskey. Think Laphroaig with a little less bite.1 point

-

If there are no sales/redemptions, then there is no taxable item to report.1 point

-

Someone once said that if you can't stand in front of is and defend it, it's not yours. I will go back to green ledger paper before I put data on the cloud (except as second backup).1 point

-

I don't know what Lagavulin is but I am game to try ANYTHING ! To date the service has LOST two of my client's mailed returns after cashing the payment checks included with the returns. They advise they have not received the client's return for the referenced year. Last year a client who filed in October 2020 got the same letter in December and had a certified mail receipt from the Center where the return was received. He finally got his refund in July of 2021. The season is off to a great start. I have pulled a muscle in my lower back and am sitting at my desk with a pillow stuck back there to give it support. I've not had a heating pad (good grief) in the house for years but will likely have to trundle off to Walmart and get one post haste !1 point

-

I saw others posting about this issue on another forum. ATX is aware and a fix is coming. I don't have many EIC returns and none of them have come in yet.1 point

-

Unfortunately, it sounds like he did not seek tax advice until after the fact; and the incentive money he received has all been spent?1 point

-

Be sure to close the return after deleting the 8879 and EF Info page, then reopen the return add them back and recreate the efile.1 point

-

1 point

-

Capitalization may come into this if there are significant upgrades or additional features that were never there before, or that are betterments or restorations that would extend the useful life of the property.1 point

-

I also use IDrive to back up the cloud daily. I'm not super savvy and found it was very easy to set up. It has saved my butt several times when I accidentally deleted a file. They also allow you to set it up on up to 5 computers, so I also use it to move whole folders and files back and forth between my laptop and desktop computers.1 point

-

"An unmarried father does not have legal rights to custody or visitation." In most states unmarried fathers do not have these legal rights. I don't think this has anything to do with claiming dependency.1 point

-

Thanks, y'all. The sale truly was an answer to prayer. Now I can sell my house and rent a nice apartment. It is the only way I can afford a salt water pool and 24/7 fitness center! LOL1 point

-

A snippet from one of the IRS letters (bold is mine): How the IRS determined your payment amounts Monthly payment amounts were initially based on information from an income tax return you filed or information you entered in the IRS non-filer sign-up tool in 2020 or 2021. Your monthly payment amount or how or where the IRS paid your payment may have changed based on information you provided the IRS through your 2020 income tax return if the IRS processed it after June, the Child Tax Credit Update Portal, or the dedicated IRS Child Tax Credit phone line. Review each monthly payment, including any changes, at IRS.gov/ctcportal, and click “Manage Advance Payments.” If you did not receive one or more payments, contact the IRS at 800-908-4184 before filing your return. We all know how well the IRS is at answering their phones!1 point

-

My kids do mine and in spring all gets plowed under in garden. Tomatoes seem to like the stuff. Of course I have to have the soil tested for acid content.1 point

-

1 point

-

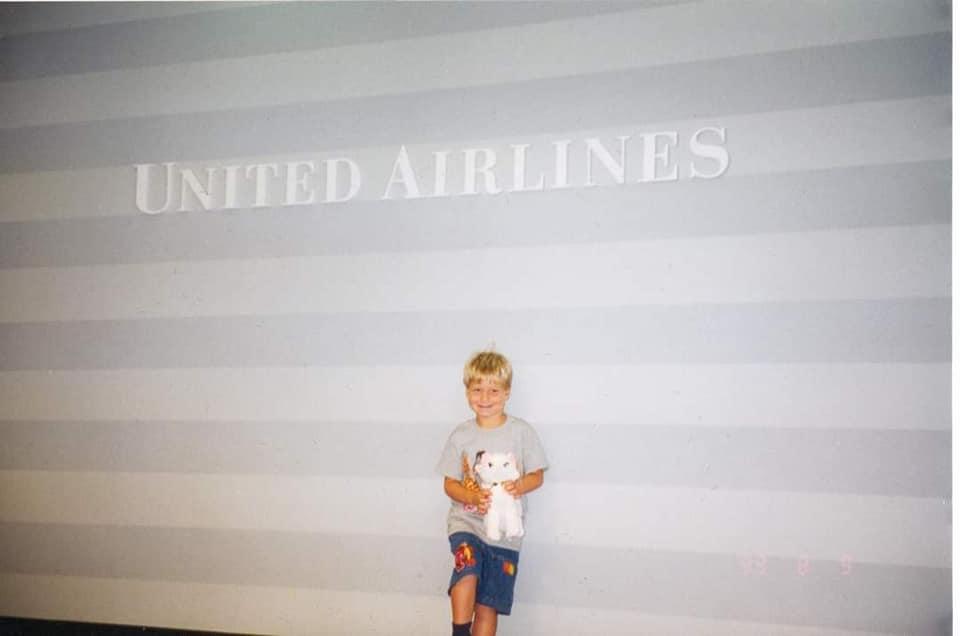

Andrew was hired by United and started training January 4. It was hard for him to leave SkyWest, but this has been his dream job since he was little. He will be flying 737s out of LAX until a spot opens in Denver. We are super happy for him. I am looking forward to more fun trips to places that I have never seen.1 point