Leaderboard

Popular Content

Showing content with the highest reputation on 02/22/2017 in all areas

-

9 points

-

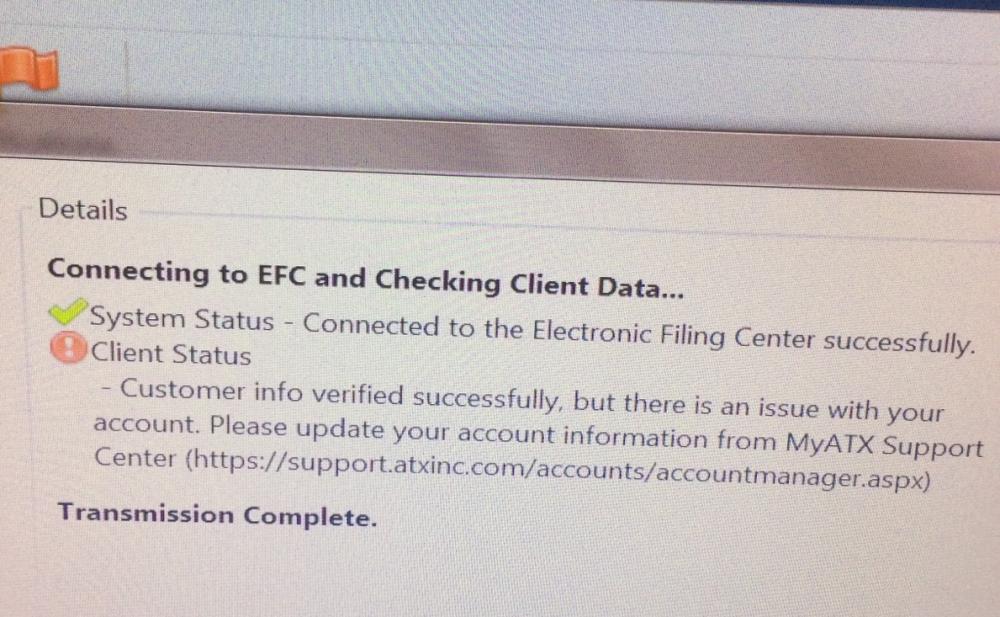

Hahaha they were kidding about updating on that screen. Seems there is a problem with my credit card info. Hahaha. Ha. Ha. Carry on.8 points

-

I told the person who emailed me and advised me to go to MyATX and pay my bill that it would be good to put "Go to MyATX and pay your bill" on that error message or shoot us an email instead of sending us to update phone and address and fax number. I updated the crap outta that stuff though. They can find me, I'm certain. LOL.6 points

-

5 points

-

When a new individual client comes in, we have a checklist for setting them up. One thing we check is the state real estate records for their house (fortunately, MD has a very nice website for doing this). We need to know if they're in town limits, but we also check whose name the house is in, when they bought it, how much they paid, how many square feet the home is, and whether they've applied for the homestead tax credit. So far this year, two new clients had not applied for the homestead credit. This can save them 100s or even 1,000s a year in real estate taxes. Just an FYI as a value added service, in case your state has a similar situation.4 points

-

Hahahaha, it's my fault for not thinking about my credit card number changing, so I might get hugged back. It's still cracking me up how I was wondering, "Why the hell do they need my fax number so badly that they just cut me right off? Seriously? Over a fax number?" LOL.4 points

-

I'm just over here trying to decide whether to call new client or not. He's called twice and dropped the name of my most PITA client. Yay. I'm wondering if this is a PITA added referral.3 points

-

Nothing! I do not do that kind of work during busy season. That said, my May and June are starting to look like they are going to be pretty good months with all of the non-busy time work I am deferring.3 points

-

I sometimes feel like this kid when you have work to do and windows is updating in the background3 points

-

In early January I send a letter to all clients in which I remind them that I will need this "personal" information and why...if asked again, I blame IRS and explain that I am only doing what RS says I must.3 points

-

Just received an email from Amazon saying my order has shipped, a fancy smancy Dell computer, $1600 worth. I never ordered this so I called Amazon and they said it is a spoofing email that many people are getting. Now I need to Google "spoofing email" as I never heard of these. She said don't respond to it (I was born at night, not last night). It's a mine field out there.2 points

-

2 points

-

Did the cite continue to state: The earner with the highest AGI is supposed to claim all the children? Thereby limiting CTC, EITC, and the various other credits that could be claimed by the lower earner? Rich2 points

-

Thanks for explaining the difference. I do try to click save now and then while working in a return. Can't help it if there's a crash but I wouldn't want to unplug my computer just to test it.2 points

-

That's what ATX used to be - a series of excel spread sheets. That is why you could + - * / in any numeric field. Alas, those days are gone.2 points

-

2 points

-

The responses sound reasonable to me. My clients know better than to ask that kind of question. They learned along time ago that I march to the beat of my own drummer and don't give a flip about what other practitioners do. The folks on this forum being an exception to that statement, of course!2 points

-

"My neck is on the line to have this documentation. I will not put my ability to perform my business at risk due to your lack of having or wanting to provide this documentation. Call your Congressman."2 points

-

I take the standard deduction but have dividends,interest, capital gains, SS, IRA RMD, and have an installment sale involving principal and interest, but as a former tax pro, I can handle it.2 points

-

Bart: You don't need to worry about doing his work. I think he was shopping around because he called me too. He seemed honest enough, so I gave him a fair estimate and he sent me his thumb drive. I'm opening it right now and it looks like everything is strictly on the up and up34324234-2934-=02-0`-2``=9210=`0`02-12`-2`-2`-2`12`3=01243-09137849082374012734=-ipdjk;sdjfasnm p qkjsd ]po mi=I r2r-ir i3 ] ^^^3_(_)(*&)*tilt()))++)+ 3 m] o 3o #####2 points

-

Well, I followed the directions here and updated where it said to update and I've emailed ATX. I would rather take a beating than call support. Any support, not just ATX. Last time I did I think it was when the software changed to "spaceship up in here". I told "James" (not his real name) that while some appreciate bells and whistles I really don't all that much. Taxes are not sexy, James, trust me on this..." And he started laughing and we had a light moment. I miss him. Any words of wisdom from my water cooler buddies?1 point

-

If I remember correctly, Drake will adjust this for you and will use the net amount of premiums minus the PTC actually allowed and report that on Sch A. In other words, the deduction on Sch A for 2016 will take into account the amount of the payback that occurs in 2017. Drake is handling the Sch A as if the TP received the exact correct amount of PTC from the Form 8962 without additional credit or payback. Last one I had, Drake did create a backup worksheet that listed what the Sch A deduction was comprised of. Hope that all makes sense.1 point

-

If the easement was worth $500k. Development rights, for example, and then you sell them to a qualified charity for $300k, then you might have a $200k charitable contribution. That is why you need the appraisal. Rich1 point

-

Anybody that works on anything for an hour without saving, gets what they deserve. You once accused me of saving too often! Ha! No. Such. Thing. And, I've never had ATX crash where I couldn't save my return before closing.1 point

-

You talk to the people who got the money. They own the land, and the property. Their basis in that property is reduced to zero, and then whatever is left over is subject to tax for the sale of the easement at capital gain rates. If they have basis of $200k in the property, then they are free and clear, Otherwise the rest is taxed. I have one in 2017 who sold an easement for $800k, with a basis of $400k... The taxman cometh... Was an appraisal done? Could there be a charitable contribution of some sort? Rich1 point

-

This year I am asking for more documents for my EIC/CTC etc.... clients, a few had asked me why I was asking for so many documents if their friends preparer didn't, I respond by saying I am not responsible for what others are doing, I am responsible for myself and business. MAS1 point

-

I have very few EIC clients, but one with the ACTC also had W2s for each of their kids for a photo shoot the whole family did. Relied on docs? Sure did. The EIC one I did had a 1099-SSA because he and his child are disabled. So in both cases they has government docs with the children's addresses on them. Can't get better than that, I'd think.1 point

-

Oh my last client could probably DIY. Wages, some interest & dividends, mortgage , & RE tax. Except for the stock options and pension payout part of his golden handshake which was earned in PA, NY and CA. If not for the NY it would still be easy.1 point

-

1 point

-

Backup withholding is supposed to be at 28%. In case anyone didn't notice, this topic that was revived is five years old.1 point

-

LLC's are a creation of state law and have nothing to do with income tax status. For tax purposes an entity is either a sole proprietor, partnership or corporation.1 point

-

It is a best practice to always collect Form W-9 from your vendors before making payments. This will ensure you have all the information you need from them when preparing your 1099s at the end of the year. Once you receive the W-9 back from the vendor/payee, if they have checked the C Corporation Box, the S Corporation Box or the Limited Liability Company Box with a “C” or “S” noted, you are not required to prepare a 1099 and send to them. For vendors/payees who have marked as their tax classification: Individual/sole proprietor, Partnership, Trust/ Estate or Limited liability company with a “P” marked or Other, then you are required to send a 1099 to them. The only exception is all payments to attorneys should be reported on a 1099-MISC as mentioned above. You should retain indefinitely the Form W-9 to support your filing or lack of filing a 1099. If you are unable to get the EIN of your vendor, the IRS requires you to withhold 25% from any payments you make to that company or person. This is referred to as backup withholding.1 point

-

Actually when you closed the return you triggered a different function called "autobackup", which does work. Autosave is intended to to prevent loss of data, when ATX crashes or your computer crashes while you have the return open. I agree with Jack, unplug your computer with a return open and see what happens.1 point

-

Open a new return, work on it for 20 minutes then unplug your computer. If Auto-Save is working every 5 minutes, you should lose very little. I can tell you that it DOES NO WORK.1 point

-

The con men (strike that - I meant to say con persons - we here in Dogpatch observe all the PC amenities) are apparently gonna be flockin' here to get their "short forms" done. Who know, maybe John H. was right when he said price and distance were no object -- except I b'lieve their focus is on fleecin' the sheep. Somebody here the other day said all we used to have to watch out for was Nigerian princes, but they're a little more savvy now. This guy acquired a local area code number to make his pitch. First off, although he wouldn't give HIS name, he was very insistent on US maintaining Circular 230 strict confidentiality (never heard THAT one before). Next, said he'd send all his stuff to me on a thumb drive with links. Told him not to worry; although I have a friend who writes The Weekly Wiper gossip-column, she would cross-her-heart promise to keep mum. On the down side, I advised him that, while we don't deal with thumbs, we must occasionally give obnoxious people the finger and I believed he qualified. Must have been the sensitive type 'cause he hung up. .1 point

-

My seniors are more complex, in spite of paying off their mortgages so taking standard deduction. They have many, many, many sources of income: SS, IRAs, pensions/401(k)s, SEPs/SIMPLESs, capital gains, interest, dividends, and lots more interest, and maybe a part-time job or SE &/or renting out a spare room or renting their house until it sells while they move in to a smaller place (did they get 1099-S?), and LTC benefits when ill and double-checking RMDs and which were ROTHs and which were inherited and....1 point

-

I have put these verification codes in the same pile with 1095-B and 1095-C.... Waste of time. The requirement will never happen or be enforced.1 point

-

I'm with you there. But I have found that there is a huge difference between being happy with the pretty new light fixture and being disgusted with the tax returns that are now completed. The latter brings very little satisfaction, and it has to be done every year, taking tons of time you could spend doing other things you enjoy more. Plenty of my clients came the first year saying, "I'm only going to come this year because of special situation X; hope you don't mind" who later (usually on pickup) then say, "This was SO much easier - may I come back next year?" They realize they did NOT waste three lovely Sunday afternoons wrangling with the doggone forms (that of course took me about 45 minutes total), and that the fee I charge is well worth the missing headache(s).1 point

-

There is no letter o in the verification code.So if you see 0, it will always be a zero.1 point

-

Yes, I see/saw that but it doesn't change my position. If the entity self-designates 'corporation' in whatever guise, no 1099MISC is required. But you don't know if you don't have the W-9. I prepare 1099MISC for all entities (for which I have a W-9) that are not, in any form, a corporation. If an LLC is a sm or partnership, I send it. The newer form jsut acknowledges that an LLC can opt to be taxed for federal purposes as a corporation or, if mm, a partnership. I still think sending one or more that may not technically be needed is better than to not send one and discover, on audit, that the expense was thrown out because no W-9 was on file and/or nor Form 1099MISC was issued. At least in my practice, the time spend pondering this is potentially more than the time it would take to enter the data and send it. And I do not believe there is a penalty for sending one unnecessarily. Your mileage may vary.1 point