Leaderboard

Popular Content

Showing content with the highest reputation on 03/31/2018 in all areas

-

Taser would be fun and multi-purpose too. We could zap those trying to escape the "Rita" hugs. Dog shock collar would work too. Give 'em a jolt with every stoopid question or annoying comment.7 points

-

And tonight is the start of Passover. It always starts before Easter Sunday, for good reason.6 points

-

5 points

-

Being mezza e mezza (half and half) I get to eat chocolate covered macaroons and marzipan, and Easter pie, I love these holidays, but Monday I diet.5 points

-

5 points

-

Check this out! He blocked all 7 shots after stepping in as emergency goalie. https://deadspin.com/blackhawks-play-36-year-old-local-accountant-as-emergen-18241995925 points

-

Client... Makes $271k this year... Taxable is $219k. Sends an email to complain about the $300 in underpayment penalties, because *he* decides when he wants to fund his estimates. Which generally means he is light early in the year, and then pays more later. Which, as *we* all know, results in him owing an underpayment penalty. I point out, that due to the composition of his income, he paid taxes of $22k on that income, and that is 10%, and only 8 per cent of the gross income figure. He keeps being argumentative. Finally, I send a short email: Client, I can annualize your income, please send me what you earned 1st, 2nd, and 3rd Qtr, and it may increase or decrease your penalty. He responds: That may be too much work! Guess your time isn't worth $300 an hour, is it? ZAP! Rich5 points

-

Not that I won't be here tomorrow working. But there was a time when the kids were young that I would leave early on Good Friday and we would do eggs and make things on Easter Saturday and visit the bunny. At least this year I have promised not to work on Easter Sunday. May the bunny fill your basket full of extensions!4 points

-

4 points

-

4 points

-

And the waiting forever on them so we can finalize a return. Just because they owe a lot they think if they wait to the last minute it will change. A good zap to goose them a little.4 points

-

4 points

-

ZAP! If only I had that kind of unlimited zapping power during tax season. It's only 4 months a year, although I might need a bit of that to survive October. Maybe we can do a per-zap basis around then? Where can we buy this???? And if we can, that's definitely going in as a business expense.4 points

-

4 points

-

3 points

-

I'm working today and Saturday. Church Sunday with an egg hunt/coffee hour. Hubby will make dinner (a nice client provided the ham as a Christmas present, frozen since then until this week). There will probably be naps involved. I've reached a procrastination stage, not a good stage to be in right now. I have about nine returns that don't need a lot of work, just proofreading, printing, uploading to my portal, packaging for mailing, that kind of thing. And, a LOT of returns to start. Just had a client email that she's going out of state to help her daughter move 8 April and won't return until after the deadline; hope she doesn't mind an extension! Happy Easter, everyone; and pause to give thanks for all we have, including this forum!3 points

-

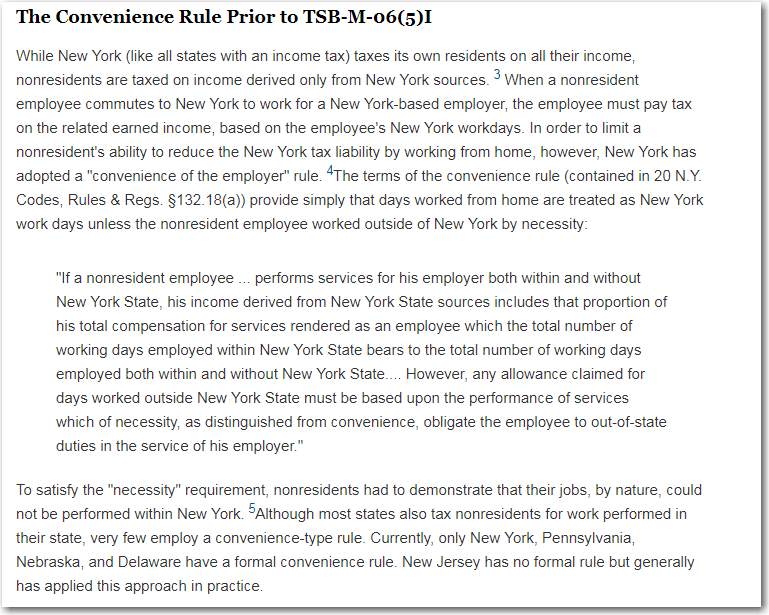

Yep. I get a lot of DIY clients who end up getting NY letters and then wanting to amend CT (CT's an easy return but a bit of a pain to amend) who stay with me ever after. Only if you work outside NY for the employer's convenience, visiting clients, training, etc., are you "out of state." If working from home for employee's convenience, he's still under the control of his NY employer, could've performed those duties at the office. It's not logical; it's the law. You should've tried an allocation, two allocations really, when NYC came into play for out-of-state residents!!2 points

-

I am working Saturday and Sunday, but I will do egg riddles, hide eggs, stuff a basket for my son (thank you, Amazon), and go to Church, egg hunt, and cook brunch for my family. A blessed Easter to all!2 points

-

Thank You....Happy Easter to you too......And all the folks on Here.....2 points

-

2 points

-

Alex is a zombie and has *ahem* lurked enough to know we're all more than a little nuts.2 points

-

No wonder, I didn't have to wait on line at the PO for a certified mail today. Too bad, it's my only break time talking to other humans. I like when someone says, oh, I need a new tax guy, sorry, not taking on new clients, that feels so good.2 points

-

When I feel my head start to tighten, like that tool old people use to take a tight cap off a jar, I know it's time to stop! I hope we're not scaring away original poster Alex.2 points

-

Thought this was to be a WEBINAR too? Maybe even live streaming? Just tie us into Rita's security system cameras and mic's and we can all experience the REAL TN happening (except for the food -- maybe make our own????).2 points

-

The part that is a first home counts, but not the part that is a rental or not the taxpayer's residence.1 point

-

I attach the appraisal as a .pdf to the return. But, you can mail with the 8453 within 3 (?) days.1 point

-

This one is pretty big. Home appraised at over 350K. Client is elderly. I just want to make sure that it is done properly. Thanks Tom Modesto, CA1 point

-

I've just scanned and attached before. Either way, IRS isn't looking at it.1 point

-

1 point

-

I'll try to help. I only have non-resident Iowa partnership k-1s, so I've never actually used this form. The allocations work well for the Iowa return. Are the K-1s coming from the same partnership? I think that based on the K-1 input, the K-1 information should only be flowing through to the state on that K-1. Are you getting the errors when you try to create the E-file? I would make sure that they are getting allocated to the correct state. You can send the NE K-1 copy as a PDF attached to the return if you can ever get the e-file created. I would not be surprised if you had to paper file, just because NE is a little antiquated and ATX is not really up to speed on Nebraska returns. I have been begging to have partnership and corporation returns added to ATX's efile program ever since Nebraska finally figured it out and allowed e-filing a couple of years ago. I hope this helped a little, but I don't see any other way to get the correct state except for in the address.1 point

-

And Happy Easter to everyone here. Our office is never open on Good Friday but I work and am finishing up a couple of complicated returns today. I will work on State Corporate and Partnership extensions tomorrow as well as do our monthly billings. And then I will take the rest of the weekend off. Up early Easter morning for a sunrise service at the local church camp followed by a wonderful brunch and great fellowship, Then it will be time for me to head to the couch for my Easter nap! A Blessed Easter to one and all!1 point

-

Possibly. Some antivirus software likes to make decisions for you to keep you safer.1 point

-

Yep, I saved this thread to her computer folder while talking to her on the phone. Saving the links now, also, separately. Max: your link doesn't go anyplace. Would you please upload it or type in the link. Thank you.1 point

-

1 point

-

Drake's program wouldn't cause this. Even though you say Drake is the only new program, do you have any programs set to auto-update, or running any other AV like Malwarebytes? It might only be a conflict with another program that updated and not a virus or malware infection that turned it off. A conflict shouldn't switch your setting over to auto update though. I'd check the list of installed updates and installed programs through Control Panel to see if anything pops out there. Run scans through any AV programs for a start.1 point

-

Mine too. Using the quiet to get some work done. See how hard I'm working right now.1 point

-

1 point

-

ABC qualifies for an exception to the penalty you charged under IRC Section 6698(a)(1), because all two (2) partners, XZ, 222-22-2222, and YZ, 333-33-3333, reported all their shares of income and deductions timely on their joint 2008 income tax return Form 1040. Therefore, the partnership meets the criteria specified in Rev. Proc. 84-35, which says in part: “A domestic partnership composed of 10 or fewer partners and coming within the exception outlined in section 6231(a)(1)(B) of the Code will be considered to have met the reasonable cause test and will not be subject to the penalty imposed by section 6698 for the failure to file a complete or timely partnership return, provided that the partnership, or any of the partners, establishes, if so required by the Internal Revenue Service, that all partners have fully reported their shares of the income, deductions, and credits of the partnership on their timely filed income tax returns.” We trust that you will remove the penalty due to reasonable cause for small companies.1 point

-

1 point

-

1 point

-

Doubt I'll have time to write it by then. Yeah, and it might just be a bit shy of 'three hours'.1 point

-

That could be similar to my husband's reaction when I get home before dark anytime from January through April.1 point

-

1 point

-

I am in, but only for $25. I am a cheap skate. That is the early sign up period discount - just like ATX. Tom Modesto, CA1 point

-

You are putting on a three hour seminar this summer, right? Put the book in .pdf, buy some cheap flash drives and sell them there!!1 point

-

Just checked the ATX User Guide and it only says to 'drag and drop'. I should start a Hidden Features of ATX book and sell it to users for 45 bucks.1 point

-

I don't do Zombie... I do prickly. I can go along with about anything... Until you go to far, and then its... ZAP. Gotta be careful with that. Rich1 point

-

I would never use the auto check feature to tell IRS they can talk to me about the return. First, I hear they don't honor that box and want a 2484 anyway. Second, some of those clients I'd prefer THEY talk to IRS. Let them explain their expenses. Although I've asked them if they have all the required receipts, log books, records, etc., I sometimes wonder..... Most clients I do check the box, but there are others....1 point