Leaderboard

Popular Content

Showing content with the highest reputation on 03/08/2022 in all areas

-

Use the next day the market is open as part of the calculation. see § 20.2031-2(b)(1) where it says "within a reasonable time"3 points

-

2 points

-

Geez. Now that I've thought this through, I feel like a complete idiot for posting this. Sometimes I can't see the forest through the trees. I know that never happens to anyone but me :(.2 points

-

Me - making mountains out of mole hills in my stressed state. I deleted the K1 and re-entered. Duh. On another note- Can I strangle someone for allowing deferral of tax on IRA distributions last year..........2 points

-

where did you hear/see this? That's an interesting mess.2 points

-

As for amending, I'd do the math and let the client decide. With figures from 12 years ago showing basis of $250,000 and $1 million in FMV at that time, what is the FMV now? We don't know the amounts of these distributions, the % of basis to be recovered, or what the tax brackets were in the open years, so we shouldn't say whether or not amending is worth it to the client.2 points

-

I wouldn't amend. All that happened is that the taxpayer didn't recover any of his basis and still has it. Enter that on Line 2 of the 8606. The software will do the math as to how much of the current year distribution is taxable.2 points

-

I had one where IRS wanted all the clients' tax docs. All were the type already reported to IRS like 1099Rs, INT, DiV, etc. I didn't tell the client, but my suspicion was that another return had been filed for these people and IRS was trying to determine who was the real taxpayer. (The fraudster wouldn't have the original docs that exactly matched the real return.) I think grandmabee and Pacun's posts expose conspiracy theories that may be circulating. Hopefully this kind of information doesn't go viral. Our clients read that stuff.2 points

-

This proves why DIY software can be dangerous. It takes a tax professional to know what the return is supposed to look like and catch these data entry errors. To me, the most important part of tax prep is looking at the return when it's completed to be sure everything makes sense and is where it's supposed to be. Believe me, I am not looking for new business and rarely take new clients, and I would be beyond bored if all I did was easy 1040s. (At this time of year, is there such a thing?) Lots of folks could easily do their own returns with no problems, but EIP and ACTC and premium tax credits and on and on make that less likely for many. As I've said before, at least half of the returns I do have something missing, and if software doesn't alert the DIY folks who knows what they're missing out on. Like attempting your own electrical work or plumbing, it's important to know what you don't know and turn to a pro.2 points

-

It's a huge system and none of us has seen every page of every form.2 points

-

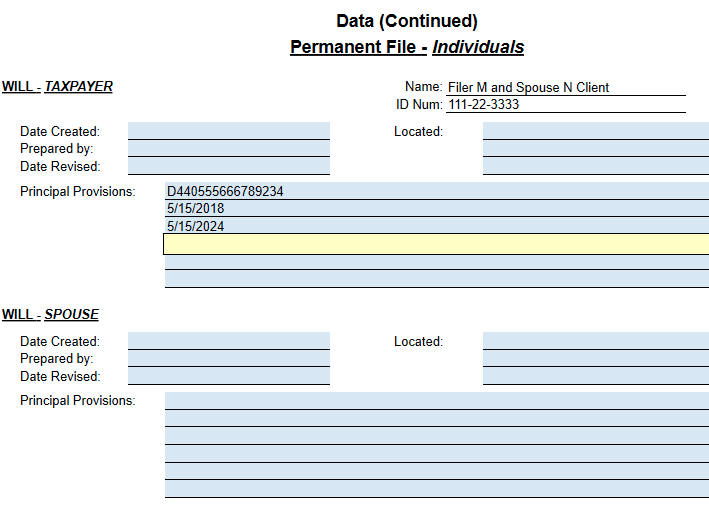

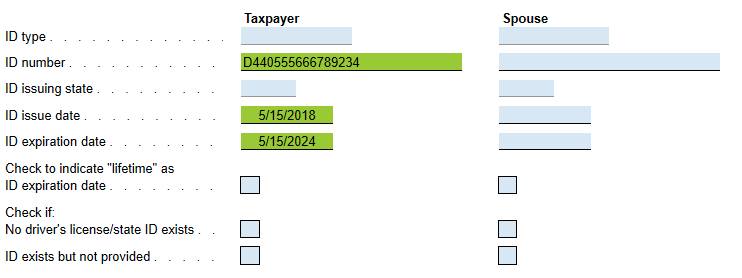

WOW, I have been using ATX since the saber days and I didn't know there was a "permanent file tab" Where have I been?????2 points

-

Plus this gets complained about every year, and I had recently suggested just keeping a note, so you could copy/paste the license number into ATX. Then last night, it just hit me. Enter it somewhere else in ATX that will rollover and link it. I was having a rough day where nothing went right, so I had a shower, drank a beer and it hit me. Besides linking fields in ATX is one of the best features and also one of the most underutilized features. I'd bet that the majority of users don't even know it's there.2 points

-

Add the Permanent File form and on the Data 2 tab, enter the license number, issue date and expiration date on 3 separate lines. Then link those lines to the Main Info form. This will need to be tested to see if causes any efile rejections, but the Permanent File form will rollover and the links will be there.1 point

-

Thanks, Judy @jklcpa. It's what I figured - but of course this was a DOD over a Christmas holiday weekend and markets were closed day for like four days straight. And there was a huge jump in stock price on the stock that was sold by the executor, too. Got to over-thinking it and needed a hand-hold to extricate myself.1 point

-

MassDOR is famous for demanding proof of withheld tax from the Mass Teachers Retirement system. Who administers that system, sends out the payments, and withholds the taxes? If you said MassDOR, you'd be 100% correct! So they ask retired teachers to prove to MassDOR that MassDOR withheld the tax they say they withheld. One poor lady they demanded the same thing every year for about four (or five, or six) years, when I finally got a POA from her and lambasted them for harassing her. Politely, but I reamed them one. They did not ask the next year...1 point

-

I believe they could, but I think what the others are saying is it would most likely not be the best tax move because of the tax rates the estate would pay in addition to the NIIT. We may not have all the info to make that judgement, but I tend to agree that with what we have to work with, passing the income to the beneficiaries seems like it will produce a lower tax to them. Tom Longview, TX1 point

-

It's a tossup who gives better tax advice a realtor or a barber? Assuming the previous LLC filed a 1065, that tax entity ended on the day the sale closed. Which leaves a SMLLC which is a disregarded entity.1 point

-

Disregard, I figured it out! Thanks!1 point

-

I don't know if there is a better way, but you could always delete and re-enter that one K-1.1 point

-

1 point

-

If you made improvements, you could also have additional depreciation.1 point

-

I personally received one, I do some consulting work and I request for all my earnings to be sent to my federal withholding, COVID hit and the irs never processed the 2019 1099s, I resolved it by sending in a copy.1 point

-

I have never seen an estate that has a required income distribution, only some trusts. I don't understand why the estate is hanging on to the money instead of distributing it. If this is the only remaining asset, there is no reason to do so. Sometimes estates distribute everything but a reasonable sum to pay accounting and attorney fees, etc. The estate then closes for tax purposes even though a bank account remains open. (Yes, an estate can close for tax purposes even though not formally closed by the situs state.) Sounds to me like the executor is not doing his/her fiduciary duty. If all the beneficiaries are in the same tax bracket and will pay the same NIIT as the estate, I guess it makes no difference which one pays the tax.1 point

-

Yes, our office had one today. possi1 point

-

Depreciation uses 39 year. Direct expenses go 100% against the rental income received. Utilities are prorated based on the portion rented vs the portion used by the owners. Use the same ratio for taxes, house insurance, mortgage, etc. Don't forget to deduct from Schedule E a different portion of personal cell phone if used to receive calls or to check reservations from clients and your payment. I hope they don't cook for their clients because it could become ugly.1 point

-

If I am not mistaken, the IRS gets everything together in December. They trust the W2s have the withholding claimed but the IRS doesn't have proof of that, hence they send fraudulent refunds with invented W2s.1 point

-

1 point

-

I just read on another board that tiga put out a report that IRS shredded over 30 million information returns last year because they couldn't get them processed. We may be seeing a lot of these request.1 point

-

Unless the pension file did not get uploaded into the IRS computers correctly and there is a mismatch between the return and what they have? Tom Longview, TX1 point

-

Generally for IRAs, the custodian will put the full amount as taxable in Box 2a, but will check the "Taxable amount not determined" box in 2b. That's because the custodian does not usually know if there is any basis (and is not required to track basis). It is up to the taxpayer (or you) to keep track of the basis using Form 8606, which is required each year there is a distribution.1 point

-

I can do that. I just thought it was weird they were asking for that when they would have received the federal copy of the 1099 and should also have social security on file. It seemed weird they would ask for info they should have already, when they are understaffed.1 point

-

I have. We supplied a copy of the W2 / 1099, showing the withholdings. That satisfied their inquiry.1 point

-

1 point

-

"A. Yes, they are. However, if there are any unexpended retirement contributions in the late spouse’s account, a portion of the annuity would be tax-free. For more information, go to https://www.irs.gov/publications/p721/index.htm"1 point

-

You are my hero. I spent 20 minutes trying to figure this out before I stumbled on this post. Thank you, thank you. I love this forum. Reminds me to go make my annual donation!!1 point

-

Yeah, I have a client who is a full time Home Health Aide for a wealthy family who gets paid about $ 25 per hour. She doesn't receive a W-2 or a 1099. I have explained the situation to her but she really likes her job and doesn't want to rock the boat. So I report her income on Schedule C,and she pays the SE tax.1 point

-

The Realtor and Tile Company who handled the sale will be your best friend here. They can tell you who sold the property (it has to be recorded). Get the TIN of the seller and most of your answers will follow. Tom Longview, TX1 point

-

Do you call your shower creations Water Music ?1 point

-

Yes, step-up to DOD FMV. But OP doesn't say when was DOD, how long the estate owned the house. Just that there was no activity in the estate until 2021 when the house was sold. We don't know how much appreciation since DOD.1 point

-

1 point

-

My mind works 24/7. I have some of my best ideas in the shower. I've considered billing clients for my shower time, when I come up with a solution for their problem. But seriously, this year, I'm only part time because I am done as of the 18th. Although I'm sure I'll get calls for at least a year from those wanting to pick my brain.1 point

-

And the answer is...there isn't one! I neglected to see that I didn't give enough info regarding what kind of penalty, etc. Now I could say I sprung out my back and was loopy from muscle relaxers, but that's just whining, isn't it1 point

-

Just a wild guess, but I'm thinking maybe....umm...."Do not pass go; do not collect $200!"1 point

-

"The IRS plans to hire 10,000 new full-time workers to play a direct role in helping the agency reduce its backlog of millions of unprocessed tax returns and other mail from individual and business taxpayers, according to the leader of the union that represents most of the IRS workforce. The National Treasury Employees Union “has received notification that the IRS has been granted Direct Hire Authority for roughly 10,000 entry-level positions in submission processing and accounts management, presumably to help address concerns that the agency’s hiring process is difficult and slow,” said the union’s national president, Tony Reardon." This won't help this tax season. Hopefully, they can get the backlog reduced some by the beginning of next tax season.1 point

-

Did they file for retroactive reinstatement, which would go back to the the date of revocation? Otherwise I think the postmark date in November is the reinstatement date.1 point

-

1 point

-

I had a client bring in a notebook today with the clear pages that each tax doc was inserted. So I have to pull them all out and copy and then yes he wants them back into the clear jackets and put back into the notebook. They think they are being helpful, helpful would be clients who open the enveloped and throw them away.1 point

-

It was actually not that hard after I fiddled around with it. Actually, I duplicated the return and fiddled in that one until I had it right. I prepared the 8824 first, then went to fixed assets, disposition tab, type exchange. Once I completed the disposition a new asset was created, but I was able to edit the activity. Everything flowed smoothly through to the Sch. E. It is pretty slick. Reminds me why I stick with ATX. This was one of those transactions I don't do very often, so I needed a quiet time to play with it. Tom Modesto, CA1 point

-

I noticed ATX charged my credit card over $500. I’ve called, asked support over a week ago. The only response I’ve gotten is that they have internal issues with billing. No one will call me.0 points