Leaderboard

Popular Content

Showing content with the highest reputation on 04/12/2024 in all areas

-

Almost over people !!! Take a couple weeks off then finish the stragglers we filed extensions for. Its been a trying year that has dragged on forever !!! Been saying for years we need to cut back, but this year solidifies we need to. Tired and wore out as I imagine we all are. Hope everyone has a fantastic summer !!7 points

-

Amazingly 20 minutes after e-mail she shows up all apologetic. Didn't give her the return, only the original documents.6 points

-

I did see that happen one time (over 20 years ago). I hadn’t prepared the extension or the return, but was asked to look over an audit report. The original extension request showed zeros on all lines. The actual tax liability was significant - $15 k or so. The taxpayer was self-employed and clearly should have know there would be tax due. The audit only turned up a nominal amount of additional tax - maybe $1k or so. But the auditor added full FTF penalties, stating that a reasonable estimate of the tax liability was absent from the 4868 and thus it was invalid. That’s the only time I’ve ever seen that happen, so I conclude there’s no attention paid to the numbers in the 4868 unless there’s an audit. But then they have a slam-dunk case for invalidating the extension retroactively if the extension shows all zeros. That’s why I agree with the approach to estimate the projected tax liability high, even if there’s only a token payment (or no payment) submitted with the 4868. It’s perfectly fine to lowball the payment (or even not submit a payment), but don’t lowball the expected liability.6 points

-

5 points

-

I'm essentially done other than one that is a total PITA. They dropped off info late March. I sent email of a couple basic items missing. Various emails over the last 2 weeks to get the info. Sent email that they were done Tues, and she replied she will pick up today. Did not answer my return email as to what time today. I sent another this morning saying they need to be picked up by 1 pm. At 1:05 I'll be sending another email with password protected file of their original documents telling them they need to go somewhere else. They have 1 dependent that graduated HS in 2023 and another in college. Guessing at least one of them filed their own returns without indicating they were being claimed by someone else. Same crap happened last year and needed to prepare a revised return for them on 4/18 because kid claimed herself. I can be very nice until I feel taken advantage of. When I reach that point, look out!5 points

-

If I have nothing, I just use last year's tax as a guesstimate for this year. I automate that in ATX by linking the prior year tax from the comparison form to the 4868. It's better than zero.5 points

-

Wait a minute! I don't remember you under your desk with a bottle of whiskey. (Full or empty?) Was that in my handout?!5 points

-

just enter the amount that was rolled over at the bottom of the 1099-R worksheet, will show zero taxable on the 1040. Didn't need to be issued if it was institution to institution--but it could be correct if taxpayer moved the money themselves.5 points

-

I saw a note in ATX that they now track basis for PTP K1s, which is nice I suppose, but the K1 always includes supplemental pages when units are sold, to show the cumulative decreases in basis, and the amount of ordinary income for you, so I doubt I'd ever bother with that. I had one yesterday where units were transferred to a new account, and the K1 included all the info as if the units were sold. I checked the 1099B and the K1 was not listed as a sale, so I ignored those pages, but I worry what will happen with those amount when the investment is sold. If those amounts should have transferred with the units in the new account, then it may be lost. I allocated some carryover losses to the new account because I thought that made sense. Sometimes, you just can't worry about tracking all this nonsense.4 points

-

Holding your ground is a good thing. Erosion (I am a left coaster so it is physical as well as mental) hurts.4 points

-

Farm and ranch fences are specifically listed under asset class 01.1 and are 7 year GDS. Keep in mind these are pasture or range type fences, not corrals which are 15 year property. New ones are made out of steel post and wire, and that is not cheap. Neither is labor cost which varies with the terrain. Fences are often overlooked and I have used 3115 several times for that purpose. You need to reduce that basis of the land for the amount allocated to the fencing. The client needs to make an estimate of the value at time the property was acquired considering: the condition, age of the fence, and replacement cost at the time. You also have to consider partial ownership of boundary fences in some cases. The last one I did came out to $93,000 which was about 1/2 the replacement value of about 10 miles of fence. That was for a relatively small parcel of property. This is right up my alley because I also do fencing as part of my other work. I am starting on a couple mile project next week!4 points

-

You'd get to see the (totally staged) photo of me hiding under my desk with a bottle of whiskey, when the full extent of the debacle becomes known...4 points

-

I'm fortunate enough to be at a point in my life where I don't need to be bringing in money from preparing returns. For the most part, I still enjoy it and the vast majority of my clients I look forward to seeing each year. Email sent and now I'm going to go dig in some dirt and plant some veggie seeds!3 points

-

But then we're waiting on signatures to direct debit payment to the IRS, and especially to the states where so many require payment to accept the extension. I've been sending these late ones to DirectPay and their state equivalents. Then they call/email me with questions, but I can go only so far in the states to tell them each step. I'm tired. And, cranky!3 points

-

3 points

-

"Court appointed" is why I said to attach a pdf of the Short Certificate that the son has already obtained. Here, the Register of Wills is THE agency with the authority and issues the Short Certificate because our county Register of Wills is a branch of the Court of Chancery and definitely has the legal authority to issue that document showing the official legal appointment of the named executor to act on behalf of the estate. Maybe it works differently where you live, but an executor here with a Short Certificate in hand has all he or she needs and could definitely file without the 1310.3 points

-

Next lesson: we cannot allow ourselves to care more than the client does. Care about the quality of our work, yes! Care more than they about penalties for being late? Nope. And I at least have to re-learn this every couple of years.3 points

-

Anyone looking for a couple of CPE hours in late April, I'm presenting online. https://www.bigmarker.com/tax-practice-pro-inc1/When-1040s-Go-Wrong-Navigating-a-Tax-Train-Wreck @Lion EA saw the first presentation of this, live, last September.2 points

-

Thank you all! I put $1 in box one and shipped it off. No state return affected. Same organization did her 2023 return and reported all income in all 3 boxes. I still think both year's W2s are incorrect, as I think the money was her living stipend, but unless/until she gets me her agreement, it stands as reported. Thanks again!2 points

-

I have always agreed with your statement. My threshold gets lower and lower every day. For instance, I have a hard line of end of relationship when a customer sends me something my granddaughter should not see. It is a matter of being professional/business-like, as well as liking to have her in play in the room when I am working.2 points

-

It is very peaceful to let go of those whose revenue does not cover their expense and headache. Although long ago someone here said there is a price which makes any client worth having, and our job is to get that full price.2 points

-

From the instructions, Form 1310 with Box B checked is only required for an amended return, not the original return:2 points

-

If a client wants to file a zero extension, tell them to go online at irs.gov and use Direct Pay to pay something before the deadline--counts as filing an extension. If they balk...not a very good client.2 points

-

I have never found an appraiser who will put a value on a fence, even for large estates with miles upon miles of fencing. It is a good faith reasonable estimate following AICPA standards. Otherwise clients are missing out on allowable depreciation. On the other hand, I have seen buyers (non-clients) put values way beyond what the actual replacement cost would be.2 points

-

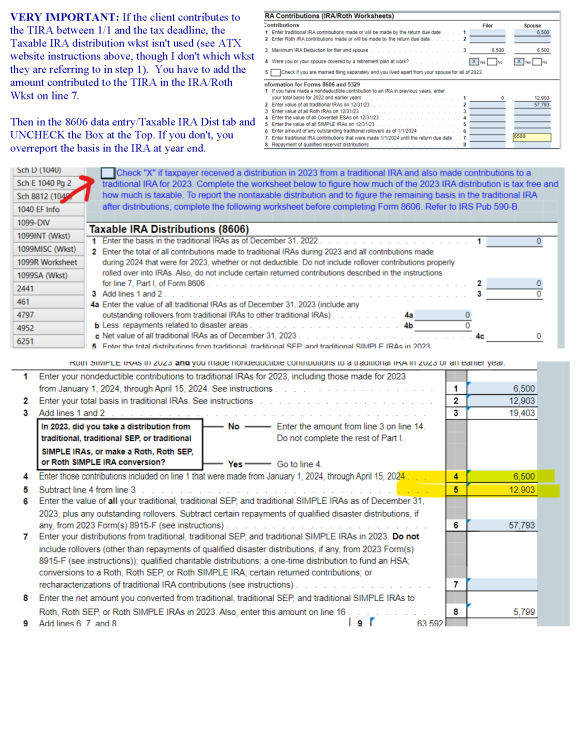

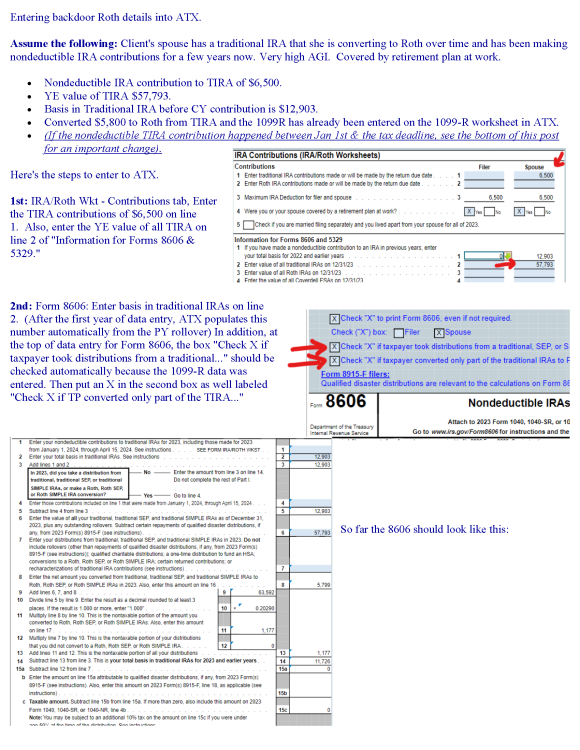

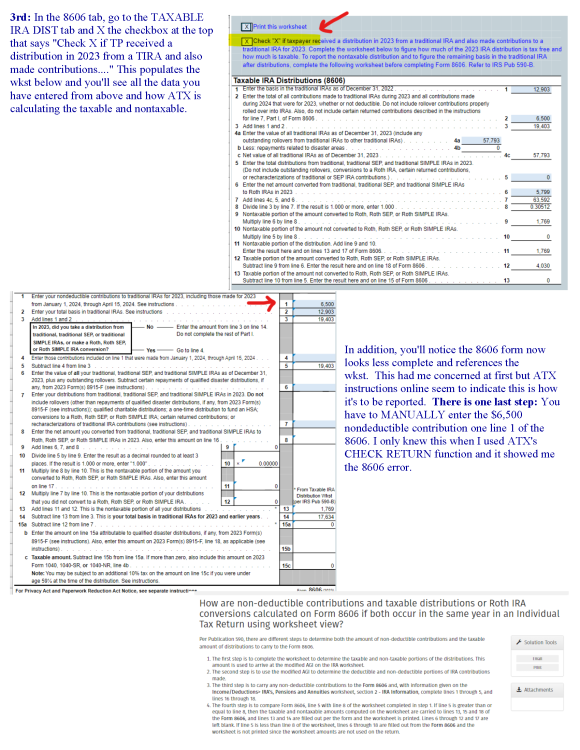

I prepare these cheats for myself so I don't have to always go through the torture of navigating ATX data entry. Maybe this helps anyone that needs to enter backdoor Roth details into ATX. PDF attached with the instructions I use for Backdoor Roth in ATX with Aggregation & PY Basis. Good luck and please, if someone sees an error, let me know! Hopefully this formatting is easier to read than the first post.2 points

-

I don't like to file zero extensions unless I'm absolutely sure the client is due refunds. IRS can reject extensions you know. Say someone ends up owing $50k and filed a zero extension, IRS can say No Way and hit him with failure to file penalties. I've never seen it happen--has anyone else? I'd have the client pay $10 or something with the extensions.2 points

-

Can't start depreciating a 2017 asset this year. Maybe a 3115 for which you'll bill him an arm and a leg.2 points

-

It's more likely that this is some sort of stipend that isn't taxable as federal wages but had the SS & Medicare withheld. As others said, either ignore the w-2 completely or enter $1 as federal taxable wages. Personally I'd ignore it if there isn't anything in any other boxes that needs reporting. Nothing on the that W-2 that affects any state return?2 points

-

The person who set it up made a lot of money. Apparently enough to "incentivize" brokers.2 points

-

Indeed, posted prominently in my space: Lack of planning on your part does not constitute an emergency on my part. I also have to remind myself of this frequently, however, as it seems at times I care more about the client than they do.2 points

-

When there is NO information on which to base anything - no papers at all, a client who varies year to year from owing v getting refunds - the worst that happens, that I see, is that the IRS invalidates the extension later. But they may not. If there ends up being a refund, you have extended the statute for collecting that refund an additional 6 months. I have a couple of clients who show up every 3 years, with 3 years' worth of documents in hand. I put in extensions, every year, just in case. They know the risks (as they get told, by yours truly) and if they don't pay anything it's all on them. I figure it's worth a try, for minimal effort on my part.1 point

-

1 point

-

1 point

-

We treat the payments as a separate from the extension, and the client handles that, most of the time. so we efile extensions without payments and let those who normally know they should make a payment.1 point

-

Yes, this is correct. It depends on how long the investment has been held.1 point

-

That's what I do too, but it is so frustrating. This is a large return in terms of the number of bank, brokerage, and retirement accounts and pensions this couple has.1 point

-

Is this a DIY project for a tax payer, or does it require an unbiased third-party cost segregator to break out the land from the fences from other land improvements to depreciate? Like getting a qualified appraiser.1 point

-

1 point

-

1 point

-

1 point

-

That always annoyed me to no end, but I wonder if it's because many of us don't work the off season, and so might miss any notices sent later. Like others, I quit MAX 2 years ago. Last year it worked out to be about the same cost, but then I fired all my non-profits, and a bunch of 1040 clients. This year I'll fire more 1040s. Goal is to hold onto tax season but without extensions and without clients who stress me out, lol. This year the delay in so many K1s is kinda screwing that up, but as long as I have everything done and double checked, I'm ok with just plugging in the K1s later on.1 point

-

1 point

-

It's a lot less work for both you and for the IRS to handle with a 3115 and just the current year. It basically works out the same in the end, except for some IRS interest.1 point

-

Form 3115 is the correct way to do it.....but I would just add the capital improvements in 2023, sell the rental and be done with it. I know that is not how it "should" be done, but the gain remains the same. What changes is the amount of depreciation recaptured, but since it was not deducted against ordinary income there is no harm, so no foul. If audited, the IRS should recognize immediately that there is no tax to be harvested. But if you want a higher fee, do it via the 3115. Tom Longview, TX1 point

-

BrewOne, no composite return; the partnership paid the PTET for this partner, so a NY return was required. I was able to finish the return, send to the TP and successfully efile the returns.1 point

-

I did reboot last night. And, well - it worked today. (Not last night when I was panicking.) Thank you Mr. Slippery Pencil!1 point

-

1 point

-

Along the same lines but slightly different, my client has signed up for Acorns (that app that lets you round up your purchases and invest the change). And they have like 25 trades of fractional shares of 3 different mutual funds both short and long term and wash sales that don't even add up to $0.50. What a pain for a $2 net loss on the Schedule D. Cost them more for my services than they will ever realize from the investments. Tom Longview, TX1 point

-

Okay, if it's not a hobby I guess you can't lump it all together because you can't take any losses, you can only zero out personal items sold at a loss. You need to report the total amount from the Schedule K-1 but you should only pay taxes on the profitable items. The IRS says if you get a 1099-K for a personal item you sold at a loss that you can put it on Schedule 1 (8z) and then put a negative amount on Schedule 1 (24z) to zero it out. This is going to be a big problem going forward and I would look at Schedule 1 before I tried to put everything on the 8949.1 point

-

If there are bunches, or bleepity-bleep bunches, then do a profit for each month and a loss for each month. In your case of 6 months, you'd have no more than 12 lines, fewer if not all months had both gains and losses. It's almost April, and I do less typing as it gets closer to the deadline. Not right, but it's practical. The more lines I have to type, the longer it takes me to proofread. Don't tell the IRS. Or, my clients!1 point