Leaderboard

Popular Content

Showing content with the highest reputation on 02/21/2022 in all areas

-

I like getting the 1099DIVs that still have the last quarter of the year's check attached. Is this my tip?5 points

-

This evening, I called the gal who worked for me pre-Covid and pre-Vaccine and asked her if she would think about coming in for a few days a month to help out. No hesitation. She said that her life is so boring. I told her that she could balance checkbooks, do bookkeeping and would not have to prepare tax returns unless she wanted to. She is all for it. I just got my third license downloaded and working on Saturday so I know she will do simple returns. We are getting so far behind already as I am teaching and interviewing and getting too many interruptions to actually get much work done during the day. Therefore, all I can say is Woo Hoo!! I have always believed in doing the best job possible and even if I don't have as much profit as usual this year; it will be worth it to get these returns done correctly. Who knows what is still ahead of us!!!!4 points

-

Client is a high income couple, he is self-employed. Has been able to max out his SEP contribution every year. Asked me what the limit was earlier in the year. I gave him the amounts right off the IRS website which say: 25% of your net self-employment income or $58K, whichever is less. I forgot to add the part about the special rule for self-employed. He did not earn enough this year to max out under the special rule at 20%, but did if you take the general rule of 25%. When I was preparing the return, I let him know he had to withdraw the excess contribution and now he is pissed at me. It is my fault, I should have been more specific about the rate. Sometimes it sucks to do this job. Thanks for letting me whine about my mistake. Tom Longview, TX4 points

-

If the contribution was made in 2022, then he can just apply the rest to the 2022 contribution.4 points

-

Ditto. We all understand, but we know your client doesn't always understand. Apologize for being rushed, but don't apologize for giving a too-simplified answer while rushed. Because, human...4 points

-

4 points

-

We've all done this, which is why I prefer to run it through the software to be certain of my answer, in some cases.3 points

-

I'm sorry, Tom. Don't be too hard on yourself because we all make mistakes from time to time. Like you, mine are usually with the most demanding of clients and are usually not answers to the most complicated of questions they ask.3 points

-

Hubby could claim one child and still get the credits, because he didn't claim the child last year. Obviously, claiming both children will get him more! If wife's income is high enough to have to pay back, try each with one child to see if the household as a whole does better. We're spending more time on each client. I'm going to get some pushback on my fees this year!3 points

-

Part of the problem is that a lot of taxpayers got debit cards, which don't show up on bank statements. I have one client who got the three stimulus payments all three ways--check, dir deposit, dr card. Like posters here, most good tax pros prod clients and make them go hunting for those payments they claim they didn't get. I wonder how much of the backlog of returns IRS is hand reviewing came from self-prepareds? Our clients tell us they didn't get anything and we send them searching. Tell Turbo Tax you got zero and move on to the next screen. This gets me thinking about how accurate those DIY returns can be. I estimate close to half of the returns I get are missing some doc or another. A stray dividend, pension, IRA, HSA, 529 contribution, child care, you know. Maybe the software prods for this info so users go find it. I'm not trying to create more business; in fact, I don't like to waste my time doing one W-2 and maybe some interest returns. I tell clients with not much going on that they are eligible for free VITA or AARP tax prep. It's no wonder the IRS is calling tax pros partners again--we keep their number of notices and subsequent phone calls down.3 points

-

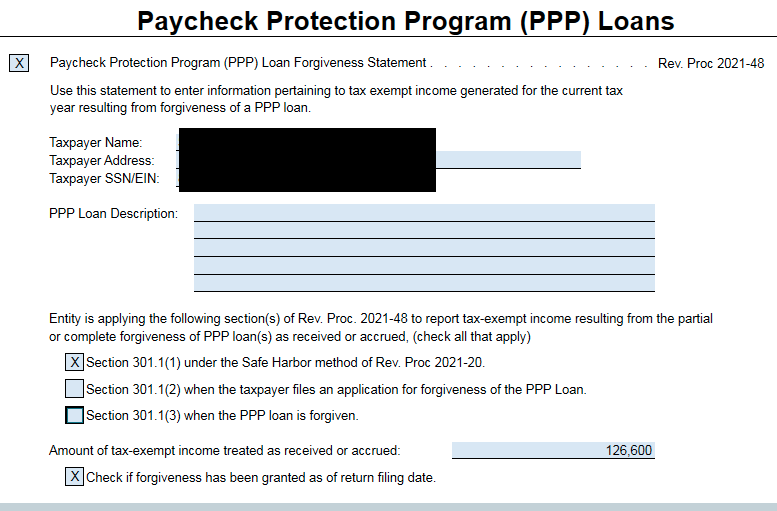

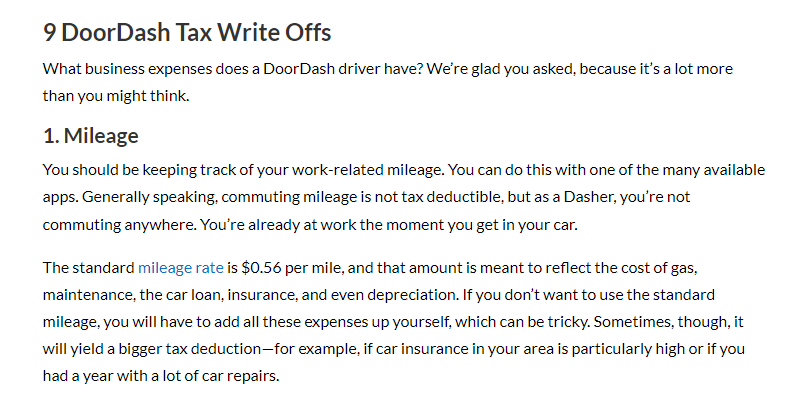

Thanks guys. I was inclined to ignore the commuting miles to first and from last pickup until I read this (attached) from a "tax advisor" and started second guessing myself. I had already told her no commuting mileage and I'm not venturing into a home office with her when all she's doing is answering her phone there.2 points

-

If the student files on their own for the non-refundable portion, their income would need to be over 17,550 to see any net tax benefit. After standard deduction, 17550 earned income would have $500 tax offset by the non-refundable AOC. Mom loses the $500 other dependent credit, so break even. Also, it money Mom took from retirement was an IRA, see if it can be exempt from 10% penalty for higher education expenses.2 points

-

I think you may be mistaken. This from IRS.gov: Who is an eligible student for AOTC? To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential Be enrolled at least half time for at least one academic period* beginning in the tax year Not have finished the first four years of higher education at the beginning of the tax year Not have claimed the AOTC or the former Hope credit for more than four tax years Not have a felony drug conviction at the end of the tax year My bold above. This is why I have alerted clients with college bound children to carefully consider when to pay what. At times, it has been beneficial to not take AOTC for the first fall semester, at other times it was better to prepay the last spring semester to be within the four tax years.2 points

-

I just go with what the report says. I don't add miles to it. It is my understanding that Uber now count the miles when you first connect to their application. So technically, you could drive a lot of miles before you pick up anyone and those miles will be reported. Remember that it is a business need for the uber driver to move to busy areas after each food or passenger is dropped otherwise they could stay parked all night. I personally hate home office because they are painted gray. I have done only a few in my life time and for sure NOT for uber drivers. Most of the records they present are pulled in two minutes from uber's website and they consist of their 1099 forms and report at tax time.2 points

-

Likely only the mileage from the pickup to the delivery is allowable, unless there are back to back gigs before going home. Maybe during times when there may be multiple gigs, advise to park somewhere along the way for some amount of time, waiting for another gig, instead of always going home? Since rural, there may be enough miles to make the waiting time worth it?2 points

-

The miles from pickup location to delivery location are deductible. What you want to get is the miles from home/garage to pickup location and from delivery back to home/garage location. That takes a legitimate business office in the home. Do they have a legitimate, regular and exclusive office in the home? Do they check their app from that office in the home? Do they do their bookkeeping from that location? Are they running the activity like a business so they can claim the office in the home? If they don't have a home office, I only take the miles between stops. Tom Longview, TX2 points

-

This is a good point, but also remember that, not only is it available for only 4 tax years, the AOTC is also only available for the first 4 years of postsecondary curriculum, as determined by the educational institution, generally the freshman through senior years.2 points

-

What Lion said, unless one of the employers withheld too much SS or Tier 1 RRTA, or it is excess Tier 2 RRTA. Even if there are multiple employers, if one withheld too much then the employee must go back to the employer. If there's too much Tier 2 RRTA, then form 843 is required. https://www.irs.gov/taxtopics/tc6082 points

-

For the non-refundable portion, see https://www.irs.gov/publications/p970#en_US_2021_publink1000204381 For the refundable portion, there are additional requirements - see https://www.irs.gov/publications/p970#en_US_2021_publink10002117992 points

-

2 points

-

2 points

-

We had a "Hold" box last year for the unemployment issue, once it was announced. We also had to wait for Wisconsin to update their forms as WI did not follow the protocol of the IRS on this issue. This year, so far, I have not had a single client come in without the letter from the IRS regarding the EIP and none of them have argued with what their letter said. SO FAR!!!2 points

-

The best thing I've ever gotten in a client's bits was a $50 off coupon for H&R Block. I thought about dropping their return off. The second best thing I've ever gotten was a 1099-SSA with a huge red stain on it and an arrow to a note from my client saying 'this is squash'.2 points

-

I agree with Margaret. It doesn't have to be the FIRST four years. And, it doesn't have to be four CONSECUTIVE years.1 point

-

The IRS words it on their online "assistant" as...Has the student received four years academic credit for postsecondary education before the beginning of 2021? Of course, you still can take it only four times, so the five years or longer (part-time, stop and restart college, for example) you still have to count/keep track of how often a student used it. I've amended a student who took it her first year/fall at a community college and then transferred to a much more expensive college to use all four years of eligibility at the more expensive college.1 point

-

That will be over 5 calendar years though, as the student almost always starts in fall. In actuality, it can run over several calendar years as the requirement is "at least 1/2 time".1 point

-

Yes, that would work as long as the next year's course that is being prepaid begins within the first 3 months of the year.1 point

-

This is her only job. It's a rural area so she doesn't go anywhere unless she gets a notification from the app. Once she accepts the job, she leaves home and goes to pickup/deliver whatever. She doesnt really have an office, she's just using her phone to get notices.1 point

-

Tom makes great points. I have been 'round and 'round this one for years when I was training amateur game (but paid) umpires. Most were going to their gigs from their day job and wanting to claim home office and travel. I was able to (for instance) swing by my main work before going to my games, even on weekends or for weekend tournaments. I also had a separate desk for the computer, which I was only using for game scheduling, training prep, etc. A tiny fraction of one room, but it was still exclusive use. My main work was less than half a mile from home... The main person who was spouting the other scenario, where he was claiming mileage to and from home, was another trainer, and since he has never been audited, believes he is in the right. He would always tell the newbies if they were not showing at least a 3x loss every year (because of expenses) they were doing something wrong.1 point

-

Let me assume that the wife makes less than $50K and that the old child is 7. If the mother claimed the old child, she will not have to return any of the $1,500 she got in advanced and the husband will get $6,600 as child tax credit. If they split the children, they will get $1,500 less child tax credit. Regardless, don't forget that the new born will also get $1,400 stimulus.1 point

-

1 point

-

1 point

-

They might be eligible for the non-refundable portion of AOC if they meet all the other requirements. Or, the LLC. If they can get the same amount from the LLC (it'll come down to tax liability of the student, which might be small) save the AOC for another year, because it expires after four uses per student. You know the family's situation, so do the best for the family as a whole.1 point

-

If your client had only one employer who withheld SS, then he must go to his employer. If he had more than one employer that withheld SS, the excess is claimed on his return, as you say.1 point

-

In this case the husband will have to claim both children for the double dipping to occur.1 point

-

I had a client that insisted that the IRS didn't send him $1,400. I asked him to check his bank for the months of April 2021, May and June. He found that the IRS had deposited $1,400. Another told me the same story. I asked him, have you filed for the last two years and he said "yes, you have filed for me electronically (sometimes.. I mean most of the time, I don't know who is who). I went to my records and I remember that the last two years he was all kisses and hugs with his girlfriend. I said, where is your girlfriend and he said, she left with another man... I politely said "call that guy that he took your girlfriend and your EIP3 because you signed a paper to have your deposit be sent to her account and the IRS uses the last bank account to send the stimulus". We both started laughing and he that was the end of the conversation. In this case, the IRS is right or at least the computer issued a check or direct deposit. I have not found one that is wrong but a few of my clients need to be reminded where the money went.1 point

-

I seem to have gotten a lot of the plastic binder/envelope things. Not sure what they're called, but they're just a little too wide to fit in my file drawer, plus I'm not paying to mail back crap like that with their tax return. And yeah, the ones who don't open their mail and give me all the envelopes. Or include tons of stuff I don't need, often things they don't even need. But better too much than too little, sort of.1 point

-

Obviously, JohnH, they did it to see if you were paying attention! Congratulations; you win the kewpie doll. Include its FMV in your income for 2022.1 point

-

I have a couple of clients for whom we file every year without official requirements. One wants that SOL to be started. The other lives in subsidized housing and requires a copy of her return every year to prove her continued eligibility for the subsidy. If we have to prepare it anyway, it's dumb not to file it too. I charge very little for those returns (and no charge for the 2nd paper copy for the lady getting the subsidy - and she gives it to the board, or whoever demands it).1 point

-

Someone claimed as a dependent cannot get AOTC. Someone who qualifies as a dependent but is not claimed CAN get AOTC. They always get the non-refundable portion, but would have to have taxable income to benefit (the same as for Lifetime Learning). They probably do not qualify for the refundable portion, but the rules are NOT exactly the same as the dependency rules. For example, a student with no living parents would qualify, as would a 19-23 year old who is only a half-time student.1 point

-

Yes, clients have to be trained. Mine are either supplying the letters or telling me what they received. I also had the first one come in with both spouse's letters for the ACTC. I will say that last year, and will be the same this year too, that I did my absolute best to ascertain the correct information for inclusion on the returns for the EIPs and for the correct taxation of the unemployment. All of my clients opted to wait and to file correct returns for the unemployment after the law change AND programs were updated. I don't want my clients' returns ending up in limbo needing correction, IRS human intervention, or for my clients to receive notices. My clients hire me me for the best job and advice I can give them, and that will never include "file it and let the IRS sort it out" way of dealing with these issues. This is especially true now more than ever with the IRS backlog, lack of staff, and difficulty of contact.1 point

-

1 point

-

1 point

-

1 point

-

Don't be embarrassed Terry. Uber forms are new to most of us, and we've all learned something from this thread so we'll be better prepared. And you of course are well-prepared for the next one. You should only be embarrassed when you believe a client who says "my return is really simple, or "I'm head of household" (single, no dependents), or "they already took the tax out" (just the 10% early distrib, not the income tax). Or the latest: "I didn't get any stimulus payment."1 point