Leaderboard

Popular Content

Showing content with the highest reputation on 03/24/2016 in all areas

-

We finally put in a generator. Love it. Best decision we ever made. Don't know why we didn't do it years ago. Worth every penny. Even when we don't need it, it reduces my stress and worry because I know it's there and I won't be out of work for 11 days during tax season every again.5 points

-

4 points

-

4 points

-

Leave the Honey off.........just the Cashews!!!!! We have a good foot of snow and it is still coming down.4 points

-

4 points

-

I agree. On the 5329, there is a way to waive the penalty and assume that the IRS will agree. I have always filed this way, with the return and not separately, and I have never had it questioned.3 points

-

I'm going to learn to love extensions. I do a lot of financial statement, some bookkeeping, some consulting stuff that keeps me busy all year, but it would be nice not to feel that self imposed pressure for the April deadline. This year, for sure.3 points

-

I love extensions, and even the people who can't get it together until October or November or the next year, so I can work all year long and make money all year long. I almost never let someone jump my queue. I have done some quick ones ahead of their spot in line when they were nice about it and long-time clients and had a one-time need (first FAFSA is one example) and charged them a $100 rush fee or even an additional 50%. I had one this year who needed a prior year done for a mortgage, and I said No at first because I never prepare prior year returns during the main tax season. But, he's a nice guy who's been with me a long time and had everything in perfect order and offered to pay whatever I wanted; so, I charged him double. As I told him, and he was fine with it, I might lose a client for good that gets pushed farther back in the line, so I need to cover myself. $1,620. Probably worth it.3 points

-

I don't mind preparing a return after October 15th. The client is the one that pays the penalty.3 points

-

It's also OK to file it separately if the error is discovered after the return is filed. RMD's on inherited Roth IRA's are a little outside the norm, so it would easily be possible to justify the separate filing. Also, when you write the letter, you'd want to know if the Roth IRA was moved to another trustee, and what information the old or new trustee gave to the client regarding the necessity of RMD's in this situation. Having done nothing during the entire 5-year period might actually work to the client's advantage. Mainly you want the letter to be so pitiful it will make them cry.3 points

-

3 points

-

A client brought me 3 choc covered peanut butter eggs(homemade) that must weigh a lb each. If I going for Cadbury I want the Big ones.3 points

-

Time to get out the heavy equipment. Bigger coffee mug, industrial pencil sharpener, heavier paper clips, and those big pocket folders. Extra strength Tylenol wouldn't hurt either.3 points

-

If someone is absolutely determined to file by 4/15 and I have to bump them out of the regular queue, I charge a "rush" fee (or something similarly named) and tell them specifically it is because other people must wait so that I can complete their return. Hopefully teaches them something plus reimburses me slightly if there are folks I then have to contact who expected to be finished. But normally - nope. I *love* extensions as I cannot see the point in killing myself to finish a return by a deadline when the client got me papers late.3 points

-

The due date to recipients is the end of May to allow for contributions made by 4/15 for the previous tax year.2 points

-

I know the instructions say to file together. I did that for a client who owed the penalty on a regular IRA. She paid the penalty with her return. I never convinced the IRS that it was filed and paid before she died and they gave up trying to collect the 50% penalty twice. Even though I resubmitted copies over and over. And talked to people on the phone. And wrote letters. That is why if I do it again I will do a separate submission. And not pay the penalty before requesting the waiver. Most frustrating experience I ever had with IRS.2 points

-

Saw the severity of the storm on the news last night. Hope everyone stayed safe and the disruption of daily lives is over quickly. Also, if you are even thinking about going out to shovel remember this, you've been behind a desk for 2 months, so be really careful. Now where are those neighborhood kids with the shovels?2 points

-

2 points

-

This is true for me as well. It took a while for me to stop wondering "is this all there is to do" when I'd finish the input so quickly and also not have to fiddle with overrides or fixing the letters of instruction.2 points

-

2 points

-

2 points

-

Wow. I have really long hair, and I regularly send a 12 inch bunch to an organization that makes wigs for children. I have a tax practice, so I think about deductions often, and it never even occurred to me to consider deducting the cost of the haircut. Eeegads.2 points

-

Me too. This site helps me in many, many ways, including helping me to not lose my sanity. Thank you. Terry2 points

-

Not because of the date alone, but I do find that I charge more for can't get it together the later they are at can't get it together. I think that's more a function of Rita wearing on. I, too, love extensions, and never fuss at people for coming in too late for me to get their return done by April 15th. I just keep cool (well, I pretend to keep cool), and say, "Hey, thanks for bringing it in, I'll have to get you an extension, just like I get myself one, and I'll get to it as soon as I can." I go back to normal hours on April 15th and get to it when I get to it. Happy for the work. I also do not have a deadline for dropping off, because I'd feel obligated to get those returns done. I feel like that is fair. And clients do, too. Trust me, they do. If I give you a deadline, I'm imposing one on myself. Prefer to be laid back about it. There is never a time from last week of January on that I am caught up. It would be worse if I had more drop offs because of a deadline I set. I already can't get done by April 15th. And, that's just fine, because April 15 means nothing with automatic extensions.2 points

-

I don't charge more, because there is no such thing as "late in the season" for me. I use extensions to take Apr 15 off the table as a meaningful date, so there's no need to treat returns coming in now any differently than those that came in back in Feb. They drop the info off, I give them an extension, and we move on. Since this effectively increases the number of returns I can file, and take the pressure off me, I see no reason to charge them more. An hour of my time in March or April is the same value as an hour of my time in May, June, or July as far as I'm concerned.2 points

-

I am laughing my head off at my client's 3rd urgent message. "IRS picked the wrong guy to mess with, I've called my Congress Person, and she is all over it. I'm also going to drive to Knoxville or Chattanooga and speak to someone personally. Meanwhile, I am going to make sure that I OWE THEM NEXT YEAR." I called him back, I know many of you would not, and let him spew it all again. That's how I choose to run my business. He said he's not mad at me but hates those bleeping bleeping %$%#$%$#$$%^&**&* at IRS. Bleep. Bleep. It was hard not to laugh. His return was accepted 2/29. He's such a loose cannon. I told him I agree, I'd back off on the unnecessary withholding, and I know it doesn't help you right now, but there is so much fraud I understand why they might need to be cautious when issuing a refund of $14,492. I don't think he understood my point of view. At. All. But he said he felt better, and he'd let me know the minute he knew what was going on. Oh, I know you will... I'm actually crying I'm laughing so hard.1 point

-

1 point

-

I don't think it will reject. My question is: Why are you not at your office today? It's March 24th!1 point

-

Like Judy, once I have good numbers I put info directly into Drake by hand. I don't trust imports and frankly have NO clients who do their own books whose QB files I trust: I see how many items I have to fix to get decent statements that reflect accounting reality rather than the "bookkeeper's" fantasy of how things work. When I do the books, it's all so clear and streamlined that direct input takes me very little time. Leaving me more time to argue with balance sheet items which I always find aggravating. I tried once, years ago, to import one QB file into ATX, to see how it went. Just *finding* all the errors took me about twice as much time as direct entry would have so I abandoned that idea permanently. I have found Drake to be very *open* to programming suggestions but not necessarily *responsive* to me directly. I sent in a couple of suggestions last year and got nothing but the auto-response (and never even got that from CCH). Then found some of those suggestions incorporated into this year's version. The K-1 import in Drake, from S-corp and partnership returns, is flawless and fast. I like that. The trades import from Gruntworx (or any excel file, I guess) is also very good but I try to make sure I make any changes needed (T, S, J coding, adding the state, for two examples) in Excel first because I can auto-fill there but not on the 8949 entry grid.1 point

-

1 point

-

I have not had this particular situation, but I think that I would file the penalty completely separate from the regular tax return and request the waiver with the filing, but not pay the tax until the waiver is denied. I hope that you will keep us advised on what you decide to do and how it turns out for your client.1 point

-

Did a quick Google search and located the following: The first and most important rule to remember regarding income taxes is the five-year rule. A Roth IRA must have been established for at least five years before its earnings can be withdrawn exempt from any income taxes. These earnings become tax-free starting on the first day of the fifth taxable year after the Roth IRA’s establishment. If the early withdrawal of earnings is not due to premature death, a 10% distribution penalty is levied in addition to regular income tax. If it is due the holder’s death, then the 10% distribution penalty does not apply. If the five-year requirement is satisfied, then beneficiaries can take out the Roth IRA’s earnings tax-free, without regard to the ages of the decedent or beneficiary. I know there is a lot of confusion on Roth IRA's and what is taxable or not. Hope this helps and starts your search to find solid info for your client.1 point

-

1 point

-

No, but I no longer prepare last minute returns.1 point

-

The detail for Box 7 includes amounts for Livestock Forage Program, Price Loss Coverage and Market Gains. The amount shown in Box 7 for Market Gains is exact, to the penny, to the amount shown in Box 9 - Market Gain. Client records aren't detailed but do know loans were not included in income previously.1 point

-

Thank you Eric. This is the only forum that I follow on the internet. I really appreciate those who contribute, and the way that you and the moderators keep the site professional (and fun). I love "Laugh of the Day." I also have found important answers to issues that come across my desk--usually at just the right moment. So now I have just contributed my two-cents, and $$! Keep up the great work.1 point

-

I send clients the link to the "where's My Refund" from MY web site - hoping they look there first, next time. A vain hope, I know.1 point

-

IRS Dragon small business card dragon (mine has blue crystal eyes)1 point

-

When they do call, I tell them to call 1-800-829-1040 and ask why so long. I will not put in the time to wait. 90% of the time, the client KNOWS why it is being delayed. Besides, there is not one blessed thing we, or anyone else can do, to speed up the process. I find myself very lacking in tolerance of grown adults that CHOOSE not to read...1 point

-

I have one that's over $6,000 with large amounts of SS withholding. It pisses me off that I just had to fax all of their 1099's and W-2s to the IRS just now. My client's freaked out, because they got the letter from the IRS and I don't blame them. Their return was accepted on 2/25. Why didn't the IRS just check the 1099's that they should have received. It's not abnormal for people to have SS withholding. Now it will take them weeks to look at the fax to see that the return was correct and they stressed out old people that are already stressed enough. Not to mention making me an even bitchier person than I already am these days.1 point

-

I have a student whose return was accepted 2/12/16. He still does not have his refund. I think that it is because he is claiming himself, and getting refundable AOC, the IRS is checking a little harder. I have told him that. But since he is a student and self-supporting, he could really use that money. But as far as I am aware, there is nothing that anyone can do to cause the IRS to release a refund until they are ready.1 point

-

Citibank doesn't even use deposit slips anymore, you hand the stack to the teller or slide the stack into the atm machine. you can also take a picture of the check and get it deposited that way.1 point

-

My deposit slips don't have my corporate name on them. I've never had a teller require the corporate name on them in over 10 years until the current one employed by my bank. About 1/2 the time she declares the deposit slip is in violation of the rules and I must write the corporate name on the deposit slip. The other 1/2 of the time she ignores it also.The other 2+ dozen tellers over the years all just ignored it. One even commented how nice and clean the deposit slip was.1 point

-

On three different occasions I have received checks that were not signed and I went ahead and deposited them anyway and they went through. Never heard a thing from them. My daughter wrote a check one time and signed her first name as "Gina" instead of "Regina" as shown on her account and the check was sent back. Depends. . .1 point

-

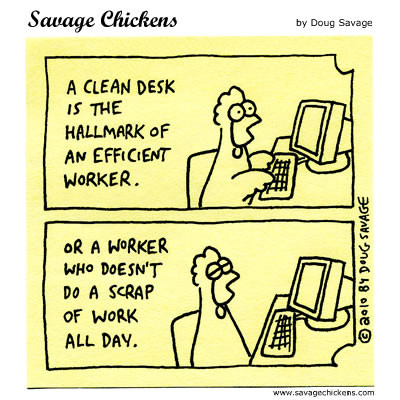

My point - my husband is a neat desk freak and I am 180 degrees opposite. I have to have everything in reach and I do know what is in each pile. I've tried neatness and it just doesn't work for me. So glad to know I am not alone out here!1 point

-

Lion's desk looks better messy than mine does when it is cleaned off.1 point

-

1 point

-

We must keep Eric happy. This is too valuable a resource to lose!!! Let's make sure that he gets enough donations to take care of the site in the most excellent way AND even take his family out for a nice dinner!! I think the dinner is a very fitting thing for him to spend some of our donations on. I/we certainly appreciate him that much!!!1 point

-

From my experience, if the names are similar and you write "For Deposit Only" on the back, the bank will never notice. Had a client who went to the bank teller to ask how to cash it - the bank came up with 2 pages of instructions that would have cost in legal fees more then the amount of the check. I told them to write the For Deposit Only and go through the drive-through or ATM and do NOT try and cash it directly. Zero problems.1 point

.jpg.f947b3d3d190450b9ec7ad889fae3356.jpg)