Leaderboard

Popular Content

Showing content with the highest reputation on 04/22/2021 in Posts

-

I have always had the same DL# as well. It’s six digits long. In the intervening years, NC added another digit to all license numbers. Now, whenever I give my license number, the person almost always asks for the “last digit”. Sometime they even insist the number isn’t long enough, plus they don’t believe me when I tell them to add a “0” at the beginning. So I have to explain that I’m so old my DL number should be close to 0000001.7 points

-

5 points

-

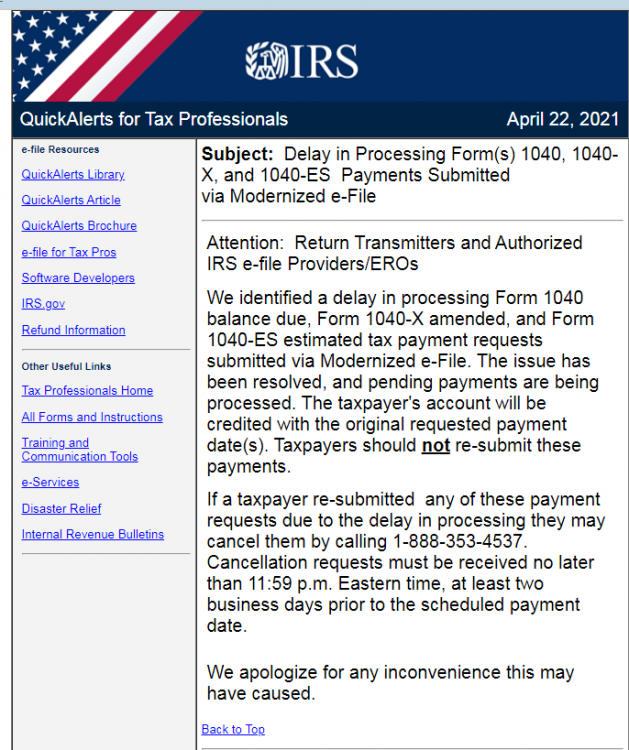

My balance due was supposed to come out on 4/15. It's finally showing on bank account with today as withdrawal date.3 points

-

While I have been able to keep up my regular work schedule I have now hit a wall with the usual procrastination and getting information has become like pulling teeth. It’s the same people every year but with the month extension they use it as a license to torture me. Only answer to that is price increase. I also have a few EMS workers who are testing for Covid at NY metro airports as contract workers. They all talk among themselves saying they should deduct meals, mileage, parking, tolls, masks (like they’re not supplied) and haircuts! My answer is to use someone who will help you with that. Two took my advice, what a relief.3 points

-

These issues never end this year. I can't pick up a single gravy return. Every single one has something in it that I gotta mess with. This guy claims the 1099C debt was for a used car that he had purchased 5 years ago and returned to the dealer claiming lemon-law. Says that everything was settled. I asked him if Wells Fargo had tried to contact him, or send him any notices on this debt that was supposedly taken care of. He claims not. And of course - can't come up with any of that old paperwork. SMH...........crying..............searching for new career......................2 points

-

Keep in mind that where the money from the distribution went doesn't matter. If the person, spouse, dependent or household member was affected by covid-19, the distribution can be reported evenly for the next three years. She could potentially, roll over 1/3 before she files for 2021 and another 1/3 before she files for 2022 if her business gives her profits. If her business was shut down at the farmer's market for a couple of months, that's enough reason to be affected by covid 19.2 points

-

Eligible retirement plans that can make coronavirus-related distributions include all plans that are able to receive plan rollovers. Eligible retirement plans include: Traditional IRAs Roth IRAs Simplified Employee Pension (SEP) IRAs Savings Incentive Match Plan for Employees (SIMPLE) IRAs Salary Reduction Simplified Employee Pension (SARSEP) IRAs Profit-sharing plans 401(k) plans Pension plans 403(b) plans Governmental 457(b) plans 403(a) plans If her distribution was from a qualifying plan, it doesn't matter what she used the money for, she still gets the 3 year spread.2 points

-

It sounds like she qualifies for the 3 year spread on her retirement distributions. I would deduct the attorney fees, but the architectural fees are in limbo to be capitalized if and when the project comes together.. I would also deduct the business expansion related travel expenses. I have seen this before with clients who emotionally can't let go of a business failure.2 points

-

2 points

-

If he used it 2 out of the 5 and then sold it, does he have to recapture the depreciation if the total gain is under 250,000? https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/property-basis-sale-of-home-etc/property-basis-sale-of-home-etc-5 "Generally, the law allows an annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. If you don't claim some or all of the depreciation deductions allowable under the law, you must still reduce the basis of the property by the amount allowable before determining your gain on the sale of the property. The gain attributable to the depreciation may be subject to the 25% unrecaptured Section 1250 gain tax rate. Additionally, taxable gain on the sale may be subject to a 3.8% Net Investment Income Tax. For more information, see Questions and Answers on the Net Investment Income Tax. Refer to Publication 523, Selling Your Home and Form 4797, Sales of Business Property for specifics on how to calculate and report the amount of gain."2 points

-

While, as a man, I've had that thought many times in my life, some things are best not spoken aloud in public.2 points

-

Did you know that autocorrect thinks "Rita" is not a very common name, and my client really enjoyed the reminder that day: "Hey, we need to do March sales tax. Thanks, Tits."2 points

-

And the fact that your DL# NEVER CHANGES. At least not in MD. I've had the same license # since I was a teenager.2 points

-

1 point

-

1 point

-

Lion, she has described this exactly as an expansion of her existing business. Affected by COVID? Most certainly, however she stated that she withdrew a lot of money to put into her house thinking that the business plan would be approved and all would be wonderful. There was no 10% penalty as she took from her pension as a retiree (firefighter). The issue here is whether I can put those attorney fees and architect fees as deductible with zero income. Before everything shut down she also traveled to a couple of other cities that have 'container venues' to check them out as her outdoor farmer's market business isn't available over the winter. But before she could set up again with warm weather, well, we know what happened. Okay, I will input the deductions as a business expansion. Thanks for the support/clarification/reply. I feel better about it even with no income. She never tried to get any loans or grants or anything and had no employees. Remember it was fairly recent the sole props could apply. My guess is she won't want to go through with this and, frankly, I really don't want to deal with it either but will mention it. Her choice.1 point

-

Not sure if this was posted or not but, My Wish For ATX is to have them send the client an email notification or text that the return was efiled and approved. It would be a nice touch to receive that automatically once the return is approved.1 point

-

Employers are entitled to tax credits for providing paid leave to employees who take time off related to COVID-19 vaccinations. Just another thing to be aware of for your clients: https://www.irs.gov/newsroom/employer-tax-credits-for-employee-paid-leave-due-to-covid-191 point

-

schiralli, I really appreciate you stepping up and taking one for the team with this client. I know the law of averages kicks in at some point, but I have been really fortunate so far this year.1 point

-

This is a minor expansion of the FFCRA credit claimed when you file your quarterly 941. What's unclear is if you offer this optional benefit are you required to offer all of the other covid 19 2 week sick leave benefits?1 point

-

Went crazy with a young son of a new client. Had his SS card, so couldn't understand what was wrong. Mom called. Son had two middle names, but SSA used one of his middle names as his last name.1 point

-

Husband texted me that he was running late and I answered with what was supposed to be "ok, thanks for letting me know" that I sent as "ok, thanks for loving me now." Then I started to send "geez, I should proofread before sending" which started to convert to "Cheese Arthur profit..." which started me laughing so hard that I had tears running. It was at that exact moment that a representative from the state's division of revenue returned my call. All I can say is that poor woman must think I'm totally nuts, and that it's a good thing I don't text much with my clients.1 point

-

And just to put icing on the cake, the 1098T from the daughters college shows 200 tuition and 25000 scholarships. I GIVE UP!1 point

-

And, in order to reduce the taxable amount of the pension by $3000, he/she must have paid for the insurance directly from the pension.1 point

-

On the 1099R input, at the very bottom of the page, there's a box that says "Check box to exclude ins premiums for retired ...", and then enter the amount in the field on the same line.1 point

-

This is a hot item for my customers. Given the totality of the liabilities and credits, it may be the IRS is simply looking at Q liability vs Q deposits, for timeliness. There is likely no reasonable way to come up with perfect daily liability numbers until the quarter has ended (for the IRS, and for all but the most skilled employers). Some of the issues are when to apply qualified health care expenses, and when and if there is an advance from a 7200 form received. For the average employer, paying the usual deposit amount (no credits) is a safe course, then taking credits with the 941. For the skilled payroll person, taking some or all of the credits, by reducing deposits, can work if documented well, but it is a manual calculation for the most part. Since the non refundable credits can be retroactively applied starting with the first payroll of the quarter, the 941b shows one set of figures, while paycheck register type reports show other figures. Another case of those in charge wonking it up for those that do.1 point

-

Thank you all friends, . I will try this time to see if I can resolve the problem.1 point

-

For my part ATX works just fine. As for growls the tax system provides me with plenty of those gastric and otherwise.1 point

-

Sorry, just now getting back to the board, crazy week. Got the whole thing figured. No, Mom's alive and well, but after a lengthy phone convo, there were a lot more factors, and I think we're finally on the same page.1 point

-

I enter the names as they appear on their Social Security cards and I print their return. If the name is too long to efile, I take out the second last name from the spouse. If I still have the issue, I take the second last name from the first person. I have not needed to go any further.1 point

-

I have had this situation before, I request a prior year tax return to see how the name appears and that solves the problem.1 point

-

Wife sent a text to the kids that was supposed to say "Dad and I are going to Disney" but it auto corrected to "Dad and I are going to divorce". Needless to say she got a couple of frantic calls!1 point

-

But all my NY commuters are required to have DLs to e-file, so CT requires me to re-confirm it each year. Yeah, they ask for all this stuff to CYA when we're the ones that know whether a client is new to us or known for decades. It's as much a waste of time as all those codes I have to get on my cell and enter all day long, even though it's just me in my home office in a locked house on a desktop system that'd be hard to lug away. I agree, just because they can.1 point

-

I think it's a CT requirement. If I hadn't had to check with my clients this year, I would've missed at least two who had their wallets/purses stolen and got new DLs with new #s and dates and a whole bunch of clients who didn't realize that 2021 is their renewal year until I brought it up. But I think it's a pain. CT, CA, and a list of other states also require me to confirm address &/or contact information every year. My generic Have you moved? is a good starting point, but I have to ask more questions each year.1 point

-

I don't believe it's an IRS requirement since Drake rolls over DL details every year.1 point

-

And sometimes it doesn't take much. I needed a break and went and pulled garlic mustard (invasive weed) for ten minutes. Out in the fresh air, listening to the birds, watching the puppy next door try to herd a flower pot, and getting rids of weeds before they flowered. I felt great afterwards, and was able to come back to my computer refreshed.1 point

-

I've cut out anything I don't enjoy. I only work for a few hours each day, even during tax season. You do need to take care of yourself! You've been working in tax for 42 years! 42 years! Stop right now and take a walk. And tell yourself you will do the same tomorrow.1 point

-

1 point

-

I think the license info doesn't roll over because we are supposed to ID everybody every year. I have also noticed that university information must be entered every year by IRS requirements and they don't roll over anymore. For my practice and taste, ATX is the best in the market. Stand alone installation, who opens the program knows what forms and what questions to ask (at least that's what I believe), interface and price look good.1 point

-

That's what I have done. I have scaled back to the point where it's sustainable, a bit less than half time. I plan to keep working as long as my health will let me, since I still enjoy what I do and I like almost all of the clients I have left. Admittedly, it's much easier to do this, since my practice is small business write up, payroll, and business entity tax returns. The only personal tax return clients that I have left are people that I like.1 point

-

1 point

-

1 point

-

Is it possible you can just scale back? I'm at a point in life where I don't actually "need" the money. This year has been quite stressful and I admit it's been quite freeing to play the Seinfeld Soup Nazi and tell clients this is their last year. For the clients where there is mutual respect, I'll keep doing returns for several years. The ones that want to be demanding jerks can do so elsewhere.1 point

-

If ATX still worked like it used to prior to 2012, I would have never left for Drake.1 point

-

AND the authorized individuals and their EINs in Fiduciary/Corporate/Partnership returns.1 point

-

THIS!!! STOP IT. STOP IT RIGHT NOW. If you don't take care of yourself, you will burn out and get stress illnesses. I came to this realization some years ago and stopped working one day a week. Usually, but not always, Sunday. Found out that if I took a day for myself I got more done the other six days than in uninterrupted seven without end. Any client who expects instant response any day or any time of day is a client who does not respect us and who is definitely under-paying us. For me, if you want 24/7 instant response, you had better be be a close family member. Anyone else gets me as I choose to respond. If they don't like that, they can go down the street to someone else, and (likely) pay more for poorer-quality work.1 point

-

After 42 years of tax seasons, I feel the same way. This has been the worst for too many reasons. I am just trying to stick it out until 65 (16 months!) so that I can get Medicare in place of ACA. I don't even know that my business is worth selling. I wish that I didn't love most of my clients, but I honestly am sick of the liability and stress of doing it on my own and feeling guilty every time I do something not work related.1 point

-

I've never been so far behind. Really trying to figure out how to make a career change!1 point

-

so far behind, too. Glad to know I'm not the only one. Me too, have a client who owes, I've redone twice, and still the same. He says it isn't fair. I said, not enough withholding. Told him the same last year. Ready to send him on his way.1 point