Leaderboard

Popular Content

Showing content with the highest reputation on 04/06/2018 in all areas

-

10 points

-

I don't hate you (you're too nice a guy) but I can't imagine how you manage to pull it off. Personally you're liable to find me lying back in the swivel chair, legs up on desk, mouth open, dozing and half-awake at any time after lunch. Either the loud doorbell or my assistant {wife} jolts me awake just in time for my feet to hit the floor and to sit up straight 5 seconds and try to look normal before the intruder gets to my large (lay-down) desk. I remind myself of a client; an older guy housepainter who has a pickup and a Purdy paintbrush hanging out of his paint-speckled overalls who, worn out, went to the doctor for general malaise. Doc said "Do exercises." He said "Doc, I'm 75. After a day's work it's all I can do to make it back home and fall in the recliner."8 points

-

Yes. Don't undervalue yourself. I have clients that pay more for ADP/Paychex to prepare 5 employees payroll on an annual basis than me, and anytime there is an issue with *Them* they tell the client to call *me* to fix it. Investment fees are another example. It is only *1* percent, but that *1* per cent on a large account is pretty significant. And they throw my clients into expensive mutual funds and !horrors! MLP's to fatten their bottom line... One firm, that collects $25k from my client, sent them this: They invested my client in these MLP's in 2016, the5 MLP's returned about a $12k loss last year, and they sold them in 2018 to "harvest" the tax losses. So, they sold you out of losers, and just put you into a larger basket of losers. With a better fee to the firm. Un Fricking believable. And I told my clients that. Rich8 points

-

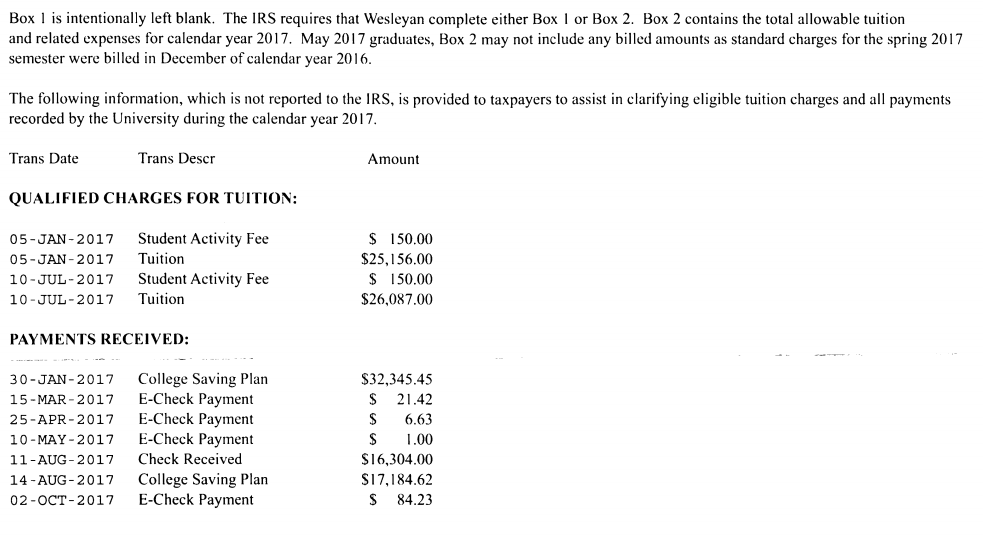

You know how you explain to clients the first year Junior went off to school that you need the Bursar's statement from college, and they remember to bring that every year forever and ever? Yeah, me neither.7 points

-

7 points

-

6 points

-

6 points

-

HA! I amazed myself with this desk, but I think the low volume background music form the 60s might have something to do with my energy level. I do know I like standing at a bar with music playing (or a ballgame) in background with good conversation on each side of me, I never get tired, so maybe it is the same principal. Your painter shouldn't worry, it's all in his head, he gets enough exercise and should have peace of mind knowing his work is top notch using a high quality Purdy brush. You're a nice guy too, like everyone else here, it's the nice guy and gal forum, maybe that's what keeps us up.5 points

-

5 points

-

Ship I am going to send my client student dependents to that school, it's like pulling teeth with some or a "whatcha talkin bout Willis" look.5 points

-

Glad it's fixed for you all. We had a visit from one of our cchsfs lurkers looking at this post. Funny about that and how they never comment, but check us out.3 points

-

3 points

-

3 points

-

3 points

-

3 points

-

Hey Rich...I hear you on the stability this year. I have been with this software a long time, and I am finally getting comfortable with it being reliable. They may have finally recovered from the 2012 launch disaster. The next step is to make it more efficient for me to work with. I need to spend some time learning to set the defaults and preferences to make it work better for me. It seems that my clientele is getting more complicated every year, and I am spending more time on the returns, so any clicks I can remove from the process is going to free up my time. I think I am going to get new computers this year. Both the desktop in the office and the laptop I take to our seasonal office. I have been running 2 stand alone installs of ATX and just keeping them in sync. It is getting harder to do. How much is GoToMyPC and do you think it is worth it? Thanks Tom Modesto, CA3 points

-

Not to jinx ATX, but it has worked well this year. I use it via GoToMyPC, and it doesn't crash that way. So does one of my office folks. Looks of missing info... We are screaming into next weekend. Rich3 points

-

This year we've been doing all our "final checks" as we finish the first pass. Careful notes on what is missing - then when those arrive, plug 'em in and ship 'em. (With attention to the few items that can wreak havoc with all the forms already "done" of course.) That said, YES it's taking longer. Lots of people seem to think the new tax law was for 2017. Lots of questions about "Why is my refund lower? -Everything's the same!" when income is up $15K and withheld tax is down $5K.3 points

-

I find that it is the same 25-30 clients that drag it out for me every year. Since it's only 10% of my clientele I do charge a generous bonus for my work hoping they will leave, but they come back every year, waiting on a few right now.. There's about 5 in the rack now that have been there over a month, I consider that a failure on my part.3 points

-

The other thing that works before you get the standing desk is two or ten files in each chair. Hey, whatever it takes. There are advantages to being a paper freak, don't let the youngsters mislead you.3 points

-

Not looking to jinx ATX, it's been working flawlessly this year. Nice to have a program that you're used to and functions well. With that said, I've noted that it's taking me longer to complete a return this year. I'm sorting through more information, have more missing documents and more questions from clients. Maybe it's related to all the news about the new tax law or maybe it's just because. Whatever the reason, I have noted a time increase. For those clients I deal with in person, I have told them personally. For those who receive my invoice as part of their packet of information, I will include a letter. I plan on raising my fees for 2018 25% to 50% across the board. I'm providing notice to my clients so there are no surprises. There are many reasons for my decisions, with that said, I have several new clients this year who have brought me their previous returns. They easily paid two to three times more than what I would have charged. I always knew I was on the low side, I never thought it was that significant. Shame on me, I guess.2 points

-

Just a heads up! I should not have jinxed it when I said that I had not had any issues with ATX. I am now getting a system error when transmitting and there are a bunch of others reporting on the ATX board.2 points

-

I use Drake and set up a macro to check all the boxes. Then I just adjust for the situations that are different. Whew!2 points

-

Use Form 709, Gift Tax Return. The exclusion is $5mil, tax credit $2mil+ The potential tax is applied against the lifetime credit. Since this is a generation skip, look at the election https://www.law.cornell.edu/uscode/text/26/2632 I think with a little reading and the correct form, you will figure it out. With such generosity, take into account any earlier filed 709's.2 points

-

Tom: I use GoToMyPC to login the desktop in the office when I am at my satellite office. I am always running it from the same place, so no reason to sync it. I take my laptop from location A to Location B. I have a staffer at location B that logs into my server via GoToMyPC, and thee other computers that talk to the server in location A. I have had 5 or 6 people posting to ATX at one time. Still stable. Rich2 points

-

2 points

-

2 points

-

2 points

-

Interestingly, today's Checkpoint email was about an LLC that filed 1065's late in 2010 and 2011, and then claimed it was a disregarded single-member LLC and did not owe the penalties. NOT the same situation as your client, but close enough to be an amazing coincidence. If you are curious you can look at TC Memo 2018-35.2 points

-

Imagine using a drone to deliver your clients copy of their income tax return. I just thought that was a funny idea.... Or...You could use this, although.. it's analog....2 points

-

I must say that my "one pass" rule is working well again this year. On virtually everything I'm doing, I make one pass entering the data. If there's something missing or I need to ask for more info, I just prepare an extension. (There are a few common-sense exceptions of course, but that's the basic process) Been doing that since the first of February. And of course everything coming in during the past few weeks automatically gets an extension. I'll get back to many of them, and that's fine. But if not, don't bother me - they will hear from me sometime after the 17th (or maybe after the 30th, depending upon how quickly I get the payroll reports out).2 points

-

You're better off without that one for sure. Now that they heard someone will do it cheaper, they would probably pester you about it going forward if they stuck with you. May as well use that free time to replace them with a profitable client.2 points

-

Yes, had one recently with fees over 23K and fees of 2K for municipal bond work. With over a million $ in trades, and double that in account value, at end of the year it was up less than the fees. Some bad trades I suspect, in an up market something is not right.2 points

-

If they don't sit down maybe they will leave sooner. We may be on to something. But I must say, this desk is working out really well, I actually look forward to it each day, I feel like I'm on stage with no audience. My stage fright went away.2 points

-

1 point

-

agree with that but if it wasn't attached the irs would have denied the deduction and then i would have had a different fight on my hands. Plus for this much money the client might have decided to have a tax attorney handle it and then claim my lack of proper filing of the 8453 would make me responsible for his fees too. If you have the appraisal, there is no reason to not supply it properly. [not suggesting that is what you are saying to do]1 point

-

What a mess, ask for a huge retainer for all the work you’ll be doing if it’s possible. How about just filing a zero 1065 for 2107, report the revenue and expenses on Sch C and sentd the client back to the prior preparer. Sometimes it’s stinks trying to be a superhero.1 point

-

I never renew until December. I always get the discount. I hate it that there are so many different prices. Weird business practice.1 point

-

in September, I received an email offering me the May discount as an "Anniversary Month" special. Who knew I had an Anniversary Month ? I think that in 3 out of the previous 5 years, I received the May discount in November. Based on previous discussions with my long time sales rep, he had the ability to offer the discount in certain circumstances, although once or twice he said he had to get it approved by his supervisor.1 point

-

My guy that came in yelling "Land Shark" paid his planners $28,000 last year. He would never whine about my fee. The first year he came here, he told me he worked on it himself for four days before he threw in the towel.1 point

-

haha, you know I have that broom that I fly on magic wand and fairy dust. Oh yeah, I can't forget to mention the crystal ball that we all have.1 point

-

Image counts. Brokers represent big money, and have office appearances to prove it. He works in a state-of-the-art building in an exclusive part of town, and people somehow think they are entitled to fees that they can hide on the back page of the statement. Lawyers same image. But US? They come to a modest office with papers stacked everywhere and talk to someone with none of the aforementioned image. Some of my customers come to my house. We're proud of it, but certainly not the Waldorf-Astoria. I'm convinced by the fees that I see (customers never bother to look), that some of the brokerage houses are making more money than the investor. p.s. in case any of you care, Rita has a very nice office.1 point

-

1 point

-

What I just typed in there would earn me another bad mark on this forum. This will come in handy!1 point

-

My bad: I indeed did get "Notifications" but had not arranged to have those emailed to me. Eric's creation still is perfect.1 point

-

You're right, Rita & Yardley -- and THANKS. It's in the name of "customer service" that I've been wondering how to mitigate these taxpayers' sudden whim; but ultimately I'd rather have them know me for my technical skill than cuddlesomeness. P.S. Apology for this late response: I don't seem to have received any Notifications when my post was commented upon, only dropped in today with a different question!1 point

-

Nah, my one complainer guy's broker fees were only $9,057. He doesn't like my (finally up to) $350 fee. He's been struggling with my enormous fee for ten years now but manages to drop in five times a year to get advice. I have decided he will get the opportunity to find a better, less expensive alternative than me next year. That's right, I'm letting him live to regret trying that haggling ship on me. We don't do that here. If I think I'm paying too much, I smile politely, thank you, pay your fee, and don't come back nine more times. My #1 rule is everybody in this office is happy. My #2 rule is if everybody can't be happy, Rita will be happy.1 point

-

I don't think you have any responsibility at all to the son at this point. With the exception of possibly reminding him that he was taken as a dependent on his parents return. He can then take responsibility to find out what that means. Hand back the son's information and then allow him to take care of his own return filing.1 point

-

Scan the appraisal to a PDF. Choose E-file MENU and Attach PDF. Scroll to the form 8283 click on an appropriate paper clip. In your case there isn't one so I'd go with Donee Org Ack.\ Ignore warning from ATX that your PDF is too big, and just remember this as the one time you've ever heard that in your life.1 point

-

I have one client for whom I prepare the S-corp return, but they have their own bookkeeper and use Paychex. Paychex has a code for >2% shareholder HI. Each December, the bookkeeper runs a QB report for the HI and checks with the owner re any open HI invoices he will pay that month and then gives the amount to their Paychex rep. I don't prepare his personal taxes, but do communicate with his personal CPA, so have heard that all is well using the Paychex procedure.1 point