Leaderboard

Popular Content

Showing content with the highest reputation on 02/22/2022 in all areas

-

I tell clients to drop off their info or mail it to me and I'll get back to them if I need anything else. But years ago when I would have a sit-down with them to go over everything in my office, I always enjoyed stuffing the boilerplate and the mailing envelopes into the shredder as we were talking. Sometimes, while that thing was grinding away, the expression on their faces would be priceless.5 points

-

The most persnickety of clients have karma attached to them, attracting mistakes on our part. Seen it time and time again over the years!4 points

-

Same, but I like to input on the Details tab because it's like a spreadsheet and it has totals. You'll want to set the Preference to not calculate when working in Detail tabs because, for some unknown reason, it calculates really slowing in Detail tabs. But saving recalculates so enter a line and save, then check that the gain is correct. If there are wash sales, the code is MW, and multiple codes have to be alphabetical (BMOW). And, yes, I have used the BMOW code when a K1 sale is included on the 1099B.4 points

-

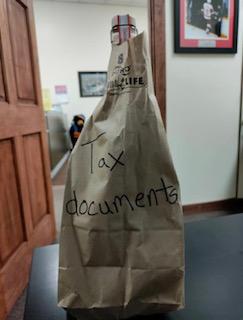

4 points

-

Money is fungible. It doesn't matter what she actually used the distribution for. If she had qualified higher education expenses in the same year as the distribution, the penalty is waived for the amount of the distribution up to the amount of the expenses.3 points

-

I almost never use those lines because I like to see the totals on the 8949 Details tab. In the case of multiple brokerages, I would enter totals by brokerage by code. I would not add them together because it's easier to look at later and double check, if they're entered separately. But from a tax standpoint, you could add them up or do an Itemized List on Sch D, but at that point, you might as well enter them on 8949.3 points

-

The worst is records from a smokers house. Smells awful and it makes me sneeze. Fortunately, there aren't many of those anymore. Also, I never see the hard copies of the records, just a PDF, so someone else has to deal with smelly records.3 points

-

Her note should have said, "don't call the cops". Then when the cops' chemical analysis came back that it was squash, she could have said, "I told you not to call the cops".3 points

-

This evening, I called the gal who worked for me pre-Covid and pre-Vaccine and asked her if she would think about coming in for a few days a month to help out. No hesitation. She said that her life is so boring. I told her that she could balance checkbooks, do bookkeeping and would not have to prepare tax returns unless she wanted to. She is all for it. I just got my third license downloaded and working on Saturday so I know she will do simple returns. We are getting so far behind already as I am teaching and interviewing and getting too many interruptions to actually get much work done during the day. Therefore, all I can say is Woo Hoo!! I have always believed in doing the best job possible and even if I don't have as much profit as usual this year; it will be worth it to get these returns done correctly. Who knows what is still ahead of us!!!!2 points

-

Client is a high income couple, he is self-employed. Has been able to max out his SEP contribution every year. Asked me what the limit was earlier in the year. I gave him the amounts right off the IRS website which say: 25% of your net self-employment income or $58K, whichever is less. I forgot to add the part about the special rule for self-employed. He did not earn enough this year to max out under the special rule at 20%, but did if you take the general rule of 25%. When I was preparing the return, I let him know he had to withdraw the excess contribution and now he is pissed at me. It is my fault, I should have been more specific about the rate. Sometimes it sucks to do this job. Thanks for letting me whine about my mistake. Tom Longview, TX2 points

-

2 points

-

2 points

-

That is aggressive. Wish they had a code section or regulation to back that up. Unless the rules changed, going from your home to your work has always been commuting miles. Tom Longview, TX2 points

-

Sure. Form 8888, but read the instructions re what could happen if refund is a different amount than anticipated/which account gets adjusted. https://www.irs.gov/forms-pubs/about-form-8888#:~:text=Use Form 8888 to directly,savings bonds with your refund.2 points

-

I'm sorry, Tom. Don't be too hard on yourself because we all make mistakes from time to time. Like you, mine are usually with the most demanding of clients and are usually not answers to the most complicated of questions they ask.2 points

-

I like getting the 1099DIVs that still have the last quarter of the year's check attached. Is this my tip?2 points

-

The best thing I've ever gotten in a client's bits was a $50 off coupon for H&R Block. I thought about dropping their return off. The second best thing I've ever gotten was a 1099-SSA with a huge red stain on it and an arrow to a note from my client saying 'this is squash'.2 points

-

They stay the same. Just roll them over. Pretty please.1 point

-

My client went through the Tax Organizer very carefully and answered every question, filled in every box. Then she taped her supporting documents to the back of the related page of the organizer. Next she took her multi page Brokerage 1099 which had been 3 hole punched and carefully inserted bread bag twist ties through each hole and bound the brokerage statement pages all together. She actually is a very nice person, but I have no words to explain this . . . . .1 point

-

I was wondering about this too. I do plan to attach it. I prepare many NY returns and CT-399 is a PDF attached requirement too so I'm used to the extra legwork. On a separate note, it would be nice if ATX pulled the Shareholder basis stmt info from the 1120S return to the 7203 during the K-1 import. Probably a big ask, but it would be nice since it's pulling the K-1 data anyway.1 point

-

What is a temp rental? Are you reporting from 4797? Are you using ATX? You might have to make a manual entry on the distributable income tab. Curious as to why in today's market the rental is selling at a loss?1 point

-

It is entered as a reduction of wages. For example on Schedule C, open the input sheet for Line 26 wages, enter ERC on 2(g) and it make the reduction. not sure what you are referring to. no, it is treated as non taxable income1 point

-

I have client tell his broker to provide me with an Excel format of the gain/lost statement. Or, use CCH's Scan & Flow. Or enter the summary per Schedule D Instructions pages D-10 to D-11. This is particularly easy when you meet the qualifications listed. https://www.irs.gov/pub/irs-pdf/i1040sd.pdf1 point

-

ditto to Catherine - 2 of mine had success calling.. I have them waiting from Feb, March - the one from 2017 - just got hers!! amended in 2018!!1 point

-

I recently completed one of these with a lot of questions and one of those questions was the mileage. The mileage that Uber/Door Dash reports is the mileage of the trip for the customer and as Pacun stated, it may include milage when the app is turned on. They do not break it into any detail. In my case, my client has a home office for transacting their Uber business. Mind you, this person is well in the five digit figures, and spends nearly all their time driving folks, hanging out at airports; etc. To error on the side of caution, and because there doesn't appear to be any code or regulation, I did not take the commute mileage to either pick up the passenger or go to the airport. I did use the report mileage and did advise my client to keep a better mileage log. I agree with Tom and Abby on this.1 point

-

Thanks so much Catherine! I will ask my client to call.1 point

-

In retrospect, after reading all the comments about double dipping; we have gone back and are checking a few young ladies and men who have just fallen off of their parents' returns. Sure enough! Another $1400 refund. This just doesn't seem possible but, as someone said, we don't make the laws. I am watching this board closely every day to see what else comes up. And, now; don't forget the new baby. We are seeing some really huge refunds. Where is all this money going to come from?1 point

-

We've all made mistakes. And I'm sure the sucky parts are few and far between.1 point

-

I looked on the IRS's newish "gig" page and that directs to the usual IRS Pub 463 for car expenses, which could imply the usual commuting parts are not deductible. However, Pub 463 is being revised currently. Maybe to update for the gig economy?1 point

-

The AOC is only good for the first 4,000 of tuition/fees. If they already have that much, I'd pay the Spring in 2023 to at least get some Lifetime Credit if the AOC has already been used 4 years.1 point

-

The IRS words it on their online "assistant" as...Has the student received four years academic credit for postsecondary education before the beginning of 2021? Of course, you still can take it only four times, so the five years or longer (part-time, stop and restart college, for example) you still have to count/keep track of how often a student used it. I've amended a student who took it her first year/fall at a community college and then transferred to a much more expensive college to use all four years of eligibility at the more expensive college.1 point

-

If the contribution was made in 2022, then he can just apply the rest to the 2022 contribution.1 point

-

The miles from pickup location to delivery location are deductible. What you want to get is the miles from home/garage to pickup location and from delivery back to home/garage location. That takes a legitimate business office in the home. Do they have a legitimate, regular and exclusive office in the home? Do they check their app from that office in the home? Do they do their bookkeeping from that location? Are they running the activity like a business so they can claim the office in the home? If they don't have a home office, I only take the miles between stops. Tom Longview, TX1 point

-

Thoughts only - Does the driver have another job that is his main employment? I would then be inclined to count all of the mileage as a driver except that to and from his regular place of employment. If this is his only employment as a door dash/uber eats driver then I would be inclined to count the first "leg" and last "leg" of his driving for the day as commuting and the rest as deductible business miles. BUT this is a totally un-researched opinion.1 point

-

Ditto. We all understand, but we know your client doesn't always understand. Apologize for being rushed, but don't apologize for giving a too-simplified answer while rushed. Because, human...1 point

-

If your client had only one employer who withheld SS, then he must go to his employer. If he had more than one employer that withheld SS, the excess is claimed on his return, as you say.1 point

-

1 point

-

1 point

-

I seem to have gotten a lot of the plastic binder/envelope things. Not sure what they're called, but they're just a little too wide to fit in my file drawer, plus I'm not paying to mail back crap like that with their tax return. And yeah, the ones who don't open their mail and give me all the envelopes. Or include tons of stuff I don't need, often things they don't even need. But better too much than too little, sort of.1 point

-

1 point

-

I have the plastic sleeve client, several don't open envelopes, a couple staple happy ones, some that use a box of paper clips and one that puts sticky notes on everything. Like I need a sticky note to tell me a W2 is a W2.1 point

-

I will take them all from you. I have a hard time finding out if mine got the 3rd stimulus payment or their advanced CTC. Send them to me with their perfect docs! Tom Longview, TX1 point

-

1 point

-

1 point

-

1 point

-

1 point

-

I had a client bring in a notebook today with the clear pages that each tax doc was inserted. So I have to pull them all out and copy and then yes he wants them back into the clear jackets and put back into the notebook. They think they are being helpful, helpful would be clients who open the enveloped and throw them away.1 point

-

As long at it was oversight and missing distribution is taken before filing return, they won't assess the penalty. From 5329 instructions: Waiver of tax for reasonable cause. The IRS can waive part or all of this tax if you can show that any shortfall in the amount of distributions was due to reasonable error and you are taking reasonable steps to remedy the shortfall. If you believe you qualify for this relief, attach a statement of explanation and file Form 5329 as follows. Complete lines 52 and 53 as instructed. Enter “RC” and the amount of the shortfall you want waived in parentheses on the dotted line next to line 54. Subtract this amount from the total shortfall you figured without regard to the waiver, and enter the result on line 54. Complete line 55 as instructed. You must pay any tax due that is reported on line 55. The IRS will review the information you provide and decide whether to grant your request for a waiver. If your request is not granted, the IRS will notify you regarding any additional tax you may owe on the shortfall.1 point